by Calculated Risk on 11/16/2014 08:11:00 AM

Sunday, November 16, 2014

Unofficial Problem Bank list declines to 415 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 14, 2014.

Changes and comments from surferdude808:

Four removals this week from the Unofficial Problem Bank List that push the list count down to 415 institutions with assets of $128 billion. From last week, assets have declined by $3.9 billion, with $2.9 billion coming from the roll to Q3 from Q2 assets. A year ago, the list held 655 institutions with assets of $223.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 415.

Actions have been terminated against Community First Bank & Trust, Columbia, TN ($436 million) and Devon Bank, Chicago, IL ($239 million). Through a merger partner, Highlands Independent Bank, Sebring, FL ($251 million) and Grant County Deposit Bank, Williamstown, KY ($76 million) have found a way off the list.

Next week, we anticipate the OCC will provide an update on its latest enforcement action activity.

Saturday, November 15, 2014

Schedule for Week of November 16th

by Calculated Risk on 11/15/2014 12:12:00 PM

The key economic reports this week are October housing starts on Wednesday, and October existing home sales on Thursday.

For manufacturing, the October Industrial Production and Capacity Utilization report, and the November NY Fed (Empire State), Philly Fed and Kansas City Fed manufacturing surveys, will be released this week.

For prices, PPI will be released on Tuesday and CPI on Thursday.

8:30 AM: NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of 10.5, up from 6.2 in October (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

Note: New York Fed to Publish Blog Series on Long-term Unemployment and Labor Market Slack

8:30 AM: The Producer Price Index for October from the BLS. The consensus is for a 0.1% decrease in prices, and a 0.1% increase in core PPI.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 55, up from 54 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. Total housing starts were at 1.017 million (SAAR) in September. Single family starts were at 646 thousand SAAR in September.

The consensus is for total housing starts to increase to 1.025 million (SAAR) in October.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

2:00 PM: the FOMC Minutes for the Meeting of October 28-29, 2014

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 281 thousand from 290 thousand.

8:30 AM: Consumer Price Index for October. The consensus is for a 0.1% decrease in CPI in October, and for core CPI to increase 0.1%.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 5.15 million on seasonally adjusted annual rate (SAAR) basis. Sales in September were at a 5.17 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.28 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 18.5, down from 20.7 last month (above zero indicates expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2014

11:00 AM: the Kansas City Fed manufacturing survey for November.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in October

by Calculated Risk on 11/15/2014 08:11:00 AM

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for a few selected cities in October.

On distressed: Total "distressed" share is down in these markets mostly due to a decline in short sales.

Short sales are down significantly in these areas.

Foreclosures are up slightly in several of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct-14 | Oct-13 | Oct-14 | Oct-13 | Oct-14 | Oct-13 | Oct-14 | Oct-13 | |

| Las Vegas | 10.6% | 21.0% | 8.9% | 6.0% | 19.5% | 27.0% | 35.1% | 44.9% |

| Reno** | 6.0% | 16.0% | 4.0% | 4.0% | 10.0% | 20.0% | ||

| Phoenix | 3.7% | 8.4% | 6.2% | 6.9% | 9.9% | 15.3% | 27.7% | 31.6% |

| Sacramento | 6.1% | 13.7% | 6.3% | 5.9% | 12.4% | 19.6% | 20.6% | 23.9% |

| Minneapolis | 2.7% | 5.1% | 9.8% | 16.4% | 12.5% | 21.5% | ||

| Mid-Atlantic | 4.8% | 8.2% | 10.0% | 7.9% | 14.9% | 16.1% | 19.2% | 19.9% |

| California * | 6.1% | 10.3% | 5.3% | 6.7% | 11.4% | 17.0% | ||

| Bay Area CA* | 3.5% | 7.3% | 2.7% | 3.7% | 6.2% | 11.0% | ||

| So. California* | 5.9% | 10.8% | 4.8% | 6.3% | 10.7% | 17.1% | ||

| Hampton Roads | 19.7% | 25.5% | ||||||

| Northeast Florida | 30.0% | 38.2% | ||||||

| Toledo | 38.2% | 37.1% | ||||||

| Tucson | 26.8% | 32.1% | ||||||

| Des Moines | 18.8% | 20.2% | ||||||

| Peoria | 22.8% | 21.1% | ||||||

| Georgia*** | 27.8% | N/A | ||||||

| Pensacola | 33.5% | 33.7% | ||||||

| Memphis* | 13.3% | 19.8% | ||||||

| Birmingham AL | 15.2% | 21.0% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Friday, November 14, 2014

Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/14/2014 04:22:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports from across the country released so far this month, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.28 million, up 2.1% from September’s pace and up 2.9% from last October’s pace. My “best guess” is that the NAR’s estimate for the number of existing homes for sale at the end October will be down about 3% from September and up about 5.7% from last October. Finally, I “guesstimate” that the NAR’s estimate for the median existing SF home sales price in October will be up by about 4.4% from last October.

A few notes: first, not all realtor/MLS reports define “inventory” in the same way, and some of the publicly-released reports differ from reports sent to the NAR. These differences have made my NAR inventory estimates less reliable than my sales estimates. Second, lately the NAR median existing SF home sales prices have shown faster YOY growth than local realtor/MLS reports would have suggested, and in September the YOY increase in the median sales price in the Northeast was WAY higher than state realtor report would have indicated. I don’t know why.

I’ll update my estimate next week if newly-released realtor/MLS reports warrant an update.

CR Note: the NAR is scheduled to release October existing home sales next Thursday, The consensus is the NAR will report sales at a 5.10 million SAAR (the consensus will move up once this is posted!)

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States in Q3 2014

by Calculated Risk on 11/14/2014 02:13:00 PM

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

“On an aggregated basis, both judicial and non-judicial states saw decreases in loans in foreclosure, although the judicial states continue to have a combined foreclosure inventory rate that is around three times that of non-judicial states. New Jersey continues to lead the nation in loans in foreclosure, although it saw another decrease from the previous quarter. Florida, once with the highest percentage of loans in foreclosure, experienced a significant decrease in the third quarter. The foreclosure inventory in Florida has declined steadily for over two years now, and the percentage of loans in foreclosure is currently less than half of its peak in 2011. State level trends continue to be driven by local economic factors and state law. For example, a change in DC foreclosure mediation requirements was the likely cause of a shift of loans from the 90 days or more past due status to having the foreclosure process initiated,” [Mike Fratantoni, MBA’s chief economist] said.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission. Blue is for judicial foreclosure states, and red for non-judicial foreclosure states.

The top states are New Jersey (7.96% in foreclosure, down from 8.10% in Q2), Florida (6.12%, down from 6.81%), New York (5.72%, down from 5.89%), and Maine (4.29% down from 4.51%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures (D.C added some new foreclosure mediation requirements).

Former bubble states California (1.05% down from 1.10%) and Arizona (0.85%, unchanged from Q2) are now far below the national average by every measure.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for nine consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for nine consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for a couple more years - however the non-judicial states are closer to normal levels.

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q3, Lowest since 2007

by Calculated Risk on 11/14/2014 10:05:00 AM

From the MBA: Mortgage Delinquencies Continue to Decrease in Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.85 percent of all loans outstanding at the end of the third quarter of 2014. The delinquency rate decreased for the sixth consecutive quarter and reached the lowest level since the fourth quarter of 2007. The delinquency rate decreased 19 basis points from the previous quarter, and 56 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 2.39 percent, down 10 basis points from the second quarter and 69 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the fourth quarter of 2007.

...

“Delinquency rates and the percentage of loans in foreclosure fell to their lowest levels since 2007,” said Mike Fratantoni, MBA’s chief economist. “We are now back to pre-crisis levels for most measures. Foreclosure starts were unchanged on a seasonally adjusted basis, but increased slightly in the raw data. Given that this measure reached the lowest level in eight years last quarter, and given the continued decline in delinquency and foreclosure inventory rates, we expect that the increase in the unadjusted starts rate is just regular seasonal fluctuation.”

