by Calculated Risk on 9/07/2014 07:51:00 PM

Sunday, September 07, 2014

Sunday Night Futures

From Ben Leubsdorf at the WSJ: Services-Spending Report Gains Wider Attention

A quarterly reading from the Commerce Department has quietly emerged as one of the most consequential government reports, with the power to roil estimates for U.S. economic growth and the impact of the Affordable Care Act.The Q2 Quarterly Services Report will be released on Thursday, September 11, 2014 at 10AM ET.

The Quarterly Services Survey, or QSS, measures revenue at service-providing companies including hospitals, day-care centers and law offices. ... Federal Reserve policy makers and private economists are taking a much closer look at the gauge. ...

Consumer spending accounts for more than two-thirds of U.S. economic output, but measuring spending on services is tricky. The government often relies on indirect clues, like payroll growth in certain industries. The QSS offers the best—that is, only—source of timely hard data. It is the basis for roughly one-fifth of the Commerce Department's quarterly calculation of gross domestic product.

June's report led to a steep downgrade for first-quarter GDP.

Weekend:

• Schedule for Week of September 7th

• Update: Prime Working-Age Population Growing Again

• Research: Much of Recent Decline in Labor Force Participation Rate due to "ongoing structural influences"

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 14 (fair value).

Oil prices were down slightly over the last week with WTI futures at $93.48 per barrel and Brent at $100.80 per barrel. A year ago, WTI was at $109, and Brent was at $116 - so prices are down solidly year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.44 per gallon (down almost 15 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Research: Much of Recent Decline in Labor Force Participation Rate due to "ongoing structural influences"

by Calculated Risk on 9/07/2014 12:23:00 PM

For several years, I've been arguing that "most of the recent decline in the participation rate" was due to demographics and other long term structural trends (like more education). This is an important issue because if most of the decline had been due to cyclical weakness, then we'd expect a significant increase in participation as the economy improved. If the decline was due to demographics and other long term trends, then the participation rate might keep falling (or flatten out) as the economy improves.

Note: So far this year, the participation rate has moved sideways at 62.8% - probably because demographics and other long term factors are being offset by people returning to the labor force this year. However, looking forward, the participation rate should continue to decline for the next couple of decades.

From Federal Reserve researchers Stephanie Aaronson, Tomaz Cajner, Bruce Fallick, Felix Galbis-Reig, Christopher L. Smith, and William Wascher: Labor Force Participation: Recent Developments and Future Prospects

The evidence we present in this paper suggests that much of the steep decline in the labor force participation rate since 2007 owes to ongoing structural influences that are pushing down the participation rate rather than a pronounced cyclical weakness related to potential jobseekers’ discouragement about the weak state of the labor market – in many ways a similar message as was conveyed in the 2006 Brookings Paper. Most prominently, the ongoing aging of the babyboom generation into ages with traditionally lower attachment to the labor force can, by itself, account for nearly half of the decline. In addition, estimates from our model, as well as the supplementary evidence on which we report, show persistent declines in participation rates for some specific age/sex categories that appear to have their roots in longer-run changes in the labor market that pre-date the financial crisis by a decade or more.

In particular, participation rates among youths have been declining since the mid-1990s, in part reflecting the higher returns to education documented extensively by other researchers, but also, we believe, some crowding out of job opportunities for young workers associated with the decline in middle-skill jobs and thus greater competition for the low-skilled jobs traditionally held by teenagers and young adults. Such “polarization” effects also appear to have weighed on the participation of less-educated prime-age men and, more recently, prime-age women. In contrast, increasing longevity and better health status, coupled with changes in social security rules and increased educational attainment, have contributed to an ongoing rise in the participation rates of older individuals, but these increases have not been large enough to provide much offset to the various downward influences on the aggregate participation rate.

That is not to say that all of the decline in labor force participation reflects structural influences. Our cohort-based model suggests that cyclical weakness was depressing the participation rate by about ¼ percentage point in 2014:Q2, while evidence from cross-state regressions suggests that the contribution of cyclical weakness could be as much as 1 percentage point. The greater cyclicality evidenced in the cross-state regressions could be capturing some of the features of the current labor market we discussed outside the context of the model, such as the unusually high level of those out of the labor force who want a job, or any unusual cyclicality in youth participation or retirement.

Looking ahead, demographics will likely continue to play a prominent role in determining the future path of the aggregate labor force participation rate. The youngest members of the baby-boom generation are still in their early fifties, and thus the effects of population aging will continue to put downward pressure on the participation rate for some time. Indeed, on our estimates, the continued aging of the population alone will subtract 2½ percentage points from the aggregate participation rate over the next ten years. And the overall downtrend could be even larger if some of the negative trends evident for particular age-sex groups persist.

