by Calculated Risk on 9/16/2014 09:17:00 AM

Tuesday, September 16, 2014

BLS: Producer Price Index unchanged in August

The Producer Price Index for final demand was unchanged in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.1 percent in July and 0.4 percent in June. On an unadjusted basis, the index for final demand increased 1.8 percent for the 12 months ended in August.This was slightly lower than expectations, and was mostly due to a decline in energy products. However this is another indicator a low level of inflation.

...

The index for final demand goods moved down 0.3 percent in August, the largest decrease since a 0.7-percent drop in April 2013. Over 80 percent of the August decline is attributable to prices for final demand energy, which fell 1.5 percent. The index for final demand foods decreased 0.5 percent. Prices for final demand goods less foods and energy were unchanged.

emphasis added

Monday, September 15, 2014

LA area Port Traffic: Soft in August

by Calculated Risk on 9/15/2014 07:51:00 PM

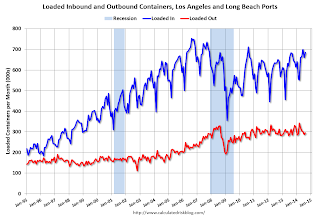

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Note: From the Port of Long Beach: Shipping surge cools after early ‘peak season’

Container cargo shipments declined by 9.1 percent in August at the Port of Long Beach, reflecting both early shipping by importers this year and the comparison to an August last year that was the Port’s busiest month since 2007. ... The downturn last month followed a surge in Long Beach from April through June 2014, when retailers shipped their products early ahead of the expiration of the longshore contract at the end of June.The contract was settled fairly quickly in July, and I expect traffic to increase over the next few months.

Last year’s August was very busy and started off the typical August through October “peak season.” That peak season may have occurred earlier this year.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in July. Outbound traffic was down 0.5% compared to 12 months ending in July.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were up slightly year-over-year in August, exports were down 6% year-over-year.

Overall traffic was a little soft in August, possibly due to concerns about a longer strike.

Las Vegas: Visitor Traffic on pace for record in 2014, Convention Attendance Returning

by Calculated Risk on 9/15/2014 02:28:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012, although visitor traffic was down slightly in 2013.

Convention attendance in 2013 was still about 18% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Through July, visitor traffic in 2014 is running 3.9% above 2013 - and on a record pace.

Convention traffic is up 5.4% from last year, but is still way below the pre-recession peak - although I wonder if the previous convention peak was related to "How to Flip a House" and "How to Buy with no money" type conventions!

In general, the gamblers are back - and the conventions are returning.

Goldman's Hatzius: Expect "Considerable time" to remain in FOMC Statement this Meeting

by Calculated Risk on 9/15/2014 11:35:00 AM

Excerpts from a note by Goldman Sach's chief economist Jan Hatzius: Q&A on "Why Renege Now?"

Q: You expect the phrase “considerable time after the asset purchase program ends” to remain in the statement. Many others don’t; what are they missing?

A: Many are missing the distinction between a decision not to extend existing guidance and a decision to renege on existing guidance. Let’s compare the current situation with the runup to the last rate hike cycle, when the committee went from “considerable period” in August-December 2003 to “patient” in January 2004, “measured pace” in May 2004, and finally rate hikes in June 2004.

The shift from “considerable period” in December 2003 to “patient” in January 2004 is an example of a decision not to extend existing guidance. Informed observers concluded from this shift that the committee had retained its guidance that a hike would probably come no earlier than June, but was unwilling to go beyond that. And indeed, the first hike came in June.

But if the committee removed the phrase “considerable time after the asset purchase program ends” this week or replaced it with something weaker, it would not only decline to extend the existing guidance into the future, but would in fact renege on the existing guidance. That would be a much bigger step than in January 2004.

Q: But don't they have to change the guidance as QE ends?

A: Eventually yes, but we think September is too early because QE has another six weeks to run, assuming they taper the program down to $15bn per month this week and end it at the October 29-30 meeting.

Even a material change at the October meeting would be a shortening of the existing guidance. (By "material change" we mean anything that goes beyond deleting the phrase "after the asset purchase program ends.") For example, replacing "considerable time" by “some time” on October 30 might be interpreted to mean that the no-hikes guidance expires, say, in February instead of April. Of course, it is possible that the data surprise sufficiently on the upside or the outlook changes in some other way to justify a more material change at the October meeting--remember, the guidance is conditional on the outlook.

But barring such a surprise, the right time to make a substantive change in the guidance is the December meeting. There are three basic options at that point: 1) keep “considerable time” and effectively extend the no-hikes guidance past the end of April, 2) move to weaker terms such as “patient” or “some time” and thereby decline to extend the no-hikes guidance past the end of April, or 3) move to more qualitative guidance phrased in terms of the remaining amount of slack or the level of inflation relative to the target.

...

Q: Do you think your forecast implies a dovish surprise for the markets this week?

A: Probably, but not necessarily. It is clear that many market participants expect a change in the "considerable time" language. If we are right that the language will remain unchanged, this would likely be dovish for near-dated fed funds futures contracts. That said, there are a lot of moving parts in an FOMC meeting that includes a press conference and a new SEP. If other aspects of the statement such as the post-liftoff guidance sound more hawkish, that could negate or even overwhelm the impact of the liftoff guidance, at least for the longer-dated contracts. Also, regardless of any changes in the statement, we expect the "dots" to drift up a bit further in 2015-2016 and to show rates for 2017 that are well above current market pricing, although this already seems to be widely expected and might therefore not have much impact on its own. And finally, of course, we might just be wrong and “considerable time” might go after all.

Fed: Industrial Production decreased 0.1% in August

by Calculated Risk on 9/15/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

The index of industrial production edged down 0.1 percent in August, and the index for manufacturing output decreased 0.4 percent; the declines were the first for each since January. The gains in July for both indexes were revised down. The declines in total industrial production and in manufacturing output in August reflected a decrease of 7.6 percent in the production of motor vehicles and parts, which had jumped more than 9 percent in July. Excluding motor vehicles and parts, factory output rose 0.1 percent in both July and August. The production at mines moved up 0.5 percent in August, and the output of utilities rose 1.0 percent. At 104.1 percent of its 2007 average, total industrial production in August was 4.1 percent above its year-earlier level. Capacity utilization for total industry decreased 0.3 percentage point in August to 78.8 percent, a rate 1.0 percentage point above its level of a year earlier and 1.3 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.8% is 1.0 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.1% in August to 104.1. This is 24.3% above the recession low, and 3.3% above the pre-recession peak.

The monthly change for Industrial Production was below expectations.

NY Fed: Empire State Manufacturing Survey indicates "business activity expanded at a robust pace" in September

by Calculated Risk on 9/15/2014 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

The headline general business conditions index rose thirteen points to 27.5, a multiyear high. The new orders index moved up three points to 16.9, and the shipments index advanced two points to 27.1. ...This is the first of the regional surveys for September. The general business conditions index was well above the consensus forecast of a reading of 16.0, and indicates solid expansion (above zero suggests expansion). The index is at the highest level since 2009.

Employment indexes showed a slight increase in employment levels and hours worked. Indexes for the six-month outlook conveyed a high degree of optimism about future business conditions.

emphasis added

Sunday, September 14, 2014

Sunday Night Futures

by Calculated Risk on 9/14/2014 09:05:00 PM

This will be interesting to watch on Tuesday from the WSJ: Ties to Scotland Bring Debate to U.S.

With Scotland set to vote Thursday on whether to end a 307-year-old union with the U.K., Scottish-Americans and Scottish expatriates across the U.S. also are watching—and debating—a campaign that polls suggest is too close to call.Weekend:

...

A survey released late Saturday by ICM Research for the Telegraph newspaper put support for independence at 49% of those surveyed with 42% against. Two other surveys put support for the union at 47% in both, versus 43% or 41% and a survey by Panelbase for the Sunday Times also put the union camp slightly ahead.

• Schedule for Week of September 14th

• FOMC Preview: More Tapering

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 7 and DOW futures are down 50 (fair value).

Oil prices were down over the last week with WTI futures at $90.96 per barrel and Brent at $96.42 per barrel. A year ago, WTI was at $108, and Brent was at $113 - so prices are down 15%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.39 per gallon (down almost 15 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: More Tapering

by Calculated Risk on 9/14/2014 08:15:00 AM

The FOMC will meet on Tuesday and Wednesday. The FOMC statement will be released Wednesday at 2:00 PM ET. Fed Chair Janet Yellen will hold a press conference at 2:30 PM.

What will know for this meeting:

• The FOMC will not raise rates. D'oh!

• The FOMC will reduce asset purchases (aka QE3) by $10 billion to $15 billion for the month of October. Note: the FOMC is expected to end QE3 at the October 29th meeting, so the October purchases are likely the final $15 billion for QE3.

