by Calculated Risk on 9/03/2014 02:00:00 PM

Wednesday, September 03, 2014

Fed's Beige Book: Economic Activity Expanded, No "distinct shift in the overall pace of growth"

Fed's Beige Book "Prepared at the Federal Reserve Bank of Philadelphia and based on information collected on or before August 22, 2014."

Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded since the previous Beige Book report; however, none of the Districts pointed to a distinct shift in the overall pace of growth. The New York, Cleveland, Chicago, Minneapolis, Dallas, and San Francisco Districts characterized their growth rates as moderate; Philadelphia, Atlanta, St. Louis, and Kansas City reported modest growth. Boston reported that business activity appeared to be improving, and Richmond reported further strengthening. Philadelphia, Atlanta, Chicago, Kansas City, and Dallas explicitly reported that contacts in their Districts generally remained optimistic about future growth; most of the other Districts cited various examples of ongoing optimism from specific sectors.And on real estate:

Barely half of the Districts reported stable or growing residential real estate activity related to the construction of new homes and sales of existing houses. New construction and existing home sales generally grew modestly; market conditions tended to vary by metropolitan area and by neighborhood within metropolitan areas. Boston, New York, and Dallas reported high levels of ongoing multifamily construction projects; Chicago reported a moderate pace of growth, and San Francisco noted a pickup in activity.Very cautious comments on residential real estate, although nonresidential is seeing some growth.

A little over half of the Districts reported some degree of growth in nonresidential real estate activity, with increased construction, leasing, or both tied to steady or falling vacancy rates and to rent increases. None of the Districts reported a decline in overall activity, although New York and St. Louis described activity as mixed. In addition to traditional office space, certain Districts reported increased demand for specific projects: Boston noted demand for construction in the hospitality sector, Philadelphia cited industrial and warehouse projects, Richmond noted distribution centers, and St. Louis reported new retail and mixed-use projects as well as new industrial facility construction.

emphasis added

Early: August Vehicle Sales may be over 17 Million SAAR, Highest Sales Rate since July 2006

by Calculated Risk on 9/03/2014 11:50:00 AM

From John Sousanis at WardsAuto Counting Cars: Summer Sales Heat Up

SUMMARY: With a few exceptions, automakers are reporting higher than expected August sales, pointing to the possibility that the forecasted July 17-million SAAR, which failed to materialize, just may have been a month late coming.WardsAuto is currently projecting sales in August at 17.06 million seasonally adjusted annual rate (SAAR). This would be the highest sales rate since July 2006.

A few excerpts:

Toyota beat WardsAuto expections by nearly 9%, delivering 246,100 LVs in August. The automaker's daily sales rose 10.2% from same-month year-ago ...

[Ford] daily deliveries up just 3.9% over same-month year-ago, on total LV sales of 217,040.

...

General Motors poored a little cold water on August sales reports, recording a 2.4% DSR gain on year-ago, with LV deliveries of 272,243 units - 3% below WardsAuto's expectations for the company ...

Nissan is reporting August sales of almost 135,000 LVs, a 15.7% rise in DSR compared with same-month 2013. Volkswagen brand daily sales fell 9.6%, but the result was better than expected, with VW moving 35,181 units during the month.

Fiat-Chrysler reports over 197,000 LV deliveries in August, a massive 24.2% leap over year-ago sales

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 9/03/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 29, 2014. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.25 percent, the lowest level since June 2013, from 4.28 percent, with points decreasing to 0.24 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 73% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, September 02, 2014

Wednesday: Auto Sales, Fed's Beige Book

by Calculated Risk on 9/02/2014 05:30:00 PM

Wednesday:

• All day, Light vehicle sales for August. The consensus is for light vehicle sales to increase to 16.5 million SAAR in August from 16.4 million in July (Seasonally Adjusted Annual Rate).

• 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 10.5% increase in July orders.

• At 2:00 PM, Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their District

Oil prices were down sharply today with Brent October futures down to $100.58 per barrel according to Bloomberg. A year ago Brent was at $115 per barrel - so this is a significant year-over-year decline.

The recent decline in prices could give a little boost to consumer spending on other items. This decline will also hold down the annual cost-of-living-adjustment (COLA) for this year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.43 per gallon (down about a 15 cents per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

CoreLogic: House Prices up 7.4% Year-over-year in July

by Calculated Risk on 9/02/2014 12:03:00 PM

Notes: This CoreLogic House Price Index report is for July. The recent Case-Shiller index release was for June. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 7.4 Percent Year Over Year in July

Home prices nationwide, including distressed sales, increased 7.4 percent in July 2014 compared to July 2013. This change represents 29 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 1.2 percent in July 2014 compared to June 2014.

...

Excluding distressed sales, home prices nationally increased 6.8 percent in July 2014 compared to July 2013 and 1.1 percent month over month compared to June 2014. ...

“While home prices have clearly moderated nationwide since the spring, the geographic drivers of price increases are shifting,” said Sam Khater, deputy chief economist for CoreLogic. “Entering this year, price increases were led by western and southern states, but over the last few months northeastern and midwestern states are migrating to the forefront of home price rankings.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.2 in July, and is up 7.4% over the last year.

This index is not seasonally adjusted, so a solid month-to-month gain was expected for July.

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for twenty nine consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increase was slightly higher in July than in June (revised), however I expect the year-over-year increases to continue to slow.

Construction Spending increased 1.8% in July

by Calculated Risk on 9/02/2014 10:47:00 AM

Earlier the Census Bureau reported that overall construction spending increased in July:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during July 2014 was estimated at a seasonally adjusted annual rate of $981.3 billion, 1.8 percent above the revised June estimate of $963.7 billion. The July figure is 8.2 percent above the July 2013 estimate of $906.6 billion.Both private and public spending increased in July:

Spending on private construction was at a seasonally adjusted annual rate of $701.7 billion, 1.4 percent above the revised June estimate of $692.2 billion. Residential construction was at a seasonally adjusted annual rate of $358.1 billion in July, 0.7 percent above the revised June estimate of $355.6 billion. Nonresidential construction was at a seasonally adjusted annual rate of $343.6 billion in July, 2.1 percent above the revised June estimate of $336.6 billion. ...

In July, the estimated seasonally adjusted annual rate of public construction spending was $279.6 billion, 3.0 percent above the revised June estimate of $271.5 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has flattened recently and is 47% below the peak in early 2006 - but up 57% from the post-bubble low.

Non-residential spending is 17% below the peak in January 2008, and up about 52% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 8%. Non-residential spending is up 14% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2014. Residential spending is still very low, non-residential is starting to pickup, and public spending has probably hit bottom after several years of austerity.

This was a strong report, especially considering the upward revisions to spending in May and June.

ISM Manufacturing index increases to 59.0 in August

by Calculated Risk on 9/02/2014 10:06:00 AM

The ISM manufacturing index suggests faster expansion in August than in July. The PMI was at 59.0% in August, up from 57.1% in July. The employment index was at 58.1%, down slightly from 58.2% in July, and the new orders index was at 66.7%, up from 63.4% in July.

From the Institute for Supply Management: August 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in August for the 15th consecutive month, and the overall economy grew for the 63rd consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The August PMI® registered 59 percent, an increase of 1.9 percentage points from July's reading of 57.1 percent, indicating continued expansion in manufacturing. This month's PMI® reflects the highest reading since March 2011 when the index registered 59.1 percent. The New Orders Index registered 66.7 percent, an increase of 3.3 percentage points from the 63.4 percent reading in July, indicating growth in new orders for the 15th consecutive month. The Production Index registered 64.5 percent, 3.3 percentage points above the July reading of 61.2 percent. The Employment Index grew for the 14th consecutive month, registering 58.1 percent, a slight decrease of 0.1 percentage point below the July reading of 58.2 percent. Inventories of raw materials registered 52 percent, an increase of 3.5 percentage points from the July reading of 48.5 percent, indicating growth in inventories following one month of contraction. The August PMI® is led by the highest recorded New Orders Index since April 2004 when it registered 67.1 percent. At the same time, comments from the panel reflect a positive outlook mixed with caution over global geopolitical unrest.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was solidly above expectations of 56.8%. The employment index was strong - and the new orders index was at the highest level since April 2004.

Very strong report.

Black Knight releases Mortgage Monitor for July

by Calculated Risk on 9/02/2014 12:40:00 AM

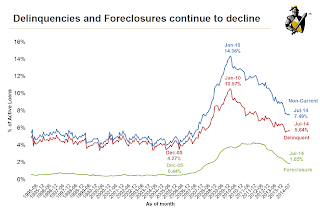

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for July today. According to BKFS, 5.64% of mortgages were delinquent in July, down from 5.70% in June. BKFS reports that 1.85% of mortgages were in the foreclosure process, down from 2.82% in July 2013.

This gives a total of 7.49% delinquent or in foreclosure. It breaks down as:

• 1,713,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,136,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 935,000 loans in foreclosure process.

For a total of 3,785,000 loans delinquent or in foreclosure in June. This is down from 4,599,000 in July 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

July’s data also showed continued improvement in new problem loans, which, at 0.6% of active loans, are now firmly back to 2005-2006 levels. Likewise, “roll rates” (the number of loans that shift from current into progressively more delinquent statuses) have been improving over the long term across all categories. Black Knight has observed roll rates increasing on loans shifting from 60 to 90 days delinquent and from 90 days to foreclosure over the last four months. It should be noted, however, that nearly 75 percent of 90-day defaults and almost 80 percent of foreclosure starts are from loans originated in 2008 and earlier.There is much more in the mortgage monitor.

emphasis added

Monday, September 01, 2014

State and Local Governments: Contributions to GDP and Employment

by Calculated Risk on 9/01/2014 11:00:00 AM

Two and half years ago I argued that "most of the drag from state and local governments would be over by mid-year 2012. Just eliminating the drag from state and local governments would help GDP and employment growth". This has been an important change.

Here is a graph showing the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. RI (blue) added to GDP growth for a few years, before subtracting in Q4 2013 and Q1 2014. RI bounced back in Q2, and since RI is still very low, I expect RI to make a positive contribution to GDP for some time.

State and local governments had been a drag on GDP for several years (red). Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline was relentless and unprecedented.

Now the contribution from state and local governments has been positive for 5 of the last 6 quarters.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years, but the decline slowed sharply in 2012. (Note: Scale doesn't start at zero to better show the change.)

The second graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years, but the decline slowed sharply in 2012. (Note: Scale doesn't start at zero to better show the change.)

In July 2014, state and local governments added 11,000 jobs. State and local government employment is now up 151,000 from the bottom, but still 593,000 below the peak.

It is pretty clear that state and local employment is now increasing. Note: Federal government layoffs have slowed (unchanged in July), but Federal employment is still down 22,000 for the year.

I expect state and local governments to make a positive contribution going forward.

Sunday, August 31, 2014

Mortgage Rates: A Long Way to Fall for a Significant Increase in Refinance Activity

by Calculated Risk on 8/31/2014 09:26:00 PM

I've seen some recent discussion suggesting that mortgage refinance activity might pickup significantly if mortgage rates fall just a little more. I think this is incorrect.

First, from Freddie Mac last week: Mortgage Rates Remain Low Heading Into Holiday Weekend

Freddie Mac ... released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates largely unchanged amid mixed news on the housing front heading into the Labor Day weekend.

...

30-year fixed-rate mortgage (FRM) averaged 4.10 percent with an average 0.5 point for the week ending August 28, 2014, unchanged from last week. A year ago at this time, the 30-year FRM averaged 4.51 percent.

15-year FRM this week averaged 3.25 percent with an average 0.6 point, up from last week when it averaged 3.23 percent. A year ago at this time, the 15-year FRM averaged 3.54 percent.

Click on graph for larger image.

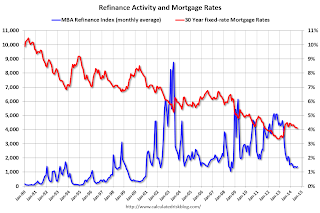

Click on graph for larger image.This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Sure, borrowers who took out mortgages last year can probably refinance now - but that is a small number of total borrowers. For a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

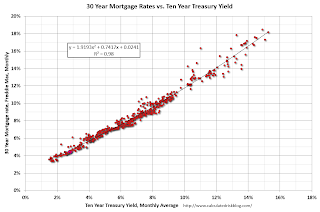

The second graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Currently the 10 year Treasury yield is at 2.34% and 30 year mortgage rates are at 4.10% (according to the Freddie Mac survey). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 3.5% when 10-year Treasury yields are around 1.4% (unlikely any time soon).

Currently the 10 year Treasury yield is at 2.34% and 30 year mortgage rates are at 4.10% (according to the Freddie Mac survey). Based on the relationship from the graph, the 30 year mortgage rate (Freddie Mac survey) would be around 3.5% when 10-year Treasury yields are around 1.4% (unlikely any time soon).To really have a refinance boom, 10-year Treasury yields would have to fall to 1% or so!

So I don't expect a significant increase in refinance activity any time soon.