by Calculated Risk on 10/12/2014 11:32:00 AM

Sunday, October 12, 2014

Goldman on 2015: "Potential Renewed Uncertainty around Fiscal Deadlines"

A couple of months ago I wrote: Flashback to August 2011 and 2013 (And a hint for 2015). I discussed the policy insanity in 2011 and 2013, and worried about 2015 (this happens in odd years because politicians hope voters will forget).

From Goldman Sachs economist Alec Phillips:

In many policy areas, a shift in Senate control would simply result in a new flavor of the gridlock that has prevailed since the 2010 election. The split between Congress and the White House would still exist and, while Republicans would set the agenda in both chambers if they held a majority, a degree of bipartisan support would still be necessary in the Senate light of the 60-vote threshold necessary to pass most legislation.Here was go again in 2015.

The exception would be the annual budget resolution and legislation related to it. The budget resolution sets out annual targets for federal spending, revenue, and debt. More importantly, it can be used to clear a procedural path for legislation that includes policies to reconcile the level of spending, revenue, or debt under current law with the levels in the budget resolution. Such “reconciliation” legislation is not subject to filibuster and can therefore pass both chambers with only a simple majority (i.e., 51 votes in the Senate).

Issues like the debt limit could be handled in one of two ways. In theory, reconciliation would allow Republicans to couple a debt limit hike with other measures and send it to the President with only Republican votes. However, in practice this would be difficult: with a narrow majority and differences between centrists and conservatives in the party, Republican leaders could struggle to get 51 votes for a debt limit hike.

The alternative would be for Republican Senate leaders to try to attract Democratic support to pass a debt limit hike with 60 votes. However, if Republicans win the Senate majority, we would expect them to push for greater concessions from the White House around this sort of fiscal deadline than they have managed to get recently.

The result is likely to be less predictability regarding the process surrounding major fiscal deadlines. Since the confrontation between House Republicans and the White House over the debt limit in 2011, markets have gradually become inured to fiscal brinksmanship, as these debates have started to follow a predictable pattern. If Republicans win majorities in both chambers as polls currently suggest they might, that pattern seems likely to change, which could lead to renewed uncertainty ahead of future fiscal deadlines.

emphasis added

Saturday, October 11, 2014

Fed Vice Chairman Fischer: "The Federal Reserve and the Global Economy"

by Calculated Risk on 10/11/2014 06:09:00 PM

For your Saturday reading pleasure, from Fed Vice Chairman Stanley Fischer: The Federal Reserve and the Global Economy. Here is the conclusion:

To summarize and conclude, the Fed's statutory objectives are defined by its dual mandate to pursue maximum sustainable employment and price stability in the U.S. economy. But the U.S. economy and the economies of the rest of the world have important feedback effects on each other. To make coherent policy choices, we have to take these feedback effects into account. The most important contribution that U.S. policymakers can make to the health of the world economy is to keep our own house in order--and the same goes for all countries. Because the dollar is the primary international currency, we have, in the past, had to take action--particularly in times of global economic crisis--to maintain order in international capital markets, such as the central bank liquidity swap lines extended during the global financial crisis. In that case, we were acting in accordance with our dual mandate, in the interest of the U.S. economy, by taking actions that also benefit the world economy. Going forward, we will continue to be guided by those same principles.

Schedule for Week of October 12th

by Calculated Risk on 10/11/2014 08:15:00 AM

The key economic reports this week are September retail sales on Wednesday, and September housing starts on Friday.

For manufacturing, the September Industrial Production and Capacity Utilization report, and the October NY Fed (Empire State) and Philly Fed manufacturing surveys, will be released this week.

For prices, PPI will be released on Wednesday.

The is a federal/bank holiday. The Bond market will be closed in observance of the Columbus Day holiday. The stock market will be open for trading.

7:30 AM ET: NFIB Small Business Optimism Index for September.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for September will be released.

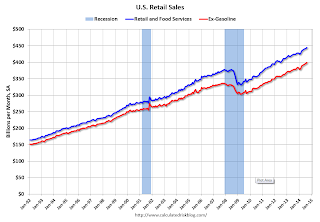

8:30 AM ET: Retail sales for September will be released.This graph shows retail sales since 1992 through August 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).On a monthly basis, retail sales increased 0.6% from July to August (seasonally adjusted), and sales were up 5.0% from August 2013.

