by Calculated Risk on 9/13/2014 08:11:00 AM

Saturday, September 13, 2014

Unofficial Problem Bank list declines to 435 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 12, 2014.

Changes and comments from surferdude808:

Two mergers lowered the Unofficial Problem Bank List to 435 institutions with assets of $137.5 billion. A year ago, the list held 700 institutions with assets of $246 billion. Finding their way off the list by finding a merger partner were United Central Bank, Garland, TX ($1.3 billion) and Idaho Banking Company, Boise, ID ($96 million). Idaho Banking company had also been operating under a Prompt Corrective Action order since February 2011. Next Friday we expect for the OCC to provide an update on its enforcement action activities.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 435.

Friday, September 12, 2014

Housing: "Price cuts are back"

by Calculated Risk on 9/12/2014 06:56:00 PM

From Tim Logan and Andrew Khouri at the LA Times: Housing price cuts point to a shift in Southland market

The latest sign that buyers are gaining leverage in Southern California's housing market: Price cuts are back.Inventory has increased significantly in a number of markets, after bottoming in 2013. And more inventory means slower price increases (maybe even price declines in some markets). Yet many sellers have listed their homes assuming the double digit price increases would continue. The result: no buyers and price cuts.

The number of homes with reduced asking prices has risen sharply in recent months ... In Orange County, the region's priciest market, about one-third of sellers have been forced to cut prices, according to data from real estate firm Redfin. ...

These trends have been building all year. But home sellers -- often the last to see market shifts -- are finally getting the message, said Paul Reid, a Redfin agent in Temecula.

"A lot of what we've seen over the last six or eight weeks is people lowering their prices to get buyers in the door," Reid said.

A few Analysts comments on FOMC meeting next week

by Calculated Risk on 9/12/2014 01:18:00 PM

Here are some analyst comments on the upcoming FOMC meeting. From Nomura:

We expect the September FOMC meeting to give us additional insight into the future path of monetary policy. We will receive another round of FOMC forecasts for the first time since June, which will incorporate significant new data. Forecasts should also be extended to 2017, thus giving us a better sense of how the participants judge the current balance between actual and potential output.From Merrill Lynch:

We expect the FOMC to make changes to its forward guidance. At a minimum, we expect the FOMC to add language that stresses the “data dependence” of future interest rate decisions. We expect the FOMC to continue to state that the adjustment of interest rates, when it comes, will be “balanced” and that it expects interest rates to converge to normal levels more slowly than employment and inflation. But in light of sustained improvement in labor market performance, and the inherent complexities in assessing their state, we expect that the FOMC to drop its assessment that “lift-off” is still a “considerable time” away

[P]inpointing the exact timing of the first rate hike is more of a guess than a forecast. Nonetheless, the case for an earlier move has grown over the last several months. ... The more immediate question is: when will the Fed change its rhetoric enough to scare the markets? In particular, could the FOMC do something big in its announcement on Wednesday? It is hard to predict the specific changes, but the risk of a hawkish signal is high:And from Goldman Sachs:

• Given the soft August jobs report, we expect them to continue to see a “significant underutilization of labor resources.” That language change probably requires a couple of better jobs reports.

• It is a close call, but we expect them to modify their promise to keep the funds rate near zero for “considerable time.” However, they will try to change the statement in a market neutral fashion, dropping the reference to “considerable time” and substituting “considerable reduction in slack and notable progress toward the inflation goal.”

• We expect small changes in the FOMC forecasts. In particular, we see some risk of another uptick in the “dot plot.” At this meeting, they introduce forecasts for 2017, and we expect median “dots” of 3.25 to 3.50%.

• Finally, we think Yellen and her allies will try to avoid shocking the markets. In the past, when the FOMC has reworked its forward guidance, they have often softened the blow by explicitly noting that their view on the likely timing of the exit has not changed or by downplaying the change in the press conference.

With respect to the appropriate timing of the first hike of the funds rate, recent comments point to a greater clustering of FOMC participants' views around mid-2015. In particular, one or two FOMC participants (namely, Presidents Lockhart and Rosengren) have likely pulled forward their views on the most appropriate date for liftoff; there is nothing to indicate that those previously expecting a mid-2015 hike have moved; and the more hawkish participants have also likely stayed in place.CR note: I'll post some thoughts on the upcoming meeting this weekend.

Preliminary September Consumer Sentiment increases to 84.6

by Calculated Risk on 9/12/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September was at 84.6, up from 82.5 in August.

This was above the consensus forecast of 83.1. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Retail Sales increased 0.6% in August

by Calculated Risk on 9/12/2014 08:41:00 AM

On a monthly basis, retail sales increased 0.6% from July to August (seasonally adjusted), and sales were up 5.0% from August 2013. Sales in July were revised up to a 0.3% increase from unchanged. Sales in June were also revised up.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $444.4 billion, an increase of 0.6 percent from the previous month, and 5.0 percent (±0.9%) above August 2013. ... The June to July 2014 percent change was revised from virtually unchanged to 0.3 percent.

Click on graph for larger image.

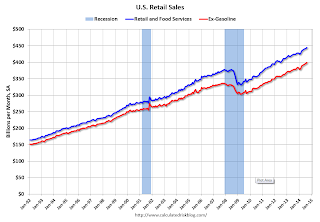

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were up 0.3%.

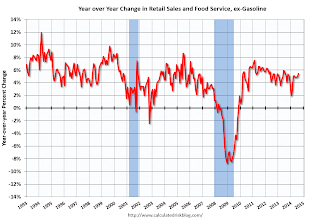

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.0% for all retail sales).

Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.0% for all retail sales).The increase in August was above consensus expectations of a 0.4% increase.

Including the upward revisions to June and July, this was a strong report.

Thursday, September 11, 2014

Friday: Retail Sales

by Calculated Risk on 9/11/2014 07:43:00 PM

First, from Merrill Lynch:

We have revised up our forecast for 3Q GDP growth to 3.5% from 3.0% and 2Q tracking has moved up to 4.8%, from 4.0%.Some of this is a bounce back from the -2.1% decline in Q1 GDP (on a seasonally adjusted annual rate basis, SAAR).

Friday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for retail sales to increase 0.4% in August, and to increase 0.3% ex-autos.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 83.1, up from 82.5 in August.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.5% increase in inventories.

DataQuick: Home Sales slow in SoCal and Bay Area

by Calculated Risk on 9/11/2014 04:32:00 PM

From DataQuick: Southland Home Sales Sputter; Median Sale Price Hits 80-Month High

A total of 18,796 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.7 percent from 20,369 sales in July, and down 18.5 percent from 23,057 sales in August 2013, according to CoreLogic DataQuick data. ...From DataQuick: Bay Area Home Sales Slow in August; Prices Increases Ease Back

...

Foreclosure resales – homes foreclosed on in the prior 12 months – represented 5.0 percent of the Southland resale market last month. That was down from 5.2 percent the prior month and down from 7.0 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.9 percent of Southland resales last month. That was up slightly from 5.8 percent the prior month and down from 11.5 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.5 percent of the Southland homes sold last month. That tied the July level as the lowest absentee share since December 2010, when 23.4 percent of homes sold to absentee buyers. Last month’s figure was down from 26.7 percent a year earlier. The peak was 32.4 percent in January 2013, while the monthly average since 2000, when the CoreLogic DataQuick absentee data begin, is about 19 percent.

emphasis added

A total of 7,578 new and resale houses and condos sold in the nine-county Bay Area last month. That was down 10.6 percent from 8,474 in July and down 12.0 percent from 8,616 in August last year, according to CoreLogic DataQuick data. ...A few key year-over-year trends: 1) declining distressed sales (about half as many this year as in August 2013), 2) generally declining investor buying, and 3) declining total sales. For August, it looks like non-distressed sales were also down significantly.

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.9 percent of resales, up from 2.7 percent the month before, and down from 4.3 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent, CoreLogic DataQuick reported.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.8 percent of Bay Area resales last month. That was down from an estimated 4.0 percent in July and down from 7.6 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 18.4 percent of all Bay Area homes. That was down from a revised 18.9 percent the prior month, and down from 20.3 percent a year earlier.

emphasis added

Hotels: Occupancy up 4.5%, RevPAR up 10.6% Year-over-Year

by Calculated Risk on 9/11/2014 01:55:00 PM

From HotelNewsNow.com: STR: US results for week ending 6 September

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 31 August through 6 September 2014, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rate rose 4.5 percent to 59.0 percent. Average daily rate increased 5.9 percent to finish the week at US$108.87. Revenue per available room for the week was up 10.6 percent to finish at US$64.20.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

There is always a dip in occupancy after the summer (less leisure travel), and business travel should pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at about the level as for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels. Since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy. Note: Smith Travel analysts say that supply growth will pickup next year, but remain relatively slow, "hotel supply growth in the United States is forecast to be 1% this year and 1.3% in 2015".

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Goldman Sachs Revises Q2 GDP estimate to 4.7%

by Calculated Risk on 9/11/2014 12:05:00 PM

From Brett LoGiurato at Business Insider: Goldman Is Now Saying That Q2 GDP Growth Was Absolutely Massive

Goldman Sachs revised its estimate of second-quarter GDP growth to 4.7% on Thursday, based on new data from the Census Bureau's Quarterly Services Survey (QSS).Here is the Q2 Quarterly Services Press Release

Stronger-than-expected healthcare spending growth led to the revised Goldman estimate of 4.7%, which was up 0.5% from the Bureau of Economic Analysis' second advance-estimate of 4.2%.

Health care and social assistance The estimate of U.S. health care and social assistance revenue for the second quarter of 2014, not adjusted for seasonal variation, or price changes, was $565.6 billion, an increase of 3.0 percent (± 0.9%) from the first quarter of 2014 and up 3.7 percent (± 0.9%) from the second quarter of 2013. The fourth quarter of 2013 to first quarter of 2014 percent change was not revised from -2.0 percent (± 0.8%).The third estimate of Q2 GDP will be released on Friday, September 26th. Some of the Q2 GDP increase was a bounce back from the weather impacted Q1.

Weekly Initial Unemployment Claims increase to 315,000

by Calculated Risk on 9/11/2014 08:35:00 AM

The DOL reports:

In the week ending September 6, the advance figure for seasonally adjusted initial claims was 315,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 302,000 to 304,000. The 4-week moving average was 304,000, an increase of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 302,750 to 303,250.The previous week was revised up to 304,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 304,000.

This was above the consensus forecast of 300,000 and in the normal range for an economic expansion.