by Calculated Risk on 10/23/2014 12:13:00 PM

Thursday, October 23, 2014

Philly Fed: State Coincident Indexes increased in 43 states in September

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2014. In the past month, the indexes increased in 43 states, decreased in four, and remained stable in three, for a one-month diffusion index of 78. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In September, 45 states had increasing activity (including minor increases). This measure declined sharply during the winter, but is close to normal for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again.

FHFA: House Prices increased 0.5% in August, Up 4.8% Year-over-year

by Calculated Risk on 10/23/2014 09:10:00 AM

This house price index is only for houses with Fannie or Freddie mortgages.

From the FHFA: FHFA House Price Index Up 0.5 Percent in August

U.S. house prices rose in August, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.1 percent increase in July was revised to reflect a 0.2 percent increase.

The FHFA HPI is calculated using home sales price information from mortgages sold to or guaranteed by Fannie Mae and Freddie Mac. From August 2013 to August 2014, house prices were up 4.8 percent. The U.S. index is 5.8 percent below its April 2007 peak and is roughly the same as the August 2005 index level. This is the ninth consecutive monthly house price increase.

For the nine census divisions, seasonally adjusted monthly price changes from July 2014 to August 2014 ranged from -0.6 percent in the New England and South Atlantic divisions to +1.2 percent in the Mountain division. The 12-month changes were all positive ranging from +1.9 percent in the Middle Atlantic division to +7.8 percent in the Pacific division.

emphasis added

Weekly Initial Unemployment Claims increase to 283,000, 4-Week Average lowest since May 2000

by Calculated Risk on 10/23/2014 08:35:00 AM

The DOL reports:

In the week ending October 18, the advance figure for seasonally adjusted initial claims was 283,000, an increase of 17,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 264,000 to 266,000. The 4-week moving average was 281,000, a decrease of 3,000 from the previous week's revised average. This is the lowest level for this average since May 6, 2000 when it was 279,250. The previous week's average was revised up by 500 from 283,500 to 284,000.The previous week was revised up to 266,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 281,000.

This was slightly below the consensus forecast of 285,000 and suggests few layoffs.

Wednesday, October 22, 2014

Thursday: Unemployment Claims, FHFA House Price Index

by Calculated Risk on 10/22/2014 07:41:00 PM

From Kathleen Madigan at the WSJ: Why Rising Rents Haven’t Pumped Up Inflation

For the 12 months ended in September, [owners’ equivalent rent] OER is up 2.7%, up from 2.2% a year ago. (Actual rent paid by tenants is up a faster 3.3%.)Without OER, inflation would be even lower. If we look at shelter1, All times less Shelter is up just 1.1% year-over-year, and All items less food, shelter, and energy is only up 0.9%.

OER is the big gorilla in the inflation room. It accounts for 24% of the total CPI and 31% of the core. So why isn’t the accelerating OER rate pushing up the core? Because other factors are offsetting the upward push.

The biggest drag is the downward pressure on goods prices coming from overseas. ... On the service side, other major categories have seen a slowdown in markups.

Rents can't keep rising this quickly without rising wages. And without rising rents, inflation would be even lower.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 264 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 9:00 AM, the FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

• At 9:00 AM, the Kansas City Fed manufacturing survey for October.

1 From the BLS: "Rent of primary residence (rent) and Owners' equivalent rent of primary residence (rental equivalence) are the two main shelter components of the Consumer Price Index (CPI)."

QE Timeline Update

by Calculated Risk on 10/22/2014 04:31:00 PM

With QE3 expected to end next week, by request, here is an updated timeline of QE (and Twist operations):

• November 25, 2008: Press Release: $100 Billion GSE direct obligations, $500 billion in MBS

• December 16, 2008 FOMC Statement: Evaluating benefits of purchasing longer-term Treasury Securities

• January 28, 2009: FOMC Statement: FOMC Stands Ready to expand program.

• March 18, 2009: FOMC Statement: Expand MBS program to $1.25 trillion, buy up to $300 billion of longer-term Treasury securities

• March 31, 2010: QE1 purchases were completed at the end of Q1 2010.

• August 27, 2010: Fed Chairman Ben Bernanke hints at QE2: Analysis: Bernanke paves the way for QE2

• November 3, 2010: FOMC Statement: $600 Billion QE2 announced.

• June 30, 2011: QE2 purchases were completed at the end of Q2 2011.

• September 21, 2011: "Operation Twist" announced. "The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less."

• June 20, 2012: "Operation Twist" extended. "The Committee also decided to continue through the end of the year its program to extend the average maturity of its holdings of securities."