Saturday, September 06, 2014

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 9/06/2014 06:06:00 PM

This is an update to a previous post through August.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Schedule for Week of September 7th

by Calculated Risk on 9/06/2014 01:12:00 PM

The key report this week is August retail sales on Friday.

3:00 PM: Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $17.4 billion.

7:30 AM ET: NFIB Small Business Optimism Index for August.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 4.671 million from 4.577 million in May. This was the highest level since February 2001.

The number of job openings (yellow) were up 18% year-over-year compared to June 2013. Quits were up 15% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.5% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 302 thousand.

10:00 AM: The Q2 Quarterly Services Report from the Census Bureau.

2:00 PM ET: The Monthly Treasury Budget Statement for August.

8:30 AM ET: Retail sales for August will be released.

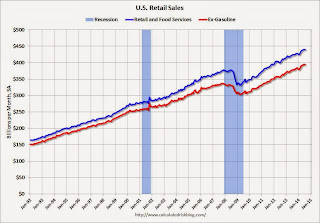

8:30 AM ET: Retail sales for August will be released.This graph shows retail sales since 1992 through July 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 3.7% from July 2013.

The consensus is for retail sales to increase 0.4% in August, and to increase 0.3% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 83.1, up from 82.5 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.5% increase in inventories.

Friday, September 05, 2014

Unofficial Problem Bank list declines to 437 Institutions

by Calculated Risk on 9/05/2014 09:40:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 5, 2014.

Changes and comments from surferdude808:

The Federal Reserve terminating two actions were the only changes to the Unofficial Problem Bank List this week. After removal, the list holds 437 institutions with assets of $138.9 billion. A year ago, the list held 704 institutions with assets of $249.8 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The Fed terminated actions against Commercial Bank, Harrogate, TN ($771 million) and American Bank, Bozeman, MT ($313 million). With these terminations, there are only 44 or 5.1 percent of the 858 banks supervised by the Fed operating under a formal enforcement action. In comparison, 6.2 percent of the state non-member banks supervised by the FDIC and 10.5 percent of the national banks supervised by the OCC are operating under a formal agreement.

Next week should be as quiet as the OCC will likely not provide an update on its enforcement action activity until September 19th.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Lawler: Latest Release Shows Sizable Revisions in S&P/Case-Shiller “National” Home Price Index

by Calculated Risk on 9/05/2014 04:35:00 PM

From housing economist Tom Lawler:

This week’s S&P/Case-Shiller Home Price Report for June 2014 contained two data “surprises.” The first was that the SPCS “National” HPI, previously released only quarterly, will now be published on a monthly basis. The second, and much more dramatic, surprise was that the historical data for the SPCS “National” HPI was revised substantially. Here is a table showing growth rates in the previously-published National HPI and the revised National HPI over selected periods, using not seasonally adjusted data.

While the revised HPI shows very similar growth rates to the previous HPI from 1990 to 2000, it shows (1) slower growth rates during the 2000-2006 period; (2) a substantially smaller peak-to-trough decline from mid-2006 to late 2011/early 2012; and (3) a somewhat slower growth rate from early 2012 to early 2014.

| Growth Rates, Previous vs. Revised SPCS "National" HPI | ||||

|---|---|---|---|---|

| Cumulative Previous | % Change Revised | Annualized Previous | % Change Revised | |

| Q2/1990 - Q2/2000 | 35.8% | 35.3% | 3.1% | 3.1% |

| Q2/2000 - Q2/2006 | 83.0% | 76.0% | 10.6% | 9.9% |

| Q2/2006 - Q1/2012 | -34.6% | -26.3% | -7.1% | -5.2% |

| Q1/2012 - Q1/2014 | 21.4% | 18.7% | 10.2% | 8.9% |

| Peak* | Q2/2006 | Q2/2006 | ||

| Trough* | Q1/2012 | Q4/2011 | ||

| Peak-to-Trough % Change | -34.6% | -26.7% | ||

| *For Quarterly HPI | ||||

The catalyst for this revision appears to a change in the sources of sales transactions data to sources used by CoreLogic, which “bought” the SPCS HPIs last year. Here is an excerpt from a July 2014 “methodology” report.

“The sources for sale transaction data were changed to sources used by CoreLogic, Inc. beginning with the March 2014 update of the S&P/Case-Shiller indices. Since the repeat sale pair samples collected from CoreLogic sources are not identical to samples collected from prior sources1, divisors are used to prevent any breaks in the index series. The divisors applied to index points estimated for March 2014 and all months afterward are listed below. The divisors are calculated by calculating the index value for February, 2014 with the old data source and the new data source separately. If we assume that the change in the data source increases the index level for February 2014 by 5%. Then the divisor is set to 1.05 and the index based on the new data source is divided by 1.05 for March 2014 and all subsequent months. This prevents a jump in the index and preserves the month-to-month percentage changes.”

