by Calculated Risk on 9/17/2014 11:08:00 AM

Wednesday, September 17, 2014

Key Measures Show Low Inflation in August

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.5% annualized rate) in August. The 16% trimmed-mean Consumer Price Index was essentially unchanged (0.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here. Note that motor fuel prices declined at a 39% annual rate in August, and "Meats, Poultry, Fish & Eggs" increased at a 20% annual rate.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.2% (-2.4% annualized rate) in August. The CPI less food and energy was essentially unchanged (0.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for June and increased just 1.5% year-over-year.

On a monthly basis, median CPI was at 1.5% annualized, trimmed-mean CPI was at 0.3% annualized, and core CPI increased 0.2% annualized.

On a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

NAHB: Builder Confidence increased to 59 in September, Highest since 2005

by Calculated Risk on 9/17/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 59 in September, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Hits Highest Level Since November of 2005

Builder confidence in the market for newly built, single-family homes rose for a fourth consecutive month in September to a level of 59 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This latest four-point gain brings the index to its highest reading since November of 2005.

“Since early summer, builders in many markets across the nation have been reporting that buyer interest and traffic have picked up, which is a positive sign that the housing market is moving in the right direction,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del.

“While a firming job market is helping to unleash pent-up demand for new homes and contributing to a gradual, upward trend in builder confidence, we are still not seeing much activity from first-time home buyers,” said NAHB Chief Economist David Crowe. “Other factors impeding the pace of the housing recovery include persistently tight credit conditions for consumers and rising costs for materials, lots and labor.”

..

All three HMI components posted gains in September. The indices gauging current sales conditions and traffic of prospective buyers each rose five points to 63 and 47, respectively. The index gauging expectations for future sales increased two points to 67.

Builder confidence also rose across every region of the country in September. Looking at the three-month moving average for each region, the Midwest registered a five-point gain to 59, the South posted a four-point increase to 56, the Northeast recorded a three-point gain to 41 and the West posted a two-point increase to 58.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 56 and the highest reading since 2005.

Early Look at 2015 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/17/2014 08:30:00 AM

From the Bureau of Labor Statistics (BLS): Consumer Price Index - August 2014

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.2 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment. ... The energy index fell 2.6 percent, with the gasoline index declining 4.1 percent and the indexes for natural gas and fuel oil also decreasing.On a year-over-year basis, CPI is up 1.7 percent, and core CPI is up also up 1.7 percent. This was below the consensus forecast of no change for CPI, and a 0.2% increase in core CPI.

...

The index for all items less food and energy was unchanged in August; this was the first month since October 2010 that the index did not increase.

emphasis added

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The BLS also reported this morning:

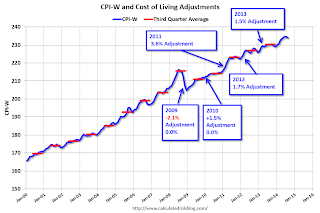

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.6 percent over the last 12 months to an index level of 234.030 (1982-84=100). For the month, the index fell 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

Since the highest Q3 average was last year (Q3 2013), at 230.327, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

Using the average for July and August, CPI-W was up 1.7% compared to Q3 2013.

Gasoline prices have continued to decline in September, and COLA will be below 2%, and possibly close to the 1.7% in 2012.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2013 yet, but wages probably increased again in 2013. If wages increased the same as last year, then the contribution base next year will be increased to around $120,500 from the current $117,000.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 9/17/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 12, 2014. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 10 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. ...

...

“Application volume rebounded coming out of the Labor Day holiday, even as rates increased to their highest level in the last few months,” said Mike Fratantoni, MBA’s Chief Economist. “Given the volatility in activity around the long weekend, it can be helpful to look at the change over a two week span: refinance applications are down 1.4 percent while purchase applications are up 2.1 percent. Purchase volume continues to track almost ten percent behind last year’s levels.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.36 percent, the highest level since June 2014, from 4.27 percent, with points decreasing to 0.20 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

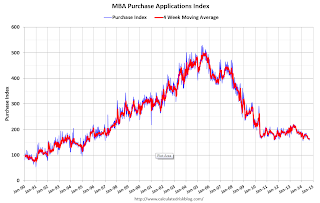

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 74% from the levels in May 2013.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 10% from a year ago.

Tuesday, September 16, 2014

Wednesday: FOMC Statement and Press Conference, CPI, Home Builder Confidence

by Calculated Risk on 9/16/2014 08:01:00 PM

More previews on the FOMC statement and press conference:

From Jon Hilsenrath at the WSJ: How the Federal Reserve Could Tweak ‘Considerable Time’

"Given the economic backdrop, they don’t want to send a signal right now that rate increases are imminent,” Hilsenrath said. “I think what they do, at the end of the day, is they qualify it.” ... One of the headlines they’re going to come out with I expect to be formalizing some of their exit plan,” Hilsenrath said. “It becomes, in their mind, a lot for the market to digest if they announce their exit strategy and change their guidance at the same time."From Robin Harding at the Financial Times: Money Supply: A “considerable” challenge

The bottom line is that “considerable time” may survive in some form on Wednesday, but if so, I’ll be surprised if there is not a significant change to the statement that sets up its eventual departure.Wednesday:

excerpt with permission

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for August. The consensus is for no change in CPI in August and for core CPI to increase 0.2%.

• At 10:00 AM, the September NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the FOMC Statement. The FOMC is expected to reduce monthly QE3 asset purchases from $25 billion per month to $15 billion per month at this meeting.

• Also at 2:00 PM, the FOMC projections will be released. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Lawler: Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/16/2014 04:31:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for several selected cities in August.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us!

On Orlando, Lawler notes: "MLS-based foreclosure sales in Orlando last month were up 30.1% from last August, while MLS-based short sales were down 64.9%."

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down significantly in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up sharply in Orlando, and up a little in Las Vegas and the Mid-Atlantic.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | Aug-14 | Aug-13 | |

| Las Vegas | 11.5% | 25.0% | 8.9% | 8.0% | 20.4% | 33.0% | 32.1% | 52.5% |

| Reno** | 8.0% | 21.0% | 4.0% | 5.0% | 12.0% | 26.0% | ||

| Phoenix | 3.6% | 10.3% | 6.6% | 8.9% | 10.3% | 19.3% | 25.2% | 34.1% |

| Minneapolis | 2.5% | 5.5% | 8.1% | 15.2% | 10.6% | 20.7% | ||

| Mid-Atlantic | 4.1% | 7.6% | 8.9% | 7.0% | 13.0% | 14.6% | 17.5% | 17.5% |

| Orlando | 7.1% | 17.2% | 25.8% | 16.7% | 32.9% | 33.9% | 42.1% | 46.0% |

| California * | 6.0% | 11.4% | 5.4% | 7.8% | 11.4% | 19.2% | ||

| Bay Area CA* | 3.8% | 7.6% | 2.9% | 4.3% | 6.7% | 11.9% | 21.8% | 23.7% |

| So. California* | 5.9% | 11.5% | 5.0% | 7.0% | 10.9% | 18.5% | 24.4% | 28.4% |

| Hampton Roads | 18.6% | 21.0% | ||||||

| Northeast Florida | 33.3% | 36.7% | ||||||

| Georgia*** | 26.8% | N/A | ||||||

| Toledo | 32.2% | 30.1% | ||||||

| Des Moines | 16.0% | 16.8% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| Birmingham AL | ||||||||

| Springfield IL** | ||||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/16/2014 02:14:00 PM

From housing economist Tom Lawler:

Based on August realtor association/board/MLS reports released so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.12 million, down 0.6% from July’s pace and down 3.9% from last August’s seasonally adjusted pace. I also estimate that unadjusted sales last month were down about 6% from a year ago.CR Note: The NAR is scheduled to release August existing home sales on Monday, September 22nd.

Based on realtor/MLS reports as well as other reports on home listings, I project that the NAR’s estimate of the number of existing homes for sales at the end of August will be 2.35 million, down 0.8% from July but up 6.3% from last August. Finally, I project that the NAR’s estimate of the median existing SF home sales price last month will be $217,500, up 3.7% from last August.

