by Calculated Risk on 10/01/2014 08:18:00 AM

Wednesday, October 01, 2014

ADP: Private Employment increased 213,000 in September

Private sector employment increased by 213,000 jobs from August to September according to the August ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly above the consensus forecast for 200,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Job gains remain strong and steady. The pace of job growth has been remarkably similar for the past several years. Especially encouraging most recently is the increasingly broad base nature of those gains. Nearly all industries and companies of all sizes are adding consistently to payrolls.”

The BLS report for September will be released on Friday.

MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

by Calculated Risk on 10/01/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 26, 2014. ...

The Refinance Index decreased 0.3 percent from the previous week. The seasonally adjusted Purchase Index remained unchanged from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 11 percent lower than the same week one year ago. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent from 4.39 percent, with points decreasing to 0.31 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013.

Refinance activity is very low this year and will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.

Tuesday, September 30, 2014

Wednesday: Vehicle Sales, ISM Manufacturing, ADP Employment, Q3 Office Vacancies, Construction Spending

by Calculated Risk on 9/30/2014 08:01:00 PM

Wednesday will be busy! First, from the National Restaurant Association: Restaurant Performance Index Registers August Gain

Driven by stronger same-store sales and customer traffic levels and a more optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a solid gain in August. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.9 in August, up 1.0 percent from July and its first gain in three months. In addition, the RPI stood above 100 for the 18th consecutive month, which signifies expansion in the index of key industry indicators.

“The August gain in the RPI was fueled by stronger same-store sales and customer traffic results, aided by continued improving economic conditions,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Looking forward, restaurant operators remain generally optimistic about continued sales growth, while a majority plans to make a capital expenditure in the next six months. However, operators still report food costs and government among top challenges that continue to negatively affect the operating environment.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.9 in August, up from 101.0 in July. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is a solid reading.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• All day, Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 16.8 million SAAR in September from 17.4 million in August (Seasonally Adjusted Annual Rate).

• 8:15 AM, the ADP Employment Report for September. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in September, down from 205,000 in August.

• Early, Reis Q3 2014 Office Survey of rents and vacancy rates.

• At 10:00 AM, the ISM Manufacturing Index for September. The consensus is for a decrease to 58.0 from 59.0 in August. The ISM manufacturing index indicated expansion in August at 59.0%. The employment index was at 58.1%, and the new orders index was at 66.7%.

• At 10:00 AM, Construction Spending for August. The consensus is for a 0.5% increase in construction spending.

Fannie Mae: Mortgage Serious Delinquency rate below 2% in August, Lowest since October 2008

by Calculated Risk on 9/30/2014 04:11:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined slightly in August to 1.99% from 2.00% in July. The serious delinquency rate is down from 2.61% in August 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac has not reported for August yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.62 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in 2016.

House Prices: Real Prices and Price-to-Rent Ratio decline in July

by Calculated Risk on 9/30/2014 01:44:00 PM

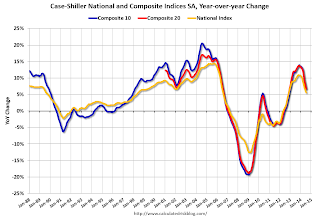

I started 2014 expecting a slowdown in year-over-year (YoY) prices as "For Sale" inventory increases, and the price slowdown is very obvious! The Case-Shiller Composite 20 index was up 6.7% YoY in July; the smallest YoY increase since November 2012 (the National index was up 5.6%, also the slowest YoY increase since November 2012.

I expect YoY prices to slow further over the next several months.

It is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

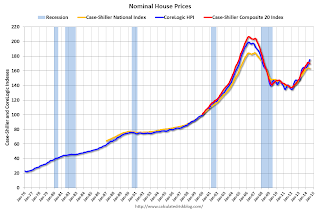

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to February 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to September 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

In real terms, the National index is back to July 2002 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

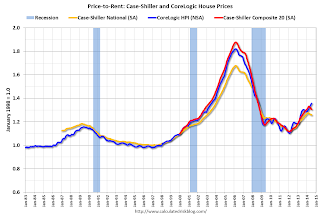

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2002 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 9/30/2014 11:20:00 AM

A few key points:

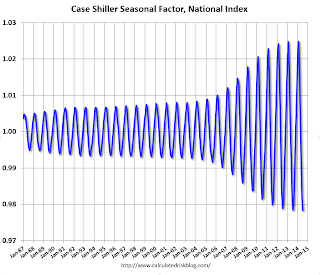

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change.

