by Calculated Risk on 8/17/2014 10:59:00 AM

Sunday, August 17, 2014

Demolition as Stimulus

Gretchen Morgenson writes in the NY Times: In a Bank Settlement, Don’t Forget the Bulldozers

[T]he sheer size of the Bank of America settlement makes it an enormous opportunity, housing experts say, to help the forgotten victims of the mortgage crisis. These are people who still pay their mortgages and property taxes but are caught in the devastating cycle that zombie houses can create in a neighborhood. Many of these homeowners, already poor, are impoverished further by blight on their streets.In January 2009, I proposed adding a demolition plan to the stimulus package. This would have helped remove blight from many areas, and would have employed many idled construction workers. I think this was a small missed opportunity.

“We had hoped that with these settlements we could bring down the number of never-to-be-lived-in houses,” said Jim Rokakis, director of the Thriving Communities Institute, a program of the nonprofit Western Reserve Land Conservancy that works to take over and repurpose vacant properties in the Cleveland area. “Vacancy rates are 15 percent or higher, all as a result of the crisis. Now it’s a matter of burying the dead.”

Mr. Rokakis’s organization also works with 22 county land banks throughout the state, nonprofit entities that take over distressed properties and sell them for nominal amounts to people who will rebuild on them or, more commonly, turn them into gardens or community spaces.

Studies show that bulldozing distressed properties reduces foreclosure rates in the surrounding neighborhoods and can improve the values of nearby homes. An analysis conducted for the Western Reserve Land Conservancy found that demolishing 6,000 homes in and around Cleveland between 2009 and 2013 helped slow the fall in property values, generating a net benefit in retained property values of $1.40 for every dollar spent on demolition.

Saturday, August 16, 2014

Schedule for Week of August 17th

by Calculated Risk on 8/16/2014 01:03:00 PM

The key reports this week are July Housing Starts on Tuesday and Existing Home Sales on Thursday.

For manufacturing, the August Philly Fed survey will be released on Thursday.

For prices, July CPI will be released on Tuesday.

The key focus of the week will probably be on Fed Chair Janet Yellen's speech at Jackson Hole on Friday.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 53, unchanged from 53 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2014

8:30 AM: Consumer Price Index for July. The consensus is for a 0.1% increase in CPI in July and for core CPI to increase 0.2%.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 893 thousand (SAAR) in June. Single family starts were at 575 thousand SAAR in June.

The consensus is for total housing starts to increase to 963 thousand (SAAR) in July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for the Meeting of July 29-30, 2014.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 311 thousand.

10:00 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 18.5, down from 23.9 last month (above zero indicates expansion).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in June were at a 5.04 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.09 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Speech by Fed Chair Janet Yellen, Labor Markets, At the Federal Reserve Bank of Kansas City Economic Symposium: Re-Evaluating Labor Market Dynamics, Jackson Hole, Wyoming

Unofficial Problem Bank list declines to 447 Institutions

by Calculated Risk on 8/16/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 15, 2014.

Changes and comments from surferdude808:

As expected, the OCC provided an update on its enforcement action activities today, which contributed to several changes to the Unofficial Problem Bank List. In all, there were four removals and two additions that leave the list at 447 institutions with assets of $142.1 billion. A year ago, the list held 717 institutions with assets of $253.9 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 447.

Actions were terminated against NorStates Bank, Waukegan, IL ($392 million Ticker: NSFC); First National Bank, Ronceverte, WV ($237 million Ticker: FBSW); Bank of Atlanta, Atlanta, GA ($198 million); Pickens Savings and Loan Association, FA, Pickens, SC ($94 million).

Added this week were First Federal Savings and Loan Association of Greensburg, Greensburg, IN ($158 million) and Quontic Bank, Astoria, NY ($126 million). The other notable change was the OCC issuing a Prompt Corrective Action order against The National Republic Bank of Chicago, Chicago, IL ($1.0 billion), which has been laboring under a formal enforcement action since 2010.

Next week will likely be quiet as we do not anticipate the FDIC providing an update until two weeks from now.

Friday, August 15, 2014

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/15/2014 04:15:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in July.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us!

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up a little in few areas like Nevada, Sacramento and the Mid-Atlantic.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| July-14 | July-13 | July-14 | July-13 | July-14 | July-13 | July-14 | July-13 | |

| Las Vegas | 11.5% | 28.0% | 10.1% | 8.0% | 21.6% | 36.0% | 35.6% | 54.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 7.0% | 12.0% | 28.0% | ||

| Phoenix | 3.7% | 11.5% | 5.9% | 9.4% | 9.6% | 20.8% | 24.8% | 35.8% |

| Sacramento | 5.7% | 17.9% | 6.3% | 5.1% | 12.0% | 23.0% | 20.9% | 25.5% |

| Minneapolis | 3.0% | 5.7% | 9.5% | 15.0% | 12.5% | 20.7% | ||

| Mid-Atlantic | 4.3% | 6.6% | 7.7% | 6.6% | 12.1% | 13.2% | 17.1% | 16.1% |

| Orlando | 8.3% | 17.9% | 24.4% | 17.5% | 32.7% | 35.4% | 39.6% | 47.8% |

| California * | 6.6% | 12.7% | 5.6% | 8.3% | 12.2% | 21.0% | ||

| Bay Area CA* | 4.2% | 8.5% | 2.7% | 4.6% | 6.9% | 13.1% | 20.2% | 23.5% |

| So. California* | 5.9% | 12.7% | 5.2% | 7.7% | 11.1% | 20.4% | 24.5% | 30.0% |

| Hampton Roads | 19.3% | 20.5% | ||||||

| Northeast Florida | 30.7% | 34.9% | ||||||

| Memphis* | 13.4% | 16.9% | ||||||

| Georgia*** | 24.1% | N/A | ||||||

| Toledo | 32.9% | 35.0% | ||||||

| Wichita | 28.0% | 24.1% | ||||||

| Des Moines | 15.1% | 15.1% | ||||||

| Tucson | 26.2% | 29.1% | ||||||

| Omaha | 17.0% | 15.9% | ||||||

| Pensacola | 32.9% | 30.0% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/15/2014 02:47:00 PM

From housing economist Tom Lawler:

Based on reports released so far by local realtor associations/boards/MLS, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.09 million in July, up 0.6% from June’s estimate but down 5.4% from last July’s estimate.CR Note: The NAR is scheduled to release July existing home sales on Thursday, August 21st. The consensus is for sales at a 5.00 million pace (SAAR).

