by Calculated Risk on 10/14/2014 04:15:00 PM

Tuesday, October 14, 2014

Lawler: Early Read on Existing Home Sales in September, Table of Distressed and All-Cash Share

From economist Tom Lawler:

Based on realtor association/MLS reports across the country, I estimate that existing home sales as measured by the National Association of Realtors will come in at a seasonally adjusted annual rate of 5.14 million in September, up 1.8% from August’s pace but down 2.3% from last September’s pace.Lawler also sent me the table below of short sales, foreclosures and cash buyers for several selected cities in September.

Local realtor/MLS data suggest that the NAR’s inventory estimate for September will be down by about 3.0% from August, and up by about 3.2% from last September. Finally, I expect that the NAR’s median existing SF home sales price in September will be about 4.5% higher than last September.

On distressed: Total "distressed" share is down in these markets due to a decline in short sales.

Short sales are down in all these areas.

Foreclosures are up slightly in several of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | Sep-14 | Sep-13 | |

| Las Vegas | 10.4% | 23.0% | 8.8% | 7.0% | 19.2% | 30.0% | 34.3% | 47.2% |

| Reno** | 7.0% | 20.0% | 7.0% | 5.0% | 14.0% | 25.0% | ||

| Phoenix | 3.8% | 8.8% | 5.8% | 8.0% | 9.6% | 16.8% | 25.7% | 33.4% |

| Sacramento | 5.3% | 12.1% | 6.5% | 3.9% | 11.8% | 16.0% | 19.4% | 23.6% |

| Minneapolis | 3.4% | 6.0% | 9.4% | 16.0% | 12.8% | 22.0% | ||

| Mid-Atlantic | 5.5% | 7.7% | 9.7% | 8.2% | 15.2% | 15.9% | 19.1% | 18.4% |

| Bay Area CA* | 3.6% | 7.5% | 2.8% | 3.6% | 6.4% | 11.1% | 20.9% | 23.3% |

| So. California* | 6.0% | 10.9% | 4.7% | 6.4% | 10.7% | 17.3% | 24.3% | 28.7% |

| Tucson | 26.7% | 29.8% | ||||||

| Hampton Roads | 19.6% | 26.1% | ||||||

| Toledo | 31.4% | 38.1% | ||||||

| Des Moines | 16.8% | 19.2% | ||||||

| Georgia*** | 27.4% | N/A | ||||||

| Omaha | 19.9% | 19.1% | ||||||

| Memphis* | 11.7% | 16.5% | ||||||

| Springfield IL** | 9.5% | 14.1% | 22.6% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

DataQuick on California Bay Area: Strongest September for Home Sales in Five Years, Distressed Sales and Investor Buying declines

by Calculated Risk on 10/14/2014 01:35:00 PM

From DataQuick: Strongest September for Bay Area Home Sales in Five Years; Prices Flat

The number of homes sold in the Bay Area last month edged up to its highest level for a September since 2009, the result of some spillover summer activity and sustained demand in a strong regional economy. Prices appear to have flattened out at a level reached this spring, Irvine-based CoreLogic DataQuick reported.A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) generally flat total sales (up 4.2% year-over-year in September), 4) an increase in non-distressed sales.

A total of 7,443 new and resale houses and condos sold in the nine-county Bay Area last month. That was down 1.8 percent from 7,578 in August and up 4.2 percent from 7,141 in September last year, according to CoreLogic DataQuick.

A decline in sales from August to September is normal for the season. Last month’s sales count was the highest for any September since 7,879 homes were sold in 2009.

...

“Some analysts are re-calculating what they consider to be normal sales levels, taking out the ‘loans-gone-wild’ years of over-available credit. And if you do that, current sales are right in the normal range. We still have issues today, though. The mortgage market is still dysfunctional. There are categories of buying and selling that are still inactive, and nobody really has any idea just how much pent-up demand there is out there,” said John Karevoll, CoreLogic DataQuick analyst.

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.8 percent of resales, unchanged from a revised 2.8 percent the month before, and down from 3.6 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.7 percent, CoreLogic DataQuick reported.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.6 percent of Bay Area resales last month. That was down from an estimated 3.8 percent in August and down from 7.5 percent a year earlier.

