by Calculated Risk on 10/18/2014 01:11:00 PM

Saturday, October 18, 2014

Schedule for Week of October 19th

The key reports this week are September New home sales on Friday, and Existing home sales on Tuesday.

For prices, CPI will be released on Wednesday.

No releases scheduled.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.09 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.05 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.14 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for September 2014

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for September. The consensus is for no change in CPI in September and for core CPI to increase 0.1%.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 264 thousand.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

11:00 AM: the Kansas City Fed manufacturing survey for October.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for a decrease in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 504 thousand in August.

Unofficial Problem Bank list declines to 426 Institutions

by Calculated Risk on 10/18/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 17, 2014.

Changes and comments from surferdude808:

Unexpectedly, there was a bank failure today. Expectedly, the OCC provided us an update on their enforcement action activities through September. For the week, there were four removals and one addition that leave the Unofficial Problem Bank List at 426 institutions with assets of $135.5 billion. A year ago, the list held 677 institutions with assets of $236.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 426.

The OCC terminated actions against Heartland National Bank, Sebring, FL ($309 million); First Federal Savings and Loan Association of Kewanee, Kewanee, IL ($66 million); and American Loan and Savings Association, Hannibal, MO ($5 million). Also, the OCC issued a Formal Agreement against Homestead Savings Bank, Albion, MI ($72 million).

NBRS Financial, Rising Sun, MD ($191 million) became the 15th bank failure this year. At the 41st week of the year, the pace of 15 failures matches approximates the 16 failures at the 41st week of 2008. This is well under the 129 failures at the same point in 2010.

Since publication of the Unofficial Problem Bank List in August 2009, 384 banks on the list have been removed because of failure. This trails actual failures of 410 over the same period. Thus, there have been 26 banks that have failed without being under a published enforcement action.

We anticipate for the FDIC to provide an update on its enforcement action activities on the last Friday of the month on the 31st. So next week will likely see few changes to list.

Friday, October 17, 2014

Bank Failure Friday: NBRS Financial, Rising Sun, Maryland,15th Failure of 2014

by Calculated Risk on 10/17/2014 06:12:00 PM

This is the first bank failure since July!

From the FDIC: Howard Bank, Ellicott City, Maryland, Assumes All of the Deposits of NBRS Financial, Rising Sun, Maryland

As of June 30, 2014, NBRS Financial had approximately $188.2 million in total assets and $183.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.3 million. ... NBRS Financial is the 15th FDIC-insured institution to fail in the nation this year, and the second in Maryland. The last FDIC-insured institution closed in the state was Slavie Federal Savings Bank, Bel Air, on May 30, 2014.

WSJ: "Fannie, Freddie Near Deal That Promises to Boost Mortgage Lending"

by Calculated Risk on 10/17/2014 01:01:00 PM

From Joe Light at the WSJ: Fannie, Freddie Near Deal That Promises to Boost Mortgage Lending

Mortgage giants Fannie Mae and Freddie Mac , their regulator and lenders are close to an agreement that could greatly expand mortgage credit while helping lenders protect themselves from charges of making bad loans, according to people familiar with the matter.CR Note: There are two parts: 1) less risk to lenders of being forced to buyback faulty loans, and 2) a lower downpayment in certain circumstances. According to the article the agreement could be announced next week.

...

The new agreement would clarify what mistakes should constitute fraud, giving greater confidence to lenders that they won’t be penalized many years after a loan is made.

...

Separately, Fannie Mae, Freddie Mac and the FHFA are considering new programs that would allow them to guarantee some mortgages with down payments of as little as 3%.

A few comments on September Housing Starts

by Calculated Risk on 10/17/2014 11:45:00 AM

There were 761 thousand total housing starts during the first nine months of 2014 (not seasonally adjusted, NSA), up 9.5% from the 695 thousand during the same period of 2013. Single family starts are up 4%, and multifamily starts up 23%. The key weakness has been in single family starts.

The following table shows the annual housing starts since 2005, and the percent change from the previous year (estimates for 2014). The housing recovery has slowed in 2014, especially for single family starts. I expect to further growth in starts over the next several years.

| Housing Starts (000s) and Annual Change | ||||

|---|---|---|---|---|

| Total | Total % Change | Single | Single % Change | |

| 2005 | 2,068.3 | 5.8% | 1,715.8 | 6.5% |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.3 | 24.3% |

| 2013 | 924.9 | 18.5% | 617.6 | 15.4% |

| 20141 | 990.0 | 7.0% | 630.0 | 2.0% |

| 1Estimate for 2014 | ||||

This graph shows the month to month comparison between 2013 (blue) and 2014 (red). Starts in 2014 have been above the same month in 2013 for six consecutive months.

Click on graph for larger image.

Click on graph for larger image.Starts in Q1 2014 averaged 925 thousand SAAR, and starts in Q2 averaged 985 thousand SAAR, up 7% from Q1.