• August 31, 2012: Fed Chairman Ben Bernanke hints at QE3: Analysis: Bernanke Clears the way for QE3 in September

• September 13, 2012: FOMC Statement: $40 Billion per month QE3 announced.

• December 12, 2012: FOMC Statement: Announced completion of "Operation Twist", expanded QE3 to $85 Billion per month.

• May 22, 2013: In Testimony to Congress, The Economic Outlook, Fed Chairman Ben Bernanke said “If we see continued improvement and we have confidence that that is going to be sustained, then in the next few meetings, we could take a step down in our pace of purchases.” (aka "Taper Tantrum").

• June 19, 2013: In Chairman Bernanke’s Press Conference, Bernanke said "If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year."

• December 18, 2013: FOMC Statement: Announced "tapering" of QE3. Note: QE3 tapered $10 billion per month at each meeting of 2014.

• October 29, 2013: FOMC expected to complete QE3 (next week).

Key Measures Show Low Inflation in September

by Calculated Risk on 10/22/2014 01:25:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.8% annualized rate) in September. The 16% trimmed-mean Consumer Price Index also rose 0.1% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for September here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.0% annualized rate) in September. The CPI less food and energy also rose 0.1% (1.7% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.7%. Core PCE is for August and increased just 1.5% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.8% annualized, and core CPI increased 1.7% annualized.

On a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

Cost of Living Adjustment: 1.7%, Contribution Base for 2015: $118,500

by Calculated Risk on 10/22/2014 09:55:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2015.

Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (1.7% increase) and a list of previous Cost-of-Living Adjustments. Note: this is not the headline CPI-U.

The contribution and benefit base will be $118,500 in 2015.

The National Average Wage Index increased to $44,888.16 in 2013, up 1.28% from $44,321.67 in 2012 (used to calculated contribution base). A very small increase ...

SPECIAL NOTE on CPI-chained: There has been some discussion of switching from CPI-W to CPI-chained for COLA. This will not happen this year, but could happen in the future, and the switch would impact future Cost-of-living adjustments, see: Cost of Living and CPI-Chained.

If CPI-chained was used instead of CPI-W, the COLA increase would be 1.6% instead of 1.7%. CPI-chained would have minimal impact on any one year, but would reduce benefits over time.

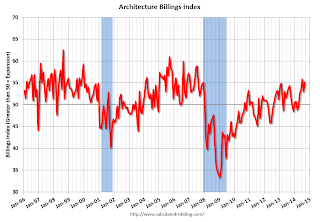

AIA: Architecture Billings Index increases in September, "Robust Construction Conditions Ahead"

by Calculated Risk on 10/22/2014 09:01:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Shows Robust Conditions Ahead for Construction Industry

With all geographic regions and building project sectors showing positive conditions, there continues to be a heightened level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 55.2, up from a mark of 53.0 in August. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 64.8, following a mark of 62.6 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in August was 56.8.

“Strong demand for apartment buildings and condominiums has been one of the main drivers in helping to keep the design and construction market afloat in recent years,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “There continues to be a healthy market for those types of design projects, but the recently resurgent Institutional sector is leading to broader growth for the entire construction industry.”

• Regional averages: South (55.3) , Midwest (55.1), West (54.2), Northeast (51.0) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.2 in September, up from 53.0 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest an increase in CRE investment this year and in 2015.

BLS: CPI increases 0.1% in September, Core CPI 0.1%, Cost-Of-Living Adjustment 1.7%

by Calculated Risk on 10/22/2014 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.7 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was close to the consensus forecast of no change for CPI, and a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in September. ... The 12-month change in the index for all items less food and energy also remained at 1.7 percent.

Cost-Of-Living Adjustment (COLA): The BLS reported CPI-W increased to 234.170 in September, for a Q3 average of 234.242. In Q3 2013, CPI-W average 230.33. The annual Social Security Cost-Of-Living Adjustment will be 1.7%.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 10/22/2014 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 17, 2014. This week’s results did not include an adjustment for the Columbus Day holiday. ...

The Refinance Index increased 23 percent from the previous week to the highest level since November 2013. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier....

...

“Continuing concerns about weak economic growth in Europe and a few US economic indicators that came in below expectations caused a flight to quality into US Treasuries last week, leading to sharp drops in interest rates,” said Mike Fratantoni, MBA’s Chief Economist. “Mortgage rates have fallen close to 30 basis points over the last four weeks. Refinance application volume reached the highest level since November 2013 as a result, and the average loan balance for refinance applications increased to $306,400, the highest level in the survey’s history.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.10 percent, the lowest level since May 2013, from 4.20 percent, with points increasing to 0.21 from 0.17 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 66% from the levels in May 2013.

Even with the recent increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 9% from a year ago.