Last month absentee buyers – mostly investors – purchased 19.1 percent of all Bay Area homes. That was up from August’s revised 18.6 percent, and down from 20.9 percent in September last year.

emphasis added

Mortgage Rates: Close to 4%, No Significant Increase in Refinance Activity Expected

by Calculated Risk on 10/14/2014 12:41:00 PM

With the ten year yield falling to 2.23%, mortgage rates should move lower. Based on a historical relationship (see 2nd graph below), 30-year rates will probably fall close to 4%.

However I do not expect a refinance boom due to lower rates.

Click on graph for larger image.

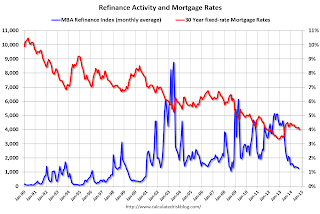

This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Borrowers who took out mortgages last year can probably refinance now - but that is a small number of total borrowers. For a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

The second graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

Based on the relationship from the graph, it appears mortgage rates will be close to 4% soon.

However, to have a significant refinance boom, the 30 year mortgage rate (Freddie Mac survey) would be have to fall below the 3.35% of late 2012, and that means 10-year Treasury yields would have to fall well below 2%.

So I don't expect a significant increase in refinance activity any time soon.

NFIB: Small Business Optimism Index Declines in September

by Calculated Risk on 10/14/2014 09:21:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Declines in September

September’s optimism index gave up 0.8 points, falling to 95.3. At 95.3, the Index is now 5 points below the pre-recession average (from 1973 to 2007). ...Hiring plans decreased to 9 (still solid).

NFIB owners increased employment by an average of 0.24 workers per firm in September (seasonally adjusted), the 12th positive month in a row and the largest gain this year.

emphasis added

And in a positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 14, down from 17 last year - and "taxes" at 21 and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 95.3 in September from 96.1 in August.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

Monday, October 13, 2014

DataQuick on SoCal: September Home Sales up 1% Year-over-year, Distressed Sales and Investor Buying Declines Further

by Calculated Risk on 10/13/2014 08:05:00 PM

From DataQuick: Southland Home Sales Edge Higher; Price Growth Slows

Southern California home sales hit a five-year high for a September, rising slightly above a year earlier for the first time in 12 months amid gains for mid- to high-end deals. ... A total of 19,348 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 2.9 percent from 18,796 sales in August, and up 1.2 percent from 19,112 sales in September 2013, according to CoreLogic DataQuick data. ...Even with distressed sales and investor buying declining, overall sales were still up year-over-year.

On average, sales have fallen 9.4 percent between August and September since 1988, when CoreLogic DataQuick statistics begin. Last month marked the first time sales have risen on a year-over-year basis since September last year, when sales rose 7.0 percent from September 2012.

...

Foreclosure resales – homes foreclosed on in the prior 12 months – represented 4.7 percent of the Southland resale market last month. That was down from a revised 5.0 percent the prior month and down from 6.4 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.0 percent of Southland resales last month. That was up insignificantly from 5.9 percent the prior month and down from 10.9 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 23.3 percent of the Southland homes sold last month. That was the lowest absentee share since October 2010, when 22.1 percent of homes sold to absentee buyers. Last month’s figure was down from 23.8 percent the prior month and down from 27.0 percent a year earlier. ...

emphasis added

The NAR is scheduled to release existing home sales for September on Tuesday, October 21st - and it appears sales will be up from August on a seasonally adjusted annual rate (SAAR) basis.

From 5 Years Ago: The History of the World wouldn't be complete without ...

by Calculated Risk on 10/13/2014 05:01:00 PM

I posted this cartoon 5 years ago ... it seems like yesterday.

From Larry Gonick's The Cartoon History of the Modern World, Part 2, on page 248 ... (ht TDM)

Posted with permission from Larry Gonick. Thanks!

For more on Tanta, see the menu bar above ...