The consensus is for retail sales to decrease 0.1% in September, and to increase 0.3% ex-autos.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire Manufacturing Survey for October. The consensus is for a reading of 20.0, down from 27.5 in September (above zero is expansion).

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.4% increase in inventories.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 287 thousand.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

10:00 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.0, down from 22.5 last month (above zero indicates expansion).

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts were at 956 thousand (SAAR) in August. Single family starts were at 643 thousand SAAR in August.

The consensus is for total housing starts to increase to 1.010 million (SAAR) in September.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 84.2, down from 84.6 in September.

Friday, October 10, 2014

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in September

by Calculated Risk on 10/10/2014 04:02:00 PM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for a few selected cities in September.

Lawler also noted: "While I do not yet have enough local realtor/MLS reports to produce a reliable estimate for national existing home sales last month, my very early read is that NAR-based existing home sales ran at a seasonally adjusted annual rate of about 5.14 million in September, up 1.8% from August."

On distressed: Total "distressed" share is down in these markets due to a decline in short sales.

Short sales are down significantly in these areas.

Foreclosures are up slightly in several of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | |

| Las Vegas | 10.4% | 23.0% | 8.8% | 7.0% | 19.2% | 30.0% | 34.3% | 47.2% |

| Reno** | 7.0% | 20.0% | 7.0% | 5.0% | 14.0% | 25.0% | ||

| Phoenix | 25.7% | 33.4% | ||||||

| Sacramento | 5.3% | 12.1% | 6.5% | 3.9% | 11.8% | 16.0% | 19.4% | 23.6% |

| Mid-Atlantic | 5.5% | 7.7% | 9.7% | 8.2% | 15.2% | 15.9% | 19.1% | 18.4% |

| Tucson | 26.7% | 29.8% | ||||||

| Toledo | 31.4% | 38.1% | ||||||

| Des Moines | 16.8% | 19.2% | ||||||

| Georgia*** | 27.4% | N/A | ||||||

| Omaha | 19.9% | 19.1% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Moody's Zandi: "Have We Underestimated U.S. Wage Growth?"

by Calculated Risk on 10/10/2014 02:47:00 PM

My view is that there is still significant slack in the labor market. Evidence of slack includes the elevated unemployment rate at 5.9%, the elevated level of U-6 at 11.8% (an alternative measure of labor underutilization), the large number of people working part time for economic reasons (included in U-6), and the low level of wage growth.

Some new research from Moody's Mark Zandi suggests wage growth might be picking up: Have We Underestimated U.S. Wage Growth? A few excerpts:

[W]hat if wage growth is accelerating already, and the BLS wage measures have yet to pick this up? This is the message in new data from ADP, based on payroll processing records for more than 24 million employees, or about one-fifth of all U.S. workers.

Moody’s Analytics helped ADP separate the changes in hourly wages paid to those staying in their jobs, labeled job holders, from wages paid to those who change jobs, new entrants to the workforce, and those leaving it. The data track changes quarterly from the second quarter of 2011 to the third quarter of 2014, long enough allow for seasonal adjustments. The data can also be broken down by industry, region, company size, worker age and gender, tenure on the job, pay scale, and part- vs. full-time.

The hourly wage rate for job holders is the most telling. It is up 4.5% from a year ago in the third quarter, a strong and steady acceleration from its low two years ago. The acceleration in hourly wage growth occurs across the board, although it is up most for younger workers, those with one to five years on the job and at lower pay levels, and those who work at small companies. Wage gains have also picked up most in financial services and construction in the West and South.

Baby boomers who work at big companies in healthcare and in leisure and hospitality in the Northeast and Midwest have experienced the slowest acceleration in wages.

The ADP-based hourly wage data likely overstate the acceleration in wage growth in the broader labor market for several reasons. First, ADP’s client companies tend to perform better than average, particularly among smaller companies. A small firm will not use a payroll processing service unless its prospects are good.

How much this inflates the ADP data has not been estimated, but judging from the impact on employment, which we have quantified in our work estimating payroll employment (the ADP National Employment Report), it is meaningful. This may suggest that the ADP data foreshadow broader trends if conditions continue to improve.

Second, the ADP hourly wage for job holders more accurately measures workers’ base pay. This is unlike other BLS wage measures, which include other forms of compensation. The BLS average hourly earnings gauge includes pay for overtime hours and incentive pay (though not irregular bonuses). In 2011 and early 2012, overtime hours were increasing as was incentive pay. This supported growth in the BLS average hourly earnings metric, but not in the ADP measure. Indeed, ADP hourly wage growth lagged BLS hourly earnings growth during this period.

During the past two years, overtime hours and incentive pay have leveled off, weighing on the BLS hourly earnings growth gauge, but not on ADP’s base hourly wages measure. This effect should wear off soon, however, and stronger growth in base pay, which is evident in the ADP data, should appear as well in the BLS data.

The increase in personal income tax rates at the start of 2013 also affected the timing of some workers’ income. Businesses moved income into 2012 to benefit from the lower tax rate, reducing income afterward. This likely had a bigger impact on the BLS measures of labor compensation than on ADP’s base wage rates for job holders. Yet this impact too should also fade quickly.

Third, the significant increase in the number of job leavers and new entrants since early 2013 may also be weighing more heavily on BLS wage measures. In the third quarter of this year, there were approximately 400,000 more job leavers and 500,000 more new entrants than in the first quarter of 2013. Since new entrants are paid less than those at the ends of their careers (a large share of the leavers), measured wage growth has been depressed. While this also affects growth in ADP’s hourly wages for job holders, it does so later than it affects the BLS wage measure.

Implications

If the acceleration in ADP hourly wages presages an imminent acceleration in broader measures of labor compensation, the implications are substantial. Most encouragingly, it signals that workers will finally participate more equitably in the benefits of the economic recovery.

Sacramento Housing in September: Total Sales down 1% Year-over-year, Equity Sales up 5%, Active Inventory increased 51%

by Calculated Risk on 10/10/2014 12:00:00 PM

About 5 years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September 2014, 11.1% of all resales were distressed sales. This was down from 11.7% last month, and down from 16.0% in September 2013. This is the post-bubble low.

The percentage of REOs was at 6.0%, and the percentage of short sales was 5.1%.

Here are the statistics for September.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Look at all that BLUE!

Active Listing Inventory for single family homes increased 50.9% year-over-year (YoY) in September. Although this was a large YoY increase, the YoY increases have been trending down after peaking close to 100%.

Cash buyers accounted for 19.4% of all sales, down from 23.6% in September 2013, and down from 20.2% last month (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 0.6% from September 2013, and conventional equity sales were up 5.2% compared to the same month last year.

Summary: Distressed sales down sharply (at post bubble low), cash buyers down significantly, and inventory up significantly (but increases slowing). This is what we'd expect to see in a healing market. As I've noted before, we are seeing a similar pattern in other distressed areas.

FNC: Residential Property Values increased 7.5% year-over-year in August

by Calculated Risk on 10/10/2014 10:09:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their August index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.8% from July to August (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.9% and 1.1% in August. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was the same in August as in July, with the 100-MSA composite up 7.5% compared to August 2013. In general, for FNC, the YoY increase has been slowing since peaking in February at 9.4%.

The index is still down 18.8% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through August 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes had been showing a slowdown in price increases - although the indexes increased the same or slightly more year-over-year in August compared to July.

The August Case-Shiller index will be released on Tuesday, October 28th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Thursday, October 09, 2014

Lawler: Comments on Pending Home Sales and All Cash Purchases

by Calculated Risk on 10/09/2014 07:10:00 PM

A couple of notes today from housing economist Tom Lawler:

NAR on Pending Home Sales Index in the West --- We Know Already

In one of last week’s reports I highlighted how the National Association of Realtors’ Pending Home Sales Index for the West region (not seasonally adjusted) was inconsistent both with the pattern of closed sales in the West and with local realtor/MLS reports from that region.

It turns out that the NAR is “aware of the fact that (their) pending data in the West does not look correct,” and they are going through their records to see if they can figure out why. The NAR argues, however, that the YOY trend changes look fine, and “line up” better with other reported data.

From my perspective, if the underlying, unadjusted data are wrong, I’d be leery of the YOY trends as well. As such, analysts are cautioned not to place much weight in the PHSI until the NAR fixes the underlying data.

HMDA Data on Mortgage Originations Suggest All-Cash Share Peaked in 2011

HMDA data show that the number of purchase mortgage originations by HMDA reporters in 2013 was up 13.6% from 2012. HMDA purchase mortgage originations in 2012 were up 13.1% from 2011. In both years the percentage increase in the number of purchase mortgage originations modestly exceeded the percentage increase in estimated total home sales. That was in stark contrast to the previous six years, when the number of purchase mortgage originations fell relative to the estimated number of home sales - with especially steep relative declines from 2008 to 2011. These data suggest that the “all-cash” share of home sales hit an annual high in 2011, but still remained unusually high last year.

Hotels: Occupancy up 3.7%, RevPAR up 6.6% Year-over-Year

by Calculated Risk on 10/09/2014 03:10:00 PM

From HotelNewsNow.com: STR: US results for week ending 4 October

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 28 September through 4 October 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 2.8 percent to 66.5 percent. Average daily rate increased 3.7 percent to finish the week at US$115.93. Revenue per available room for the week was up 6.6 percent to finish at US$77.04.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

There is always a dip in occupancy after the summer (less leisure travel), and then more business travel in the Fall.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at about the level as for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels. Since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Housing: Appears Inventory build is Slowing in Previous Distressed Markets

by Calculated Risk on 10/09/2014 01:02:00 PM

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And at the beginning of this year I argued house price increases would slow in 2014 because of the increase in inventory.

I don't have a crystal ball, but watching inventory helps understand the housing market. If inventory kept increasing rapidly in certain markets, then we would eventually see price declines. However it now appears the inventory build is slowing in some former distressed markets.

The table below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (September not available yet). Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It now appears the inventory build is slowing in these markets.

This makes sense. Prices increased rapidly in these markets in 2012 and 2013 (bouncing off the bottom with low inventory). Higher prices attracted more people to list their homes. But now that prices have flattened out - and there is plenty of inventory - potential sellers aren't as motivated to list their homes. Unlike following the housing bubble, most of these potential sellers probably don't need to sell, so listings will not grow to the moon!

I still expect overall inventory to continue to increase, but this is something to watch.

| Year-over-year Change in Active Inventory | |||

|---|---|---|---|

| Month | Las Vegas | Phoenix | Sacramento |

| Jan-13 | -58.3% | -11.7% | -61.1% |

| Feb-13 | -53.4% | -8.5% | -51.1% |

| Mar-13 | -42.1% | -5.2% | -37.8% |

| Apr-13 | -24.1% | -4.9% | -10.3% |

| May-13 | -13.2% | -2.1% | 5.3% |

| Jun-13 | 3.7% | -1.6% | 18.3% |

| Jul-13 | 9.0% | -1.6% | 54.3% |

| Aug-13 | 41.1% | 2.4% | 46.8% |

| Sep-13 | 60.5% | 7.8% | 77.3% |

| Oct-13 | 73.4% | 15.7% | 93.2% |

| Nov-13 | 77.4% | 15.2% | 56.8% |

| Dec-13 | 78.6% | 20.9% | 44.2% |

| Jan-14 | 96.2% | 29.6% | 96.3% |

| Feb-14 | 107.3% | 37.7% | 87.8% |

| Mar-14 | 127.9% | 45.5% | 71.2% |

| Apr-14 | 103.1% | 48.8% | 46.3% |

| May-14 | 100.6% | 47.4% | 83.7% |

| Jun-14 | 86.2% | 43.1% | 91.0% |

| Jul-14 | 55.2% | 35.1% | 68.0% |

| Aug-14 | 38.8% | 21.9% | 60.6% |

| Sep-14 | 29.5% | 13.2% | NA |