While this paragraph appears to be related to the construction of the 20 metro area HPIs, I’m assuming that new CoreLogic data sources were used to construct revised national HPIs.

A Bloomberg article picked up on these revisions, though Case-Shiller principal economist David Stiff’s “explanation” in that article seemed incomplete. According to article Stiff said that “the index only looks different because it’s been rebuilt with new, higher quality data.” He also said that “CoreLogic’s data allowed Case-Shiller to weed out more bank repossessions,” implying that the major source of the revisions was that Case-Shiller’s HPI previously erroneously included non-arms-length transactions such as bank repossessions.

It seems highly unlikely, however, that this factor was the major reason for revisions in the national HPI. First, there were no similar revisions in pre-2014 data for the HPIs for the 20 metro areas SPCS publishes. Second, the new national HPI grew by seven percentage points less than the previous national HPI from Q2/2000 to Q2/2006, when distressed transactions were de minimis.

A more likely (though not verified) reason is that the new SPCS National HPI, using CoreLogic’s larger database, now covers a much wider geographic area than the old SPCS HPI. The geographic coverage of the old SPCS National HPI was pretty “light.” Here is SPCS’ estimate of its coverage of the housing market in each Census division (based on market value).

| Division Coverage (% Value) | Zero-Coverage States | |

|---|---|---|

| New England | 93.5% | Maine |

| Middle Atlantic | 76.1% | |

| East North Central | 63.3% | Indiana, Wisconsin |

| West North Central | 53.0% | North Dakota, South Dakota |

| South Atlantic | 63.0% | South Carolina, West Virginia |

| East South Central | 38.3% | Alabama, Mississippi |

| West South Central | 48.7% | |

| Mountain | 70.4% | Idaho, Montana, Wyoming |

| Pacific | 91.6% | Alaska |

While SPCS is now apparently using data sources used by CoreLogic, the two HPIs are still significantly different, now mainly reflecting methodological and aggregation differences.

The “new” SPCS “National” HPI now looks much more similar to the FHFA Expanded Dataset HPI, once the latter is adjusted (albeit crudely) to be market-value weighted instead of housing unit weighted (SPCS is value weighted). If one were to construct a FHFA “National” HPI by applying Census 2000 market value weights to each FHFA State HPI, here is what it would look like relative to the previous and revised SPCS National HPI.

Payroll Employment: Best Years, Worst Month

by Calculated Risk on 9/05/2014 01:32:00 PM

One of the dumbest comments I saw this morning was from Douglas Holtz-Eakin who wrote "Disaster in August jobs!"

Really? Was this a "disaster"? I'm sure Holtz-Easkin wrote "disaster" in 1984 when payroll employment only increased 128 thousand in one month (on the way to almost 3.9 million for the year). Or "DISASTER" (all caps) in 1983 when payroll jobs plunged 308 thousand one month (on the way to almost 3.5 million for the year).

Or how about in 1997 when the economy lost 39 thousand jobs one month (on the way to 3.4 million jobs added for the year)?

For fun, below is a table of the best years for job growth since 1980 with the worst month of the year. Obviously there is a significant amount of volatility in the employment report.

If the August report was a "jobs disaster" then there is a "disaster" every year! It would be important if this is the start of lower employment reports, but I think that is very unlikely.

Note 1: Job growth was stronger in the '80s and '90s when the prime working age population was growing quickly. This decade the prime working age population has actually declined, so we should expect as much job growth, see: Demographics: Prime Working-Age Population Growing Again

Note 2: I've called out Holtz-Eakin before. He voted to ban 'the phrases "Wall Street" and "shadow banking" and also the words "interconnection" and "deregulation" from' the Financial Crisis Inquiry Commissiom report! Oh my ...

| Non-Farm Payroll: Best Years, Worst Month | ||

|---|---|---|

| Year | Annual (000s) | Worst Month (000s) |

| 1984 | 3,880 | 128 |

| 1994 | 3,851 | 200 |

| 1983 | 3,458 | -308 |

| 1997 | 3,408 | -39 |

| 1988 | 3,242 | 94 |

| 1999 | 3,177 | 107 |

| 1987 | 3,153 | 171 |

| 1998 | 3,047 | 124 |

| 1996 | 2,825 | -18 |

| 1993 | 2,817 | -49 |

| 2014 | 2,5851 | 142 |

| 2005 | 2,506 | 67 |

| 1985 | 2,502 | 124 |

| 2013 | 2,331 | 84 |

| 2012 | 2,236 | 88 |

| 1995 | 2,159 | -16 |

| 2006 | 2,085 | 2 |

| 2011 | 2,083 | 70 |

| 2004 | 2,033 | 32 |

| 12014 is the hiring pace through August. | ||

Comments on Employment Report

by Calculated Risk on 9/05/2014 09:50:00 AM

Earlier: August Employment Report: 142,000 Jobs, 6.1% Unemployment Rate

Although the headline number and revisions were disappointing, this is just one month of data and historically the employment report is "noisy".

