by Calculated Risk on 7/30/2014 08:15:00 AM

Wednesday, July 30, 2014

ADP: Private Employment increased 218,000 in July

Private sector employment increased by 218,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 235,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The July employment gain was softer than June, but remains consistent with a steadily improving job market. At the current pace of job growth unemployment will quickly decline. Layoffs are still receding and hiring and job openings are picking up. If current trends continue, the economy will return to full employment by late 2016.”

The BLS report for July will be released on Friday.

MBA: Mortgage Purchase Applications Increase Slightly in Latest MBA Weekly Survey

by Calculated Risk on 7/30/2014 07:01:00 AM

From the MBA: Purchase Applications Increase Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 2.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 25, 2014. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.33 percent, with points increasing to 0.24 from 0.23 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, July 29, 2014

Wednesday: Q2 GDP, FOMC Statement, ADP Employment

by Calculated Risk on 7/29/2014 11:59:00 PM

First, for a very interesting discussion on GDP and seasonality see: GDP: Seasons and revisions . Too bad the BEA doesn't release NSA data any more - but the graph is interesting.

And the Atlanta Fed released their final GDPNow for Q2:

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2014 was 2.7 percent on July 25, unchanged from its July 17 reading. The first GDPNow model forecast for GDP growth in the third quarter will be released August 1.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 235,000 payroll jobs added in July, down from 280,000 in June.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2014 (advance estimate); Includes historical revisions from the BEA. The consensus is that real GDP increased 2.9% annualized in Q2.

• At 2:00 PM, the FOMC Statement. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in June

by Calculated Risk on 7/29/2014 09:00:00 PM

The Case-Shiller house price indexes for May were released this morning. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Forecast: Expecting Further Slowdowns Ahead

The Case-Shiller data for May 2014 came out this morning, and based on this information and the June 2014 Zillow Home Value Index (ZHVI, released July 20th), we predict that next month’s Case-Shiller data (June 2014) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased by 8.1 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from May to June will be flat for the 20-City Composite Index and 0.1 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for June will not be released until Tuesday, August 26.So the Case-Shiller index will probably show a lower year-over-year gain in June than in May (9.3% year-over-year).

| Zillow June 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | June 2013 | 173.17 | 171.70 | 159.46 | 157.92 |

| Case-Shiller (last month) | May 2014 | 185.33 | 185.79 | 170.64 | 171.04 |

| Zillow Forecast | YoY | 8.1% | 8.1% | 8.1% | 8.1% |

| MoM | 1.0% | 0.1% | 1.0% | 0.0% | |

| Zillow Forecasts1 | 187.2 | 185.8 | 172.4 | 171.0 | |

| Current Post Bubble Low | 146.45 | 149.87 | 134.07 | 137.13 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 27.8% | 24.0% | 28.6% | 24.6% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 7/29/2014 01:46:00 PM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced since the housing bust.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a larger than normal seasonal pattern mostly because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (both through May). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

It appears we've already seen the strongest month this year (NSA) for both Case-Shiller NSA and CoreLogic. This suggests both indexes will turn negative seasonally (NSA) earlier this year than the previous two years - perhaps in the August reports.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

House Prices: Real Prices and Price-to-Rent Ratio decline in May

by Calculated Risk on 7/29/2014 11:52:00 AM

I've been expecting a slowdown in year-over-year prices as "For Sale" inventory increases, and the slowdown is here! The Case-Shiller Composite 20 index was up 9.3% year-over-year in May; the smallest year-over-year increase since January 2013.

This is still a very strong year-over-year change, but on a seasonally adjusted monthly basis, the Case-Shiller Composite 20 index was down 0.3% in May. This was the first monthly decrease since prices bottomed in early 2012. (Note: The seasonal factor is skewed by foreclosures).

On a real basis (inflation adjusted), prices actually declined for the second consecutive month. The price-rent ratio also declined in May for the Case-Shiller Composite 20 index.

It is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2014), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through May) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to mid-2004 levels (and also back up to Q2 2008), and the Case-Shiller Composite 20 Index (SA) is back to October 2004 levels, and the CoreLogic index (NSA) is back to January 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2001 levels, the Composite 20 index is back to July 2002, and the CoreLogic index back to January 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q1 2002 levels, the Composite 20 index is back to November 2002 levels, and the CoreLogic index is back to May 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels. And real prices (and the price-to-rent ratio) have declined for two consecutive months using Case-Shiller Comp 20.

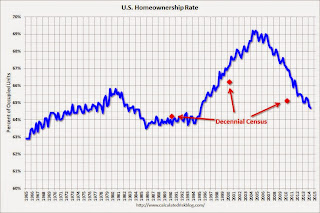

HVS: Q2 2014 Homeownership and Vacancy Rates

by Calculated Risk on 7/29/2014 10:15:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q2 2014 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.7% in Q2, from 64.8% in Q1.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

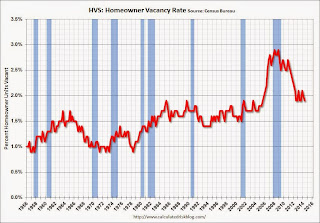

The HVS homeowner vacancy decreased to 1.9% in Q2.

