by Calculated Risk on 11/13/2014 02:14:00 PM

Thursday, November 13, 2014

DataQuick on California Bay Area: Home Sales increased slightly in October, Few Distressed Sales

From DataQuick: San Francisco Bay Area Home Sales Edge Higher; Price Growth Ratchets Down Again

The Bay Area housing market posted another modest uptick in sales during October but activity remained below average as cash purchases continued to taper off and buyers faced a limited inventory as well as affordability and mortgage availability challenges. Home prices appear to have plateaued in recent months, although the October median sale price was still about 11 percent higher than a year earlier.A few key year-over-year trends: 1) declining distressed sales (can't decline much further!), 2) generally declining investor buying, 3) mostly flat total sales (up 1.3% year-over-year in October), 4) an increase in non-distressed sales.

A total of 7,693 new and resale houses and condos sold in the nine-county San Francisco Bay Area in October 2014. That was up 3.4 percent from 7,443 in September and up 1.3 percent from 7,595 in October 2013, according to CoreLogic DataQuick data..

A small gain in sales from September to October is normal for the season. The October sales count was the highest for that month since 7,902 homes sold in October 2012. October sales have ranged from a low of 5,486 in 2007 to a high of 13,392 in 2003. October 2014 sales were 9.7 percent below the October average of 8,521 sales since 1988, when CoreLogic DataQuick’s data began.

...

“After hitting what many view as a stratospheric level, Bay Area home prices have shown signs of leveling off,” said Andrew LePage, data analyst for CoreLogic DataQuick. “To some extent it’s the result of sticker shock and a modest pickup in inventory."

...

Foreclosure resales accounted for 2.7 percent of resales in October, down from a revised 2.8 percent the month before, and down from 3.7 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average since 1995 is 9.7 percent. Foreclosure resales are homes that had been foreclosed on in the prior 12 months.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 3.5 percent of Bay Area resales in October. That was down from an estimated 3.8 percent in September and down from 7.3 percent in October 2013.

emphasis added

Hotels: Occupancy Rate Finishing 2014 Strong

by Calculated Risk on 11/13/2014 12:27:00 PM

From HotelNewsNow.com: STR: US results for week ending 8 November

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 2-8 November 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 3.5 percent to 66.2 percent. Average daily rate increased 5.4 percent to finish the week at US$117.48. Revenue per available room for the week was up 9.1 percent to finish at US$77.74.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Business travel has peaked for the Fall season, and now hotels are heading into the slow period.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and since mid-June, the 4-week average of the occupancy rate has been a little higher than for the same week in 2000.

Right now it looks like 2014 will be the best year since 2000 for hotels. And since it takes some time to plan and build hotels, I expect 2015 will be even better for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

BLS: Jobs Openings at 4.7 million in September, Up 20% Year-over-year

by Calculated Risk on 11/13/2014 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.7 million job openings on the last business day of September, little changed from 4.9 million in August, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits increased from 2.5 million in August to 2.8 million in September. This was the highest level of quits since April 2008.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in September to 4.735 million from 4.853 million in August.

The number of job openings (yellow) are up 20% year-over-year compared to September 2013.

Quits are up 16% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a very positive report. It is a good sign that job openings are over 4 million for the eight consecutive month, and that quits are increasing year-over-year - and at the highest level since April 2008.

Weekly Initial Unemployment Claims increased to 290,000

by Calculated Risk on 11/13/2014 08:34:00 AM

The DOL reported:

In the week ending November 8, the advance figure for seasonally adjusted initial claims was 290,000, an increase of 12,000 from the previous week's unrevised level of 278,000. The 4-week moving average was 285,000, an increase of 6,000 from the previous week's unrevised average of 279,000.The previous week was unrevised at 278,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 285,000.

This was higher than the consensus forecast of 275,000, but the level suggests few layoffs.

Wednesday, November 12, 2014

Thursday: Job Openings, Unemployment Claims

by Calculated Risk on 11/12/2014 08:04:00 PM

From Nick Timiraos as the WSJ: Elevated Level of Part-Time Employment: Post-Recession Norm?

The unemployment rate has fallen sharply over the past year, but that improvement is masking a still-bleak picture for millions of workers who say they can’t find full-time jobs.Every month I post a graph of those working part time for economic reasons. Here is the October graph:

...

The situation of these so-called involuntary part-time workers—those who would prefer to work more than 34 hours a week—has economists puzzling over whether a higher level of part-time employment might be a permanent legacy of the great recession. If so, it could force more workers to choose between underemployment or working multiple jobs to make ends meet, leading to less income growth and weaker discretionary spending.