Starts in Q3 averaged 1.024 million SAAR, up 4% from Q2 (and up 16% from Q3 2013).

This year, I expect starts to mostly increase throughout the year (Q1 will probably be the weakest quarter, and Q2 the second weakest).

However the year-over-year growth will slow in Q4 because the comparisons will be more difficult.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

For the second consecutive month, there were more multifamily completions than multifamily starts.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts had been moving up, but recently starts have only increased slowly on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Preliminary October Consumer Sentiment increases to 86.4

by Calculated Risk on 10/17/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for October was at 86.4, up from 84.6 in September.

This was above the consensus forecast of 84.2. Sentiment has been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Housing Starts increase to 1.017 Million Annual Rate in September

by Calculated Risk on 10/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,017,000. This is 6.3 percent above the revised August estimate of 957,000 and is 17.8 percent above the September 2013 rate of 863,000.

Single-family housing starts in September were at a rate of 646,000; this is 1.1 percent above the revised August figure of 639,000. The September rate for units in buildings with five units or more was 353,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,018,000. This is 1.5 percent above the revised August rate of 1,003,000 and is 2.5 percent above the September 2013 estimate of 993,000.

Single-family authorizations in September were at a rate of 624,000; this is 0.5 percent below the revised August figure of 627,000. Authorizations of units in buildings with five units or more were at a rate of 369,000 in September.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in September (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased slightly in September.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was at expectations of 1.010 million starts in September.

This was an OK report; close to expectations. I'll have more later ...

Thursday, October 16, 2014

Friday: Housing Starts, Yellen

by Calculated Risk on 10/16/2014 07:35:00 PM

From Jann Swanson at Mortgage News Daily: Relaxed QRM Rules Expected Next Week(ht Soylent Green is People)

Federal regulators may finally produce the long anticipated market standards for Qualified Residential Mortgages (QRM), perhaps even as early as next week. The new rules are designed to ensure the quality of mortgages that are pooled and packaged into securities for sale to investors on the secondary market. Insiders expect that the final regulations will be more relaxed than those originally proposed, largely in response to demands by real estate and mortgage industry groups.Friday:

• At 8:30 AM, Housing Starts for September. Total housing starts were at 956 thousand (SAAR) in August. Single family starts were at 643 thousand SAAR in August. The consensus is for total housing starts to increase to 1.010 million (SAAR) in September.

• Also at 8:30 AM, Speech by Fed Chair Janet Yellen, Economic Opportunity, At the Federal Reserve Bank of Boston Economic Conference: Inequality of Economic Opportunity, Boston, Massachusetts

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 84.2, down from 84.6 in September.

CoStar: Commercial Real Estate prices increased in August

by Calculated Risk on 10/16/2014 05:21:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Property Prices Sustain Upward Climb in August

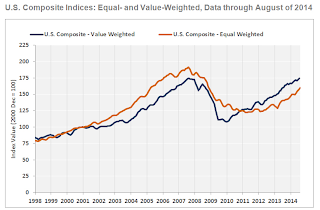

Fueled by better than expected job growth, demand continues to outstrip supply across major property types, resulting in tighter vacancy rates and continued investor interest in commercial real estate. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 1% and 1.5%, respectively, in August 2014.

...

The value-weighted U.S. Composite Index, which is heavily influenced by larger, core transactions, has now reached prerecession peak levels, and price gains have naturally slowed as a result. The Index increased 8.7% for the 12 months ending in August 2014, following 12% growth in the prior 12 months. Meanwhile, price growth in the equal-weighted U.S. Composite Index, which is influenced more by smaller non-core deals, accelerated to an annual rate of 13.6% in August 2014, up from an average of 8.7% in the prior 12 months.

...

Just 10.5% of all repeat sale transactions involved distressed assets in the first eight months of 2014, down from one-third of all repeat sale transactions in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is back to the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Earlier: Philly Fed Manufacturing Survey declines to 20.7 in October

by Calculated Risk on 10/16/2014 12:56:00 PM

Earlier from the Philly Fed: October Manufacturing Survey

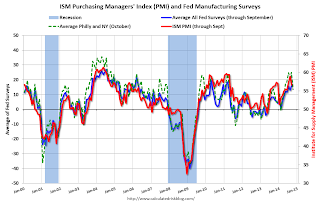

The diffusion index for current activity edged down from a reading of 22.5 to 20.7 this month ... The current shipments and employment indexes also declined but remained positive, while the current new orders index increased 2 points [to 17.3].This at the consensus forecast of a reading of 20.0 for October.

...

Although positive for the 16th consecutive month, the employment index decreased 9 points. [to 12.1] ...

The survey’s indicators for future manufacturing conditions fell from higher readings but continued to reflect general optimism about growth in activity and employment over the next six months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys declined in October, but still suggests another decent ISM report for October.