by Calculated Risk on 10/31/2014 09:03:00 AM

Friday, October 31, 2014

Final October Consumer Sentiment at 86.9, Chicago PMI increases to 66.2

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October was at 86.9, up from the preliminary reading of 86.4, and up from 84.6 in September.

This was slightly above the consensus forecast of 86.4. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

This was the highest level since 2007.

Chicago PMI October 2014: Chicago Business Barometer Up 5.7 Points to 66.2 in October, New Orders Rise Sharply to the Highest Since October 2013

The Chicago Business Barometer rose 5.7 points to a one year high of 66.2 in October, fuelled by a double digit gain in New Orders. ...This was well above the consensus forecast of 60.0.

New Orders was the strongest component of the Barometer and increased sharply to 73.6, the highest level since October 2013. ... Employment increased to the highest level since November 2013, a potential sign that the recovery is becoming more entrenched.

emphasis added

BEA: Personal Income increased 0.2% in September, Core PCE prices up 1.5% year-over-year

by Calculated Risk on 10/31/2014 08:36:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $22.7 billion, or 0.2 percent ... in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $19.0 billion, or 0.2 percent.A key point is that the PCE price index was only up 1.4% year-over-year (1.5% for core PCE). This is still below the Fed's target.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.2 percent in September, in contrast to an increase of 0.5 percent in August. ... The price index for PCE increased 0.1 percent in September, in contrast to a decrease of 0.1 percent in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

...

Personal saving -- DPI less personal outlays -- was $732.2 billion in September, compared with $702.0 billion in August. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 5.6 percent in September, compared with 5.4 percent in August.

Thursday, October 30, 2014

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 10/30/2014 06:52:00 PM

From Freddie Mac: Mortgage Rates Rebound, Remain Below Four Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher across the board this week and rebounding from the lowest rates of the year.Mortgage News Daily shows rates today were at 4.01%.

30-year fixed-rate mortgage (FRM) averaged 3.98 percent with an average 0.5 point for the week ending October 30, 2014, up from last week when it averaged 3.92 percent. A year ago at this time, the 30-year FRM averaged 4.10 percent.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, the Chicago Purchasing Managers Index for October. The consensus is for a reading of 60.0, down from 60.5 in September.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 86.4, unchanged from the preliminary reading of 86.4, and up from the September reading of 84.6.

Hotels: Occupancy up 5.4%, RevPAR up 10.8% Year-over-Year

by Calculated Risk on 10/30/2014 02:54:00 PM

From HotelNewsNow.com: STR: US results for week ending 25 October

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 19-25 October 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 5.4 percent to 69.4 percent. Average daily rate increased 5.1 percent to finish the week at US$119.52. Revenue per available room for the week was up 10.8 percent to finish at US$82.89

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Business travel has probably peaked for the Fall season, and now hotels are heading into the slow period.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is a little above the level for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels.

And since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Lawler: MDC Results and Homebuilder Summary Table

by Calculated Risk on 10/30/2014 11:36:00 AM

From housing economist Tom Lawler: M.D.C. Holdings: Net Orders Up, Orders per Community Down; Margins Fall on Higher Incentives

M.D.C. Holdings reported that net home orders in the quarter ended September 30, 2014 totaled 1,081, up 17.0% from the comparable quarter of 2013. Net orders per active community were down 2.3% from a year ago. Home deliveries totaled 1,093 last quarter, down 13.0% from the comparable quarter of 2013, at an average sales price of $370,600, up 7.4% from a year ago. The company’s order backlog at the end of September was 1,874, up 6.4% from last September, at an average order price of $422,700, up 10.0% from a year ago.

Here are some excerpts from the company’s press release.

‘Larry A. Mizel, MDC's Chairman and Chief Executive Officer, stated, "Against the backdrop of an uneven recovery for housing and overall economic conditions, we are pleased that we have consistently produced profitable results since the beginning of 2012. However, the volatility of the housing market recovery was evident in our third quarter results, as elevated land and construction costs, combined with our use of additional incentives to stimulate demand for new homes, have pressured our homebuilding gross margins."M.D.C.’s results were below “consensus.”

‘Mr. Mizel continued, "While we believe that the housing recovery remains on solid footing, it is evident that certain obstacles, such as Qualified Mortgage Standards and reduced Federal Housing Authority loan limits, have taken their toll on housing demand, especially for the first time buyer segment. Additionally, on the production side of our business, we have seen a negative impact from tighter subcontractor availability and adverse weather conditions in certain markets, as well as an elongated mortgage approval process. We believe the impact of many of these factors will diminish over time, allowing us to return to more robust levels of demand as overall economic conditions continue to improve."’

Here are some summary results for large publicly-traded builders who have reported results for last quarter. For these six builders combined, net orders per active community last quarter were up 1.8% YOY. Excluding the impact of acquisitions of other builders, net orders last quarter were up about 8.3% YOY.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/14 | 9/30/13 | % Chg | 9/30/14 | 9/30/13 | % Chg | 9/30/14 | 9/30/13 | % Chg |

| Pulte Group | 3,779 | 3,781 | -0.1% | 4,646 | 4,817 | -3.5% | $334,000 | 310,000 | 7.7% |

| NVR | 2,936 | 2,381 | 23.3% | 3,236 | 3,342 | -3.2% | $366,200 | 349,200 | 4.9% |

| The Ryland Group | 1,707 | 1,592 | 7.2% | 2,018 | 1,883 | 7.2% | $331,000 | 298,000 | 11.1% |

| Meritage Homes | 1,500 | 1,300 | 15.4% | 1,522 | 1,418 | 7.3% | $358,000 | 341,000 | 5.0% |

| MDC Holdings | 1,081 | 924 | 17.0% | 1,093 | 1,257 | -13.0% | $370,600 | 345,000 | 7.4% |

| M/I Homes | 892 | 869 | 2.6% | 985 | 937 | 5.1% | $320,000 | 284,000 | 12.7% |

| Total | 11,895 | 10,847 | 9.7% | 13,500 | 13,654 | -1.1% | $345,918 | $322,597 | 7.2% |

Weekly Initial Unemployment Claims increased to 287,000, 4-Week Average lowest since May 2000

by Calculated Risk on 10/30/2014 10:30:00 AM

Earlier the DOL reported:

In the week ending October 25, the advance figure for seasonally adjusted initial claims was 287,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 283,000 to 284,000. The 4-week moving average was 281,000, a decrease of 250 from the previous week's revised average.The previous week was revised up to 284,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 281,000.

This was close to the consensus forecast and suggests few layoffs.

BEA: Real GDP increased at 3.5% Annualized Rate in Q3

by Calculated Risk on 10/30/2014 08:44:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2014 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 3.5 percent in the third quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.The advance Q3 GDP report, with 3.5% annualized growth, was above expectations of a 2.8% increase.

...

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Personal consumption expenditures (PCE) increased at a 1.8% annualized rate - a slow pace.

The first graph shows the contribution to percent change in GDP for residential investment (RI) and state and local governments since 2005.

This shows the huge slump in RI during the housing bust (blue), followed by the unprecedented period of state and local austerity (red) not seen since the Depression.

Click on graph for larger image.

Click on graph for larger image.State and local government spending was positive in Q3, and I expect state and local governments to continue to make a positive contribution to GDP in Q4 and in 2015.

RI (blue) added to GDP growth for a few years, before subtracting in Q4 2013 and Q1 2014. RI bounced back in Q2 and Q3.

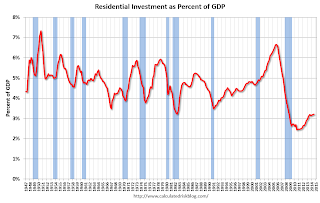

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..

The third graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..I'll add details for investment in offices, malls and hotels next week.

Overall this was an OK report, however PCE was weak (I expect stronger PCE going forward).

Wednesday, October 29, 2014

Thursday: Q3 GDP, Unemployment Claims

by Calculated Risk on 10/29/2014 08:34:00 PM

From the Atlanta Fed GDPNow:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2014 was 2.7 percent on October 28From Chico Harlan at the WaPo: Tomorrow’s GDP numbers will give a better read on the U.S. economy

Many economists now say that the first quarter slide stemmed from a horrid East Coast winter that kept consumers indoors. They say that the second quarter was buoyed by a bounce-back effect, a release of all that pent-up demand for cars and homes. But this quarter? We’ll probably get something in between, confirmation of a recovery that’s yielding more jobs but little wage growth.And from Nick Timiraos at the WSJ: 5 Things To Watch in Thursday’s U.S. GDP Report

According to economists surveyed by Bloomberg, the GDP probably rose around 3 percent in the latest quarter. ... Three percent growth is hardly dazzling, but the number shines relative to other advanced economies.

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2014 (advance estimate). The consensus is that real GDP increased 2.8% annualized in Q3.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 280 thousand from 283 thousand.

Lawler on Housing Vacancy Survey for Q3: Reported Household Growth Remained Muted; “True” Homeownership Rate Probably Lowest Since the 1960’s

by Calculated Risk on 10/29/2014 05:28:00 PM

From housing economist Tom Lawler:

Yesterday the Census Bureau released the “Residential Vacancies and Homeownership” Report (commonly referred to as the Housing Vacancy Survey, or HVS) for the third quarter of 2014. The HVS is based on a relatively small sample of housing units, still uses an outdated “sampling frame,” and does not perform adequate follow-ups to surveyed units, and for well over a decade the HVS has overstated the housing vacancy rate and overstated the US homeownership rates. The HVS is a supplement to the monthly Current Population Survey, which also suffers from sampling “issues.”

Here are a few summary statistics from yesterday’s report.

| Housing Vacancy Survey "Results" | |||

|---|---|---|---|

| Q3/14 | Q2/14 | Q3/13 | |

| Gross Vacancy Rate | 13.5% | 13.6% | 13.6% |

| Rental Vacancy Rate | 7.4% | 7.5% | 8.3% |

| Homeowner Vacancy Rate | 1.8% | 1.9% | 1.9% |

| Homeownership Rate NSA | 64.4% | 64.7% | 65.3% |

| Homeownership Rate SA | 64.3% | 64.7% | 65.2% |

The report also shows “estimates” of the US housing inventory, which are “controlled” to independent estimates of the housing stock by the Population Division using a questionable methodology. Here are some summary stats on the housing stock from the report.

| HVS "Estimates" of US Housing Inventory (000's) | |||

|---|---|---|---|

| Q3/14 | Q3/13 | Change | |

| All Housing Units | 133,331 | 132,843 | 488 |

| Vacant | 18,021 | 18,075 | -54 |

| Year-Round | 13,447 | 13,603 | -156 |

| Seasonal | 4,575 | 4,475 | 100 |

| Occupied | 115,310 | 114,769 | 541 |

| Owner | 74,240 | 74,897 | -657 |

| Renter | 41,070 | 39,872 | 1,198 |

If one were to believe these estimates, US households grew by just 541,000 over the last year, and just 1.012 million over the last two years. Given Census’ estimate of housing completions and manufactured housing placements (which strangely are not used by the Population Division in estimating the housing stock), the change in the housing stock shown in the HVS over the last year looks too low, possibly by around 160,000 or so. Even if one assumed the housing stock grew by 160,000 more, however, the HVS-based household estimate would have increased by only 679,000.

With respect to the homeownership rate, below is a table comparing homeownership rates from the Decennial Census for April 1 to the homeownership rates from the HVS for the first-half of the year for 1990, 2000, and 2010.

| Different Homeownership Rate Estimates | |||

|---|---|---|---|

| 1990 | 2000 | 2010 | |

| Decennial Census (April 1) | 64.2% | 66.2% | 65.1% |

| HVS (first half average) | 63.9% | 67.2% | 67.0% |

The HVS homeownership rate for the third quarter of 2014 was 2.6 percentage points lower than the HVS homeownership rate in the first half of 2010. If the “true” homeownership rate in the US fell by a similar amount over this period, then the “true” homeownership rate would have been about 62.5% last quarter, the lowest homeownership rates since the 1960’s.

FOMC Statement: QE3 Ends, "Considerable Time" before rate increase

by Calculated Risk on 10/29/2014 02:00:00 PM

QE3 ends. Considerable time until first rate hike. Labor market upgraded from "significant underutilization" to "underutilization".

FOMC Statement:

Information received since the Federal Open Market Committee met in September suggests that economic activity is expanding at a moderate pace. Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources is gradually diminishing. Household spending is rising moderately and business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has continued to run below the Committee's longer-run objective. Market-based measures of inflation compensation have declined somewhat; survey-based measures of longer-term inflation expectations have remained stable.Word count declined from 895 in September to 707 in October.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators and inflation moving toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for economic activity and the labor market as nearly balanced. Although inflation in the near term will likely be held down by lower energy prices and other factors, the Committee judges that the likelihood of inflation running persistently below 2 percent has diminished somewhat since early this year.

The Committee judges that there has been a substantial improvement in the outlook for the labor market since the inception of its current asset purchase program. Moreover, the Committee continues to see sufficient underlying strength in the broader economy to support ongoing progress toward maximum employment in a context of price stability. Accordingly, the Committee decided to conclude its asset purchase program this month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee anticipates, based on its current assessment, that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program this month, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored. However, if incoming information indicates faster progress toward the Committee's employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Stanley Fischer; Richard W. Fisher; Loretta J. Mester; Charles I. Plosser; Jerome H. Powell; and Daniel K. Tarullo. Voting against the action was Narayana Kocherlakota, who believed that, in light of continued sluggishness in the inflation outlook and the recent slide in market-based measures of longer-term inflation expectations, the Committee should commit to keeping the current target range for the federal funds rate at least until the one-to-two-year ahead inflation outlook has returned to 2 percent and should continue the asset purchase program at its current level.

emphasis added