Last July, of course, was the peak month for home sales in 2013. Based on a combination of local realtor/MLS reports and real-estate listings trackers, I project that the NAR’s estimate of the number of existing homes for sale at the end of July will be up about 3.0% from the end of June. Barring revisions, such a gain would imply a YOY inventory increase of 5.8%, compared to the YOY gain of 6.5% in June.

Finally, based on local realtor/MLS reports I project that the NAR’s estimate of the median existing SF home sales price in July will be 3.7% higher than last July. The estimated YOY gain in June was 4.5%.

On inventory, if Lawler is correct, this would put inventory in July at close to the same level as two years ago - in July 2012 -when prices started increasing faster. Now, with rising inventory, this should mean slower price increases.

Preliminary August Consumer Sentiment decreases to 79.2

by Calculated Risk on 8/15/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for August was at 79.2, down from 81.8 in July.

This was the lowest reading since last November and below the consensus forecast of 82.3. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Fed: Industrial Production increased 0.4% in July

by Calculated Risk on 8/15/2014 09:15:00 AM

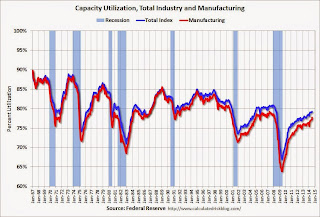

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in July for its sixth consecutive monthly gain. Manufacturing output advanced 1.0 percent in July, its largest increase since February. The production of motor vehicles and parts jumped 10.1 percent, while output in the rest of the manufacturing sector rose 0.4 percent. The production at mines moved up 0.3 percent, its ninth consecutive monthly increase. The output of utilities dropped 3.4 percent, as weather that was milder than usual for July reduced demand for air conditioning. At 104.4 percent of its 2007 average, total industrial production in July was 5.0 percent above its year-earlier level. Capacity utilization for total industry edged up 0.1 percentage point to 79.2 percent in July, a rate 1.7 percentage points above its level of a year earlier and 0.9 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is 0.9 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4% in July to 104.4. This is 24.7% above the recession low, and 3.6% above the pre-recession peak.

The monthly change for Industrial Production was slightly above expectations.

NY Fed: Empire State Manufacturing Survey indicates "business conditions continued to improve" in August

by Calculated Risk on 8/15/2014 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The August 2014 Empire State Manufacturing Survey indicates that business conditions continued to improve for New York manufacturers, but the improvement was less wide-spread than in the previous month. The headline general business conditions index retreated eleven points to 14.7, after reaching a four-year high in July. The new orders index slipped almost five points to 14.1, while the shipments index edged up a point to 24.6—a multiyear high. ...This is the first of the regional surveys for August. The general business conditions index was below the consensus forecast of a reading of 20.0, but still indicates solid expansion (above zero suggests expansion). However this is slower expansion in August than in July (the index was at a four-year high in July).

Labor market conditions were mixed but continued to improve overall. The index for number of employees slipped three points to 13.6, suggesting a slight pullback in the pace of hiring. However, the average workweek index rose six points to 8.0, signaling a slight increase in hours worked.

Despite the pullback in most of the survey’s indexes for current conditions, optimism about the near-term outlook grew increasingly widespread. The index for future general business conditions climbed eighteen points to 46.8—its highest level in two-and-a-half years.

emphasis added

Thursday, August 14, 2014

Friday: Industrial Production, NY Fed Mfg Survey, PPI, Consumer Sentiment

by Calculated Risk on 8/14/2014 08:15:00 PM

First from the WSJ: New Rules Near on Credit-Ratings Firms

The rules, expected to be somewhat tougher than those proposed more than three years ago, will take additional steps to ensure that the firms' interest in winning business doesn't affect ratings analysis, said the people familiar with the process.The downgrades might have triggered the crisis, but the key problem wasn't the downgrade - it was that the bonds were rated too high when first rated. I'll review why this happened (ratings too high) again soon.

Credit raters have been lambasted by critics and lawmakers over their actions in the run-up to the 2008 financial crisis. A 2011 U.S. congressional report cited widespread and sudden downgrades of mortgage-related bonds as being perhaps "more than any other single event ... the immediate trigger for the financial crisis." The bonds had previously been given top-notch ratings by the firms.

Friday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 20.0, down from 25.6 in July (above zero is expansion).

• Also at 8:30 AM, the Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 82.3, up from 81.8 in July.

Repeat: U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 8/14/2014 04:30:00 PM

Repeat: Here are graphs of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

There are many interesting points - the Depression baby bust (that started before the Depression), the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more.

What jumps out at me are the improvements in health care ... and also that the largest cohorts will all soon be under 40.

Notes: For animation, population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

Reader Druce put together the graphic below of the U.S population distribution, by age, from 1900 through 2060 using a slider. In 1900, the graph was fairly steep, but with improving health care, the graph has flattened out over the last 100 years.