by Calculated Risk on 11/18/2014 06:25:00 PM

Tuesday, November 18, 2014

Builder Confidence and Housing Starts

I used to post a graph of the NAHB homebuilder confidence index and single family housing starts. However I stopped posting the graph when I realized that many readers misunderstood the graph.

First, here is the graph through the November builder confidence report released this morning and housing starts for September (October starts will be released tomorrow).

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale).

This chart shows that confidence and single family starts generally move in the same direction, but the graph doesn't tell us anything about the expected level of single family starts.

From the NAHB:

[T]he NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.How builders respond to this survey is dependent on the recent past. After a few years of sales around 450 thousand, annual sales of 600+ thousand seem "fair" or "good" to many builders - and the NAHB index increased significantly.

But, as a counter example, in 1995 many builders thought single family sales of 1 million were "poor" (the index fell to 40). But that decline in confidence was because sales were declining from a recent peak of 1.3 million.

It should be no surprise that confidence is currently at 58 with single family starts currently at 650 thousand, but that confidence in 1995 was at 40 with single family starts at 1 million! Confidence is relative to the recent past!

With confidence at 58 for November, no one should expect a specific level of starts (or look at the gap between the two lines), however we can probably expect starts to increase some from recent levels. At that is why I used to post this graph (Several times I cautioned not to expect starts to increase in step with confidence, but some readers missed that warning).

ATA Trucking Index increased 0.5% in October

by Calculated Risk on 11/18/2014 02:21:00 PM

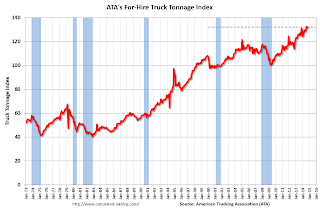

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Increased 0.5% in October

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index rose 0.5% in October, following a revised decline of 0.8% during the previous month. In October, the index equaled 132.1 (2000=100), which was the second highest level on record after August.

Compared with October 2013, the SA index increased 4.5%, up from September’s 2.9% year-over-year gain. Year-to-date, compared with the same period last year, tonnage is up 3.2%. ...

“Tonnage made a nice comeback after declining in September,” said ATA Chief Economist Bob Costello. “The gain fits with the increases in retail sales and factory output during October, as well as with good anecdotal reports about the fall freight season.”

“The solid month-to-month gain, coupled with the acceleration in the year-over-year growth rate, is a good sign for the fourth quarter,” Costello said. “In addition, I’m expecting a solid fall freight season as holiday sales are forecasted to see the largest increase since 2011.”

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 4.5% year-over-year.

LA area Port Traffic in October: Strong Imports, Soft Exports

by Calculated Risk on 11/18/2014 12:34:00 PM

Note: There is a trucker strike in LA that might impact port traffic in November. From the LA Times: L.A.-area port truckers expand strike to three new companies

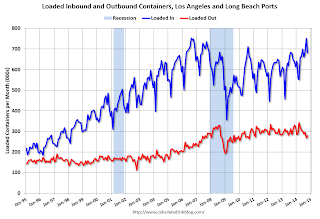

A port truck driver strike at the twin ports of Los Angeles and Long Beach grew Monday, as protest organizers targeted three more companies that they accuse of wage theft. ... The expanded strike comes as tension at the nation’s busiest port complex is high. A powerful dockworkers union and multinational shipping lines are negotiating a new contract for about 20,000 workers on the West Coast.Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October since LA area ports handle about 40% of the nation's container port traffic.

Dockworkers have been without a contract since July ...

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.5% compared to the rolling 12 months ending in September. Outbound traffic was down 0.9% compared to 12 months ending in September.

Inbound traffic has been increasing, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This was the 3rd highest level for imports in October, only behind October 2006 and 2007.

Imports were up 5.7% year-over-year in October, exports were down 10.4% year-over-year.

This might suggest U.S. retailers are expecting a happy holiday season - but exports suggest a slowdown in Asia.

NAHB: Builder Confidence increased to 58 in November

by Calculated Risk on 11/18/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58 in November, up from 54 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Four Points in November

Builder confidence in the market for newly built single-family homes rose four points to a level of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Growing confidence among consumers is what’s fueling this optimism among builders,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Members in many areas of the country continue to see increasing buyer traffic and signed contracts.”

“Low interest rates, affordable home prices and solid job creation are contributing to a steady housing recovery,” said NAHB Chief Economist David Crowe. “After a slow start to the year, the HMI has remained above the 50-point benchmark for five consecutive months, and we expect the momentum to continue into 2015.”

...

All three HMI components increased in November. The index gauging current sales conditions rose five points to 62, while the index measuring expectations for future sales moved up two points to 66 and the index gauging traffic of prospective buyers increased four points to 45.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose three points to 44, the South posted a four-point gain to 62, and the West edged up one point to 58. The Midwest registered a two-point loss to 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 55.

Monday, November 17, 2014

Tuesday: Homebuilder survey, PPI

by Calculated Risk on 11/17/2014 07:10:00 PM

Some excellent research from the NY Fed Liberty Street Economics: Measuring Labor Market Slack: Are the Long-Term Unemployed Different?. The conclusion:

[W]e find that long-term unemployed workers are not less attached to the labor market than short-term unemployed workers. If anything, the long-term unemployed group has the largest share of prime-age workers, the age group likely to have the strongest labor force attachment. We also see that long-term unemployment is an economy-wide phenomenon, spread across industries and occupations. While there may be unobservable characteristics of long-term unemployed workers that make them less attached to the labor force, when looking at their observable characteristics, it’s hard to argue that they should not be considered as part of labor market slack.The "underutilization of labor resources" may be "gradually diminishing" (from the recent FOMC statement), but based on this research, the unemployment rate, and the number of people working part time for economic reasons, it appears there is still a fair amount of slack in the labor market.

Tuesday:

• At 8:30 AM ET, the Producer Price Index for October from the BLS. The consensus is for a 0.1% decrease in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, the November NAHB homebuilder survey. The consensus is for a reading of 55, up from 54 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

CoStar: Commercial Real Estate prices increased in September

by Calculated Risk on 11/17/2014 04:14:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Price Surge Continues In Third Quarter

NATIONAL COMPOSITE INDICES CONTINUE TO CLIMB. Both the value-weighted and the equal-weighted U.S. Composite Indices of the CCRSI made strong gains in September 2014 to close the quarter. The value-weighted index, which is heavily influenced by core transactions, advanced by 1.9% in the month of September and 3.3% in the third quarter of 2014. The value-weighted index is now 2.8% above its prerecession high and continues to make solid gains. The equal-weighted U.S. Composite Index, which is heavily influenced by smaller non-core deals, increased by 1.3% in September and 4.2% in the third quarter of 2014.

...

ANNUAL PRICE GAINS REALIZED ACROSS ALL MAJOR PROPERTY SECTORS. The retail, industrial, and office segments all moved up toward 2007 pricing levels in September 2014 and are now within 11.4%, 14.4%, and 21.2% of their previous peaks, respectively. The multifamily sector, which recovered earlier than the other property types, is now 1% above its previous peak.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is above the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows indexes by sector.

The second graph shows indexes by sector.The multifamily sector is now above the previous peak. The office sector is lagging.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

WSJ: Audit shows FHA Back in Black

by Calculated Risk on 11/17/2014 12:59:00 PM

Update: Here is the summary Summary of FY2014 FHA Annual Report to Congress on the Financial Health of the Mutual Mortgage Insurance Fund

Joe Light at the WSJ writes: Federal Housing Authority in the Black for First Time Since 2011

The audit found that the FHA’s insurance fund had an economic value of $4.8 billion at the end of September, up from negative $1.1 billion last fiscal year. Its capital-reserve ratio, which the FHA is supposed to keep above 2%, grew to 0.41%. While an improvement, it was still short of last year’s projection.Recent FHA loans have performed very well, and the better performance combined with higher fees has led to the improvement.

...

More important, the report estimated that the FHA won’t return to the congressionally mandated 2% threshold until 2016, a year later than formerly estimated.

Fed: Industrial Production decreased 0.1% in October

by Calculated Risk on 11/17/2014 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in October after having advanced 0.8 percent in September. In October, manufacturing output increased 0.2 percent for the second consecutive month. The index for mining declined 0.9 percent and the output of utilities moved down 0.7 percent. At 104.9 percent of its 2007 average, total industrial production in October was 4.0 percent above its level of a year earlier. Capacity utilization for the industrial sector decreased 0.3 percentage point in October to 78.9 percent, a rate that is 1.2 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is 1.2 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.1% in October to 105.1. This is 25.3% above the recession low, and 4.1% above the pre-recession peak.

The monthly change for Industrial Production was below expectations.

NY Fed: Empire State Manufacturing Survey indicates "pace of growth somewhat faster than last month’s" in November

by Calculated Risk on 11/17/2014 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

The November 2014 Empire State Manufacturing Survey indicates that business activity continued to expand for New York manufacturers. The headline general business conditions index climbed four points to 10.2, indicating a pace of growth somewhat faster than last month’s. The new orders index rose eleven points to 9.1, and the shipments index advanced eleven points to 11.8. The index for number of employees edged down to 8.5 but remained positive, indicating that employment levels grew; the average workweek index, by contrast, was negative, pointing to a decline in hours worked. ...This is the first of the regional surveys for November. The general business conditions index was at the consensus forecast of a reading of 10.5, and indicates slightly faster expansion in November than in October (above zero suggests expansion).

emphasis added

Sunday, November 16, 2014

Monday: Industrial Production, Empire State Mfg Survey

by Calculated Risk on 11/16/2014 07:23:00 PM

Saturday, November 15th, was Doris "Tanta" Dungey's birthday. Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Monday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of 10.5, up from 6.2 in October (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

• Note: New York Fed to Publish Blog Series on Long-term Unemployment and Labor Market Slack

Weekend:

• Schedule for Week of November 16th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 4 and DOW futures are down 31 (fair value).

Oil prices were down over the last week with WTI futures at $75.84 per barrel and Brent at $79.51 per barrel. A year ago, WTI was at $94, and Brent was at $107 - so prices are down more than 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.89 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |