by Calculated Risk on 9/05/2014 08:30:00 AM

Friday, September 05, 2014

August Employment Report: 142,000 Jobs, 6.1% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 142,000 in August, and the unemployment rate was little changed at 6.1 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for June was revised from +298,000 to +267,000, and the change for July was revised from +209,000 to +212,000. With these revisions, employment gains in June and July combined were 28,000 less than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Employment is now up 2.48 million year-over-year.

Total employment is now 753 thousand above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in August to 62.8% from 62.9% in July. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The participation rate has mostly moved sideways all year.

The Employment-Population ratio was unchanged at 59.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate decreased in August to 6.1%.

This was below expectations, and the revisions to prior months were negative 28,000.

I'll have much more later ...

Thursday, September 04, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/04/2014 09:36:00 PM

Friday:

• At 8:30 AM, the Employment Report for August. The consensus is for an increase of 230,000 non-farm payroll jobs added in August, up from the 209,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decrease to 6.1% in August. As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

From Nick Timiraos at the WSJ: Things to Watch in Friday’s Jobs Report

Any pickup in wages would provide a concrete sign of firming in the labor market, since few measures reflect the health of the job market like the price of labor. Average hourly wages rose just 1 cent in July to $24.45, an increase of 2% from a year earlier and the 60th straight month that year-on-year hourly wage growth has stayed below 2.5%. Before the recession, growth routinely exceeded 3%.

Also keep an eye on a change in the work week, which rose 0.3% in July from June, the first increase since April. Average weekly earnings, at $843.53, rose 2.3% from a year earlier in July.

Preview: Employment Report for August

by Calculated Risk on 9/04/2014 03:31:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in August (range of estimates between 195,000 and 279,000), and for the unemployment rate to decline to 6.1% from 6.2% in July.

Here is a summary of recent data:

• The ADP employment report showed an increase of 204,000 private sector payroll jobs in August. This was below expectations of 213,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased slightly in August to 58.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 25,000 in August. The ADP report indicated a 23,000 increase for manufacturing jobs in August.

The ISM non-manufacturing employment index increased in August to 57.1%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 260,000 in August.

Combined, the ISM surveys suggest about 285,000 payroll jobs added in August (note that the ISM diffusion indexes are based on number of firms, not employees - and the timing is different).

• Initial weekly unemployment claims averaged close to 300,000 in August, down from 302,000 in July. For the BLS reference week (includes the 12th of the month), initial claims were at 299,000; this was down from 303,000 during the reference week in June.

The slightly lower reference week reading suggests slightly fewer layoffs in August than in July.

• The final August Reuters / University of Michigan consumer sentiment index increased to 82.5 from the July reading of 81.8. This is frequently coincident with changes in the labor market, but there are other factors too - like lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 0.01% increase in small business employment in August (hours worked increase sharply in the Intuit index).

• Conclusion: The ADP report was lower in August than in July - and slightly below forecasts. The ISM indexes were strong, and suggest hiring above the forecasts. Weekly unemployment claims were at the lowest level during the reference period in a number of years. However the Intuit small business index showed less hiring in August.

There is always some randomness to the employment report, but I expect the BLS will report over the consensus of 230,000 nonfarm payrolls jobs added in August.

Trade Deficit decreased in July to $40.5 Billion

by Calculated Risk on 9/04/2014 12:25:00 PM

Earlier the Department of Commerce reported:

[T]otal July exports of $198.0 billion and imports of $238.6 billion resulted in a goods and services deficit of $40.5 billion, down from $40.8 billion in June, revised. July exports were $1.8 billion more than June exports of $196.2 billion. July imports were $1.6 billion more than June imports of $237.0 billion.The trade deficit was smaller than the consensus forecast of $42.7 billion and the deficit was revised down for Q1 and Q2.

The first graph shows the monthly U.S. exports and imports in dollars through July 2014.

Click on graph for larger image.

Click on graph for larger image.Imports and exports increased in July.

Exports are 19% above the pre-recession peak and up 4% compared to July 2013; imports are about 3% above the pre-recession peak, and up about 4% compared to July 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through June.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $97.81 in July, up from $96.41 in June, and down up $97.07 in July 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $30.9 billion in July, from $30.1 billion in July 2013.

The trade deficit was revised down (exports up, imports down) for the previous six months.

ISM Non-Manufacturing Index increased to 59.6% in August

by Calculated Risk on 9/04/2014 10:00:00 AM

The August ISM Non-manufacturing index was at 59.6%, up from 58.7% in July. The employment index increased in August to 57.1%, up from 56.0% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 55th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59.6 percent in August, 0.9 percentage point higher than the July reading of 58.7 percent. This represents continued growth in the Non-Manufacturing sector. The August reading of 59.6 percent is the highest for the composite index since its inception in January 2008. The Non-Manufacturing Business Activity Index increased to 65 percent, which is 2.6 percentage points higher than the July reading of 62.4 percent, reflecting growth for the 61st consecutive month at a faster rate. This is the highest reading for the index since December of 2004 when the index also registered 65 percent. The New Orders Index registered 63.8 percent, 1.1 percentage points lower than the reading of 64.9 percent registered in July. The Employment Index increased 1.1 percentage points to 57.1 percent from the July reading of 56 percent and indicates growth for the sixth consecutive month. The Prices Index decreased 3.2 percentage points from the July reading of 60.9 percent to 57.7 percent, indicating prices increased at a slower rate in August when compared to July. According to the NMI®, 15 non-manufacturing industries reported growth in August. Respondents' comments vary by business and industry. The majority of the comments reflect continued optimism in regards to business conditions. Some respondents indicate that there may be some tapering off in the recent strong rate of growth in the non-manufacturing sector."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was solidly above the consensus forecast of 57.1% and suggests faster expansion in August than in July.

The NMI was at the highest level since its inception. New orders was strong - and employment was up solidly.

Weekly Initial Unemployment Claims increase to 302,000

by Calculated Risk on 9/04/2014 08:33:00 AM

The DOL reports:

In the week ending August 30, the advance figure for seasonally adjusted initial claims was 302,000, an increase of 4,000 from the previous week's unrevised level of 298,000. The 4-week moving average was 302,750, an increase of 3,000 from the previous week's unrevised average of 299,750.The previous week was unrevised at 298,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 302,750.

This was close to the consensus forecast of 305,000.

ADP: Private Employment increased 204,000 in August

by Calculated Risk on 9/04/2014 08:15:00 AM

Private sector employment increased by 204,000 jobs from July to August according to the August ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 213,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Steady as she goes in the job market. Businesses continue to hire at a solid pace. Job gains are broad based across industries and company sizes. At the current pace of job growth the economy will return to full employment by the end of 2016.”

The BLS report for August will be released on Friday.

Wednesday, September 03, 2014

Thursday: ECB's Draghi, ADP Employment, Unemployment Claims, Trade Deficit, ISM Non-Manufacturing

by Calculated Risk on 9/03/2014 08:31:00 PM

From the WSJ: Small Firms Poised to Spend More on Plants, Equipment

Among 798 small private firms with less than $20 million in revenue, for instance, 51% said in August that they planned to increase their capital outlays in the next 12 months.This survey has only been conducted for a couple of years, but this is a positive sign. On credit, the Federal Reserve's July Senior Loan Officer survey indicated some pickup in small firm demand for loans, and slightly easier lending standards.

That is ... up from 42% a year ago, according to the survey by The Wall Street Journal and Vistage International, a San Diego executive-advisory group.

August marked the first month since June 2012, when the monthly survey began, that owners of small firms who planned to spend more on fixed investments outnumbered those who planned to hold steady or cut back.

Thursday:

• At 7:45 AM ET, Press conference following the Governing Council meeting of the ECB in Frankfurt with Mario Draghi. Here is the ECB website and press conference page.

• At 8:15 AM, the ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 213,000 payroll jobs added in August, down from 218,000 in July.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 298 thousand.

• Also at 8:30 AM, the Trade Balance report for July from the Census Bureau. The consensus is for the U.S. trade deficit to be at $42.7 billion in July from $41.5 billion in June.

