by Calculated Risk on 8/21/2014 03:31:00 PM

Thursday, August 21, 2014

A Few Comments on Existing Home Sales

The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 5.8% year-over-year in July. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 10.7% from the bottom. On a seasonally adjusted basis, inventory was only up 0.2% in July compared to June.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 4.3% from July 2013, but normal equity sales were probably up from July 2013, and distressed sales down sharply. The NAR reported that 9% of sales were distressed in July (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – accounted for 9 percent of July sales, down from 15 percent a year ago and the first time they were in the single-digits since NAR started tracking the category in October 2008. Six percent of July sales were foreclosures and 3 percent were short sales.Last year in July the NAR reported that 15% of sales were distressed sales.

A rough estimate: Sales in July 2013 were reported at 5.38 million SAAR with 15% distressed. That gives 807 thousand distressed (annual rate), and 4.57 million equity / non-distressed. In July 2014, sales were 5.15 million SAAR, with 9% distressed. That gives 464 thousand distressed - a decline of over 40% from July 2013 - and 4.69 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up slightly (even with less investor buying).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in July (red column) were below the level of sales in July 2013, and above sales for 2008 through 2012.

Overall this was a solid report.

Earlier:

• Existing Home Sales in July: 5.15 million SAAR, Inventory up 5.8% Year-over-year

Philly Fed Manufacturing Survey increases to 28 in August, Highest since March 2011

by Calculated Risk on 8/21/2014 12:45:00 PM

Earlier from the Philly Fed: August Manufacturing Survey

The diffusion index of current general activity increased from a reading of 23.9 in July to 28.0 this month. The index has increased for three consecutive months and is at its highest reading since March 2011 The new orders and shipments indexes remained positive but fell to near their levels in June. The new orders index decreased 20 points [to 14.7], while the shipments index decreased 18 points.This was above the consensus forecast of a reading of 15.5 for July.

...

The current indicators for labor market conditions suggested continued modest expansion in employment. The employment index remained positive for the 14th consecutive month but declined 3 points from its reading in July [to 9.1] ...

Most of the survey’s broad indicators of future growth showed improvement this month. The future general activity index increased 8 points and is at its highest reading since June 1992 emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The average of the Empire State and Philly Fed surveys was solid in August, and this suggests another strong ISM report for August.

Existing Home Sales in July: 5.15 million SAAR, Inventory up 5.8% Year-over-year

by Calculated Risk on 8/21/2014 10:00:00 AM

The NAR reports: Existing-Home Sales Continue to Climb in July

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 2.4 percent to a seasonally adjusted annual rate of 5.15 million in July from a slight downwardly-revised 5.03 million in June. Sales are at the highest pace of 2014 and have risen four consecutive months, but remain 4.3 percent below the 5.38 million-unit level from last July, which was the peak of 2013. ...

Total housing inventory at the end of July rose 3.5 percent to 2.37 million existing homes available for sale, which represents a 5.5-month supply at the current sales pace. Unsold inventory is 5.8 percent higher than a year ago, when there were 2.24 million existing homes available for sale.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.15 million SAAR) were 2.4% higher than last month, but were 4.3% below the July 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.37 million in July from 2.29 million in June. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.37 million in July from 2.29 million in June. Headline inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 5.8% year-over-year in July compared to July 2013.

Inventory increased 5.8% year-over-year in July compared to July 2013. Months of supply was at 5.5 months in July.

This was above expectations of sales of 5.00 million. For existing home sales, the key number is inventory - and inventory is still low, but up solidly year-over-year. I'll have more later ...

Weekly Initial Unemployment Claims decrease to 298,000

by Calculated Risk on 8/21/2014 08:30:00 AM

The DOL reports:

In the week ending August 16, the advance figure for seasonally adjusted initial claims was 298,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 311,000 to 312,000. The 4-week moving average was 300,750, an increase of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 295,750 to 296,000.The previous week was revised up to 312,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 300,750.

This was lower than the consensus forecast of 305,000.

Wednesday, August 20, 2014

Thursday: Existing Home Sales, Philly Fed Mfg Survey, Unemployment Claims

by Calculated Risk on 8/20/2014 08:30:00 PM

From Andrew Ross at the San Francisco Chronicle: Household income hasn't shared in recovery

As of June, median annual household income was 4.8 percent below December 2007, when the recession began, dropping from $56,000 to $54,000. Going back to the good old days, it's down 5.9 percent from January 2000, according to the Sentier Research Group, which compiled the numbers from the latest Current Population Survey by the U.S. Census Bureau.I think this is real household income (adjusted for inflation). Hopefully, as the unemployment rate continues to decline, the median real household income will start to increase.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 311 thousand.

