by Calculated Risk on 11/11/2014 11:12:00 AM

Tuesday, November 11, 2014

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

By request, a few more employment graphs that I haven't posted in a few months ...

Here are the previous posts on the employment report:

• October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

• Comments: Solid Employment Report, Seasonal Retail Hiring at Record Level

• Employment: Party Like It's 1999!

• Update: Prime Working-Age Population Growing Again

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.9% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 663 thousand.

The BLS diffusion index for total private employment was at 62.3 in October, up from 60.4 in September.

The BLS diffusion index for total private employment was at 62.3 in October, up from 60.4 in September.For manufacturing, the diffusion index increased to 58.6, up from 53.1 in September.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in October.

Housing Update: It Appears Inventory build is Slowing in Previous Distressed Markets

by Calculated Risk on 11/11/2014 08:11:00 AM

Note: This is an update to an earlier post.

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And at the beginning of this year I argued house price increases would slow in 2014 because of the increase in inventory.

I don't have a crystal ball, but watching inventory helps understand the housing market. If inventory kept increasing rapidly in certain markets, then we would eventually see price declines. However it now appears the inventory build is slowing in some former distressed markets.

The table below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It now appears the inventory build is slowing in these markets - and might even flatten or decline year-over-year soon in Las Vegas and Phoenix.

This makes sense. Prices increased rapidly in these markets in 2012 and 2013 (bouncing off the bottom with low inventory). Higher prices attracted more people to list their homes. But now that prices have flattened out - and there is plenty of inventory - potential sellers aren't as motivated to list their homes. Unlike following the housing bubble, most of these potential sellers probably don't need to sell, so listings will not grow to the moon!

I still expect overall nationwide inventory to continue to increase, but this is something to watch.

| Year-over-year Change in Active Inventory | |||

|---|---|---|---|

| Month | Las Vegas | Phoenix | Sacramento |

| Jan-13 | -58.3% | -11.7% | -61.1% |

| Feb-13 | -53.4% | -8.5% | -51.1% |

| Mar-13 | -42.1% | -5.2% | -37.8% |

| Apr-13 | -24.1% | -4.9% | -10.3% |

| May-13 | -13.2% | -2.1% | 5.3% |

| Jun-13 | 3.7% | -1.6% | 18.3% |

| Jul-13 | 9.0% | -1.6% | 54.3% |

| Aug-13 | 41.1% | 2.4% | 46.8% |

| Sep-13 | 60.5% | 7.8% | 77.3% |

| Oct-13 | 73.4% | 15.7% | 93.2% |

| Nov-13 | 77.4% | 15.2% | 56.8% |

| Dec-13 | 78.6% | 20.9% | 44.2% |

| Jan-14 | 96.2% | 29.6% | 96.3% |

| Feb-14 | 107.3% | 37.7% | 87.8% |

| Mar-14 | 127.9% | 45.5% | 71.2% |

| Apr-14 | 103.1% | 48.8% | 46.3% |

| May-14 | 100.6% | 47.4% | 83.7% |

| Jun-14 | 86.2% | 43.1% | 91.0% |

| Jul-14 | 55.2% | 35.1% | 68.0% |

| Aug-14 | 38.8% | 21.9% | 60.6% |

| Sep-14 | 29.5% | 13.2% | 50.9% |

| Oct-14 | 8.3% | 5.7% | 29.1% |

Monday, November 10, 2014

Sacramento Housing in October: Total Sales down 1% Year-over-year, Equity Sales up 5%, Active Inventory increased 29%

by Calculated Risk on 11/10/2014 06:19:00 PM

About 5 years ago I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October 2014, 12.1% of all resales were distressed sales. This was up from 11.1% last month, and down from 16.7% in October 2013. The slight increase was probably seasonal.

The percentage of REOs was at 6.1%, and the percentage of short sales was 6.0%.

Here are the statistics for October.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 29.1% year-over-year (YoY) in October. This was the smallest YoY increase in June 2013, and the YoY increases have been trending down after peaking at close to 100%.

Cash buyers accounted for 20.6% of all sales, down from 23.9% in October 2013 (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 0.8% from October 2013, and conventional equity sales were up 4.6% compared to the same month last year.

Summary: Distressed sales down sharply, cash buyers are down significantly, and inventory up significantly (but increases slowing). This is what we'd expect to see in a healing market. As I've noted before, we are seeing a similar pattern in other distressed areas.

Lawler on Toll Brothers: Net Orders Up, Orders Per Community Down Last Quarter

by Calculated Risk on 11/10/2014 03:58:00 PM

From housing economist Tom Lawler: Toll Brothers: Net Orders Up, Orders Per Community Down Last Quarter; Deliveries Up, Partly on “Spike” in Lumpy “City Living”

From Toll:

"In anticipation of its webcast presentation and related investor meetings on November 13, 2014 at the UBS Building and Building Products 11th Annual CEO Conference in New York City, Toll Brothers, Inc. (NYSE:TOL) (www.tollbrothers.com), the nation's leading builder of luxury homes, today announced preliminary results for contracts, backlog and home building revenues for its fourth quarter and fiscal year ended October 31, 2014. These results are preliminary and unaudited. The Company will announce final totals when it releases fourth quarter and fiscal year earnings results on December 10, 2014 ...”Here are some summary statistics for the quarter ended October 31, 2014 compared to the comparable quarter of 2013.

| Units | Average Sales Price | |||||

|---|---|---|---|---|---|---|

| Quarter Ended: | 10/2014 | 10/2013 | % Chg | 10/2014 | 10/2013 | % Chg |

| Net Orders: Total | 1,282 | 1,183 | 8.4% | $756,786 | $709,214 | 6.7% |

| Traditional | 1,234 | 1,136 | 8.6% | $720,989 | $691,989 | 4.2% |

| City Living | 48 | 37 | 29.7% | $1,677,083 | $1,429,730 | 17.3% |

| Deliveries: Total | 1,807 | 1,485 | 21.7% | $747,205 | $703,367 | 6.2% |

| Traditional | 1,684 | 1,460 | 15.3% | $702,732 | $679,452 | 3.4% |

| City Living | 123 | 25 | 392.0% | $1,356,098 | $2,100,000 | -35.4% |

| Net Orders/Community | 5.01 | 5.17 | -3.1% | |||

| Backlog As of: | 10/2014 | 10/2013 | % Chg | 10/2014 | 10/2013 | % Chg |

| Total | 3,679 | 3,679 | 0.0% | $739,250 | $714,732 | 3.4% |

| Traditional | 3,535 | 3,481 | 1.6% | $708,487 | $690,089 | 2.7% |

| City Living | 144 | 198 | -27.3% | $1,494,444 | $1,147,980 | 30.2% |

Update: The California Budget Surplus

by Calculated Risk on 11/10/2014 01:08:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved significantly since then. Here is the most recent update from California State Controller John Chiang: Controller Releases October Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in October 2014. Total revenues for the fourth month of Fiscal Year 2014-15 were $6.0 billion, coming in above Budget Act estimates by $662.2 million, or 12.3 percent.This is just one state, but I've been expecting local and state governments (in the aggregate) to add to both GDP and employment in 2014 - and that has happened. I expect this trend to continue in 2015.

For the fiscal year to date (July 1-October 31), total revenues reached $27.9 billion, beating estimates by $1.2 billion, or 4.5 percent.

“Four months into the fiscal year, California's coffers overflow by $1.2 billion. The news comes on the heels of two other positive developments: the vote to strengthen California's rainy-day fund through Proposition 2, and the credit upgrade that followed one day later," Chiang said.

emphasis added

Another Recession Caller

by Calculated Risk on 11/10/2014 11:42:00 AM

Barry Ritholtz tweeted this morning: "Forcaster who was wrong about recession in 2010 sees recession in 2015" and included a link to this article from Bloomberg: Predictors of ’29 Crash See 65% Chance of 2015 Recession

“Clearly the direction of most of the recent global economic news suggests movement toward a 2015 downturn,” chairman David Levy told clients in an Oct. 23 edition of a monthly forecasting report ... Why the gloom? Levy argues the U.S. and many advanced economies still have balance-sheet excesses exposing them to renewed financial crisis. There is limited room for policy makers to reverse any slump, and low inflation risks tipping into deflation in many parts of the world.Although there are geopolitical downside risks, and there is the potential for some disastrous political showdown in the U.S. (unlikely), I don't see a recession any time soon.

Of course I could be wrong, but currently I'm not on recession watch!

This reminds me of all those recession calls in 2011 and 2012. As an example, ECRI called several recessions since August 2011 and all of their calls were wrong.

Part of the problem in forecasting recently is the sluggish recovery has ups and downs, and each down looks like the start of a recession to some models. Another problem is that negative news sells ... and there is an entire industry that sells doom and gloom. It appears Levy is basing his call on the international showdown, but I doubt that will exert enough of a drag to take the U.S. into recession.

But this does give me a chance to post an update to the recession probability chart from FRED.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is based on research by economists Chauvet and Piger. From Professor Piger's site:

"Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion."This approach is useful for calling a recession in real time (of course, no one thinks the U.S. is in recession now). Longer term, one of the best leading indicators - residential investment - is still increasing and is still very low, and suggests the recovery will continue. I think a recession in 2015 is very unlikely.

FNC: Residential Property Values increased 6.3% year-over-year in September

by Calculated Risk on 11/10/2014 10:03:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their September index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.3% from August to September (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) decreased between 0.4% and 1.0% in September. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in September than in August, with the 100-MSA composite up 6.3% compared to September 2013. In general, for FNC, the YoY increase has been slowing since peaking in February at 9.3%.

The index is still down 19.3% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through September 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes had been showing a slowdown in price increases.

The September Case-Shiller index will be released on Tuesday, November 25th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Sunday, November 09, 2014

Sunday Night Futures

by Calculated Risk on 11/09/2014 09:52:00 PM

It seems like I'm posting a link to an article like this every week, from Reuters: U.S. gasoline prices fell 13 cents in past 2 weeks-Lundberg

The average price of a gallon of gasoline in the United States dropped 13 cents in the past two weeks to its cheapest in nearly four years, according to the latest Lundberg survey released on Sunday.Lower gasoline prices should give a boost to retailers (ex-gasoline).

Gasoline prices fell to $2.94 per gallon of regular grade gasoline, its lowest level since December 2010, according to the survey conducted on Nov. 7.

Monday:

• At 10:00 AM ET, the Fed will release the new monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of November 9th

• Employment: Party Like It's 1999!

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are unchanged and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $78.98 per barrel and Brent at $83.87 per barrel. A year ago, WTI was at $95, and Brent was at $105 - so prices are down around 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.91 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Employment: Party Like It's 1999!

by Calculated Risk on 11/09/2014 06:13:00 PM

As of the October BLS report, the economy has added 2.225 million private sector jobs, and 2.285 million total jobs in 2014.

To be the best year since 1999, the economy needs to add an additional 176 thousand private sector jobs (probably happen in November), and 222 thousand total nonfarm jobs.

Also interesting: For the first time since 2008, the public sector will add jobs in 2014. State and local governments started adding a few jobs last year, but austerity has been ongoing at the Federal level. According to the WSJ The Federal Government Now Employs the Fewest People Since 1966

Not since July 1966 has the federal government’s workforce been so small. ... But that’s only the raw numbers! As a share of the total workforce ... data going back to 1939 would show no point where the federal government’s share of employment was so low.In the last 75 years (when the BLS started tracking the data), the public sector (non-military) shed jobs in 12 years. Three of those years were at the end of WWII, two in the early '80s, and the last five consecutive years (unprecedented streak since the Great Depression).

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,742 | 2,670 |

| 1 2014 is current pace annualized (through October). | ||

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 11/09/2014 12:57:00 PM

This is an update to a previous post through October.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

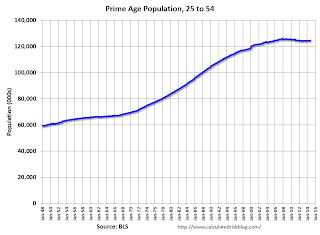

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.