by Calculated Risk on 8/14/2014 01:34:00 PM

Thursday, August 14, 2014

DataQuick on California Bay Area: July Home Sales down 9% Year-over-year, Distressed Sales and Investor Buying declines

From DataQuick: Sluggish Bay Area Home Sales in July; Prices Up – at a Slower Pace

A total of 8,474 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 7.1 percent from 7,915 in June and down 9.3 percent from 9,339 in July last year, according to Irvine-based CoreLogic DataQuick, a real estate information service.A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) flat or declining total sales, but 4) flat or some increase in non-distressed sales.

Bay Area sales usually decline around 5 percent from June to July. Sales for the month of July have varied from 6,666 in 1995 to 14,258 in 2004. The average since 1988, when CoreLogic DataQuick statistics begin, is 9,333. ...

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.7 percent of resales, down from a revised 2.9 percent from the month before, and down from 4.6 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.2 percent of Bay Area resales last month. That was down from an estimated 4.4 percent in June and down from 8.5 percent a year earlier.

Last month absentee buyers – mostly investors – accounted for 18.8 percent of all Bay Area home sales, which was the lowest absentee share of purchases since that figure was 18.5 percent in September 2010.

emphasis added

Though total sales were down 9.3% year-over-year, the percent of non-distressed sales was down about 2%.

NY Fed: Household Debt decreased Slightly in Q2 2014, Delinquency Rates Lowest Since Q3 2007

by Calculated Risk on 8/14/2014 11:00:00 AM

Here is the Q2 report: Household Debt and Credit Report. From the NY Fed:

Aggregate consumer debt was roughly flat in the 2nd quarter of 2014, showing a minor decrease of $18 billion. As of June 30, 2014, total consumer indebtedness was $11.63 trillion, down by 0.2% from its level in the first quarter of 2014. Overall consumer debt still remains 8.2% below its 2008Q3 peak of $12.68 trillion.

Mortgages, the largest component of household debt, decreased by 0.8%. Mortgage balances shown on consumer credit reports stand at $8.10 trillion, down by $69 billion from their level in the first quarter. Balances on home equity lines of credit (HELOC) also dropped by $5 billion (1.0%) in the second quarter and now stand at $521 billion. Non-housing debt balances increased by 1.9 %, boosted by gains in all categories. Auto loan balances increased by $30 billion; student loan balances increased by $7 billion; credit card balances increased by $10 billion; and other non-housing balances increased by $9 billion.

Delinquency rates improved across the board in 2014Q2. As of June 30, 6.2% of outstanding debt was in some stage of delinquency, compared with 6.6% in 2014Q1. About $724 billion of debt is delinquent, with $521 billion seriously delinquent (at least 90 days late or “severely derogatory”).

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt was flat in Q2.

Even though debt was down slightly in Q2, the recent increase in debt suggests households (in the aggregate) may be near the end of deleveraging.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate declined to 6.2% in Q2, from 6.6% in Q1. This is the lowest rate since Q3 2007.

The Severely Derogatory (red) rate has fallen to 2.28%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 1.90%, the lowest since Q3 2008.

Short term delinquencies are back to normal levels (lowest since series started in 2001).

Here is the press release from the NY Fed: New York Fed Report Shows Rises in Auto Loan Originations and Balances

There are a number of credit graphs at the NY Fed site.

Weekly Initial Unemployment Claims increase to 311,000

by Calculated Risk on 8/14/2014 08:38:00 AM

The DOL reports:

In the week ending August 9, the advance figure for seasonally adjusted initial claims was 311,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 289,000 to 290,000. The 4-week moving average was 295,750, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 293,500 to 293,750.The previous week was revised up to 290,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 295,750.

This was higher than the consensus forecast of 295,000.

Wednesday, August 13, 2014

Thursday: Unemployment Claims, NY Fed Q2 Household Debt and Credit Report

by Calculated Risk on 8/13/2014 07:26:00 PM

Thursday:

• At 8:30 AM ET, initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 289 thousand.

• At 11:00 AM, the Q2 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York.

On mortgage rates: I use the weekly Freddie Mac Primary Mortgage Market Survey® (PMMS®) to track mortgage rates. The PMMS series started in 1971, so there is a fairly long historical series.

For daily rates, the Mortgage News Daily has a series that tracks the PMMS very well, and is usually updated daily around 3 PM ET. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series).

MND reports that average 30 Year fixed mortgage rates decreased slightly today to 4.17% from 4.18% yesterday.

One year ago, rates were at 4.41% and rising. So rates are down year-over-year, but up from late 2012 and early 2013. Daily rates peaked last year at 4.85% in early September.

DataQuick on SoCal: July Home Sales down 12% Year-over-year, Distressed Sales and Investor Buying Declines Further

by Calculated Risk on 8/13/2014 01:33:00 PM

From DataQuick: Southland Home Sales Fall Yr/Yr Again; Prices Rise at Slower Pace

Southern California home sales fell to a three-year low for the month of July as supply continued to fall short of demand, some buyers struggled with higher prices, and investor activity fell. Cash deals declined to the lowest level in more than four years ...Both distressed sales and investor buying is declining - and this has been dragging down overall sales. Even though total sales are down 12.4% year-over-year, the percent of non-distressed sales was only down about 2% year-over-year.

A total of 20,369 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 1.4 percent from 20,654 sales in June, and down 12.4 percent from 23,253 sales in July 2013, according to Irvine-based CoreLogic DataQuick. ...

On average, sales have declined 6.3 percent between June and July since 1988, when CoreLogic DataQuick statistics begin. Southland sales have fallen on a year-over-year basis for 10 consecutive months. Sales during the month of July have ranged from a low of 16,225 in July 1995 to a high of 38,996 in July 2003. Last month’s sales were 19.4 percent below the July average of 25,269 sales.

...

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.2 percent of the Southland resale market last month. That was down from a revised 5.3 percent the prior month and down from 7.7 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.9 percent of Southland resales last month. That was down from a revised 6.0 percent the prior month and down from 12.7 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.6 percent of the Southland homes sold last month. That was the lowest share since December 2010, when 23.4 percent of homes sold to absentee buyers. Last month’s 23.6 percent absentee share was down from a revised 23.9 percent in June and down from 27.4 percent a year earlier. ...

emphasis added

The NAR is scheduled to release existing home sales for July on Thursday, August 21st.

Flashback to August 2011 and 2013 (And a hint for 2015)

by Calculated Risk on 8/13/2014 11:44:00 AM

Here are two posts from August in 2011 and 2013.

First, from August 14, 2011: Event Driven Declines in Consumer Sentiment.

Consumer sentiment had plunged to the lowest level in 30 years. This (and other data) led many analysts to predict the US was headed into a recession. As an example, from the WSJ in September 2011: Recession Is a ‘Done Deal,’ Per ECRI

“We are going into a recession,” ECRI director Lakshman Achuthan told CNBC this morning. “Last week we announced to our clients we are slipping into a recession. This is the first time I’m saying it publicly.”I disagreed. In the above post I argued that the plunge in sentiment was due to the threat by Congress not to pay the bills (event driven), and that sentiment would bounce quickly. I wrote:

My feeling is the debt ceiling decline - assuming the decline was due to the insanity in D.C. - is most similar to the 1987 stock market crash (that scared everyone, but had little impact on the economy) and to Hurricane Katrina (although Katrina led to higher oil prices and a direct impact on consumption in several gulf states).Second, from August 12, 2013: Comment: The Key Downside Economic Risk

If I'm correct, then sentiment should bounce back fairly quickly - but only to an already low level. And the impact on consumption should be minimal.

At the beginning of every year I post Ten Economic Questions for the year. Since 2013 (like 2011) was an off-year for elections, I expected Congress to act up again and ranked fiscal policy as the #1 downside risk in 2013. I wrote in August 2013:

Unfortunately we live in the real world, and politics trump reality. ...I was correct about the Debt Ceiling (this is a fake issue and should be eliminated), but I was too optimistic about the government shutdown. And I was correct fiscal policy is not a big downside risk this year, but this does remind us about 2015!

Still - even in the insane world of politics - the debt ceiling is a fake issue (the House will cave again - they have no choice). And hopefully we will not see a government shutdown, but I expect the negotiations will go down to the wire. My guess is we will see another "continuing resolution", but you never know with politics.

The good news is these showdowns mostly happen in odd years with the hope that the voters will forget the congressional shenanigans by the next election. So IF we can get through the fall, fiscal policy will probably not be a big downside risk in 2014. Unfortunately that is a big "if".

While most of the media is focused on the 2014 election "horse race", I'm concerned about the downside risks in 2015 from more "shenanigans". Unfortunately voters have short memories.

Retail Sales unchanged in July

by Calculated Risk on 8/13/2014 08:40:00 AM

On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 3.7% from July 2013. Sales in June were unrevised at a 0.2%. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.8 billion, virtually unchanged from the previous month, and 3.7 percent above July 2013. ... The May to June 2014 percent change was unrevised from +0.2 percent.

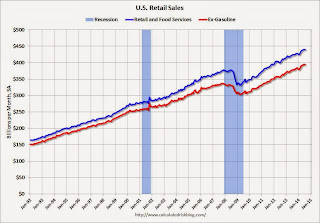

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.4% on a YoY basis (3.7% for all retail sales).

Retail sales ex-gasoline increased by 4.4% on a YoY basis (3.7% for all retail sales).The increase in July was below consensus expectations of a 0.2% increase.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 8/13/2014 07:02:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 8, 2014. ...

The Refinance Index decreased 4 percent from the previous week to the lowest level since May 2014. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier to the lowest level since February 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.35 percent, with points unchanged at 0.22 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 10% from a year ago.

Tuesday, August 12, 2014

Wednesday: Retail Sales

by Calculated Risk on 8/12/2014 08:01:00 PM

A must read piece from Tim Duy: Heading Into Jackson Hole

Bottom Line: Anything other than a dovish message coming from the Jackson Hole conference will be a surprise. Tight labor markets alone will not justify an aggressive pace of tightening. An aggressive pace requires that those tight labor markets manifest themselves into higher wage growth and higher inflation. Yellen seems content to normalize slowly until she sees the white in the eyes of inflation.CR Note: Yellen will be patient.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for July will be released. On a monthly basis, retail sales increased 0.2% from May to June (seasonally adjusted), and sales were up 4.3% from June 2013. The consensus is for retail sales to increase 0.2% in July, and to increase 0.4% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.4% increase in inventories.

EIA Forecast: Gasoline Prices expected to decline to $3.30 per gallon in December

by Calculated Risk on 8/12/2014 05:40:00 PM

It is difficult to forecast oil and gasoline prices due to world events, but currently the EIA expects gasoline prices to decline further this year according to the Short Term Energy Outlook released today:

• The market's perception of reduced risk to Iraqi oil exports and news regarding increasing Libyan oil exports contributed to a drop in the Brent crude oil spot price to an average of $107 per barrel (bbl) in July, $5/bbl lower than the June average. EIA projects Brent crude oil prices to average $107/bbl over the second half of 2014 and $105/bbl in 2015. ...Steady or declining gasoline prices would be a positive for the economy. Right now gasoline prices are down to around $3.47 per gallon nationally according to the Gasbuddy.com.

• Regular gasoline retail prices fell to an average of $3.61 per gallon (gal) in July, 8 cents/gal below the June average. Regular gasoline retail prices are projected to continue to decline to an average of $3.30/gal in December. EIA expects regular gasoline retail prices to average $3.50/gal in 2014 and $3.46/gal in 2015, compared with $3.51/gal in 2013.

emphasis added

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |