by Calculated Risk on 9/19/2014 10:43:00 AM

Friday, September 19, 2014

BLS: State unemployment rates little changed in August

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in August. Twenty-four states and the District of Columbia had unemployment rate increases from July, 15 states had decreases, and 11 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-five states and the District of Columbia had unemployment rate decreases from a year earlier, three states had increases, and two states had no change.

...

Georgia had the highest unemployment rate among the states in August, 8.1 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Georgia had the highest unemployment rate in August at 8.1%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).One state has an unemployment rate at or above 8% (light blue), and 11 states are still at or above 7% (dark blue).

Fed's Q2 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 9/19/2014 08:03:00 AM

The Federal Reserve released the Q2 2014 Flow of Funds report yesterday: Flow of Funds.

According to the Fed, household net worth increased in Q2 compared to Q1, and is at a new record high:

The net worth of households and nonprofits rose $1.4 trillion to $81.5 trillion during the second quarter of 2014. The value of directly and indirectly held corporate equities increased $1.0 trillion and the value of real estate expanded $230 billion.Net worth previously peaked at $67.9 trillion in Q2 2007, and then net worth fell to $55.0 trillion in Q1 2009 (a loss of $12.9 trillion). Household net worth was at $81.5 trillion in Q2 2014 (up $26.5 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.2 trillion in Q2 2014. The value of household real estate is still $2.3 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is above peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q2 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2014, household percent equity (of household real estate) was at 53.6% - up from Q1, and the highest since Q1 2007. This was because of both an increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 53.6% equity - and millions have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt decreased by $7 billion in Q2.

Mortgage debt has now declined by $1.32 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q2 (as house prices increased), and somewhat above the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting still a little more deleveraging ahead for certain households.

Thursday, September 18, 2014

Lawler on 2013 ACS: Headship Rates, Homeownership Rates Fell Last Year

by Calculated Risk on 9/18/2014 06:18:00 PM

From housing economist Tom Lawler:

The Census Bureau released the one-year estimates for the 2013 American Community Survey this morning. For various housing and demographic information, the results are estimates of year averages.

The ACS estimate of the number of households in 2013 was 116,291,033, up just 321,493 from 2012.

If accurate of trends, the report suggests that:

1. household growth last year was very slow

2. homeownership rates continued to decline, with significant declines in the 35-64 year age groups.

To remind folks, here is a comparison of the ACS and the HVS with the Decennial Census for 2010.

| Homeownership Rate by Age of Householder, 2010 | |||

|---|---|---|---|

| Age | Decennial Census (4/1) | ACS (avg.) | HVS (avg.) |

| 15-24 | 16.1% | 14.7% | 22.8% |

| 25-34 | 42.0% | 41.3% | 44.4% |

| 35-44 | 62.3% | 61.9% | 65.0% |

| 45-54 | 71.5% | 71.7% | 73.5% |

| 55-64 | 77.3% | 77.9% | 79.0% |

| 65-74 | 80.2% | 81.1% | 82.0% |

| 75+ | 74.5% | 75.7% | 78.9% |

| All ages | 65.1% | 65.4% | 66.9% |

And the ACS and HVS for the last four years:

| Homeownership Rate by Age of Householder | ||||||||

|---|---|---|---|---|---|---|---|---|

| American Community Survey | Housing Vacancy Survey | |||||||

| Age | 2010 | 2011 | 2012 | 2013 | 2010 | 2011 | 2012 | 2013 |

| 15-24 | 14.7% | 13.5% | 12.5% | 12.6% | 22.8% | 22.6% | 21.7% | 22.2% |

| 25-34 | 41.3% | 39.7% | 37.9% | 37.4% | 44.4% | 42.6% | 41.5% | 41.6% |

| 35-44 | 61.9% | 60.0% | 58.6% | 57.8% | 65.0% | 63.5% | 61.4% | 60.6% |

| 45-54 | 71.7% | 70.7% | 69.9% | 69.3% | 73.5% | 72.7% | 71.7% | 71.2% |

| 55-64 | 77.9% | 77.1% | 76.5% | 75.7% | 79.0% | 78.5% | 77.4% | 76.6% |

| 65-74 | 81.1% | 80.9% | 80.7% | 80.3% | 82.0% | 82.4% | 82.2% | 81.5% |

| 75+ | 75.7% | 75.8% | 76.3% | 76.1% | 78.9% | 79.3% | 80.0% | 80.0% |

| All ages | 65.4% | 64.6% | 63.9% | 63.5% | 66.9% | 66.1% | 65.4% | 65.1% |

Here are implied “headship” rates by age group from the ACS for 2012 and 2013, with headship rate defined at householders divided by resident population.

| Headship Rate by Age Group, ACS | ||

|---|---|---|

| Age | 2012 | 2013 |

| 15-24 | 10.5% | 10.4% |

| 25-34 | 42.2% | 41.6% |

| 35-44 | 51.3% | 51.1% |

| 45-54 | 54.5% | 54.2% |

| 55-64 | 57.1% | 56.8% |

| 65-74 | 60.4% | 60.0% |

| 75+ | 62.8% | 62.1% |

| All ages | 45.9% | 45.6% |

A few comments on August Housing Starts

by Calculated Risk on 9/18/2014 03:11:00 PM

This was a disappointing report for housing starts in August.

Starts were only up 8.0% year-over-year in August.

There were 670 thousand total housing starts during the first eight months of 2014 (not seasonally adjusted, NSA), up 8.6% from the 617 thousand during the same period of 2013. Single family starts are up 3%, and multi-family starts up 23%. The key weakness has been in single family starts.

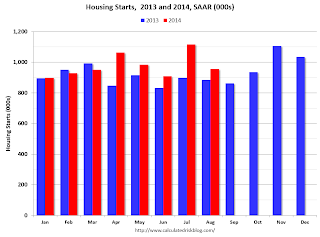

This graph shows the month to month comparison between 2013 (blue) and 2014 (red). Starts in 2014 have been above the same month in 2013 for five consecutive months.

Starts in Q1 averaged 925 thousand SAAR, and starts in Q2 averaged 985 thousand SAAR, up 7% from Q1.

Even with the weakness in August, Q3 is averaging 1.037 million SAAR, up 5% from Q2.

This year, I expect starts to mostly increase throughout the year (Q1 will probably be the weakest quarter, and Q2 the second weakest). The comparisons will be easy for the next couple of months, and starts should finish the year up from 2013.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions later this year and in 2015.

Single family starts had been moving up, but recently starts have been moving more sideways on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Earlier: Philly Fed Manufacturing Survey at 22.5 in September

by Calculated Risk on 9/18/2014 12:31:00 PM

Earlier from the Philly Fed: September Manufacturing Survey

The diffusion index for current activity fell from a reading of 28.0, its highest reading since March 2011, to 22.5 this month. The current new orders [to 15.5] and shipments indexes edged higher this month, however, increasing 1 point and 5 points, respectively.This at the consensus forecast of a reading of 22.0 for September.

...

The employment index increased 12 points to its highest reading since May 2011. [to 21.2] ...

Most of the survey’s indicators of future growth declined from their 22-year high readings reached last month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through September. The ISM and total Fed surveys are through August.

The average of the Empire State and Philly Fed surveys was solid in September (highest since 2004), and this suggests another strong ISM report for September.

Employment: Preliminary annual benchmark revision shows upward adjustment of 7,000 jobs

by Calculated Risk on 9/18/2014 10:14:00 AM

This morning the BLS released the preliminary annual benchmark revision showing an additional 7,000 payroll jobs as of March 2014. The final revision will be published next February when the January 2015 employment report is released in February 2015. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2015, with the publication of the January 2015 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2014 was 7,000 higher than originally estimated. In February 2015, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2013).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived primarily from state unemployment insurance (UI) tax records that nearly all employers are required to file. For national CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus three-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2014 total nonfarm employment of 7,000 (less than 0.05 percent). ...

There are 89,000 more construction jobs than originally estimated.

This preliminary estimate showed an additional 47,000 private sector jobs, and 40,000 fewer government jobs (as of March 2014).

Earlier: Weekly Initial Unemployment Claims decrease to 280,000

by Calculated Risk on 9/18/2014 09:35:00 AM

The DOL reports:

In the week ending September 13, the advance figure for seasonally adjusted initial claims was 280,000, a decrease of 36,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 315,000 to 316,000. The 4-week moving average was 299,500, a decrease of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 304,000 to 304,250.The previous week was revised up to 316,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 299,500.

This was below the consensus forecast of 305,000 and in the normal range for an economic expansion.

Housing Starts decrease to 956 Thousand Annual Rate in August

by Calculated Risk on 9/18/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 956,000. This is 14.4 percent below the revised July estimate of 1,117,000, but is 8.0 percent above the August 2013 rate of 885,000.

Single-family housing starts in August were at a rate of 643,000; this is 2.4 percent below the revised July figure of 659,000. The August rate for units in buildings with five units or more was 304,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 998,000. This is 5.6 percent below the revised July rate of 1,057,000, but is 5.3 percent above the August 2013 estimate of 948,000.

Single-family authorizations in August were at a rate of 626,000; this is 0.8 percent below the revised July figure of 631,000. Authorizations of units in buildings with five units or more were at a rate of 343,000 in August.

Click on graph for larger image.

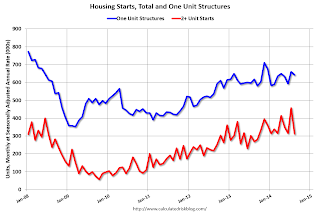

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in August (Multi-family is volatile month-to-month).

Single-family starts (blue) decreased slightly in August.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well below expectations of 1.04 million starts in August. Note: Starts for July were revised higher, but starts for June were revised lower.

This was a disappointing report - however most of the decline was due to the volatile multi-family sector. I'll have more later ...

Wednesday, September 17, 2014

Thursday: Housing Starts, Unemployment Claims, Preliminary Employment Benchmark Revision, Scotland and More

by Calculated Risk on 9/17/2014 08:55:00 PM

On Scotland, from the NY Times: Scottish Independence Vote Balances Politics and Economics

On Thursday, Scotland will vote on a referendum that could establish a Scottish state separate from Britain for the first time since 1707. If it passes, the Scottish and British economic and political landscape will change drastically.Thursday:

Registered voters in Scotland can vote on the referendum at their neighborhood polling station from 7 a.m. to 10 p.m. Votes will be counted immediately after the polls close; results are expected to be announced early Friday morning.

• At 8:30 AM ET, Housing Starts for August. Total housing starts were at 1.093 million (SAAR) in July. Single family starts were at 656 thousand SAAR in July. The consensus is for total housing starts to decrease to 1.040 million (SAAR) in August.

• Also at 8:30 AM, initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 315 thousand.

• At 8:45 AM, Speech by Fed Chair Janet Yellen, The Importance of Asset Building for Low and Middle Income Households, At the Corporation for Enterprise Development's 2014 Assets Learning Conference, Washington, D.C. (via prerecorded video)

• At 10:00 AM, 2014 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS:

"Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The final benchmark revision will be issued with the publication of the January 2015 Employment Situation news release in February."• Also at 10:00 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 22.0, down from 28.0 last month (above zero indicates expansion).

• At 12:00 PM, the Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Sacramento Housing in August: Total Sales down 13% Year-over-year, Equity Sales down 5%, Active Inventory increased 61%

by Calculated Risk on 9/17/2014 05:31:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a long time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In August 2014, 11.7% of all resales were distressed sales. This was down from 12.3% last month, and down from 19.0% in August 2013. This is the post-bubble low.

The percentage of REOs was at 5.3%, and the percentage of short sales was 6.4%.

Here are the statistics for August.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 60.6% year-over-year in August.

Cash buyers accounted for 20.2% of all sales, down from 25.4% in August 2013, and down from 20.9% last month (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 13% from August 2013, but conventional equity sales were only down 5.1% compared to the same month last year.

Summary: Distressed sales down sharply (at post bubble low), cash buyers down significantly, and inventory up significantly. So price increases should slow, and builders will slow too (with more inventory), and we might see lower land prices in some of these areas.

As I've noted before, we are seeing a similar pattern in other distressed areas.