by Calculated Risk on 11/04/2014 08:15:00 PM

Tuesday, November 04, 2014

Wednesday: ISM Non-Mfg Index, ADP Employment

From the WSJ: What Falling Exports Mean for U.S. Economic Growth

In response to Tuesday’s trade report (in addition to weak construction and factory orders data), economists are reducing the estimates for third-quarter real GDP growth. Economists at BNP Paribas now track third-quarter GDP at 2.8% and J.P. Morgan forecasters think the rate will be revised to 2.9%, while the econ shops at Goldman Sachs, Royal Bank of Scotland and Capital Economics think the rate will fall to about 3%.The BEA will release the 2nd revision of GDP on November 25th, but so far it looks like GDP will be revised down.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 212,000 payroll jobs added in October, down from 213,000 in September.

• At 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for a reading of 58.0, down from 58.6 in September. Note: Above 50 indicates expansion.

Update: Framing Lumber Prices down Year-over-year

by Calculated Risk on 11/04/2014 04:49:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices didn't fall as sharply either.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 5% from a year ago, and CME futures are down 12% year-over-year.

Lawler on NAR 2014 Profile of Home Buyers and Sellers

by Calculated Risk on 11/04/2014 02:31:00 PM

From housing economist Tom Lawler:

The National Association of Realtors released the results of its 2014 Profile of Home Buyers and Sellers, which are based on a survey of buyers who purchased a home between July 2013 and June 2014. The survey is sent to the address of the home purchased, and the virtually all respondents purchased a home for their primary residence. Thus, characteristics of buyers from the survey reflect characteristics of primary residence purchases, and not all home purchases.

According to the 2014 survey, the first-time home buyer share of primary residence home purchases over the 12 month period ending June 2014 was 33%, down from 38% a year earlier and the lowest share since the NAR has attempted to measure the share. The first-time buyer share from this survey includes both new and existing homes.

As noted above, the first-time buyer share from the Profile of Home Buyers and Sellers is an estimate of the first-time buyer share of primary residence purchases. The first-time buyer share reported in the NAR’s monthly existing home sales press release, in contrast, is an estimate of the first-time buyer share of total existing home sales, and is based on the buyer characteristics of the last home transaction in a given month of realtors who respond to the survey. When folks say that the “normal” first-time home buyer share is around 40%, they either are or should be referring to the first-time buyer share of homes sold to buyers of their primary residences. Obviously, the “normal” first-time buyer share of total home sales is lower, though it is not clear by how much, because there are no good, reliable data on the investor/second home share of total home sales.

Here are a few other “snippets” from the 2014 PHBS.

• Eighty-eight percent of primary residence buyers financed their home purchase, and for those who financed their purchase, the buyers “typically” financed 90 percent. Ninety-five percent of first-time buyers financed their purchase, compared to 84 percent of repeat buyers.Comment: The implied “all-cash” share of primary residence purchases seems way too low, and the implied average LTV for purchase mortgage originations seems way too high. That has been true of past reports as well.

• The typical home seller had lived in his/her home for 10 years, and 17 percent of recent sellers had delayed selling their home because the value of their home was below their outstanding mortgage balance. In 2006 and 2007 the typical seller had lived in his/her home for six years.Comment: this statistic reflects the “median” expected length of tenure in home purchased, and excludes a sizable “don’t know” category that has grown over time. I don’t have the full 2014 report, but here is a comparison of buyers’ responses on their expected “length of tenure” from the 2013 PHBS compared to the 2006 PHBS.

• Buyers “expect” to live in their homes for 12 years, compared to 8 years in 2006.

| Expected Length of Tenure in Home Purchased by Age Group, NAR 2006 PHBS (percent of group) | |||||

|---|---|---|---|---|---|

| All Buyers | 18-24 | 25-44 | 45-64 | 65+ | |

| <=3 Years | 12% | 18 | 14 | 9 | 7 |

| 4 to 5 years | 18 | 36 | 23 | 11 | 5 |

| 6 to 10 years | 19 | 23 | 21 | 20 | 12 |

| 11+ Years | 26 | 10 | 24 | 32 | 27 |

| Don't Know | 24 | 12 | 18 | 28 | 49 |

| "Median" (years) | 8 years | 5 | 6 | 9 | 12 |

| Expected Length of Tenure in Home Purchased by Age Group, NAR 2013 PHBS (percent of group) | |||||

|---|---|---|---|---|---|

| All Buyers | 18-24 | 25-44 | 45-64 | 65+ | |

| <=3 Years | 3% | 5 | 4 | 5 | 3 |

| 4 to 5 years | 9 | 11 | 12 | 6 | 5 |

| 6 to 10 years | 18 | 24 | 20 | 15 | 12 |

| 11+ Years | 33 | 28 | 33 | 37 | 27 |

| Don't Know | 37 | 31 | 32 | 37 | 54 |

| "Median" (years) | 15 years | 10 | 10 | 20 | 15 |

In 2006, when mortgage credit was easy and when consumer expectations for future home price growth were high, an exceptionally large percentage of home buyers, especially among “young adults” (and probably first time buyers) expected to remain in their recently purchased home for less than 3-5 years. In 2013, when credit was “tight” and when expectations for home price growth were “subdued,” there apparently were a lot fewer buyers who expected to live in their purchased home for less than five years – which makes sense, given the high transactions costs associated both with buying and with selling a home.

CoreLogic: House Prices up 5.6% Year-over-year in September

by Calculated Risk on 11/04/2014 11:31:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 5.6 Percent Year Over Year in September 2014

Home prices nationwide, including distressed sales, increased 5.6 percent in September 2014 compared to September 2013. This change represents 31 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, dropped by 0.1 percent in September 2014 compared to August 2014.

...

Excluding distressed sales, home prices nationally increased 5.2 percent in September 2014 compared to September 2013 and 0.1 percent month over month compared to August 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in August, with Mississippi being the only state to experience a year-over-year decline (-0.9 percent). Distressed sales include short sales and real estate owned (REO) transactions. ...

“Home prices continue to rise compared with this time last year but the rate of growth is clearly slowing as we exit 2014,” said Anand Nallathambi, president and CEO of CoreLogic.

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.1% in September, and is up 5.6% over the last year.

This index is not seasonally adjusted, and - as I predicted last month - the index turned slightly negative month-to-month in September (this is the beginning of the seasonally weak period for house prices).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty one consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty one consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases continue to slow.

This index was up 11.8% YoY in February 2014, and the YoY increase has been slowing since then. In July, the YoY increase was 6.4%, in August 5.8% and now, in September, the increase was 5.6%.

Trade Deficit increased in September to $43.0 Billion

by Calculated Risk on 11/04/2014 08:43:00 AM

Earlier the Department of Commerce reported:

[T]otal September exports of $195.6 billion and imports of $238.6 billion resulted in a goods and services deficit of $43.0 billion, up from $40.0 billion in August, revised. September exports were $3.0 billion less than August exports of $198.6 billion. September imports were $0.1 billion more than August imports of $238.6 billion.The trade deficit was larger than the consensus forecast of $40.7 billion and the trade deficit was revised down slightly for August.

The first graph shows the monthly U.S. exports and imports in dollars through September 2014.

Click on graph for larger image.

Click on graph for larger image.Imports increased slightly and exports decreased in August.

Exports are 18% above the pre-recession peak and up 3% compared to September 2013; imports are 3% above the pre-recession peak, and up about 3% compared to September 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $92.54 in September, down from $96.32 in August, and down from $102.00 in September 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012. Oil prices will really decline in the October and November reports!

The trade deficit with China increased to $35.6 billion in September, from $30.6 billion in September 2013. The deficit with China is almost all of the overall deficit.

Monday, November 03, 2014

Tuesday: Trade Deficit

by Calculated Risk on 11/03/2014 09:00:00 PM

Two weeks ago, Professor James Hamilton wrote: How will Saudi Arabia respond to lower oil prices? (read entire piece!). Hamilton wrote:

it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production ...And today from the WSJ: Oil Skids as Saudis Adjust Prices

U.S. oil prices tumbled to a fresh two-year low Monday on news that Saudi Arabia cut its selling price for oil to the U.S., suggesting that the kingdom is trying to compete with U.S. shale oil.Bloomberg shows WTI down to $78.24 a barrel, and Brent down to $84.78. So gasoline prices should continue to decline (currently $2.96 per gallon national average).

Tuesday:

• At 8:30 AM ET, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.7 billion in September from $40.1 billion in August.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 0.7 decrease in September orders.

Fed Survey: Banks "eased standards for construction and land development loans"

by Calculated Risk on 11/03/2014 05:12:00 PM

From the Federal Reserve: The October 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the October survey results indicated that only a modest net fraction of banks eased their standards for commercial and industrial (C&I) loans to firms of all sizes, but generally larger net fractions of banks eased each of the pricing terms listed in the survey and some non-price terms. Banks also reported having eased standards for construction and land development loans, a category of commercial real estate (CRE) loans included in the survey. On the demand side, modest net fractions of banks reported stronger demand for C&I loans to larger firms; similar net fractions experienced stronger demand for all three categories of CRE loans covered in the survey.

...

Regarding loans to households, some large banks reported having eased standards on closed-end mortgage loans, but respondents generally indicated little change in standards and terms for other types of loans to households. Reported changes in loan demand were mixed. Moderate net fractions of banks reported stronger demand for auto loans and weaker demand for nontraditional closed-end mortgage loans. Demand for other types of loans to households was about unchanged at most banks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph). Multifamily is seeing slightly tighter standards for the second consecutive quarter.

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE.

Banks are seeing a pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see a further increase in commercial real estate development.

U.S. Light Vehicle Sales unchanged at 16.35 million annual rate in October

by Calculated Risk on 11/03/2014 02:30:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 16.35 million SAAR in October. That is up 7% from October 2013, and unchanged from the 16.34 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 16.35 million SAAR from WardsAuto).

This was below the consensus forecast of 16.6 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was the sixth consecutive month with a sales rate over 16 million.

Construction Spending decreased 0.4% in September

by Calculated Risk on 11/03/2014 11:29:00 AM

Earlier the Census Bureau reported that overall construction spending decreased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2014 was estimated at a seasonally adjusted annual rate of $950.9 billion, 0.4 percent below the revised August estimate of $955.2 billion.. The September figure is 2.9 percent (±2.1%) above the September 2013 estimate of $924.2 billion.Both private and public spending decreased in September:

Spending on private construction was at a seasonally adjusted annual rate of $680.0 billion, 0.1 percent below the revised August estimate of $680.8 billion. Residential construction was at a seasonally adjusted annual rate of $349.1 billion in September, 0.4 percent above the revised August estimate of $347.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $331.0 billion in September, 0.6 percent below the revised August estimate of $333.0 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In September, the estimated seasonally adjusted annual rate of public construction spending was $270.9 billion, 1.3 percent below the revised August estimate of $274.4 billion.

emphasis added

As an example, construction spending for lodging is up 15% year-over-year, whereas spending for power (includes oil and gas) construction is down 11% since peaking in May.

Click on graph for larger image.

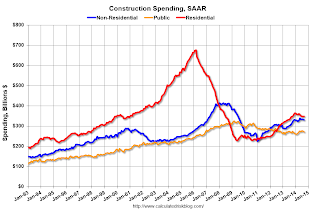

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has declined recently and is 48% below the peak in early 2006 - but up 53% from the post-bubble low.

Non-residential spending is 20% below the peak in January 2008, and up about 47% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and about 4% above the post-recession low.

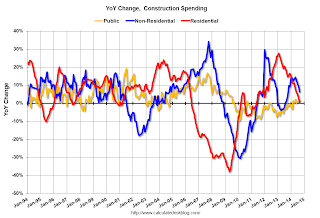

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 1%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup, and public spending has probably hit bottom after several years of austerity.

This was a weak report - well below the consensus forecast of a 0.6% increase - and there were also downward revisions to spending in July and August.

ISM Manufacturing index increases to 59.0 in October

by Calculated Risk on 11/03/2014 10:04:00 AM

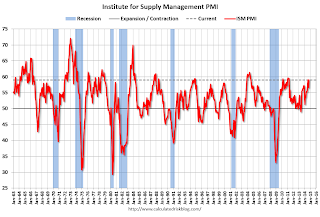

The ISM manufacturing index suggests faster expansion in October than in September. The PMI was at 59.0% in October, up from 56.6% in September. The employment index was at 55.5%, up from 54.6% in September, and the new orders index was at 65.8%, up from 60.0%.

From the Institute for Supply Management: October 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October for the 17th consecutive month, and the overall economy grew for the 65th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The October PMI® registered 59 percent, an increase of 2.4 percentage points from September’s reading of 56.6 percent, indicating continued expansion in manufacturing. The New Orders Index registered 65.8 percent, an increase of 5.8 percentage points from the 60 percent reading in September, indicating growth in new orders for the 17th consecutive month. The Production Index registered 64.8 percent, 0.2 percentage point above the September reading of 64.6 percent. The Employment Index grew for the 16th consecutive month, registering 55.5 percent, an increase of 0.9 percentage point above the September reading of 54.6 percent. Inventories of raw materials registered 52.5 percent, an increase of 1 percentage point from the September reading of 51.5 percent, indicating growth in inventories for the third consecutive month. Comments from the panel generally cite positive business conditions, with growth in demand and production volumes."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 56.0%, and indicates solid expansion in October.