by Calculated Risk on 9/25/2014 08:55:00 PM

Thursday, September 25, 2014

Friday: Revised Q2 GDP, Consumer Sentiment

From Merrill Lynch:

We look for 2Q GDP growth to be revised up yet again, likely by another 0.6pp bringing GDP growth to 4.8% qoq saar. Revisions to construction data suggest greater investment in nonresidential structures and slightly more residential construction. We also expect the trade data to be adjusted to show a narrower deficit. Inventories should also be revised lower, perhaps adding 1.3pp to growth versus the prior estimate of 1.7pp. Spending on consumer services will also likely be revised, but there is uncertainty on the magnitude.Friday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2014 (third estimate). The consensus is that real GDP increased 4.6% annualized in Q2, up from 4.2% in the second estimate.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 84.6, unchanged from the preliminary reading of 84.6, and up from the August reading of 82.5.

Lawler on ACS: Sharp Slowdown in Household Growth in 2013 Mainly Attributable to Fewer Folks Living Alone, Big Increases in “Doubling (and more) Up

by Calculated Risk on 9/25/2014 05:52:00 PM

From housing economist Tom Lawler:

ACS: Sharp Slowdown in Household Growth in 2013 Mainly Attributable to Fewer Folks Living Alone, Big Increases in “Doubling (and more) Up”

As I noted last week, ACS for 2013 suggested that there was a sharp slowdown in the growth of the number of households in 2013.

That sharp slowdown was not because of slower population growth, but instead was attributable to a significant jump in the average household size – though that in and of itself is not insightful, since if the growth rate in households is below the growth rate in the household population, ...

While I hope to send out a write up tomorrow, the table below I believe provides some significant insights into the jump in average household size/slowdown in household growth.

The table compares changes in household populations and households for various households/relationships from 2012 to 2013 with annual average changes from 2010 to 2012. Certain really significant differences are in bold type.

| Households and Household Populations by Various Types, ACS | |||||

|---|---|---|---|---|---|

| Annual Change | |||||

| 2013 | 2012 | 2010 | 2012-2013 | 2010-2012 (Average) | |

| Population in Households | 308,099,169 | 305,885,362 | 301,362,366 | 2,213,807 | 2,261,498 |

| Households | 116,291,033 | 115,969,540 | 114,567,419 | 321,493 | 701,061 |

| Average Household Size | 2.649 | 2.638 | 2.630 | 0.012 | 0.004 |

| Population in Family Households | 256,991,641 | 255,379,222 | 252,364,729 | 1,612,419 | 1,507,247 |

| Family Households | 76,680,463 | 76,509,262 | 76,089,045 | 171,201 | 210,109 |

| One-Person Households | 32,242,369 | 32,256,217 | 31,403,342 | -13,848 | 426,438 |

| Population in 2+ Non-Family Households | 18,865,159 | 18,249,923 | 17,594,295 | 615,236 | 327,814 |

| 2+ Non-Family Households | 7,368,201 | 7,204,061 | 7,075,032 | 164,140 | 64,515 |

| Population in Family Households | 256,991,641 | 255,379,222 | 252,364,729 | 1,612,419 | 1,507,247 |

| Householder, Spouse, Child | 226,742,233 | 226,165,010 | 223,905,638 | 577,223 | 1,129,686 |

| Other Relative (including In-Laws) | 22,938,742 | 22,275,332 | 21,610,953 | 663,410 | 332,190 |

| Nonrelatives | 7,310,666 | 6,938,880 | 6,848,138 | 371,786 | 45,371 |

| Population in 2+ Non-Family Households | 18,865,159 | 18,249,923 | 615,236 | 615,236 | 8,817,344 |

| Householder | 7,368,201 | 7,204,061 | 7,075,032 | 164,140 | 64,515 |

| Unmarried Partner | 3,952,380 | 3,909,449 | 3,809,564 | 42,931 | 49,943 |

| Other | 11,447,016 | 11,045,862 | 10,519,263 | 401,154 | 263,300 |

| Average Household Size, 2+ Non-Family Household | 2.560 | 2.533 | 2.487 | 0.027 | 0.023 |

| Roomer or boarder | 1,694,477 | 1,567,268 | 1,595,106 | 127,209 | -13,919 |

| In Family Household | 673,210 | 612,741 | 671,299 | 60,469 | -29,279 |

| In Non-Family Household | 1,021,267 | 954,527 | 923,807 | 66,740 | 15,360 |

| Housemate or Roommate | 5,978,352 | 5,793,412 | 5,587,176 | 184,940 | 103,118 |

| In Family Household | 1,206,366 | 1,189,913 | 1,180,670 | 16,453 | 4,622 |

| In Non-Family Household | 4,771,986 | 4,603,499 | 4,406,506 | 168,487 | 98,497 |

| Other non-partner/non-foster child Non-relative | 3,813,499 | 3,435,254 | 3,129,423 | 378,245 | 152,916 |

| In Family Household | 2,097,727 | 1,895,833 | 1,796,638 | 201,894 | 49,598 |

| In Non-Family Household | 1,715,772 | 1,539,421 | 1,332,785 | 176,351 | 103,318 |

Vehicle Sales Forecasts: Over 16 Million SAAR again in September

by Calculated Risk on 9/25/2014 02:29:00 PM

The automakers will report September vehicle sales on Wednesday, Oct 1st. Sales in August were at 17.45 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in September will be solidly above 16 million SAAR again.

Note: There were 24 selling days in September this year compared to 23 last year.

Here are a few forecasts:

From J.D. Power: Summer Sizzle Continues as New-Vehicle Sales in August Forecast to Hit Highest Levels of the Year

New-vehicle retail sales in September 2014 are projected to come in at 1.0 million units, a 94,000-unit increase from September 2013 and 6 percent growth on a selling-day adjusted basis (September 2014 has 24 selling days, compared with 23 in September 2013). The retail seasonally adjusted annualized rate (SAAR) in September is expected to be 13.5 million units—which is 1.2 million units more than in September 2013—marking the seventh consecutive month in which the SAAR has exceeded 13 million units. Retail transactions are the most accurate measure of true underlying consumer demand for new vehicles.From Kelley Blue Book: New-Vehicle Sales To Climb 9 Percent In September; Kelley Blue Book Adjusts 2014 Forecast To 16.4 Million

The strong sales pace in September is noteworthy as it follows an exceptionally strong August when retail sales reached 1,378,588.

“Vehicle sales typically fall sharply immediately following the Labor Day holiday before recovering later in the month, but the decline this September has been smaller than in prior years,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. “While the strong sales pace is an indicator of the health of the industry, it is being complemented by record transaction prices for the month of September.” [Total forecast 16.5 million SAAR]

New-vehicle sales are expected to increase 9.1 percent year-over-year to a total of 1.24 million units, resulting in an estimated 16.4 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ... "Following an extraordinarily strong month of sales in August, with the industry above 17 million SAAR for the first time in eight years, Kelley Blue Book expects sales to level out in September," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Sales will remain strong and show healthy year-over-year improvement. Rising incentive spend in recent months has been more than offset by increasing retail transaction prices, signaling continued consumer demand."From TrueCar: TrueCar Forecasts Continued Strong New Vehicle Sales Growth in September; Up 9.7% Compared to Last Year

Seasonally Adjusted Annualized Rate ("SAAR") of 16.4 million new vehicle sales.Another solid month for auto sales, and this should be the best year since 2006.

TrueCar's 2014 Annual Sales Forecast remains at 16.4 million vehicles as well.

Kansas City Fed: Regional Manufacturing "Activity Edged Higher" in September

by Calculated Risk on 9/25/2014 11:10:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Edged Higher

The Federal Reserve Bank of Kansas City released the September Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity edged higher, and producers’ expectations for future activity maintained their recent solid levels.The last regional Fed manufacturing survey for September will be released on Monday, Sept 29th (the Dallas Fed). All of the regional surveys so far have indicated solid growth in September (three out of four higher than in August), and this suggests another strong reading for the ISM manufacturing survey.

“We saw slightly faster growth this month after a sizable easing in August,” Wilkerson said. “This is despite continued sluggish activity in our important food processing segment, driven in part by higher beef costs this year.”

The month-over-month composite index was 6 in September, slightly higher than 3 in August but lower than 9 in July. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. ... The production index increased from 4 to 12, and the shipment index also grew from a reading of 2 in August to 14. The employment index increased significantly from -4 in the last survey period to 7 in September.

emphasis added

CoreLogic: "Nearly 950,000 homes returned to positive equity in the second quarter of 2014"

by Calculated Risk on 9/25/2014 09:30:00 AM

From CoreLogic: CoreLogic Reports 946,000 Residential Properties Regained $1 Trillion in Total Equity in Q2 2014

CoreLogic ... today released new analysis showing nearly 950,000 homes returned to positive equity in the second quarter of 2014, bringing the total number of mortgaged residential properties with equity in the U.S. to more than 44 million. Nationwide, borrower equity increased year over year by approximately $1 trillion in Q2 2014. The CoreLogic analysis indicates that approximately 5.3 million homes, or 10.7 percent of all residential properties with a mortgage, were still in negative equity as of Q2 2014 compared to 6.3 million homes, or 12.7 percent, for Q1 2014. This compares to a negative equity share of 14.9 percent, or 7.2 million homes, in Q2 2013, representing a year-over-year decrease in the number of homes underwater by almost 2 million (1,962,435), or 4.2 percent.