...

“On an aggregated basis, both judicial and non-judicial states saw decreases in loans in foreclosure, although the judicial states continue to have a combined foreclosure inventory rate that is around three times that of non-judicial states. New Jersey continues to lead the nation in loans in foreclosure, although it saw another decrease from the previous quarter. Florida, once with the highest percentage of loans in foreclosure, experienced a significant decrease in the third quarter."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 days and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is more than two-thirds of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and is two-thirds of the way back to normal.

So it has taken about 4 years to reduce the backlog of seriously delinquent and in-foreclosure loans by two-thirds, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal in a couple more years. Most other measures are already back to normal (still working through the backlog).

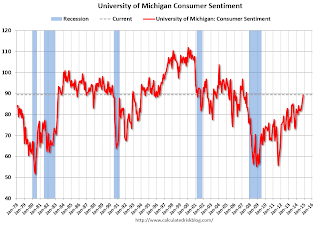

Preliminary November Consumer Sentiment increases to 89.4

by Calculated Risk on 11/14/2014 09:55:00 AM

Retail Sales increased 0.3% in October

by Calculated Risk on 11/14/2014 08:43:00 AM

On a monthly basis, retail sales decreased 0.3% from September to October (seasonally adjusted), and sales were up 4.1% from October 2013. Sales in September were unrevised at a 0.3% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $444.5 billion, an increase of 0.3 percent from the previous month, and 4.1 percent above October 2013. ... The August to September 2014 percent change was unrevised from -0.3%.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increase 0.5%.

Retail sales ex-autos increased 0.3%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.1% on a YoY basis (4.1% for all retail sales).

Retail sales ex-gasoline increased by 5.1% on a YoY basis (4.1% for all retail sales).The increase in October was above consensus expectations of a 0.2% increase.

Overall this was a solid report.

Thursday, November 13, 2014

Friday: Retail Sales, Consumer Sentiment, Q3 National Mortgage Delinquency Survey

by Calculated Risk on 11/13/2014 07:01:00 PM

One of the keys in the retail sales report will be sales ex-gasoline. From the WSJ: On Your Shopping List: Three Things to Watch in the Retail Sales Report

[C]onsider retail performance excluding gasoline stations. Retail sales are reported nominally and gas prices have plummeted since June. That means a clearer picture of the consumer sector will come from looking at retail sales excluding gas stations.Friday:

There are two reasons for that. The first is obvious: If gas sales are falling, sales excluding gas are doing better than total sales.

The second reason is that cheaper gas frees up money that can be spent elsewhere. If nongas sales don’t post a solid gain in October, consumers may be saving that extra money.

• At 8:30 AM ET, Retail sales for October will be released. The consensus is for retail sales to increase 0.2% in October, and to increase 0.2% ex-autos.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 87.5, up from 86.9 in October.

• At 10:00 AM, the Mortgage Bankers Association (MBA) Q3 2014 National Delinquency Survey (NDS).

• Also at 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.

Freddie Mac: "Fixed Mortgage Rates Hovering Near 2014 Lows"

by Calculated Risk on 11/13/2014 05:03:00 PM

From Freddie Mac: Fixed Mortgage Rates Hovering Near 2014 Lows

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates little changed from the previous week with the 30-year mortgage still hovering around 4 percent.

30-year fixed-rate mortgage (FRM) averaged 4.01 percent with an average 0.5 point for the week ending November 13, 2014, down from last week when it averaged 4.02 percent. A year ago at this time, the 30-year FRM averaged 4.35 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of 30 year fixed mortgage rates - according to the PMMS® - for 2010 through 2014 (red).

Mortgage rates are lower this year than last year (blue), and at about the same level as in 2011.

Note: Looking at daily rates from Mortgage News Daily, 30 year rates are at 4.05% today, down from 4.46% one year ago. The MND data is based on actual lender rate sheets, and is mostly "the average no-point, no-origination rate for top-tier borrowers with flawless scenarios". (this tracks the Freddie Mac series very well).