• At 10:00 AM, the ISM non-Manufacturing Index for August. The consensus is for a reading of 57.1, down from 58.7 in July. Note: Above 50 indicates expansion.

Lawler on Toll Brothers: Net Home Orders Down, Price Gains Slow; Some “Lessening” in Pricing Power

by Calculated Risk on 9/03/2014 06:01:00 PM

From housing economist Tom Lawler: Toll Brothers: Net Home Orders Down, Price Gains on Orders Slows; Some “Lessening” in Pricing Power but No “Need” to Increase Incentives Much -- Yet

Toll Brothers, the self-described “nation’s leading builder of luxury homes,” reported that net home orders in the quarter ended July 31, 2014 totaled 1,324, down 5.8% from the comparable quarter of 2013. Net orders per community last quarter were down 15.9% from the comparable quarter of 2013. The company average net order price last quarter was $717,000, up 1.4% from a year ago. Toll’s sales cancellation rate, expressed as a % of gross orders, was 6.6% last quarter, up from 4.6% in the comparable quarter of 2013. Home deliveries last quarter totaled 1,364, up 36.8% from the comparable quarter of 2013, at an average sales price of $732,000, up 12.4% from a year ago. The company’s order backlog at the end of July was 4,204, up 5.1% from last July, at an average order price of $737,300, up 4.1% from a year ago. The company controlled 49,037 home sites at the end of July, up 3.9% from last July and up 25.1% from two years ago.

For its “traditional” home building business (i.e., ex city living), net home orders totaled 1,281 last quarter, down 5.0% from the comparable quarter of 2014, at an average net order price of $700,500, up 3.4% from a year ago.

Here are a few excerpts from the company’s press release.

Douglas C. Yearley, Toll Brothers' chief executive officer:

"Although we have seen some lessening of pricing power in the past year, we have not felt the need to incentivize to spur home sales. Because we generally do not build 'spec' homes, we are not under pressure to move standing inventory. We are driven by bottom-line growth and are pleased with our continued margin expansion through what we still believe is a recovering, albeit bumpy, housing cycle. We have been particularly pleased with our performance in a number of the markets we have targeted for growth, especially Coastal California, Texas, and the urban New York City area.Robert I. Toll, executive chairman

"With pent-up demand still yet to be unleashed, we are growing community count in attractive locations.”

"The national housing data has been somewhat volatile in recent months. Without real urgency pushing buyers to make a decision, general industry demand continues to be impacted by uncertainty about the economy and world events, improving but fragile consumer confidence and reduced affordability due to rising prices and limited personal income growth. One data point we do have confidence in is the low level of production compared to historic norms. Population grew during the recession and has continued to increase since then. Based on trends over more than forty years, the industry should be building 50% more homes this year than its current pace to meet the increased population demographics.”As with many other builders, last year Toll raised prices aggressively based on stronger-than-expected demand as well as longer-than-expected development timelines that limited supply. Toll and many other builders are now increasing active communities at a double-digit pace, but are having trouble generating double-digit sales growth because prices were increased at too rapid a pace last year.

Toll’s net orders were significantly below consensus.

U.S. Light Vehicle Sales increase to 17.45 million annual rate in August, Highest since Jan 2006

by Calculated Risk on 9/03/2014 02:51:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 17.45 million SAAR in August. That is up 10% from August 2013, and up 6.4% from the 16.4 million annual sales rate last month.

This was well above the consensus forecast of 16.5 million SAAR (seasonally adjusted annual rate).

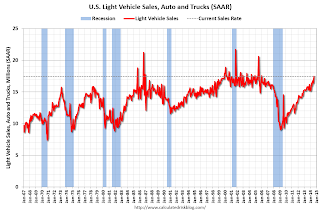

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for August (red, light vehicle sales of 17.45 million SAAR from WardsAuto).

From WardsAuto:

August's 17.45 million-unit seasonally adjusted annual rate of sales is the industry's highest monthly SAAR since January 2006.

The 103-month high was set as rising automaker incentives intersected with a strengthening economy and growing consumer confidence to boost deliveries well past 1.5 million units, for an industry wide 9.3% rise in daily sales.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

This is the highest sales rate since January 2006.