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

The housing crisis substantially changed the seasonal pattern of housing activity: relative to conventional home sales, which peak in summer, distressed home sales are more evenly spread throughout the year and sell at a discount. As a result, in years when distressed sales constitute a larger share of overall sales, the seasonal swings in home prices get bigger while the seasonal swings in sales volumes get smaller.Kolko proposed an improved seasonal adjustment. For July, the reported seasonally adjusted month-to-month change for the Composite 20 was -0.5%, but using Kolko's method prices were flat. For the National index, the reported change was +0.2%, and Kolko's method would yield 0.3%.

Sharply changing seasonal patterns create problems for seasonal adjustment methods, which typically estimate seasonal adjustment factors by averaging several years’ worth of observed seasonal patterns. A sharp but ultimately temporary change in the seasonal pattern for housing activity affects seasonal adjustment factors more gradually and for more years than it should. Despite the recent normalizing of the housing market, seasonal adjustment factors are still based, in part, on patterns observed at the height of the foreclosure crisis, causing home price indices to be over-adjusted in some months and under-adjusted in others.

Unfortunately, many have concluded that the solution to the problem of changing seasonal patterns is to downplay or ignore seasonally adjusted housing data until the foreclosure crisis is far enough in the past that it is no longer averaged into seasonal adjustment factors. Standard and Poor’s, publishers of the Case-Shiller home-price index, themselves warned in 2010 that “the unadjusted series is a more reliable indicator and, thus, reports should focus on the year-over-year changes where seasonal shifts are not a factor. Additionally, if monthly changes are considered, the unadjusted series should be used.” Even today, Case-Shiller home-price index press releases continue to emphasize non-seasonally-adjusted (NSA) changes over seasonally adjusted (SA) changes.

But ignoring seasonality during and after the foreclosure crisis is the opposite of what we should be doing. Changing seasonal patterns make seasonal adjustment more important.

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010).

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through July). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

It appears we've already seen the strongest month this year (NSA) for both Case-Shiller NSA and CoreLogic. This suggests both indexes will turn negative seasonally (NSA) earlier this year than the previous two years - perhaps in the August reports.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller National index since 1987. The factors started to change near the peak of the bubble, and really increased during the bust. It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Case-Shiller: National House Price Index increased 5.6% year-over-year in July

by Calculated Risk on 9/30/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities) and the new monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Broad-Based Easing of Home Price Gains in July According to the S&P/Case-Shiller Home Price Indices

Data through July 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... show a significant slowdown in price increases. Nineteen of the 20 cities saw lower annual returns in July. Las Vegas, Miami and San Francisco were the only cities to report double-digit annual gains. Cleveland’s rate remained unchanged at +0.9% for the 12 months ending July 2014.

In July, the 10-City and 20-City Composites increased 0.6% and the National Index 0.5%. Although all cities but one gained on a monthly basis, 17 saw smaller increases in July as compared to last month. Although New York saw a lower gain this month, it was the only city where prices rose over one percent. San Francisco posted its largest decline of 0.4% since February 2012. ...

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.6% annual gain in July 2014. The 10- and 20-City Composites posted year-over-year increases of 6.7%.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.7% from the peak, and down 0.5% in July (SA). The Composite 10 is up 23.1% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.9% from the peak, and down 0.5% (SA) in July. The Composite 20 is up 23.7% from the post-bubble low set in Jan 2012 (SA).

The National index is off 11.4% from the peak, and up 0.2% (SA) in July. The National index is up 19.7% from the post-bubble low set in Dec 2012 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.7% compared to July 2013.

The Composite 20 SA is up 6.7% compared to July 2013.

The National index SA is up 5.6% compared to July 2013.

Prices increased (SA) in 5 of the 20 Case-Shiller cities in July seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 42.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was lower than the consensus forecast for a 7.5% YoY increase for the Composite 20 index, and suggests a further slowdown in price increases. I'll have more on house prices later.

Monday, September 29, 2014

Tuesday: Case-Shiller House Prices, Chicago PMI

by Calculated Risk on 9/29/2014 08:19:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for July. Although this is the June report, it is really a 3 month average of May, June and July. The consensus is for a 7.5% year-over-year increase in the Composite 20 index (NSA) for July. The Zillow forecast is for the Composite 20 to increase 7.0% year-over-year, and for prices to increase 0.1% month-to-month seasonally adjusted.

• At 9:45 AM, the Chicago Purchasing Managers Index for September. The consensus is for a reading of 61.5, down from 64.3 in August.

Note:S&P is now releasing the National house price index monthly, and I expect reporting to shift from the Composite 20 to the National index. The National index was up 6.2% year-over-year in June. Below is a graph with the National and both composite indexes.

Earlier today I posted a table of the year-over-year changes for the Black Knight index (showing year-over-year prices have been slowing for 10 months). Here is a table for Case-Shiller showing year-over-year price changes peaked at the end of 2013, and have been slowing for months:

| Year-over-year Price Changes | |||

|---|---|---|---|

| Month | Composite 10 | Composite 20 | National Index |

| Jan-13 | 7.3% | 8.2% | 7.7% |

| Feb-13 | 8.6% | 9.4% | 8.4% |

| Mar-13 | 10.0% | 10.7% | 8.9% |

| Apr-13 | 11.3% | 11.9% | 9.0% |

| May-13 | 11.6% | 12.0% | 9.0% |

| Jun-13 | 11.7% | 11.9% | 9.2% |

| Jul-13 | 12.1% | 12.3% | 9.7% |

| Aug-13 | 12.7% | 12.8% | 10.2% |

| Sep-13 | 13.2% | 13.2% | 10.7% |

| Oct-13 | 13.6% | 13.6% | 10.9% |

| Nov-13 | 13.9% | 13.7% | 10.8% |

| Dec-13 | 13.6% | 13.4% | 10.8% |

| Jan-14 | 13.5% | 13.2% | 10.5% |

| Feb-14 | 13.2% | 12.9% | 10.2% |

| Mar-14 | 12.6% | 12.4% | 8.9% |

| Apr-14 | 10.8% | 10.8% | 7.9% |

| May-14 | 9.3% | 9.3% | 7.0% |

| Jun-14 | 8.1% | 8.1% | 6.2% |

Black Knight (formerly LPS): House Price Index up 0.2% in July, Up 5.1% year-over-year

by Calculated Risk on 9/29/2014 02:25:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.2 Percent for the Month; Up 5.1 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on July 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increases have been getting steadily smaller for the last 10 months - as shown in the table below:

...

- U.S. home prices now just 10.2 percent off 2006 peak

- Year-over-year increases in home appreciation continue to slow

- Seven of 20 largest states register monthly declines in home prices

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

| June-14 | 5.5% |

| July-14 | 5.1% |

The Black Knight HPI is off 10.2% from the peak in June 2006 (not adjusted for inflation).

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 41.7% from the peak in Las Vegas, off 34.6% in Orlando, and 31.8% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in San Jose, CA and in Nashville, TN.

Note: Case-Shiller for July will be released tomorrow.

Personal Income increased 0.3% in August, Spending increased 0.5%

by Calculated Risk on 9/29/2014 12:31:00 PM

The BEA released the Personal Income and Outlays report for August this morning:

Personal income increased $47.3 billion, or 0.3 percent ... in August, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $57.5 billion, or 0.5 percent.The following graph shows real Personal Consumption Expenditures (PCE) through August 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in August, in contrast to a decrease of 0.1 percent in July. ... The price index for PCE decreased less than 0.1 percent in August, in contrast to an increase of 0.1 percent in July. The PCE price index, excluding food and energy, increased 0.1 percent, the same increase as in July. ... The August price index for PCE increased 1.5 percent from August a year ago. The August PCE price index, excluding food and energy, increased 1.5 percent from August a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q3 PCE growth, PCE was increasing at a 2.0% annual rate in Q3 2014 (using the mid-month method, PCE was increasing 2.9%). It looks like another quarter of modest PCE growth.

On inflation: The PCE price index increased 1.5 percent year-over-year, and core PCE price index (excluding food and energy) increased 1.5 percent year-over-year in August.