by Calculated Risk on 10/29/2014 11:35:00 AM

Wednesday, October 29, 2014

Freddie Mac: Mortgage Serious Delinquency rate declined in September, Lowest since 2008

Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 1.96% from 1.98% in August. Freddie's rate is down from 2.58% in September 2013, and this is the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae is expected to report their Single-Family Serious Delinquency rate for September on Friday.

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.62 percentage points over the last year - and the rate of improvement has slowed recently. However, at that rate of improvement, the serious delinquency rate will not be below 1% until some time in 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in September

by Calculated Risk on 10/29/2014 09:25:00 AM

The Case-Shiller house price indexes for August were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Hopefully Zillow will start estimating the National Index.

From Zillow: Find Out Next Month’s Case-Shiller Numbers Today

The August S&P/Case-Shiller (SPCS) data out [yesterday] showed more slowing in the housing market with the annual change in the 20-city index falling 1.1 percentage points to 5.6 percent. The national index was up 5.1 percent on an annual basis in August. Our current forecast for SPCS next month indicates further slowing with the annual increase in the 20-City Composite Home Price Index falling to 4.7 percent in September. The last time the SPCS 20-City index grew less than 5 percent annually was in October 2012, when the index grew 4.3 percent year-over-year.So the Case-Shiller index will probably show a lower year-over-year gain in September than in August (5.6% year-over-year for the Composite 20 in August, 5.1% year-over-year for the National Index).

The non-seasonally adjusted (NSA) monthly increase in August for the 20-City index was 0.2 percent, and we expect it to fall 0.2 percent in September. We expect a monthly decline for the 10-City Composite Index, which is projected to drop 0.3 percent from August to September.

All forecasts are shown in the table below. These forecasts are based on the August SPCS data release this morning and the September 2014 Zillow Home Value Index (ZHVI), released October 22. Officially, the SPCS Composite Home Price Indices for August will not be released until Tuesday, November 25.

| Zillow September 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | September 2013 | 179.97 | 176.28 | 165.60 | 162.23 |

| Case-Shiller (last month) | August 2014 | 188.58 | 184.12 | 173.66 | 169.43 |

| Zillow Forecast | YoY | 4.5% | 4.5% | 4.7% | 47% |

| MoM | -0.3% | 0.0% | -0.2% | 0.1% | |

| Zillow Forecasts1 | 188.0 | 184.2 | 173.3 | 169.7 | |

| Current Post Bubble Low | 146.45 | 149.88 | 134.07 | 137.06 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.4% | 22.9% | 29.3% | 23.8% | |

| Bubble Peak | 226.29 | 226.87 | 206.52 | 206.61 | |

| Date of Bubble Peak | Jun-06 | Apr-06 | Jul-06 | Apr-06 | |

| Below Bubble Peak | 16.9% | 18.8% | 16.1% | 17.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/29/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 24, 2014. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. ... The seasonally adjusted purchase index and conventional purchase index were the lowest since February 2014, while the government purchase index was the lowest since August 2007.

...

“Borrowers with jumbo loans tend to be most sensitive to changes in rates, and that sensitivity has been clearly apparent in the past few weeks with double and even triple digit percentage changes in refinance application volume for jumbo loans,” said Mike Fratantoni, MBA’s Chief Economist. “The average loan size for refinance applications decreased to $263,600 in the most recent week from a survey high of $306,400 the previous week. The decrease was driven by a 41 percent drop in refinance applications for loans greater than $729,000, which had surged almost 130 percent the week before.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.13 percent from 4.10 percent, with points remaining unchanged at 0.21 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 68% from the levels in May 2013.

Even with the recent increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 15% from a year ago.

Tuesday, October 28, 2014

Wednesday: FOMC Statement

by Calculated Risk on 10/28/2014 07:15:00 PM

From Tim Duy: FOMC Meeting

Regarding the statement, here is what I anticipate:Wednesday:

1. The general description of the economy will remain essentially unchanged, expanding at a "moderate pace." ...

2. That said, they will mention they remain watchful of foreign growth.

3. They will acknowledge the further decline in unemployment rates yet retain the view that labor market indicators still suggest underutilization of resources. I would not be surprised by specific mention of low wage growth as evidence of underutilization.

4. I expect the Fed will acknowledge the decline in market-based measures of inflation expectations, but ultimately dismiss those measures for now in favor of stable of survey based measures. ...

5. I expect the risks to growth and employment will remain balanced, and the risk of persistently low inflation will continue to be "somewhat diminished."

6. They will announce the end of the asset purchase program, but emphasize continued reinvestment of principle and that the sizable asset holdings will continue to provide support for the recovery.

7. They will note that despite the end of asset purchases, such purchases remain in the monetary toolbox and could be revived if conditions warranted.

8. The "considerable time" language will remain. ...

9. I expect at least one dissent.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the FOMC Meeting Statement. The FOMC is expected to announce the end of QE3 asset purchases at this meeting.

NMHC Survey: Apartment Market Conditions Slightly Tighter in Q3 2014

by Calculated Risk on 10/28/2014 02:16:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Expand Further in October NMHC Quarterly Survey

For the third quarter in a row, apartment markets expanded across all four areas of the National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. Market tightness (52), sales volume (58), equity financing (54) and debt financing (71) indexes all remained above 50 – indicating growth from the previous quarter.

“The apartment markets are still firing on all cylinders,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Demand for apartment residences is still strong enough to offset the gradually rising level of new apartment deliveries. Even with occupancy rates at high levels, markets got just a bit tighter in the last three months."

The survey also asked about apartment demand from demographics beyond the core mid-to-late twenties set. One in five (22 percent) reported a significant increase in the number of Baby Boomers among their residents. A similar share (21 percent) indicated a significant increase in “forty-somethings” in their properties. A smaller share of respondents reported increases among single parents (13 percent) and married couples with children (4 percent).

“Young people still make up a disproportionate share of apartment renters. But now we’re starting to see growing segment of baby boomers attracted to apartment living,” said Obrinsky.

...

The Market Tightness Index fell from 68 to 52. Slightly more than half (52 percent) of respondents reported unchanged conditions. Approximately one-quarter (26 percent) saw conditions as tighter than three months ago, a decrease from July’s survey, where half saw conditions as tighter than three months ago. Looser conditions were reported by 22 percent of respondents, a slight uptick from July’s 15 percent.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates slightly tighter market conditions in Q3.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. The apartment market is still solid.

House Prices: Real Prices and Price-to-Rent Ratio in August

by Calculated Risk on 10/28/2014 11:59:00 AM

I started 2014 expecting a slowdown in year-over-year (YoY) house prices as "For Sale" inventory increases - and the price slowdown is very clear. The Case-Shiller Composite 20 index was up 5.6% YoY in August; the smallest YoY increase since October 2012 (the National index was up 5.1%, also the slowest YoY increase since October 2012.

This slowdown was expected by several key analysts, and I think it is good news. As Zillow chief economist Stan Humphries said today:

“After several months in a row of slowing home value growth, it’s fair to say now the market has officially turned a corner and entered a new phase of the recovery. We’re transitioning away from a period of hot and bothered market activity, characterized by low inventory and rapid price growth, onto a more slow and steady trajectory, which is great news. In housing, boring is better."Boring - in the housing market - would be good!

emphasis added

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

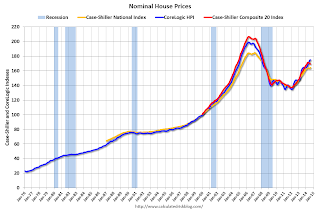

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to February 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to September 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to September 2002 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2003 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels - and maybe moving a little sideways now.

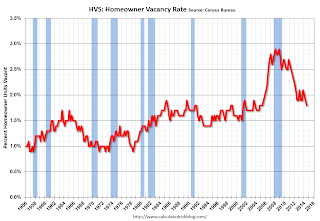

HVS: Q3 2014 Homeownership and Vacancy Rates

by Calculated Risk on 10/28/2014 10:00:00 AM

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2014.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.4% in Q3, from 64.7% in Q2.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

It isn't really clear what this means. Are these homes becoming rentals?

Once again - this probably shows that the general trend is down, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate increased slightly in Q3 - and might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply.

Case-Shiller: National House Price Index increased 5.1% year-over-year in August

by Calculated Risk on 10/28/2014 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the new monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Fade Further According to the S&P/Case-Shiller Home Price Indices

Data through August 2014, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... continue to show a deceleration in home price gains. The 10-City Composite gained 5.5% year-over-year and the 20-City 5.6%, both down from the 6.7% reported for July. The National Index gained 5.1% annually in August compared to 5.6% in July.

On a monthly basis, the National Index and Composite Indices showed a slight increase of 0.2% for the month of August. Detroit led the cities with the gain of 0.8%, followed by Dallas, Denver and Las Vegas at 0.5%. Gains in those cities were offset by a decline of 0.4% in San Francisco followed by declines of 0.1% in Charlotte and San Diego. ...

“The deceleration in home prices continues,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The Sun Belt region reported its worst annual returns since 2012, led by weakness in all three California cities -- Los Angeles, San Francisco and San Diego. Despite the weaker year-over-year numbers, home prices are still showing an overall increase, as the National Index increased for its eighth consecutive month."

Click on graph for larger image.

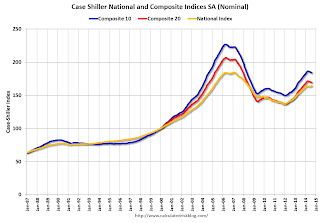

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.8% from the peak, and down 0.2% in August (SA). The Composite 10 is up 22.8% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.9% from the peak, and down 0.2% (SA) in August. The Composite 20 is up 23.8% from the post-bubble low set in Jan 2012 (SA).

The National index is off 11.3% from the peak, and up 0.4% (SA) in August. The National index is up 19.7% from the post-bubble low set in Dec 2012 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.5% compared to August 2013.

The Composite 20 SA is up 5.6% compared to August 2013.

The National index SA is up 5.1% compared to August 2013.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in August seasonally adjusted. (Prices increased in 14 of the 20 cities NSA) Prices in Las Vegas are off 42.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was slightly above than the consensus forecast for a 4.9% YoY increase for the National index, and suggests a further slowdown in price increases. I'll have more on house prices later.

Monday, October 27, 2014

Tuesday: Case-Shiller House Prices, Durable Goods, and much more

by Calculated Risk on 10/27/2014 07:46:00 PM

From Nick Timiraos at the WSJ: Gas at $3 Carries Rewards—and Risks

Gasoline prices have dropped below $3 a gallon at most U.S. gas stations, delivering a welcome lift to American consumers and retailers heading into the holidays. But the related oil-price drop has a thorny underside: It is threatening to slow the nation’s energy boom and hit the broader economy.I'll take the rewards! Besides $80 per barrel isn't cheap. In January 2001, oil was under $30 per barrel (about $40 adjusted for inflation), and then increased more than four-fold to $134 per barrel in 2008 - before crashing during the financial crisis.

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for September from the Census Bureau. The consensus is for a 0.9% increase in durable goods orders.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices. The consensus is for a 4.9% year-over-year increase in the National Index for August , down from 5.7% in July (consensus 5.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 5.7% year-over-year in August, and for prices to increase 0.1% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for October.

• Also at 10:00 AM, the Conference Board's consumer confidence index for October. The consensus is for the index to increase to 87.2 from 86.0.

• Also at 10:00 AM, the Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

• During the day, the Q3 NMHC Apartment Tightness Index.

Vehicle Sales Forecasts: Over 16 Million SAAR again in October

by Calculated Risk on 10/27/2014 03:35:00 PM

The automakers will report October vehicle sales on Monday, Nov 3rd. Sales in September were at 16.34 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in October will be solidly above 16 million SAAR again.

Note: There were the 27 selling days in October this year compared to 27 (same) last year.

Here are a few forecasts:

From WardsAuto: Forecast: October Sales Steady Before End-of-Year Spike

A WardsAuto forecast calls for U.S. automakers to maintain solid year-over year gains in October, delivering 1.28 million light vehicles over 27 selling days. The resulting daily sales rate of 47,356 units represents a 6.5% improvement over same-month year-ago (also 27 days) and an 8.2% month-to-month drop from September (24 days), in line with seasonal expectations. The forecast equates to a 16.4 million-unit SAAR, a tick above the 16.3 million year-to-date SAAR through September.From J.D. Power: New-Vehicle Retail Sales On Pace for 1.1 Million, the Strongest October since 2004; Record-Breaking Consumer Spending for the Month

New-vehicle retail sales in October 2014 are projected to come in at 1.1 million units, a 6 percent increase, compared with October 2013. The retail seasonally adjusted annualized rate (SAAR) in October is expected to be 13.6 million units, 0.7 million units stronger than October 2013.From Kelley Blue Book: New-Vehicle Sales To Jump 5.4 Percent In October, According To Kelley Blue Book

...

“The industry continues to demonstrate strong sales growth and robust transaction prices, resulting in another record-breaking month for industry consumer spending,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. [Total forecast 16.3 million SAAR]

New-vehicle sales are expected to increase 5.4 percent year-over-year to a total of 1.27 million units ... The seasonally adjusted annual rate (SAAR) for October 2014 is estimated to be 16.3 million, up from 15.3 million in October 2013 and even with 16.3 million in September 2014.From TrueCar: TrueCar Forecasts Strong Sales in October; Up 5.9% Compared to Last Year

Seasonally Adjusted Annualized Rate ("SAAR") for October of 16.3 million new vehicle sales.Another solid month for auto sales, and this should be the best year since 2006.

"Industry-wide, we're looking at the strongest October since 2004, with incentive spending at healthy levels, and on-track to finish the year at 16.4 million units." [said John Krafcik, president of TrueCar].