... Of the 44 million residential properties with positive equity, approximately 9 million, or 19 percent, have less than 20-percent equity (referred to as “under-equitied”) and 1.3 million of those have less than 5 percent (referred to as near-negative equity). Borrowers who are “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall. In contrast, if home prices rose by as little as 5 percent, an additional 1 million homeowners now in negative equity would regain equity. ...

"The increase in borrower equity of $1 trillion from a year earlier is evidence that things are moving solidly in the right direction,” said Sam Khater, deputy chief economist for CoreLogic. “Borrower equity is important because home equity constitutes borrowers’ largest investment segment and, as a result, is driving forward the rise in wealth for the typical homeowner.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 26.3 percent, followed by Florida (24.3 percent), Arizona (19.0 percent), Illinois (15.4 percent) and Rhode Island (14.8). These top five states combined account for 32.8 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down significantly from a year ago (Q2 2013) when the negative equity share in Nevada was at 36.4 percent, and at 31.5 percent in Florida.

The second graph shows the distribution of home equity in Q2 compared to Q1 2014. Close to 4% of residential properties have 25% or more negative equity, down from Q1.

The second graph shows the distribution of home equity in Q2 compared to Q1 2014. Close to 4% of residential properties have 25% or more negative equity, down from Q1.In Q2 2013, there were 7.2 million properties with negative equity - now there are 5.3 million. A significant change.

Weekly Initial Unemployment Claims increase to 293,000

by Calculated Risk on 9/25/2014 08:34:00 AM

The DOL reports:

In the week ending September 20, the advance figure for seasonally adjusted initial claims was 293,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 280,000 to 281,000. The 4-week moving average was 298,500, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised up by 250 from 299,500 to 299,750.The previous week was revised up to 281,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 298,500.

This was below the consensus forecast of 300,000 and in the normal range for an economic expansion.

Black Knight: Mortgage Delinquencies increased in August

by Calculated Risk on 9/25/2014 07:01:00 AM

According to Black Knight's First Look report for August, the percent of loans delinquent increased in August compared to July - mostly due to an increase in short term delinquencies - and declined by 5% year-over-year.

Note: Usually delinquencies increase seasonally in September, but this might have moved to August this year. The increase was mostly in the 30 day bucket.

Also the percent of loans in the foreclosure process declined further in August and were down 32% over the last year. Foreclosure inventory was at the lowest level since March 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.90% in August, up from 5.64% in July. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 1.80% in August from 1.85% in July.

The number of delinquent properties, but not in foreclosure, is down 129,000 properties year-over-year, and the number of properties in the foreclosure process is down 428,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for August in early October.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2014 | July 2014 | Aug 2013 | Aug 2012 | |

| Delinquent | 5.90% | 5.64% | 6.20% | 6.87% |

| In Foreclosure | 1.80% | 1.85% | 2.66% | 4.12% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,852,000 | 1,713,000 | 1,836,000 | 1,910,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,143,000 | 1,136,000 | 1,288,000 | 1,520,000 |

| Number of properties in foreclosure pre-sale inventory: | 913,000 | 935,000 | 1,341,000 | 2,020,000 |

| Total Properties | 3,908,000 | 3,786,000 | 4,465,000 | 5,450,000 |

Wednesday, September 24, 2014

Thursday: Unemployment Claims, Durable Goods

by Calculated Risk on 9/24/2014 08:15:00 PM

On August Durable Goods from MarketWatch: What goes up must come down: Durable-goods orders set to sink

After flying high in July, orders for U.S. durable goods are likely to take a big dive in August.Thursday:

But don’t pay any heed. The record 22.6% surge in orders in July was propelled mainly by a pile of new contracts for Boeing jets. Those orders tumbled in August and will drag orders into deep negative territory. Economists polled by MarketWatch forecast a 17.3% in new orders.

Strip out airplanes and autos, however, and Wall Street expects orders for durable goods to rise by 1% or more in August.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 280 thousand.

• Also at 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 17.1% decrease in durable goods orders (last month durable goods orders were up 22.6% due to aircraft orders).

• At 11:00 AM, the Kansas City Fed manufacturing survey for September.