• At 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in June were at a 5.04 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.09 million SAAR. A key will be the reported year-over-year increase in inventory of homes for sale.

• Also at 10:00 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 18.5, down from 23.9 last month (above zero indicates expansion).

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in July

by Calculated Risk on 8/20/2014 04:34:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in July.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us!

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up a little in few areas like Nevada, Sacramento, Orlando, Miami and the Mid-Atlantic (areas with foreclosure delays related to a judicial foreclosure process or state law changes).

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| July-14 | July-13 | July-14 | July-13 | July-14 | July-13 | July-14 | July-13 | |

| Las Vegas | 11.5% | 28.0% | 10.1% | 8.0% | 21.6% | 36.0% | 35.6% | 54.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 7.0% | 12.0% | 28.0% | ||

| Phoenix | 3.7% | 11.5% | 5.9% | 9.4% | 9.6% | 20.8% | 24.8% | 35.8% |

| Sacramento | 5.7% | 17.9% | 6.3% | 5.1% | 12.0% | 23.0% | 20.9% | 25.5% |

| Minneapolis | 3.0% | 5.7% | 9.5% | 15.0% | 12.5% | 20.7% | ||

| Mid-Atlantic | 4.3% | 6.6% | 7.7% | 6.6% | 12.1% | 13.2% | 17.1% | 16.1% |

| Orlando | 8.3% | 17.9% | 24.4% | 17.5% | 32.7% | 35.4% | 39.6% | 47.8% |

| California * | 6.6% | 12.7% | 5.6% | 8.3% | 12.2% | 21.0% | ||

| Bay Area CA* | 4.2% | 8.5% | 2.7% | 4.6% | 6.9% | 13.1% | 20.2% | 23.5% |

| So. California* | 5.9% | 12.7% | 5.2% | 7.7% | 11.1% | 20.4% | 24.5% | 30.0% |

| Miami MSA SF | 8.5% | 17.8% | 17.4% | 12.9% | 25.9% | 30.7% | 38.6% | 43.2% |

| Miami MSA C/TH | 5.1% | 12.6% | 21.7% | 17.1% | 26.8% | 29.7% | 68.1% | 75.0% |

| Georgia*** | 24.1% | N/A | ||||||

| Toledo | 32.9% | 35.0% | ||||||

| Wichita | 28.0% | 24.1% | ||||||

| Des Moines | 15.1% | 15.1% | ||||||

| Peoria | 18.4% | 18.6% | ||||||

| Tucson | 26.2% | 29.1% | ||||||

| Omaha | 17.0% | 15.9% | ||||||

| Pensacola | 32.9% | 30.0% | ||||||

| Memphis* | 13.4% | 16.9% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

FOMC Minutes: Most Participants will wait for more data

by Calculated Risk on 8/20/2014 02:11:00 PM

Note: Most participants want to see more data - and several are still concerned that inflation is too low.

From the Fed: Minutes of the Federal Open Market Committee, July 29-30, 2014. Excerpts:

With respect to monetary policy over the medium run, participants generally agreed that labor market conditions and inflation had moved closer to the Committee's longer-run objectives in recent months, and most anticipated that progress toward those goals would continue. Moreover, many participants noted that if convergence toward the Committee's objectives occurred more quickly than expected, it might become appropriate to begin removing monetary policy accommodation sooner than they currently anticipated. Indeed, some participants viewed the actual and expected progress toward the Committee's goals as sufficient to call for a relatively prompt move toward reducing policy accommodation to avoid overshooting the Committee's unemployment and inflation objectives over the medium term. These participants were increasingly uncomfortable with the Committee's forward guidance. In their view, the guidance suggested a later initial increase in the target federal funds rate as well as lower future levels of the funds rate than they judged likely to be appropriate. They suggested that the guidance should more clearly communicate how policy-setting would respond to the evolution of economic data. However, most participants indicated that any change in their expectations for the appropriate timing of the first increase in the federal funds rate would depend on further information on the trajectories of economic activity, the labor market, and inflation. In particular, although participants generally saw the drop in real GDP in the first quarter as transitory, some noted that it increased uncertainty about the outlook, and they were looking to additional data on production, spending, and labor market developments to shed light on the underlying pace of economic growth. Moreover, despite recent inflation developments, several participants continued to believe that inflation was likely to move back to the Committee's objective very slowly, thereby warranting a continuation of highly accommodative policy as long as projected inflation remained below 2 percent and longer-term inflation expectations were well anchored.

...

Members discussed their assessments of progress--both realized and expected--toward the Committee's objectives of maximum employment and 2 percent inflation and considered enhancements to the statement language that would more clearly communicate the Committee's view on such progress. Regarding the labor market, many members concluded that a range of indicators of labor market conditions--including the unemployment rate as well as a number of other measures of labor utilization--had improved more in recent months than they anticipated earlier. They judged it appropriate to replace the description of recent labor market conditions that mentioned solely the unemployment rate with a description of their assessment of the remaining underutilization of labor resources based on their evaluation of a range of labor market indicators. In their discussion, some members expressed reservations about describing the extent of underutilization in labor resources more broadly. In particular, they worried that the degree of labor market slack was difficult to characterize succinctly and that the statement language might prove difficult to adjust as labor market conditions continued to improve. Moreover, they were concerned that, despite the improvement in labor market conditions, the new language might be misinterpreted as indicating increased concern about underutilization of labor resources. At the conclusion of the discussion, the Committee agreed to state that labor market conditions had improved, with the unemployment rate declining further, while also stating that a range of labor market indicators suggested that there remained significant underutilization of labor resources. Many members noted, however, that the characterization of labor market underutilization might have to change before long, particularly if progress in the labor market continued to be faster than anticipated. Regarding inflation, members agreed to update the language in the statement to acknowledge that inflation had recently moved somewhat closer to the Committee's longer-run objective and to convey their judgment that the likelihood of inflation running persistently below 2 percent had diminished somewhat.

emphasis added

AIA: Architecture Billings Index increased in July, "Highest Mark Since 2007"

by Calculated Risk on 8/20/2014 09:59:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Reaches Highest Mark Since 2007

The last three months have shown steadily increasing demand for design services and the Architecture Billings Index (ABI) is now at its highest level since 2007. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the July ABI score was 55.8, up noticeably from a mark of 53.5 in June. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 66.0, following a very strong mark of 66.4 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in July was 54.9.

“Business conditions for the design and construction marketplace, and those industries associated with it, appear to be well-positioned for continued growth in the coming months,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The key to a more widespread boost in design activity continues to be the institutional sector which is starting to exhibit signs of life after languishing for the better part of the last five-plus years.”

• Regional averages: Northeast (55.5), South (55.1), Midwest (54.1), West (53.5) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.8 in July, up from 53.5 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest an increase in CRE investment this year and in 2015.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 8/20/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 15, 2014. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.4 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.29 percent from 4.35 percent, with points increasing to 0.26 from 0.22 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

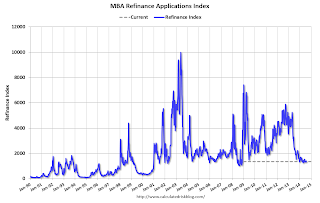

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013.

As expected, refinance activity is very low this year.

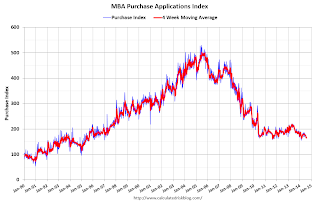

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.

Tuesday, August 19, 2014

Wednesday: FOMC Minutes

by Calculated Risk on 8/19/2014 09:32:00 PM

Wednesday:

• At 8:30 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, the AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• 2:00 PM, FOMC Minutes for the Meeting of July 29-3

In addition to housing starts for July, the Census Bureau also released the Q2 "Started and Completed by Purpose of Construction" report today.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released today showed there were 130,000 single family starts, built for sale, in Q2 2014, and that was above the 118,000 new homes sold for the same quarter, so inventory increased in Q2 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

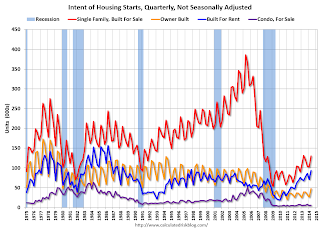

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were mostly unchanged compared to Q2 2013.

Single family starts built for sale were mostly unchanged compared to Q2 2013. Owner built starts were up 23% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly year-over-year.