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged in October at 7.0 million.The number of persons working part time for economic reasons decreased in October to 7.027 million from 7.103 million in September.

Although this is still very high, it is important to note that "normal" is probably in the 4 to 5 million range.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 275 thousand from 278 thousand.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for September from the BLS. Note that the recent employment report was for October. Jobs openings increased in August to 4.835 million from 4.605 million in July. The number of job openings (yellow) were up 23% year-over-year. Quits were up 5% year-over-year.

• At 2:00 PM, the Monthly Treasury Budget Statement for October.

Lawler: Beazer Results and Q3 Builder Summary Table

by Calculated Risk on 11/12/2014 04:18:00 PM

From housing economist Tom Lawler: Beazer Homes: Net Orders Down a Bit, Double-Digit Drop in Net Orders/Community; 2014 Unit Sales “Disappointing” Though Home Prices Increased More Than “Expected”

Beazer Homes reported that net home orders in the quarter ended September 30, 2014 totaled 1,173, down 1.3% from the comparable quarter of 2013. Net orders per community last quarter were down about 11% from a year ago. Home deliveries last quarter totaled 1,695, up 2.3% from the comparable quarter of 2013, at an average sales price of $294,500, up 12.2% from a year ago. The company’s order backlog at the end of September was 1,690, down 10.7% from last September. The company owned or controlled 28,127 lots at the end of September, up 0.4% from last September and up 16.5% from two years ago.

Company officials described housing demand as “uneven” in 2014, but on average felt that demand was “disappointing,” and the company sold fewer houses than it had “expected.” Officials also said, however, that its average sales price increased by more than “expected,” but strangely officials did not link the higher prices with lower sales.

For the latest quarter officials described July sales as “so-so,” August sales as “awesome,” and September sales as “not so good.”

For FY 2015 (Beazer’s FY ends on September 30), Beazer expects “mid-teens” growth in its net orders and its community count, and an average sales price “nearing” $320,000. The ASP was $284,800 for FY 2014 and $294,500 for the latest quarter. Officials implied that this surprisingly high ASP expectation would come mainly from regional and product mix. Most analysts were skeptical that the company could achieve that high a sales price AND grow orders at a mid-teens pace.

Here are some summary stats for nine builders reporting results for the quarter ending September 30th.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 09/14 | 09/13 | % Chg | 09/14 | 09/13 | % Chg | 09/14 | 09/13 | % Chg |

| D.R. Horton | 7,135 | 5,160 | 38.3% | 8,612 | 6,866 | 25.4% | $279,099 | 262,453 | 6.3% |

| PulteGroup | 3,779 | 3,781 | -0.1% | 4,646 | 4,817 | -3.5% | $334,000 | 310,000 | 7.7% |

| NVR | 2,936 | 2,381 | 23.3% | 3,236 | 3,342 | -3.2% | $366,200 | 349,200 | 4.9% |

| The Ryland Group | 1,707 | 1,592 | 7.2% | 2,018 | 1,883 | 7.2% | $331,000 | 298,000 | 11.1% |

| Beazer Homes | 1,173 | 1,192 | -1.6% | 1,695 | 1,657 | 2.3% | $295,400 | 263,200 | 12.2% |

| Standard Pacific | 1,154 | 1,110 | 4.0% | 1,250 | 1,217 | 2.7% | $483,000 | 420,000 | 15.0% |

| Meritage Homes | 1,500 | 1,300 | 15.4% | 1,522 | 1,418 | 7.3% | $358,000 | 341,000 | 5.0% |

| MDC Holdings | 1,081 | 924 | 17.0% | 1,093 | 1,257 | -13.0% | $370,600 | 345,000 | 7.4% |

| M/I Homes | 892 | 869 | 2.6% | 985 | 937 | 5.1% | $320,000 | 284,000 | 12.7% |

| Total | 21,357 | 18,309 | 16.6% | 25,057 | 23,394 | 7.1% | $326,373 | $305,805 | 6.7% |

Net orders per community of these nine builders combined were up about 7.4% from a year ago. Acquisitions of other builds probably added about 1.6 percentage points to the YOY growth in net orders for the group. The order backlog for these builders at the end of September totaled 37,643, up 9.5% from last September.

Here is a chart comparing Census’ estimate for new SF home sales with net orders from these nine large builders (indexed: 2010 = 100)

Click on graph for larger image.

Click on graph for larger image.Builders report net orders as gross orders in a quarter less sales cancellations in a quarter. Census defines “home sales” as gross contract signings less contract signings on homes on which a previously signed contract had been cancelled. There also appears to be a timing difference between when a builder recognizes an order and the date of a contract signing in Census’ Survey of Construction.

DataQuick: October Southern California Home Sales Dip To Three-Year Low

by Calculated Risk on 11/12/2014 01:50:00 PM

From DataQuick: Southern California Home Sales Dip To Three-Year Low; Smaller Year-Over-Year Gain for Median Sale Price

Southland homes sold at the slowest pace for the month of October in three years as sales to investors and cash buyers continued to run well below October 2013 levels. ... A total of 19,271 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October 2014. That was down 0.4 percent from 19,348 sales in September, and down 4.4 percent from 20,150 sales in October 2013, according to CoreLogic DataQuick data.The NAR is scheduled to release existing home sales for October on Thursday, November 20th.

Last month’s sales decline from September was not unusual. On average, Southern California sales have fallen 0.3 percent between September and October since 1988, when CoreLogic DataQuick data begin. ...

"It was another sub-par month for Southern California home sales. We've yet to see traditional buyers fill the void left by the drop-off in investor and cash buyers, which began in spring last year,” said Andrew LePage, data analyst for CoreLogic DataQuick. “Of course, there are multiple reasons for this year's lackluster sales. New-home transactions are still running at about half their normal level. The resale market is hampered by constrained inventory in many areas, in part because some people who want to put their homes up for sale still haven't regained enough equity to purchase their next home. Then there are the would-be buyers who continue to struggle with affordability and mortgage availability, if not uncertainty over their employment or the direction of the housing market."

...

Foreclosure resales represented 4.8 percent of the Southern California resale market in October. That was up insignificantly from 4.7 percent the prior month and down from 6.3 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009. Foreclosure resales are homes foreclosed on in the prior 12 months.

Short sales made up an estimated 5.9 percent of resales last month. That was down from 6.1 percent the prior month and down from 10.8 percent a year earlier. Short sales are transactions where the sale price fell short of what was owed on the property.

emphasis added

EIA Forecast: Gasoline Prices expected to average $2.94/gal in 2015

by Calculated Risk on 11/12/2014 12:32:00 PM

It is difficult to forecast oil and gasoline prices due to world events - and the response of producers to price changes, but currently the EIA expects gasoline prices to average $2.94/gal in 2015 according to the Short Term Energy Outlook released today:

• North Sea Brent crude oil spot prices fell from $95/barrel (bbl) on October 1 to $84/bbl at the end of the month. The causes included weakening outlooks for global economic and oil demand growth, the return to the market of previously disrupted Libyan crude oil production, and continued growth in U.S. tight oil production. Brent crude oil spot prices averaged $87/bbl in October, the first month Brent prices have averaged below $90/bbl since November 2010. EIA projects that Brent crude oil prices will average $83/bbl in 2015, $18/bbl lower than forecast in last month's STEO. There is significant uncertainty over the crude oil price forecast because of the range of potential supply responses from the Organization of the Petroleum Exporting Countries (OPEC), particularly Saudi Arabia, and U.S. tight oil producers to the new lower oil price environment. ...Lower gasoline prices are a positive for the economy. Right now gasoline prices are down to around $2.92 per gallon nationally according to the Gasbuddy.com.

• Driven largely by falling crude oil prices, U.S. weekly regular gasoline retail prices averaged $2.99/gallon (gal) on November 3, the lowest level since December 20, 2010. U.S. regular gasoline retail prices are projected to continue to decline for the remainder of the year to an average of $2.80/gal in December, $0.33/gal lower than in last month's STEO. EIA expects U.S. regular gasoline retail prices, which averaged $3.51/gal in 2013, to average $3.39/gal in 2014 and $2.94/gal in 2015.

emphasis added

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

NFIB: Small Business Optimism Index Increases in October

by Calculated Risk on 11/12/2014 09:38:00 AM

From the National Federation of Independent Business (NFIB): More owners plan to make capital expenditures, expect sales to increase

The NFIB Small Business Optimism Index crept back to its August level of 96.1 with a gain of 0.8 points led by a modest increase in the net percent of owners who plan to increase capital spending and more who expect higher sales in the next 3 months. ...And in another positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 17 last year - and "taxes" at 21 and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Job creation plans improved a point to a seasonally adjusted net 10 percent.

emphasis added

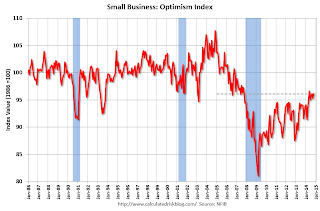

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.1 in October from 95.3 in September.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

by Calculated Risk on 11/12/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 7, 2014. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.19 percent from 4.17 percent, with points increasing to 0.26 from 0.22 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% from the levels in May 2013.

Even with the recent slight small increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.