by Calculated Risk on 10/31/2014 05:31:00 PM

Friday, October 31, 2014

Q3 GDP: Investment Contributions

This is one of my favorite GDP graphs. The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline earlier this year was not a concern.

Residential investment (RI) increased at a 1.8% annual rate in Q3 - and RI only contributed 0.06 percentage points to GDP growth. For the rate of economic growth to increase, RI will probably have to make larger positive contributions to economic growth.

Equipment investment increased at a 7.2% annual rate, and investment in non-residential structures increased at a 3.9% annual rate. Equipment and software added 0.41 percentage points to growth in Q3 and the three quarter average moved down slightly (green).

The contribution from nonresidential investment in structures was also positive in Q3. Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery.

I expect to see all areas of private investment increase over the next few quarters - and that is key for stronger GDP growth.

Q3 2014 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/31/2014 02:30:00 PM

The BEA has released the underlying details for the Q3 advance GDP report today.

Investment in single family structures is now back to being the top category for residential investment (see first graph). Home improvement was the top category for twenty one consecutive quarters following the housing bust ... but now investment in single family structures is the top category once again.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions. I expect further increases over the next few years.

The first graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Investment in single family structures was $190 billion (SAAR) (almost 1.1% of GDP).

Investment in home improvement was at a $180 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (just over 1.0% of GDP).

Investment in offices is down about 47% from the recent peak (as a percent of GDP) and increasing slowly.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 59% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 66%. With the hotel occupancy rate at the highest level since 2000, it is likely that hotel investment will probably continue to increase.

These graphs show investment is generally increasing, but from a very low level.

Preliminary: 2015 Housing Forecasts

by Calculated Risk on 10/31/2014 11:32:00 AM

The NAHB released their 2015 housing forecast today. Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows a few forecasts for 2015 (I'll update these in December).

From Fannie Mae: Housing Forecast: October 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| NAHB | 802 | 1,158 | ||

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Merrill Lynch | 557 | 1,200 | 3.6% | |

| Wells Fargo | 535 | 760 | 1,110 | 3.2% |

| Zillow | 3.0%3 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3Zillow Home Value Index, Sept 2014 to Sept 2015 | ||||

Final October Consumer Sentiment at 86.9, Chicago PMI increases to 66.2

by Calculated Risk on 10/31/2014 09:03:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October was at 86.9, up from the preliminary reading of 86.4, and up from 84.6 in September.

This was slightly above the consensus forecast of 86.4. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

This was the highest level since 2007.

Chicago PMI October 2014: Chicago Business Barometer Up 5.7 Points to 66.2 in October, New Orders Rise Sharply to the Highest Since October 2013

The Chicago Business Barometer rose 5.7 points to a one year high of 66.2 in October, fuelled by a double digit gain in New Orders. ...This was well above the consensus forecast of 60.0.

New Orders was the strongest component of the Barometer and increased sharply to 73.6, the highest level since October 2013. ... Employment increased to the highest level since November 2013, a potential sign that the recovery is becoming more entrenched.

emphasis added

BEA: Personal Income increased 0.2% in September, Core PCE prices up 1.5% year-over-year

by Calculated Risk on 10/31/2014 08:36:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $22.7 billion, or 0.2 percent ... in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $19.0 billion, or 0.2 percent.A key point is that the PCE price index was only up 1.4% year-over-year (1.5% for core PCE). This is still below the Fed's target.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.2 percent in September, in contrast to an increase of 0.5 percent in August. ... The price index for PCE increased 0.1 percent in September, in contrast to a decrease of 0.1 percent in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

...

Personal saving -- DPI less personal outlays -- was $732.2 billion in September, compared with $702.0 billion in August. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 5.6 percent in September, compared with 5.4 percent in August.

Thursday, October 30, 2014

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 10/30/2014 06:52:00 PM

From Freddie Mac: Mortgage Rates Rebound, Remain Below Four Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher across the board this week and rebounding from the lowest rates of the year.Mortgage News Daily shows rates today were at 4.01%.

30-year fixed-rate mortgage (FRM) averaged 3.98 percent with an average 0.5 point for the week ending October 30, 2014, up from last week when it averaged 3.92 percent. A year ago at this time, the 30-year FRM averaged 4.10 percent.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, the Chicago Purchasing Managers Index for October. The consensus is for a reading of 60.0, down from 60.5 in September.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 86.4, unchanged from the preliminary reading of 86.4, and up from the September reading of 84.6.

Hotels: Occupancy up 5.4%, RevPAR up 10.8% Year-over-Year

by Calculated Risk on 10/30/2014 02:54:00 PM

From HotelNewsNow.com: STR: US results for week ending 25 October

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 19-25 October 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 5.4 percent to 69.4 percent. Average daily rate increased 5.1 percent to finish the week at US$119.52. Revenue per available room for the week was up 10.8 percent to finish at US$82.89

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Business travel has probably peaked for the Fall season, and now hotels are heading into the slow period.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is a little above the level for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels.

And since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Lawler: MDC Results and Homebuilder Summary Table

by Calculated Risk on 10/30/2014 11:36:00 AM

From housing economist Tom Lawler: M.D.C. Holdings: Net Orders Up, Orders per Community Down; Margins Fall on Higher Incentives

M.D.C. Holdings reported that net home orders in the quarter ended September 30, 2014 totaled 1,081, up 17.0% from the comparable quarter of 2013. Net orders per active community were down 2.3% from a year ago. Home deliveries totaled 1,093 last quarter, down 13.0% from the comparable quarter of 2013, at an average sales price of $370,600, up 7.4% from a year ago. The company’s order backlog at the end of September was 1,874, up 6.4% from last September, at an average order price of $422,700, up 10.0% from a year ago.

Here are some excerpts from the company’s press release.

‘Larry A. Mizel, MDC's Chairman and Chief Executive Officer, stated, "Against the backdrop of an uneven recovery for housing and overall economic conditions, we are pleased that we have consistently produced profitable results since the beginning of 2012. However, the volatility of the housing market recovery was evident in our third quarter results, as elevated land and construction costs, combined with our use of additional incentives to stimulate demand for new homes, have pressured our homebuilding gross margins."M.D.C.’s results were below “consensus.”

‘Mr. Mizel continued, "While we believe that the housing recovery remains on solid footing, it is evident that certain obstacles, such as Qualified Mortgage Standards and reduced Federal Housing Authority loan limits, have taken their toll on housing demand, especially for the first time buyer segment. Additionally, on the production side of our business, we have seen a negative impact from tighter subcontractor availability and adverse weather conditions in certain markets, as well as an elongated mortgage approval process. We believe the impact of many of these factors will diminish over time, allowing us to return to more robust levels of demand as overall economic conditions continue to improve."’

Here are some summary results for large publicly-traded builders who have reported results for last quarter. For these six builders combined, net orders per active community last quarter were up 1.8% YOY. Excluding the impact of acquisitions of other builders, net orders last quarter were up about 8.3% YOY.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/14 | 9/30/13 | % Chg | 9/30/14 | 9/30/13 | % Chg | 9/30/14 | 9/30/13 | % Chg |

| Pulte Group | 3,779 | 3,781 | -0.1% | 4,646 | 4,817 | -3.5% | $334,000 | 310,000 | 7.7% |

| NVR | 2,936 | 2,381 | 23.3% | 3,236 | 3,342 | -3.2% | $366,200 | 349,200 | 4.9% |

| The Ryland Group | 1,707 | 1,592 | 7.2% | 2,018 | 1,883 | 7.2% | $331,000 | 298,000 | 11.1% |

| Meritage Homes | 1,500 | 1,300 | 15.4% | 1,522 | 1,418 | 7.3% | $358,000 | 341,000 | 5.0% |

| MDC Holdings | 1,081 | 924 | 17.0% | 1,093 | 1,257 | -13.0% | $370,600 | 345,000 | 7.4% |

| M/I Homes | 892 | 869 | 2.6% | 985 | 937 | 5.1% | $320,000 | 284,000 | 12.7% |

| Total | 11,895 | 10,847 | 9.7% | 13,500 | 13,654 | -1.1% | $345,918 | $322,597 | 7.2% |

Weekly Initial Unemployment Claims increased to 287,000, 4-Week Average lowest since May 2000

by Calculated Risk on 10/30/2014 10:30:00 AM

Earlier the DOL reported:

In the week ending October 25, the advance figure for seasonally adjusted initial claims was 287,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 283,000 to 284,000. The 4-week moving average was 281,000, a decrease of 250 from the previous week's revised average.The previous week was revised up to 284,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 281,000.

This was close to the consensus forecast and suggests few layoffs.

BEA: Real GDP increased at 3.5% Annualized Rate in Q3

by Calculated Risk on 10/30/2014 08:44:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2014 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 3.5 percent in the third quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.The advance Q3 GDP report, with 3.5% annualized growth, was above expectations of a 2.8% increase.

...

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Personal consumption expenditures (PCE) increased at a 1.8% annualized rate - a slow pace.

The first graph shows the contribution to percent change in GDP for residential investment (RI) and state and local governments since 2005.

This shows the huge slump in RI during the housing bust (blue), followed by the unprecedented period of state and local austerity (red) not seen since the Depression.

Click on graph for larger image.

Click on graph for larger image.State and local government spending was positive in Q3, and I expect state and local governments to continue to make a positive contribution to GDP in Q4 and in 2015.

RI (blue) added to GDP growth for a few years, before subtracting in Q4 2013 and Q1 2014. RI bounced back in Q2 and Q3.

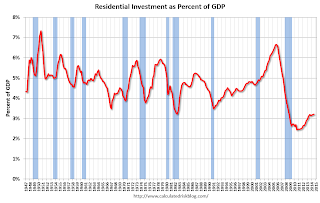

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..

The third graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..I'll add details for investment in offices, malls and hotels next week.

Overall this was an OK report, however PCE was weak (I expect stronger PCE going forward).