Lawler on Homebuilder KB Home and New Home Sales Report

by Calculated Risk on 9/24/2014 04:35:00 PM

From housing economist Tom Lawler: KB Home: Net Orders Up 5% YOY, Orders/Community Flat; Deliveries Down on Delays in Construction Schedules and Customer Mortgage Loan Closings

KB Home reported that net home orders in the quarter ended August 31, 2014 totaled 1,827, up 5.2% from the comparable quarter of 2013. Net orders per community were virtually unchanged from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 31% last quarter, down from 33% in the comparable quarter of 2013. Home deliveries last quarter totaled 1,793, down 1.8% from the comparable quarter of 2013, at an average sales price of $327,000, up 9.3% from a year ago. The company’s order backlog at the end of August was 3,432, up 12.9% from last August.

In its press release the company said that “(d)eliveries in the quarter were tempered by delays in construction schedules and customer mortgage loan closings that resulted in some deliveries being deferred to the fourth quarter.” Delays in customer mortgage loans closings were mainly related to a poorly-executed transition to Home Community Mortgage, LLC, the company’s new mortgage banking joint venture (with Nationstar).

The press release also included commentary on the average selling price.

“The overall average selling price rose 9% to $327,000, up from $299,100 for the same period of 2013. The Company's average selling price has now increased on a year-over-year basis for the last 17 quarters.The company’s CEO said that it had seen “(d)uring the third quarter there was an appreciable uptick in our traffic levels,” and in the conference call officials said that traffic last quarter was up 24% from a year ago.

“The average selling price increased primarily due to the Company's continued positioning of its new home communities in land-constrained submarkets that typically feature higher household incomes, higher median home sales prices and stronger demand for larger home sizes, as well as generally favorable market conditions.

“Average selling prices were higher in all of the Company's homebuilding regions compared to the same quarter of 2013, with increases ranging from 9% in the Central and Southeast regions to 21% in the West Coast region.”

In the previous quarter’s earnings conference call on June 27, KB Home’s CEO raised some eyebrows by saying that the company had seen some “re-emergence” of first-time home buyers, though in response to questions he noted that observed increases in first-time home buyers were in a limited number of areas with strong job growth. He did not talk about re-emerging first-time home buyer demand today.

He did, however, mention that household formations have been increasing, which suggests that his staff either hadn’t looked at or didn’t want to show him the latest CPS and ACS data on households.

And from Tom Lawler on the New Home sales report: Census Estimates that New SF Home Sales Jumped in August; Sales Estimate for the West Surged to Fastest Pace in Almost Seven Years, But Will Probably Be Revised Downward

Census estimated that new SF home sales ran at a seasonally adjusted annual rate of 504,000 in August, up 18.0% from July’s upwardly-revised (to 427,000 from 412,000) pace. (Revisions to May and June sales were de minimis). According to Census estimates, new SF home sales in the West ran at a seasonally adjusted annual rate of 153,000, up 50.0% from July’s pace and up 84.3% from last August’s pace, and the highest seasonally-adjusted sales pace since January 2008. Census’ unadjusted estimate for new SF home sales in the West last month was the highest for an August since 2007.

Based on limited anecdotal and builder reports, the Census estimate for new home sales in the West seem way to high, and a significant downward revision next month would not be surprising.

| New Single-Family Home Sales, Census Estimates | |||||

|---|---|---|---|---|---|

| Total | Northeast | Midwest | South | West | |

| 2012 (Full Year) | 368 | 29 | 47 | 195 | 97 |

| 2013 (Full Year) | 429 | 31 | 61 | 233 | 105 |

| July 2014 (SAAR) | 427 | 24 | 58 | 243 | 102 |

| August 2014 (SAAR) | 504 | 31 | 58 | 262 | 153 |

Comments on New Home Sales

by Calculated Risk on 9/24/2014 01:59:00 PM

The new home sales report for August was above expectations at 504 thousand on a seasonally adjusted annual rate basis (SAAR). This was the highest sales rate since May 2008. However, we need to remember this was just one month of data.

Also sales for the previous three months were revised up a combined 16,000 sales SAAR.

The Census Bureau reported that new home sales this year, through August, were 307,000, Not seasonally adjusted (NSA). That is up 2.7% from 299,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year (maybe 3% or so for the year).

Sales were up 33.0% year-over-year in August - however sales declined sharply in Q3 2013 as mortgage rates increased - so this was an easy comparison. The comparison for September will be pretty easy too.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year are easy right now, and I expect to see year-over-year growth for the 2nd half of 2014.

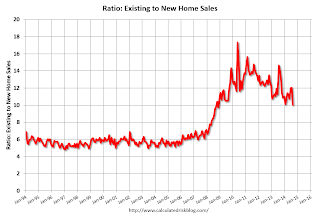

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to decline or move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.