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 10/13/2014 02:15:00 PM

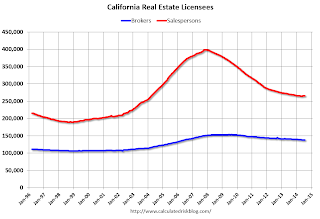

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 33.5% from the peak, and may be flattening out (still down 1.5% year-over-year). The number of salesperson's licenses has fallen to March 2004 levels.

Brokers' licenses are only off 9.9% from the peak and have only fallen to mid-2006 levels, but are still slowly declining (down 1.7% year-over-year).

So far there is no sign of a pickup in real estate agents!

"Disinflation, Here We Come"

by Calculated Risk on 10/13/2014 11:24:00 AM

From Evan Soltas: Disinflation, Here We Come

Spot prices for oil have dropped 20 percent in the last three months, from $110 to $90 a barrel. If they remain at these levels, inflation in the United States will slow quite a bit, and quickly at that. My estimate is that headline PCE inflation will fall to just under 1 percent within the next three months of data.This is why it is important to look at core measures of inflation (core CPI and PCE that remove energy), and other measures of underlying inflation such as the Cleveland Fed's median CPI and trimmed-mean CPI.

...

Recall that PCE inflation is 1.5 percent year-over-year. So, one surprise from energy markets, and we could be below one percent. At a time when we are supposed to be a couple months away from a rate hike, this could complicate the exit plan.

And from Tim Duy: The Methodical Fed

Just a few months ago the specter of inflation dominated Wall Street. Now the tables have turned and low inflation is again the worry du jour as a deflationary wave propagates from the rest of the world - think Europe, China, oil prices. How quickly sentiment changes.One thing is clear, Fed Chair Janet was correct in June when she said

And given how quickly sentiment changes, I am loath to make any predictions on the implications for Fed policy. ...

Bottom Line: Fed policy might sound dovish this week, but take note the the underlying tone has been methodically hawkish for a long, long time. And markets have responded accordingly, including anticipating a return to the zero bound when the next recession hits. Nor should this be unexpected. Monetary policymakers have yet to set clear objectives that includes a high probability that the zero bound is left behind for good.

"I think recent readings on CPI index have been a bit on the high side but I think the data we're seeing is noisy. Broadly speaking inflation is evolving in line with the committee's expectations."

Unofficial Problem Bank list declines to 429 Institutions

by Calculated Risk on 10/13/2014 08:46:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 10, 2014.

Changes and comments from surferdude808:

Minimal changes to the Unofficial Problem Bank List with only one removal. After the deduction, the list count moves down to 429 institutions with assets of $136 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 429.

A year ago, the list held 683 institutions with assets of $238.3 billion. The Bank of Palatine, Palatine, IL ($49 million) found a merger partner to depart the list. The other change this week was the Federal Reserve issuing a Prompt Corrective Action order against Fayette County Bank, St. Elmo, IL ($53 million), which just recently joined the list last month. Next week we expect the OCC will provide on update on its enforcement action activity.

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Sunday, October 12, 2014

Sunday Night Futures

by Calculated Risk on 10/12/2014 07:36:00 PM

Note: Monday is a federal/bank holiday. The Bond market will be closed in observance of the Columbus Day holiday. The stock market will be open for trading.

From Professor Hamilton: Lower oil prices

For the last 3 years, European Brent has mostly traded in a range of $100-$120 with West Texas intermediate selling at a $5 to $20 discount. But in September Brent started moving below $100 and now stands at $90 a barrel, and the spread over U.S. domestic crude has narrowed. Here I take a look at some of the factors behind these developments.More production in Libya and in the U.S., combined with a weak global economy and the stronger dollar ... and the price of oil has declined significantly.

...[see Hamilton's post]

As I’ve noted before there’s a basic limit on how much U.S. production is capable of lowering the world price. The methods that are responsible for the U.S. production boom are quite expensive. Just how low the price can go before some of the frackers start to drop out is subject to some debate.

Weekend:

• Schedule for Week of October 12th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 17 and DOW futures are down over 100 (fair value).

Oil prices were down over the last week with WTI futures at $84.33 per barrel and Brent at $88.60 per barrel. A year ago, WTI was at $102, and Brent was at $111 - so prices are down close to 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.22 per gallon (down about 10 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |