by Calculated Risk on 11/08/2014 04:52:00 PM

Saturday, November 08, 2014

Unofficial Problem Bank list declines to 419 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 7, 2014.

Changes and comments from surferdude808:

Surprising these days to have a bank failure in three out of the past four weeks, but that is just what happened. Along with the failure there were two other removals this week that push the Unofficial Problem Bank List count down to 419 institutions with assets of $131.9 billion. A year ago, the list held 661 institutions with assets of $228.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 419.

Frontier Bank, FSB, Palm Desert, CA ($88 million) became the 17th failure this year and 40th institution headquartered in California to fail since the on-set of the Great Recession. Other removals include an action termination at Carver Federal Savings Bank, New York, NY ($648 million) and a change in control and recapitalization of Michigan Commerce Bank, Ann Arbor, MI ($922 million).

Next week should be quiet as the OCC likely will not provide an update on its latest enforcement action activity until November 21st.

Schedule for Week of November 9th

by Calculated Risk on 11/08/2014 11:50:00 AM

The key economic report this week is October retail sales on Friday.

The MBA is expected to release the Q3 National Delinquency Survey on Friday.

At 10:00 AM ET: The Fed will release the new monthly Labor Market Conditions Index (LMCI).

The is a federal/bank holiday. The Bond market will be closed in observance of the Veterans Day. The stock market will be open for trading.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

7:30 AM ET: NFIB Small Business Optimism Index for October.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.2% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 275 thousand from 278 thousand.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 4.835 million from 4.605 million in July.

The number of job openings (yellow) were up 23% year-over-year. Quits were up 5% year-over-year.

2:00 PM ET: The Monthly Treasury Budget Statement for October.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.This graph shows retail sales since 1992 through September 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales decreased 0.3% from August to September (seasonally adjusted), and sales were up 4.3% from September 2013.

The consensus is for retail sales to increase 0.2% in October, and to increase 0.2% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 87.5, up from 86.9 in October.

10:00 AM: The Mortgage Bankers Association (MBA) Q3 2014 National Delinquency Survey (NDS).

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.

Update: 2015 Housing Forecasts

by Calculated Risk on 11/08/2014 08:01:00 AM

Update: On Nov 8th I added the MBA forecast.

Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

The NAR released their forecast yesterday: Home Sales Expected to Improve in 2015, but Some Headwinds Still Remain

[Lawrence Yun, chief economist of the National Association of Realtors®] expects the national median existing-home price to rise 4 percent both next year and in 2016. ... Housing starts are forecast to hit 1 million this year and reach 1.3 million in 2015, which is still below the underlying demand of about 1.5 million, but should gradually normalize as lenders open their credit box more to builders. New-home sales are likely to total 440,000 in 2014, and increase to 620,000 next year.Note: Wells Fargo updated their forecast (slight changes).

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows a few forecasts for 2015 (I'll update these in further in December).

From Fannie Mae: Housing Forecast: October 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Merrill Lynch | 557 | 1,200 | 3.6% | |

| MBA | 503 | 728 | 1,108 | 3.0%2 |

| NAHB | 547 | 802 | 1,158 | |

| NAR | 620 | 1,300 | 4%3 | |

| Wells Fargo | 530 | 770 | 1,160 | 3.3% |

| Zillow | 3.0%4 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Home price 4Zillow Home Value Index, Sept 2014 to Sept 2015 | ||||

Friday, November 07, 2014

Bank Failure #17 in 2014: El Paseo Bank, Palm Desert, California

by Calculated Risk on 11/07/2014 08:15:00 PM

As of June 30, 2014, Frontier Bank, FSB had approximately $86.4 million in total assets and $82.1 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.7 million. ... Frontier Bank, FSB is the 17th FDIC-insured institution to fail in the nation this year, and the first in California. The last FDIC-insured institution closed in the state was Palm Desert National Bank, Palm Desert, on April 27, 2012.It feels like a Friday!

Phoenix Real Estate in October: Sales up 2%, Cash Sales down Sharply, Inventory up only 6%

by Calculated Risk on 11/07/2014 04:38:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in October were up 2.5% year-over-year. Note: This is the first year-over-year sales increase this year.

2) Cash Sales (frequently investors) were down about 10% to 27.7% of total sales. Non-cash sales were up 8.4% year-over-year.

3) Active inventory is now up 5.7% year-over-year - and at about the same level as in October 2011 (about when prices bottomed in Phoenix). Note: This is the smallest year-over-year inventory increase this year, so the inventory build may be slowing.

More inventory (a theme this year) - and less investor buying - suggested price increases would slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases have flattened out in 2014.

As an example, the Phoenix Case-Shiller index through August shows prices up less than 1% in 2014, and the Zillow index shows Phoenix prices flat over the last year!

| October Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Oct-08 | 5,384 | --- | 1,348 | 25.0% | 55,7031 | --- |

| Oct-09 | 8,121 | 50.8% | 2,688 | 33.1% | 39,312 | -29.4% |

| Oct-10 | 6,591 | -18.8% | 2,800 | 42.5% | 45,252 | 15.1% |

| Oct-11 | 7,561 | 14.7% | 3,336 | 44.1% | 27,266 | -39.7% |

| Oct-12 | 7,020 | -7.2% | 3,081 | 43.9% | 22,702 | -16.7% |

| Oct-13 | 6,038 | -14.0% | 1,910 | 31.6% | 26,267 | 15.7% |

| Oct-14 | 6,186 | 2.5% | 1,712 | 27.7% | 27,760 | 5.7% |

| 1 October 2008 probably includes pending listings | ||||||

Commentary: Politics and Jobs

by Calculated Risk on 11/07/2014 02:49:00 PM

I enjoy economics, but I hate politics.

We all have different values and interests, so it is natural that we disagree on some public policy. An open and honest debate would be healthy. But politics is negative, destructive and dishonest.

Yesterday the Speaker warned the President not to "poison the well" of goodwill by taking action on immigration. In almost the next sentence, the Speaker poisoned the well by saying the House will vote to repeal the Affordable Care Act (a vote that will go nowhere). No matter what someone thinks of both issues, the speaker's words were not helpful for constructive debate.

The Speaker isn't stupid. Being hypocritical is bad policy, but probably good politics - and that is sad. A more positive approach would be to offer to work on areas of agreement for both immigration and healthcare (the areas of agreement would be small - but that approach would be positive).

And politics really bothers me when we discuss the economy.

If I wrote that Obama's 2nd term is on pace to be one of the best for private sector job creation in history - better than Reagan, and only trailing Clinton - that might surprise a few people. But it is accurate.

Here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Currently Obama's 2nd term is on pace for the third best term for these Presidents.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 2 | 4,3711 |

| 121 months into 2nd term: 9,991 pace. | |

It is correct that the economy is larger now than in the '80s, but demographics are less favorable now. The recent job creation is happening with a decline in the prime working age population, whereas in the '80s the prime working age population was growing 3% per year! This is unrelated to policy - this is just demographics.

Note: Some good news looking forward is the prime working age population is growing again.

Total employment did increase more in Reagan's 2nd term, but that was because of a huge surge in public employment. If the Speaker, yesterday, mentioned a push for 2nd term Reagan era public sector hiring, I missed it (sorry for sarcasm).

Here is a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term. Note: From the WSJ: The Federal Government Now Employs the Fewest People Since 1966

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 2 | 481 |

| 121 months into 2nd term, 110 pace | |

Overall the economy and job growth is doing pretty well right now (especially considering demographics). One key weakness is wage growth, and I expect wage growth to increase as the unemployment rate continues to decline. If we had seen better policy over the last several years - like more infrastructure investment - than we'd probably already be seeing wage growth. Failing to make these supply side investments during a period with low borrowing costs and high unemployment, was probably one of the key policy failures of the last four years.

Usually both parties support infrastructure investment, but apparently it is good politics for Congress to oppose even the best of policies when the opposing party holds the presidency. And that is depressing.

Comments: Solid Employment Report, Seasonal Retail Hiring at Record Level

by Calculated Risk on 11/07/2014 10:00:00 AM

Earlier: October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

This was another solid report with 214,000 jobs added, and job gains for August and September were revised up. This was the ninth consecutive month over 200,000, and an all time record 49th consecutive month of job gains.

As always we shouldn't read too much into one month of data, but at the current pace (through October), the economy will add 2.74 million jobs this year (2.67 million private sector jobs). Right now 2014 is on pace to be the best year for both total and private sector job growth since 1999.

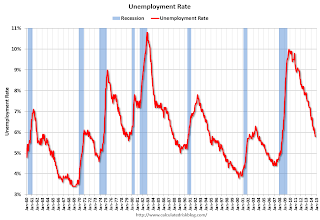

A few other positives: the unemployment rate declined to 5.8% (the lowest level since July 2008), U-6 declined to 11.5% (an alternative measure for labor underutilization) and was at the lowest level since 2008, the number of part time workers for economic reasons declined slightly (lowest since October 2008). And the number of long term unemployed declined to the lowest level since January 2009.

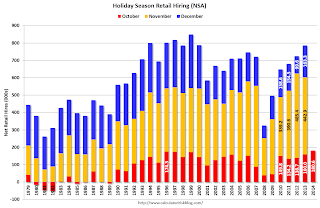

Also seasonal retail hiring was at a record level. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

Unfortunately wage growth is still subdued. From the BLS: "Average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.57 in October. Over the year, average hourly earnings have risen by 2.0 percent. In October, average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $20.70."

With the unemployment rate at 5.8%, there is still little upward pressure on wages. Wages should pick up as the unemployment rate falls over the next couple of years, but with the currently low inflation and little wage pressure, the Fed will likely remain patient.

A few more numbers:

Total employment increased 214,000 from September to October and is now 1.3 million above the previous peak. Total employment is up 10.0 million from the employment recession low.

Private payroll employment increased 209,000 from September to October, and private employment is now 1.8 million above the previous peak (the unprecedented large number of government layoffs has held back total employment). Private employment is up 10.6 million from the recession low.

Through the first ten months of 2014, the economy has added 2,285,000 payroll jobs - up from 1,973,000 added during the same period in 2013. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year. That still looks about right.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in October at the highest level since 1999.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 180.6 thousand workers (NSA) net in October. This is the all time record (just above 1996). Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are optimistic about the holiday season. Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales.

Year-over-year Change in Employment

In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing.

Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

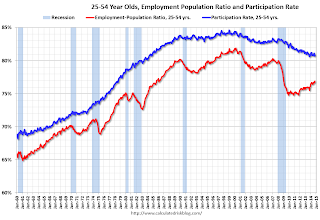

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in October to 80.8% from 80.7% in September, and the 25 to 54 employment population ratio increased to 76.9% from 76.7%. As the recovery continues, I expect the participation rate for this group to increase a little - although the participation rate has been trending down for this group since the late '90s.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged in October at 7.0 million.The number of persons working part time for economic reasons decreased in October to 7.027 million from 7.103 million in September. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.5% in October from 11.8% in September.

This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.916 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.954 in September. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In October 2014, state and local governments added 8,000 jobs. State and local government employment is now up 146,000 from the bottom, but still 598,000 below the peak.

Clearly state and local employment is now increasing. And Federal government layoffs have slowed (payroll decreased by 3 thousand in October), but Federal employment is still down 25,000 for the year.

October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

by Calculated Risk on 11/07/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 214,000 in October, and the unemployment rate edged down to 5.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for August was revised from +180,000 to +203,000, and the change for September was revised from +248,000 to +256,000. With these revisions, employment gains in August and September combined were 31,000 more than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Employment is now up 2.64 million year-over-year.

Total employment is now 1.3 million above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in October to 62.8% from 62.7% in September. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate decreased in October to 5.8%.

This was below expectations, but with the upward revisions to prior months, this was solid report.

I'll have much more later ...

Thursday, November 06, 2014

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 11/06/2014 07:33:00 PM

Yesterday I posted a summary of the monthly October employment related data: Preview: Employment Report for October. Overall the data has been positive.

From Goldman Sachs economist Kris Dawsey:

We forecast nonfarm payroll job growth of 235k in October, in line with consensus and slightly above the three-month average of 224k. On balance, labor market indicators appear consistent with a solid underlying trend on job growth.That is an interesting comment on revisions, so here are the two-month revisions released in the last five October employment reports:

...

Back revisions have a strong tendency to be positive in the October report ... over the past five years, the average net two-month back revision has been +89k, the strongest of any month of the year. While we do not necessarily expect a revision of quite that magnitude this year (the average size of the revisions seems to have trended down a bit since 2010), we think the odds favor a substantial upward revision to August and September job growth.

...

we expect the unemployment rate to remain unchanged at 5.9% in October ... This forecast assumes a roughly stable labor force participation rate. We forecast a 0.3% month-on-month gain in average hourly earnings, reflecting some degree of "catch-up" from last month's flat reading. An October increase in line with our forecast would leave the year-on-year rate at a still-subdued 2.1%.

2009: Total +91,000 "The change in total nonfarm payroll employment for August was revised from -201,000 to -154,000, and the change for September was revised from -263,000 to -219,000."

2010: Total +110,000 "The change in total nonfarm payroll employment for August was revised from -57,000 to -1,000, and the change for September was revised from -95,000 to -41,000."

2011: Total +98,000 "The change in total nonfarm payroll employment for August was revised from +57,000 to +104,000, and the change for September was revised from +103,000 to +158,000."

2012: Total +84,000 "The change in total nonfarm payroll employment for August was revised from +142,000 to +192,000, and the change for September was revised from +114,000 to +148,000."

2013: Total +60,000 "The change in total nonfarm payroll employment for August was revised from +193,000 to +238,000, and the change for September was revised from +148,000 to +163,000."

Friday:

• At 8:30 AM, the Employment Report for October. The consensus is for an increase of 240,000 non-farm payroll jobs added in October, down from the 248,000 non-farm payroll jobs added in September. The consensus is for the unemployment rate to be unchanged at 5.9% in October. As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

• At 3:00 PM, Consumer Credit for September from the Federal Reserve. The consensus is for credit to increase $16.0 billion.

Lawler: Fannie, Freddie in Q3

by Calculated Risk on 11/06/2014 05:08:00 PM

From housing economist Tom Lawler:

Fannie Mae reported that GAAP net income in the quarter ended September 30, 2014 was $3.9 billion, while “comprehensive income” was $4.0 billion. As a result, in December Fannie Mae will make a dividend payment to the US Treasury of $4.0 billion, bringing total dividend payments to $134.5 billion, compared to $116.1 billion in previous “draws” from the Treasury. Dividend payments do not reduce the Treasury’s senior preferred stock balance.

Freddie Mac reported that GAAP net income in the quarter ended September 30, 2014 was $2.0 billion, while “comprehensive income” was $2.8 billion. As a result, in December Freddie Mac will make a dividend payment to the US Treasury of $2.8 billion, bringing total dividend payments to $91.0 billion, compared to $71.3 billion in previous “draws” from the Treasury. Dividend payments do not reduce the Treasury’s senior preferred stock balance.

Fannie’s average charged Gfee on new SF acquisitions last quarter was 63.5 bp, up from 25.7 bp in 2010.

Freddie’s average charged Gfee on new SF acquisitions last quarter was 57.2 bp, up from 25 bp in 2010.

Freddie’s regulator instructed the GSEs to raise base fees several times over the last four or so years. In addition, pursuant to the Temporary Payroll Tax Cut Continuation Act of 2011, both Fannie and Freddie increased their guaranty fee on all SF residential mortgages delivered to them on of after April 1, 2012 by 10 basis points, with the incremental revenue being remitted to Treasury.

CR Note: Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased 17% year-over-year in Q3 for Fannie and Freddie combined, and combined REO inventory is at the lowest level since Q3 2009.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.