by Calculated Risk on 10/05/2014 08:50:00 PM

Sunday, October 05, 2014

Monday: Fed Labor Market Conditions Index

An interesting post from Tim Duy: Is There a Wage Growth Puzzle?

The unemployment and wage growth dynamics to date are actually very similar to what we have seen in the past. Low wage growth to date is not the "smoking gun" of proof of the importance of underemployment measures. There very well may have been much more labor market healing that many are willing to accept, even many FOMC members. The implications for monetary policy are straightforward - it suggests the risk leans toward tighter than anticipated policy.My current view is that NAIRU (non-accelerating inflation rate of unemployment) is lower than most FOMC participants think. My view is NAIRU is closer to 4% than 6%, whereas the central tendency for FOMC participants is in the 5.2% to 5.5% range with some thinking NAIRU is as high as 6%.

I think there are demographic reasons for the low NAIRU (the last time we saw the working age population increase this slowly, inflation didn't start to increase until the unemployment rate fell to around 4%). If I'm correct about NAIRU (and no one knows for sure), the unemployment rate could fall much further without a significant pickup in inflation. Also I think the risks for the FOMC of moving too quickly (inflation too low) far outweigh the risk of moving too slowly (too much inflation).

Monday:

• Early, Early: Black Knight Mortgage Monitor report for August.

• At 10:00 AM ET, the Fed will release the new monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of October 5th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 3 and DOW futures are also up 17 (fair value).

Oil prices were down over the last week with WTI futures at $89.56 per barrel and Brent at $91.90 per barrel. A year ago, WTI was at $103, and Brent was at $109 - so prices are down close to 15% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.30 per gallon (down about 5 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 10/05/2014 11:54:00 AM

By request, here is an update on an earlier post through the September employment report.

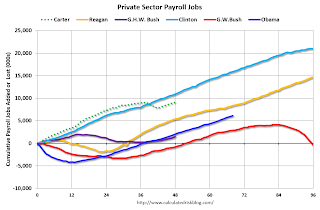

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Currently Obama's 2nd term is on pace for the third best term for these Presidents.

Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 2 | 4,1291 |

| 120 months into 2nd term: 9,910 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Twenty months into Mr. Obama's second term, there are now 6,127,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 668,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 2 | 451 |

| 120 months into 2nd term, 108 pace | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is if the public sector layoffs have ended. The cutbacks are clearly over at the state and local levels in the aggregate, and it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Saturday, October 04, 2014

Schedule for Week of October 5th

by Calculated Risk on 10/04/2014 01:11:00 PM

This will be a very light week for economic data although there will be plenty of Fed speeches (not listed).

Perhaps the most interesting releases this week will be the Fed's new Labor Market Conditions Index on Monday, and the Treasury Budget for September (end of fiscal year) on Friday.

Early: Black Knight Mortgage Monitor report for August.

At 10:00 AM ET: The Fed will release the new monthly Labor Market Conditions Index (LMCI).

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

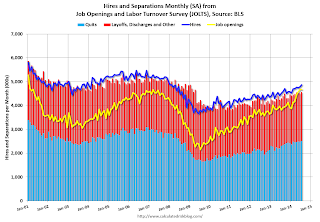

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

The number of job openings (yellow) were up 22% year-over-year. Quits were up 9% year-over-year.

3:00 PM: Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $20.5 billion.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for the September 16-17, 2014.

Early: Trulia Price Rent Monitors for September. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 287 thousand.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for August. The consensus is for a 0.3% increase in inventories.

2:00 PM ET: The Monthly Treasury Budget Statement for September.

5:00 PM ET, Speech by Fed Vice Chairman Stanley Fischer, The Federal Reserve and the Global Economy, at the 2014 International Monetary Fund Annual Meetings: Per Jacobsson Lecture, Washington, D.C. The speech can be viewed live at the IMF website.

Unofficial Problem Bank list declines to 430 Institutions, Q3 2014 Transition Matrix

by Calculated Risk on 10/04/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 3, 2014.

Changes and comments from surferdude808:

Quiet week for changes to the Unofficial Problem Bank List as there were only two removals. After the changes, the list holds 430 institutions with assets of $136.1 billion. A year ago, the list held 685 institutions with assets of $238.7 billion.

Actions were terminated against Patriot National Bank, Stamford, CT ($552 million Ticker: PNBK) and New Millennium Bank, New Brunswick, NJ ($183 million Ticker: NMNB).

With the passage of the third quarter this week, it is time for the quarterly update to the transition matrix. Full details are available in the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,673 institutions have appeared on the list. Since year-end 2012, new entrants have slowed as only 67 institutions have been added since then while 473 institutions have been removed. The pace of action terminations did slow during the latest quarter. At the start of the third quarter, there were 468 institution on the list and there were 27 action termination resulting in a removal rate of 5.8 percent, which well under the 11.9 percent rate for the previous quarter. A high termination rate is easier to achieve as the number of institutions starting each quarter has declined consistently from 1,001 at 2011q3 to the 468 at the start of 2014q3.

At the end of the third quarter, only 432 or 25.8 percent of the banks that have been on the list at some point remain. Action terminations of 646 account for 52 percent of the 1,241 institutions removed. Although failure have slowed over the past two year, they do account for a significant number of institutions that have left the list. Since publication, 383 of the institutions that have appeared on the list have failed accounting for nearly 31 percent of removals. Should another institution on the current list not fail, then nearly 23 percent of the 1,673 institutions that made an appearance on the list would have failed. A 23 percent default rate would be more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list. Of the $659.9 billion in assets removed from the list, the largest volume of $296.1 billion is from failure while terminations still trail at $270.8 billion.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 141 | (55,759,559) | |

| Unassisted Merger | 34 | (7,152,867) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (5,371,544) | ||

| Still on List at 9/30/2014 | 56 | 13,175,767 | |

| Additions after 8/7/2009 | 376 | 123,623,785 | |

| End (9/30/2014) | 432 | 136,799,552 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 505 | 215,076,758 | |

| Unassisted Merger | 164 | 72,821,593 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 229 | 111,876,012 | |

| Total | 908 | 402,098,505 | |

| 1Institution not on 8/7/2009 or 9/30/2014 list but appeared on a weekly list. | |||

Friday, October 03, 2014

Goldman: "Fed likely still holds $1 trillion MBS by the end of 2020"

by Calculated Risk on 10/03/2014 07:53:00 PM

Some interesting analysis from Hui Shan, Marty Young, Chris Henson at Goldman Sachs: Fed likely still holds $1 trillion MBS by the end of 2020

The QE program is set to end after the October FOMC meeting. In the updated exit strategy principles released on September 17, the committee announced that it anticipates (1) portfolio reinvestments will continue until after the first rate hike and (2) sales of MBS will not occur during the normalization process. The Federal Reserve currently holds close to $1.8 trillion agency MBS, accounting for one third of the total outstanding. Our US economics team forecasts the first Federal funds rate hike in 2015Q3 and the portfolio reinvestment continuing through 2015. This projection combined with the FOMC’s exit strategy principles suggests that the Federal Reserve is likely to remain the largest agency MBS investor for a long time.

...

The speed of the portfolio rundown when the Fed stops reinvesting depends on the speed of principal payments, both scheduled (i.e., through amortization) and unscheduled (i.e., through refinancing, home sales, and defaults). While scheduled principal payments are pre-determined, unscheduled principal payments depend on a host of factors such as interest rates, house prices, and economic conditions. ...

Under our baseline scenario, the Federal Reserve continues reinvesting principal payments through 2015. After that, the Fed portfolio declines slowly, with the Fed still holding $1 trillion MBS by the end of 2020. Such a gradual pace suggests that Fed portfolio rundown is unlikely to create a surge in the net supply of agency MBS for private investors to absorb after the end of QE.

emphasis added

Reis: Mall Vacancy Rate unchanged in Q3

by Calculated Risk on 10/03/2014 02:31:00 PM

Reis reported that the vacancy rate for regional malls was unchanged at 7.9% in Q3 2014. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was also unchanged at 10.3% in Q3. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] The national vacancy rate for neighborhood and community shopping centers was unchanged at 10.3% during the third quarter. This is similar to last quarter when the vacancy rate did not change. The national vacancy is now down 80 basis points from its historical peak during the third quarter of 2011. Of course, this means the pace of improvement is slow and consistent.

Completions during the quarter were low, even by the standards of this tepid recovery. Construction has yet to mount any meaningful recovery since the recession. Most of the construction occurring is small and almost always predicated on preleasing. There is still virtually no new speculative development five years removed from the start of the economic recovery.

...

Ecommerce remains a potent threat to many retail centers, but at this point, that is not what is holding the market back. The overwhelming majority of retail sales activity, roughly 94%, still occurs in physical retail locations. Surely that has imperiled some centers, but not the majority. Though ecommerce's share of the market will continue to grow and pose a larger threat over time, it will not prevent a recovery in the retail sector.

[Regional] Much like with neighborhood and community centers, the regional mall vacancy rate was unchanged this quarter at 7.9%. Although this is down 30 basis points from the third quarter of 2013, that was the last quarter during which the national vacancy rate for malls declined. Malls have been stuck at 7.9% for a year.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

Trade Deficit decreased in August to $40.1 Billion

by Calculated Risk on 10/03/2014 01:05:00 PM

Earlier the Department of Commerce reported:

[T]otal August exports of $198.5 billion and imports of $238.6 billion resulted in a goods and services deficit of $40.1 billion, down from $40.3 billion in July, revised. August exports were $0.4 billion more than July exports of $198.0 billion. August imports were $0.2 billion more than July imports of $238.3 billion.The trade deficit was smaller than the consensus forecast of $40.7 billion and the trade deficit was revised down slightly for July.

The first graph shows the monthly U.S. exports and imports in dollars through August 2014.

Click on graph for larger image.

Click on graph for larger image.Imports and exports increased in August.

Exports are 19% above the pre-recession peak and up 4% compared to August 2013; imports are 3% above the pre-recession peak, and up about 4% compared to August 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through August.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $96.32 in August, down from $97.81 in July, and down from $100.27 in August 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $30.2 billion in August, from $29.8 billion in August 2013.

Comments on Employment Report: Party Like it's 1999!

by Calculated Risk on 10/03/2014 09:42:00 AM

Earlier: September Employment Report: 248,000 Jobs, 5.9% Unemployment Rate

This was a solid report with 248,000 jobs added and combined upward revisions to July and August of 69,000. As always we shouldn't read too much into one month of data, but at the current pace (through September), the economy will add 2.72 million jobs this year (2.64 million private sector jobs). Right now 2014 is on pace to be the best year for both total and private sector job growth since 1999.

A few other positives: the unemployment rate declined to 5.9% (the lowest level since July 2008), U-6 (an alternative measure for labor underutilization) was at the lowest level since 2008, the number of part time workers for economic reasons declined slightly (lowest since October 2008), and the number of long term unemployed declined to the lowest level since January 2009.

Unfortunately wage growth is still subdued. From the BLS: "Average hourly earnings for all employees on private nonfarm payrolls, at $24.53, changed little in September (-1 cent). Over the year, average hourly earnings have risen by 2.0 percent. In September, average hourly earnings of private-sector production and nonsupervisory employees were unchanged at $20.67."

With the unemployment rate at 5.9%, there is still little upward pressure on wages. Wages should pick up as the unemployment rate falls over the next couple of years, but with the currently low inflation and little wage pressure, the Fed will likely remain patient.

A few more numbers:

Total employment increased 248,000 from August to September and is now 1.07 million above the previous peak. Total employment is up 9.78 million from the employment recession low.

Private payroll employment increased 236,000 from August to September, and private employment is now 1,547,000 above the previous peak (the unprecedented large number of government layoffs has held back total employment). Private employment is up 10.34 million from the low.

Through the first nine months of 2014, the economy has added 2,040,000 payroll jobs - up from 1,736,000 added during the same period in 2013. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year. That still looks about right.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in September to 80.7% from 81.1% in August, and the 25 to 54 employment population ratio decreased to 76.7% from 76.8%. As the recovery continues, I expect the participation rate for this group to increase a little - although the participation rate has been trending down for this group since the late '90s.

Year-over-year Change in Employment

In September, the year-over-year change was 2.635 million jobs, and it appears the pace of hiring is increasing.

Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in September at 7.1 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in September to 7.103 million from 7.277 million in August. This suggests significantly slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.8% in September from 12.0% in August.

This is the lowest level for U-6 since October 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.954 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.963 in August. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In September 2014, state and local governments added 14,000 jobs. State and local government employment is now up 143,000 from the bottom, but still 601,000 below the peak.

Clearly state and local employment is now increasing. And Federal government layoffs have slowed (payroll decreased by 2 thousand in September), but Federal employment is still down 25,000 for the year.

September Employment Report: 248,000 Jobs, 5.9% Unemployment Rate

by Calculated Risk on 10/03/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 248,000 in September, and the unemployment rate declined to 5.9 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for July was revised from +212,000 to +243,000, and the change for August was revised from +142,000 to +180,000. With these revisions, employment gains in July and August combined were 69,000 more than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Employment is now up 2.63 million year-over-year.

Total employment is now 1.07 million above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in September to 62.7% from 62.8% in August. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate decreased in September to 5.9%.

This was above expectations, and the revisions to prior months were strongly positive. A solid report!

I'll have much more later ...

Thursday, October 02, 2014

Friday: Employment Report, Trade Deficit, Q3 Mall Vacancies, ISM non-Manufacturing

by Calculated Risk on 10/02/2014 08:54:00 PM

Earlier I posted a preview for the September employment report. I noted that over the last four years, September payrolls have been revised up by an average of 55,000 - so it appears the BLS underestimates employment in September.

But that is nothing compared to the '90s.

As an example, in September 1995 the BLS initially reported an increase of 121,000 payroll jobs. Eventually that was revised up to 241,000.

In September 1996, the BLS initially reported a 40,000 decrease in payrolls jobs. This was eventually revised up to a 225,000 increase!

And in September 1997, the BLS initially reported an increase of 215,000 payroll jobs. This was revised up to 512,000 jobs! Wow.

I think the BLS methods have improved (the revisions tend to be smaller now), but there will still be significant revisions.

Friday:

• Early, Reis Q3 2014 Mall Survey of rents and vacancy rates.

• At 8:30 AM ET, the Employment Report for September. The consensus is for an increase of 215,000 non-farm payroll jobs added in September, up from the 142,000 non-farm payroll jobs added in August. The consensus is for the unemployment rate to be unchanged at 6.1% in September.

• Also at 8:30 AM, the Trade Balance report for August from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.7 billion in August from $40.5 billion in July.

• At 10:00 AM, the ISM non-Manufacturing Index for September. The consensus is for a reading of 58.8, down from 59.6 in August. Note: Above 50 indicates expansion.