The HVS homeowner vacancy decreased to 1.9% in Q2.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

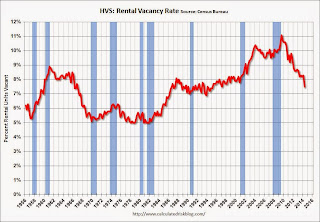

The rental vacancy rate decreased in Q2 to 7.5% from 8.3% in Q1.

The rental vacancy rate decreased in Q2 to 7.5% from 8.3% in Q1.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate is at the lowest level since 2001 - and might be close to a bottom.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply.

Case-Shiller: Comp 20 House Prices increased 9.3% year-over-year in May

by Calculated Risk on 7/29/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Continue to Moderate According to the S&P/Case-Shiller Home Price Indices

Data through May 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... show the Composite Indices increased at a slower pace. The 10-City Composite gained 9.4% year-over-year and the 20-City 9.3%, down significantly from the +10.9% and +10.8% returns reported last month. All cities with the exception of Charlotte and Tampa saw their annual rates decelerate.

In the month of May, the 10- and 20-City Composites posted gains of 1.1%. For the second consecutive month, all twenty cities posted increases. Charlotte posted its highest monthly increase of 1.4% in over a year. Tampa gained 1.8%, followed by San Francisco at +1.6% and Chicago at +1.5%. Phoenix and San Diego were the only cities to gain less than one percent with increases of 0.4% and 0.5%, respectively. ...

“Home prices rose at their slowest pace since February of last year,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The 10- and 20-City Composites posted just over 9%, well below expectations. Month-to-month, all cities are posting gains before seasonal adjustment; after seasonal adjustment 14 of 20 were lower."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.1% from the peak, and down 0.3% in May (SA). The Composite 10 is up 24.0% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.2% from the peak, and down 0.3% (SA) in May. The Composite 20 is up 24.7% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 9.3% compared to May 2013.

The Composite 20 SA is up 9.3% compared to May 2013.

Prices increased (SA) in 6 of the 20 Case-Shiller cities in May seasonally adjusted. (Prices increased in 20 of the 20 cities NSA) Prices in Las Vegas are off 43.2% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was lower than the consensus forecast for a 9.9% YoY increase and suggests a slowdown in price increases. I'll have more on house prices later.

Monday, July 28, 2014

Tuesday: Case-Shiller

by Calculated Risk on 7/28/2014 07:45:00 PM

A glass half empty view from Mark Hanson: Lack of Defaults/Foreclosures/Short Sales; A Serious Housing & Spending Headwind

Most think of the effects of foreclosures & short sales (distressed) only in the first derivative…that they are bad for housing and prices. As such, bullish leaning headlines of plunging defaults, foreclosures and short sales over the past two years are everywhere, often.I like Mark, but how do we get from the crisis phase of the housing bust to a more normal market without seeing fewer foreclosures and short sales? It isn't possible.

Some journalists and bloggers actually follow and publish the data weekly presenting them as further irrefutable evidence that “this” is the real “recovery”. But, of course, when it comes to new-era housing what instinctively sounds like a positive, or negative, is more often than not the exact opposite. And what’s ironic is that the lagging default, foreclosure, and short sale data they publish in the bullish sense is actually leading indicating data of a bearish trend-reversal in housing happening right now, which will lead to the third stimulus “hangover” in the past seven years.

So, the next time you see the headline “Mortgage Defaults (or Foreclosures) at a 6-year Low!!!” you might want to say to yourself “humm, that’s a real problem for purchase demand, house prices, construction labor, materials, appliance sales” and so on.

Bottom line: When it comes to defaults, foreclosures and short sales and how they really fit into the macro housing and economic mosaic less is bad. Foreclosures and short sales “were” a significant housing and macro economic tailwind that drove transactions, prices, home improvement retail, labor, materials, and durable goods sales, which now — down 75% since 2012 — have turned into a stiff headwind.

Tuesday:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for May. Although this is the May report, it is really a 3 month average of March, April and May. The consensus is for a 9.9% year-over-year increase in the Composite 20 index (NSA) for May.

• At 10:00 AM, the Conference Board's consumer confidence index for July. The consensus is for the index to increase to 85.5 from 85.2.

• Also at 10:00 AM, the Q2 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Weekly Update: Housing Tracker Existing Home Inventory up 15.6% YoY on July 28th

by Calculated Risk on 7/28/2014 05:53:00 PM

Here is another weekly update on housing inventory ...

SPECIAL NOTE from Ben at Housing Tracker:

I'm seeing higher than expected inventories in Dallas, Orlando and Tampa that do not appear to be accurate representations of reality. Data for those cities may be more suspect than data for other locales. National home inventory will also be skewed higher as a result. As always, consider this realtime data a rough and dirty estimate and use at your own risk.There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for June and indicated inventory was up 6.5% year-over-year).

Fortunately Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data, for 54 metro areas, for the last several years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays.

Inventory in 2014 (Red) is now 15.6% above the same week in 2013. (Note: There might be an issue with the Housing Tracker data over the last couple of weeks - Ben is checking - but inventory is still up significantly).

Inventory is also about 2.4% above the same week in 2012. According to several of the house price indexes, house prices bottomed in early 2012, and low inventories were a key reason for the subsequent price increases. Now that inventory is back above 2012 levels, I expect house price increases to slow (and possibly decline in some areas).

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.