I also expect the NAR to revise downward its median existing SF home sales price for July to $222,600 from $223,900 – or to a YOY increase of 4.5% from a YOY increase of 5.1%. In the July report the NAR showed a YOY increase in the Northeast median existing SF home sales price of 2.7%, which was well above what state and local realtor reports would suggest.

On inventory, if Lawler is correct, this would put inventory in August down about 2% compared to August 2012 - two years ago - when prices started increasing faster. Now, with rising inventory, this should mean slower price increases.

Census: Poverty Rate declined in 2013, Real Median Income increased slightly

by Calculated Risk on 9/16/2014 10:28:00 AM

From the Census Bureau: Income, Poverty and Health Insurance Coverage in the United States: 2013

The nation’s official poverty rate in 2013 was 14.5 percent, down from 15.0 percent in 2012. The 45.3 million people living at or below the poverty line in 2013, for the third consecutive year, did not represent a statistically significant change from the previous year’s estimate.

Median household income in the United States in 2013 was $51,939; the change in real terms from the 2012 median of $51,759 was not statistically significant. This is the second consecutive year that the annual change was not statistically significant, following two consecutive annual declines.

...

These findings are contained in two reports: Income and Poverty in the United States: 2013 and Health Insurance Coverage in the United States: 2013.

Click on graph for larger image.

Click on graph for larger image. From Census:

• In 2013, real median household income was 8.0 percent lower than in 2007, the year before the most recent recession (Figure 1 and Table A-1).

• Median household income was $51,939 in 2013, not statistically different in real terms from the 2012 median of $51,759 (Figure 1 and Table 1). This is the second consecutive year that the annual change was not statistically significant, following two consecutive years of annual declines in median household income.

From Census:

From Census:• In 2013, the official poverty rate was 14.5 percent, down from 15.0 percent in 2012 (Figure 4). This was the first decrease in the poverty rate since 2006.

• In 2013, there were 45.3 million people in poverty. For the third consecutive year, the number of people in poverty at the national level was not statistically different from the previous year’s estimate.

• The 2013 poverty rate was 2.0 percentage points higher than in 2007, the year before the most recent recession.

BLS: Producer Price Index unchanged in August

by Calculated Risk on 9/16/2014 09:17:00 AM

The Producer Price Index for final demand was unchanged in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.1 percent in July and 0.4 percent in June. On an unadjusted basis, the index for final demand increased 1.8 percent for the 12 months ended in August.This was slightly lower than expectations, and was mostly due to a decline in energy products. However this is another indicator a low level of inflation.

...

The index for final demand goods moved down 0.3 percent in August, the largest decrease since a 0.7-percent drop in April 2013. Over 80 percent of the August decline is attributable to prices for final demand energy, which fell 1.5 percent. The index for final demand foods decreased 0.5 percent. Prices for final demand goods less foods and energy were unchanged.

emphasis added

Monday, September 15, 2014

LA area Port Traffic: Soft in August

by Calculated Risk on 9/15/2014 07:51:00 PM

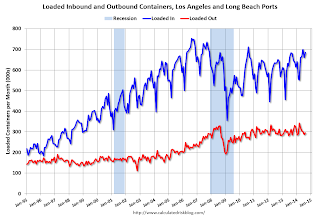

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for August since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Note: From the Port of Long Beach: Shipping surge cools after early ‘peak season’

Container cargo shipments declined by 9.1 percent in August at the Port of Long Beach, reflecting both early shipping by importers this year and the comparison to an August last year that was the Port’s busiest month since 2007. ... The downturn last month followed a surge in Long Beach from April through June 2014, when retailers shipped their products early ahead of the expiration of the longshore contract at the end of June.The contract was settled fairly quickly in July, and I expect traffic to increase over the next few months.

Last year’s August was very busy and started off the typical August through October “peak season.” That peak season may have occurred earlier this year.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in July. Outbound traffic was down 0.5% compared to 12 months ending in July.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were up slightly year-over-year in August, exports were down 6% year-over-year.

Overall traffic was a little soft in August, possibly due to concerns about a longer strike.