• During the press conference, Dr. Yellen will break into a happy dance when asked about her comment in June that inflation data was "noisy". In June she said:

"I think recent readings on CPI index have been a bit on the high side but I think the data we're seeing is noisy. Broadly speaking inflation is evolving in line with the committee's expectations."OK, no dance, but Yellen was correct.

What we don't know for this meeting:

• What changes the FOMC will make to the statement. Here is the July statement. It is possible the sentence about not raising rates for a "considerable time" after the end of QE3 will be modified or removed. Here is the sentence:

"The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored."Obviously this sentence will have to be changed soon, since the asset purchase program is expected to end next month.

• Will the FOMC or Dr. Yellen indicate the first rate hike might happen before mid-year 2015? In March, Yellen said:

"[T]he language that we used in the statement is considerable period. So I, you know, this is the kind of term it’s hard to define. But, you know, probably means something on the order of around six months, that type of thing.”My guess is Yellen will clearly state the first rate hike will not happen for some time, and that the rate hike will be data dependent.

It will also be interesting to see the changes to the FOMC projections. For review, here are the previous projections. GDP bounced back sharply in Q2, and is looking solid in Q3, but Q1 was very weak. It is possible GDP projections for 2014 will be increased slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 |

| Mar 2014 Meeting Projections | 2.8 to 3.0 | 3.0 to 3.2 | 2.5 to 3.0 |

The unemployment rate was at 6.1% in August, so the unemployment rate projection for Q4 2014 will probably be lowered slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 |

| Mar 2014 Meeting Projections | 6.1 to 6.3 | 5.6 to 5.9 | 5.2 to 5.6 |

As of July, PCE inflation was up 1.6% from July 2013, and core inflation was up 1.5%. Both PCE and core PCE inflation projections will probably be unchanged and will still be below the FOMC's 2% target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 |

| Mar 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 2.0 | 1.7 to 2.0 |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 |

| Mar 2014 Meeting Projections | 1.4 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

Saturday, September 13, 2014

Schedule for Week of September 14th

by Calculated Risk on 9/13/2014 01:01:00 PM

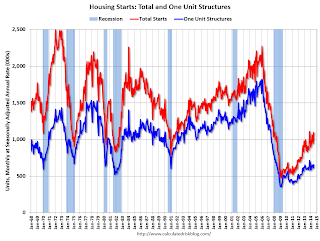

The key economic report this week is August housing starts on Thursday.

For manufacturing, the August Industrial Production and Capacity Utilization report, and the September NY Fed (Empire State) and Philly Fed manufacturing surveys, will be released this week.

For prices, PPI will be released Tuesday, and CPI on Wednesday.

The FOMC meets on Tuesday and Wednesday, and the FOMC is expected to taper QE3 asset purchases another $10 billion per month at this meeting.

Also the BLS will release the 2014 preliminary employment Benchmark Revision, and the Fed will release the Q2 Flow of Funds report on Thursday.

8:30 AM: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 16.0, up from 14.7 in August (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for August. The consensus is for no change in CPI in August and for core CPI to increase 0.2%.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to reduce monthly QE3 asset purchases from $25 billion per month to $15 billion per month at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 315 thousand.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 1.093 million (SAAR) in July. Single family starts were at 656 thousand SAAR in July.

The consensus is for total housing starts to decrease to 1.040 million (SAAR) in August.

8:45 AM: Speech by Fed Chair Janet Yellen, The Importance of Asset Building for Low and Middle Income Households, At the Corporation for Enterprise Development's 2014 Assets Learning Conference, Washington, D.C. (via prerecorded video)

10:00 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 22.0, down from 28.0 last month (above zero indicates expansion).

10:00 AM: 2014 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS:

"Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The final benchmark revision will be issued with the publication of the January 2015 Employment Situation news release in February."12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2014

Unofficial Problem Bank list declines to 435 Institutions

by Calculated Risk on 9/13/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 12, 2014.

Changes and comments from surferdude808:

Two mergers lowered the Unofficial Problem Bank List to 435 institutions with assets of $137.5 billion. A year ago, the list held 700 institutions with assets of $246 billion. Finding their way off the list by finding a merger partner were United Central Bank, Garland, TX ($1.3 billion) and Idaho Banking Company, Boise, ID ($96 million). Idaho Banking company had also been operating under a Prompt Corrective Action order since February 2011. Next Friday we expect for the OCC to provide an update on its enforcement action activities.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 435.