There were some positives in the report: the unemployment rate declined to 6.1%, U-6 (an alternative measure for labor underutilization) was at the lowest level since 2008, the number of part time workers for economic reasons declined, the number of long term unemployed declined to the lowest level since January 2009 - and payroll growth is still on pace to be the best year since 1999.

At the current pace (through August), the economy will add 2.58 million jobs this year (2.52 million private sector jobs). Right now 2014 is still on pace to be the best year for both total and private sector job growth since 1999.

Although wage growth is still subdued, it appears wage growth has picked up a little recently. From the BLS: "Average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents in August to $24.53. Over the year, average hourly earnings have risen by 2.1 percent." With the unemployment rate at 6.1%, there is still little upward pressure on wages. Wages should pick up as the unemployment rate falls over the next couple of years, but with the currently low inflation and little wage pressure, the Fed will likely remain patient.

A few numbers:

Total employment increased 142,000 from July to August, and is now 753,000 above the previous peak. Total employment is up 9.463 million from the employment recession low.

Private payroll employment increased 134,000 from July to August, and private employment is now 1,244,000 above the previous peak (the unprecedented large number of government layoffs has held back total employment). Private employment is up 10.03 million from the low.

Through the first eight months of 2014, the economy has added 1,723,000 payroll jobs - up from 1,572,000 added during the same period in 2013. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year. That still looks about right.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate has mostly moved sideways (with a downward drift started around '00) - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in August to 81.1% from 80.8% in July, and the 25 to 54 employment population ratio increased to 76.8% from 76.7%. As the recovery continues, I expect the participation rate for this group to increase - although the participation rate has been trending down for this group since the '90s.

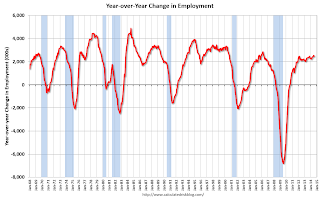

Year-over-year Change in Employment

In August, the year-over-year change was 2.482 million jobs, and it generally appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in August at 7.3 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in August to 7.277 million from 7.511 million in July. This suggests significantly slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 12.0% in August from 12.2% in July.

This is the lowest level for U-6 since October 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.963 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 3.155 in July. This is generally trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In August 2014, state and local governments added 5,000 jobs. State and local government employment is now up 123,000 from the bottom, but still 621,000 below the peak.

It is pretty clear that state and local employment is now increasing. Federal government layoffs have slowed (payroll increased slightly in August), but Federal employment is still down 19,000 for the year.

August Employment Report: 142,000 Jobs, 6.1% Unemployment Rate

by Calculated Risk on 9/05/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 142,000 in August, and the unemployment rate was little changed at 6.1 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for June was revised from +298,000 to +267,000, and the change for July was revised from +209,000 to +212,000. With these revisions, employment gains in June and July combined were 28,000 less than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Employment is now up 2.48 million year-over-year.

Total employment is now 753 thousand above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in August to 62.8% from 62.9% in July. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The participation rate has mostly moved sideways all year.

The Employment-Population ratio was unchanged at 59.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate decreased in August to 6.1%.

This was below expectations, and the revisions to prior months were negative 28,000.

I'll have much more later ...

Thursday, September 04, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/04/2014 09:36:00 PM

Friday:

• At 8:30 AM, the Employment Report for August. The consensus is for an increase of 230,000 non-farm payroll jobs added in August, up from the 209,000 non-farm payroll jobs added in July. The consensus is for the unemployment rate to decrease to 6.1% in August. As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

From Nick Timiraos at the WSJ: Things to Watch in Friday’s Jobs Report

Any pickup in wages would provide a concrete sign of firming in the labor market, since few measures reflect the health of the job market like the price of labor. Average hourly wages rose just 1 cent in July to $24.45, an increase of 2% from a year earlier and the 60th straight month that year-on-year hourly wage growth has stayed below 2.5%. Before the recession, growth routinely exceeded 3%.

Also keep an eye on a change in the work week, which rose 0.3% in July from June, the first increase since April. Average weekly earnings, at $843.53, rose 2.3% from a year earlier in July.