by Calculated Risk on 9/29/2014 11:41:00 AM

Monday, September 29, 2014

Dallas Fed: "Texas Manufacturing Strengthens" in September

From the Dallas Fed: Texas Manufacturing Strengthens

Texas factory activity increased again in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose markedly from 6.8 to 17.6, indicating output grew at a faster pace than in August.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing activity also reflected significantly stronger growth in September. The new orders index climbed 5 points to 7.5. The capacity utilization index surged to 20.2 after dipping to 3.6 in August, with nearly a third of manufacturers noting an increase. The shipments index rebounded to 15.9 after falling to 6.4 last month.

Perceptions of broader business conditions were more optimistic this month. The general business activity index moved up to a reading of 10.8, nearly four points above its nonrecession average of 7. The company outlook index rose from 1.5 to 5.8, due to a larger share of firms noting an improved outlook in September than in August.

Labor market indicators reflected continued employment growth and longer workweeks. The September employment index posted a fourth robust reading, holding fairly steady at 10.6.

emphasis added

Click on graph for larger image.

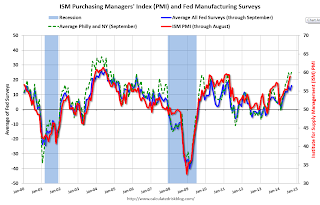

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

Four of the five regional surveys showed stronger expansion in September than August (the Philly Fed was very strong, but not as strong as August). and it seems likely the ISM index will be solid again this month. The ISM index for September will be released Wednesday, October 1st and the consensus is for a decrease to 58.0 from 59.0 in August.

NAR: Pending Home Sales Index decreased 1.0% in August, down 2.2% year-over-year

by Calculated Risk on 9/29/2014 11:31:00 AM

NOTE: We've had a power outage in my neighborhood. I'll be catching up on some earlier releases.

From the NAR: Pending Home Sales Fall Slightly in August

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 1.0 percent to 104.7 in August from 105.8 in July, and is now 2.2 percent below August 2013 (107.1). Despite the slight decline, the index is above 100 – considered an average level of contract activity – for the fourth consecutive month and is at the second-highest level since last August.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

...

The PHSI in the Northeast slipped 3.0 percent to 86.5 in August, but is still 1.6 percent above a year ago. In the Midwest the index fell 2.1 percent to 102.4 in August, and is 7.6 percent below August 2013.

Pending home sales in the South decreased 1.4 percent to an index of 117.0 in August, unchanged from a year ago. The index in the West rose for the fourth consecutive month (2.6 percent) in August to 102.1, but still remains 2.6 percent below August 2013.

Sunday, September 28, 2014

Monday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 9/28/2014 08:21:00 PM

From CNBC: Bill Clinton: I know why US incomes are stagnant

"Median income hasn't gone up for three reasons," Clinton said. "One is the labor markets aren't tight enough, and we haven't raised the minimum wage as we should. And the second reason is we haven't changed the job mix enough, to raise the median income and have more poor people working into it. The combination of jobs has to pay, on average, higher wages."

"Gross domestic product growth doesn't lead to growth in median incomes because company after company takes more of its profits and spends it on dividends, stock buybacks, management increases … and less on sharing it with the employees broadly," said Clinton ...

Here is a graph from the Census report: Income and Poverty in the United States:

"In 2013, real median household income was 8.0 percent lower than in 2007, the year before the most recent recession."My view is slack in the labor market is probably the main cause - and I expect real wages to increase as the unemployment rate falls further.

Monday:

• At 8:30 AM ET, Personal Income and Outlays for August. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to be unchanged.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.3% decrease in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for September. This is the last of the regional manufacturing surveys for September, and so far the results have been solid.

Weekend:

• Schedule for Week of September 28th

• Q3 Review: Ten Economic Questions for 2014

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and DOW futures are also down 15 (fair value).

Oil prices were mixed over the last week with WTI futures at $93.11 per barrel and Brent at $97.00 per barrel. A year ago, WTI was at $103, and Brent was at $109 - so prices are down 10%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.34 per gallon (down about 10 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Q3 Review: Ten Economic Questions for 2014

by Calculated Risk on 9/28/2014 11:35:00 AM

At the end of last year, I posted Ten Economic Questions for 2014. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2014 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and then try to understand why I was wrong).

By request, here is a Q3 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2014: Downside Risks

Happily, looking forward, it seems the downside risks have diminished significantly. China remains a key risk ... There are always potential geopolitical risks (war with Iran, North Korea, or turmoil in some oil producing country). Right now those risks appear small, although it is always hard to tell. ...There are international risks - China remains a downside risk, Europe (and the Euro) are still a mess, and the situations in the Ukraine and Iraq are serious, but overall it appears that downside risks to the U.S. economy have diminished this year.

When I look around, I see few obvious downside risks for the U.S. economy in 2014. No need to borrow trouble - diminished downside risks are a reason for cheer.

9) Question #9 for 2014: How much will housing inventory increase in 2014?

Right now my guess is active inventory will increase 10% to 15% in 2014 (inventory will decline seasonally in December and January, but I expect to see inventory up 10% to 15% year-over-year toward the end of 2014). This will put active inventory close to 6 months supply this summer. If correct, this will slow house price increases in 2014.The NAR reported inventory was up 4.5% year-over-year in August. Note: I used to follow "Housing Tracker" weekly, but the site had some data problems and they discontinued the series. It looks like a 10% to 15% increase this year might be close - but a little high - based on the NAR reports.

8) Question #8 for 2014: Housing Credit: Will we see easier mortgage lending in 2014?

Bottom line: I expect lending standards to loosen a bit in 2014 from the tight level of the last few years. It will be difficult to measure, but I'll be watching what Mel Watt says, what private lenders say, comments from mortgage brokers, and MEW.We may be seeing a little loosening according to the most recent Fed Senior Loan Officer survey showed some loosening of standards:

A moderate net fraction of domestic banks reported having eased their standards on prime residential mortgages, on net, while most indicated that standards on nontraditional mortgages and home equity lines of credit (HELOCs) were relatively little changed. Banks reported having experienced stronger demand, on balance, for prime residential mortgages for the first time since a year ago...But this is just for prime mortgages.

emphasis added

7) Question #7 for 2014: What will happen with house prices in 2014?

In 2014, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. This suggests more house price increases in 2014, but probably at a slow pace.We only have Case-Shiller data through June (8.1% year-over-year gain for Composite 20), and it appears price increases are slowing. My prediction still seems OK, but if anything, house prices might slow more than I expected.

As Khater noted, some of the "bounce back" in certain areas is probably over, also suggesting slower price increases going forward. And investor buying appears to have slowed. A positive for the market will probably be a little looser mortgage credit.

All of these factors suggest further prices increases in 2014, but at a slower rate than in 2013. There tends to be some momentum for house prices, and I expect we will see prices up mid-to-high single digits (percentage) in 2014 as measured by Case-Shiller.

6) Question #6 for 2014: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in some judicial foreclosure states in 2014. However, unlike last year when I reported that some builders were land constrained (not enough finished lots in the pipeline), land should be less of an issue this year. Even with the foreclosures, I expect another solid year of growth for new home sales.Through August, new home sales were up 2.7% over 2013, and housing starts were only up 8.6% year-over-year. There was a slow start to 2014 mostly due to higher mortgage rates, higher prices and supply constraints in some areas - and a little bit due to the weather. I still think fundamentals support a higher level of starts, and I still expect starts and new home sales to be up this year (but not as much as I initially expected). An optimistic view is that this means more growth next year!

... I expect growth for new home sales and housing starts in the 20% range in 2014 compared to 2013. That would still make 2014 the tenth weakest year on record for housing starts (behind 2008 through 2012 and few other recession lows).

5) Question #5 for 2014: Monetary Policy: Will the Fed end QE3 in 2014?

[E]ven though the Fed is data-dependent, I currently expect the Fed to reduce their asset purchases by $10 billion per month (or so) at each meeting this year and conclude QE3 at the end of the 2014.QE3 will end in October.

4) Question #4 for 2014: Will too much inflation be a concern in 2014?

[C]urrently I think inflation (year-over-year) will increase a little in 2014 as growth picks up, but too much inflation will not be a concern in 2014.Inflation is not a concern this year.

3) Question #3 for 2014: What will the unemployment rate be in December 2014?

My guess is the participation rate will stabilize or only decline slightly in 2014 (less than in 2012 and 2013) ... it appears the unemployment rate will decline to the low-to-mid 6% range by December 2014.The unemployment rate was 6.1% in August and it looks like I was too pessimistic.

2) Question #2 for 2014: How many payroll jobs will be added in 2014?

Both state and local government and construction hiring should improve further in 2014. Federal layoffs will be a negative, but most sectors should be solid. So my forecast is somewhat above the previous three years, and I expect gains of about 200,000 to 225,000 payroll jobs per month in 2014.Through August 2014, the economy has added 1,723,000 jobs, or 215,000 per month. So far this is at the expected pace.

1) Question #1 for 2014: How much will the economy grow in 2014?

I expect PCE to pick up again into the 3% to 4% range, and this will give a boost to GDP. This increase in consumer spending should provide an incentive for business investment. Add in the ongoing housing recovery, some increase in state and local government spending, and 2014 should be the best year of the recovery with GDP growth at or above 3%The first quarter was very disappointing, but economic activity picked up in Q2. However PCE hasn't picked up as much as I expected (only 2.5% in Q2). GDP should be solid in Q3 (and probably in Q4 too), but growth will probably be closer to 2% again this year.

Saturday, September 27, 2014

Schedule for Week of September 28th

by Calculated Risk on 9/27/2014 01:11:00 PM

This will be a busy week for economic data. The key report is the September employment report on Friday.

Other key reports include the August Personal Income and Outlays report on Monday, the July Case-Shiller House Price Index on Tuesday, the ISM manufacturing index and September vehicle sales both on Wednesday, and the August Trade Deficit and September ISM non-manufacturing index on Friday.

Also, Reis is scheduled to release their Q3 surveys of rents and vacancy rates for apartments, offices and malls.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to be unchanged.

10:00 AM ET: Pending Home Sales Index for August. The consensus is for a 0.3% decrease in the index.

10:30 AM: Dallas Fed Manufacturing Survey for September.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the June report, it is really a 3 month average of May, June and July.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the June report, it is really a 3 month average of May, June and July.NOTE: S&P is now releasing the National house price index monthly, and I expect reporting to shift from the Composite 20 to the National index. The National index was up 6.2% year-over-year in June.

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through the June 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 7.5% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 7.0% year-over-year, and for prices to increase 0.1% month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 61.5, down from 64.3 in August.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 16.8 million SAAR in September from 17.4 million in August (Seasonally Adjusted Annual Rate).

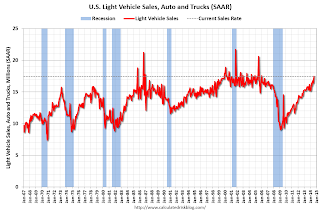

All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 16.8 million SAAR in September from 17.4 million in August (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the August sales rate.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in September, down from 205,000 in August.

Early: Reis Q3 2014 Office Survey of rents and vacancy rates.

10:00 AM: ISM Manufacturing Index for September. The consensus is for a decrease to 58.0 from 59.0 in August

10:00 AM: ISM Manufacturing Index for September. The consensus is for a decrease to 58.0 from 59.0 in AugustHere is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in August at 59.0%. The employment index was at 58.1%, and the new orders index was at 66.7%.

10:00 AM: Construction Spending for August. The consensus is for a 0.5% increase in construction spending.

Early: Reis Q3 2014 Apartment Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 297 thousand from 293 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 9.4 decrease in August orders.

8:30 AM: Employment Report for September. The consensus is for an increase of 215,000 non-farm payroll jobs added in September, up from the 142,000 non-farm payroll jobs added in August.

The consensus is for the unemployment rate to be unchanged at 6.1% in September.

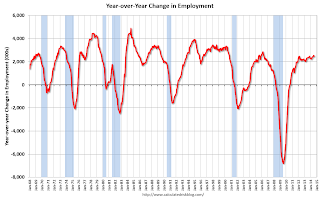

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In August, the year-over-year change was 2.482 million job, and it generally appears the pace of hiring is increasing.

Right now it looks possible that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

Early: Reis Q3 2014 Mall Survey of rents and vacancy rates.

8:30 AM: Trade Balance report for August from the Census Bureau.

8:30 AM: Trade Balance report for August from the Census Bureau. Imports and exports increased in July.

The consensus is for the U.S. trade deficit to be at $40.7 billion in August from $40.5 billion in July.

10:00 AM: ISM non-Manufacturing Index for September. The consensus is for a reading of 58.8, down from 59.6 in August. Note: Above 50 indicates expansion.

Unofficial Problem Bank list declines to 432 Institutions

by Calculated Risk on 9/27/2014 08:12:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 26, 2014.

Changes and comments from surferdude808:

The FDIC provided us with an update on its enforcement action activities through August. The update led to five removals and two additions that leave the Unofficial Problem Bank List at 432 institutions with assets of $136.8 billion. A year ago, the list held 690 institutions with assets of $240.5 billion. For the month, the list declined by seven institutions after eight action terminations, two mergers, and three additions. Over the past 28 months, the list has been declining but the drop this month is the smallest over this period.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 432.

The FDIC terminated actions against The Bank of Elk River, Elk River, MN ($350 million); Flathead Bank of Bigfork, Montana, Bigfork, MT ($209 million); First State Bank, Wrens, GA ($90 million); Waterman State Bank, Waterman, IL ($42 million); and Marshall County State Bank, Varna, IL ($28 million).

The FDIC issued actions against Independence Bank, East Greenwich, RI ($53 million) and Alamerica Bank, Birmingham, AL ($39 million).

Next week should be light in terms of changes to the list but we will bring an update to the problem bank transition matrix.

Friday, September 26, 2014

Trivial: Bill Gross and Yoga in 2007

by Calculated Risk on 9/26/2014 04:44:00 PM

Several years ago, I occasionally attended the same yoga class as former PIMCO CIO Bill Gross.

In June 2007 (a few months before the recession started), I was waiting for a yoga class and happened to be standing right next to Mr. Gross.

Some random guy walked up to Gross and asked him if it was time to buy distressed bonds (Tanta and I were writing about the coming recession and how many financial institutions would be in trouble or gone).

Gross answered "probably" (time to buy distressed bonds) ... and I almost screamed "No". Then I realized maybe Gross didn't like that guy ... or he didn't like being asked about bonds at a yoga class.

Of course neither of them knew me - but I called Tanta after the class and told her what Gross said. And that was the source of Tanta's joke in this post: BONG HiTS 4 BILL GROSS!

Merrill and Nomura Forecasts for September Non-Farm Payrolls

by Calculated Risk on 9/26/2014 12:05:00 PM

The September employment report will be released next Friday, October 3rd, and the consensus is that 200 thousand payroll jobs were added in September and the unemployment rate was unchanged at 6.1%.

Here are two forecasts:

From Merrill Lynch:

The September employment report is likely to reveal solid job growth of 235,000 with possible upward revisions to prior months. Job growth was disappointing in August, only increasing 142,000, notably below the recent trend. There has been a pattern of upward revisions to the jobs report in August, averaging about 30,000. Our forecast for September combined with likely positive revisions should keep the 3-month moving average for payrolls above 200,000. Among the components, we think government jobs will be up 10,000 while private payrolls expand 225,000. We forecast a strong gain in manufacturing jobs, reflecting healthy improvement in the survey data. Job growth in the retail sector should also be solid after a decline in August. The continued modest improvement in housing construction should continue to support hiring in the sector.From Nomura:

We forecast the unemployment rate to hold steady at 6.1% in September. The labor force participation rate fell in August while household jobs were particularly soft. We do not expect the same for September, although there is a great deal of uncertainty in the monthly forecasts of labor force participation. Average hourly earnings are likely to continue to increase at a trend 0.2% mom rate, which will push the yoy rate up to 2.2%. While this is a pickup from the annual pace in August, it is within the recent range for growth in average hourly earnings.

emphasis added

Payroll growth surprised to the downside in August. However, incoming labor market indicators released since the last jobs report have been generally more favorable for payroll growth. Initial jobless and continuing claims are still near pre-recession levels. In addition, regional manufacturing surveys released thus far in September suggest that manufacturing employment continued to increase.CR Note: In August, a strike at Market Basket in New England negatively impacted the employment report. From BLS Commissioner Erica Groshen:

Based on these labor market readings in September, we forecast a 200k increase in private payrolls, with a 10k increase in government jobs, implying that total nonfarm payrolls will gain 210k. Furthermore, given the solid momentum implied by regional manufacturing surveys, we expect manufacturing employment to grow by 15k. We forecast that average hourly earnings for private employees rose by 0.25% again in September, supporting our forecast of a gradual pick-up in wage inflation. Lastly, based on the improvement in continuing jobless claims, we expect the household survey to show that the unemployment rate fell 0.1pp to 6.0%.

Within retail, employment declined in food and beverage stores (-17,000); this industry was impacted by employment disruptions at a grocery store chain in New England.The disruption ended quickly, and food and beverage employment should bounce back in September.

Final September Consumer Sentiment at 84.6

by Calculated Risk on 9/26/2014 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for September was at 84.6, unchanged from the preliminary reading of 84.6, and up from 82.5 in August.

This was at the consensus forecast of 84.6. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Q2 GDP Revised Up to 4.6% Annual Rate

by Calculated Risk on 9/26/2014 08:36:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2014 (Third Estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 4.6 percent in the second quarter of 2014, according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 2.1 percent.Here is a Comparison of Third and Second Estimates.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 4.2 percent. With the third estimate for the second quarter, the general picture of economic growth remains the same; increases in nonresidential fixed investment and in exports were larger than previously estimated ...

The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, nonresidential fixed investment, state and local government spending, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

Real GDP increased 4.6 percent in the second quarter, after decreasing 2.1 percent in the first. This upturn in the percent change in real GDP primarily reflected upturns in exports and in private inventory investment, accelerations in nonresidential fixed investment and in PCE, and upturns in state and local government spending and in residential fixed investment that were partly offset by an acceleration in imports.