by Calculated Risk on 11/22/2014 11:56:00 AM

Saturday, November 22, 2014

Schedule for Week of November 23rd

This will be a short, but busy holiday week. The key reports this week are the second estimate of Q3 GDP, October New Home sales, October personal income and outlays, and September Case-Shiller house prices.

For manufacturing, the November Dallas and Richmond Fed surveys will be released this week.

Also, the NY Fed Q3 Report on Household Debt and Credit will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November.

8:30 AM: Gross Domestic Product, 3rd quarter 2014 (second estimate); Corporate Profits, 3rd quarter 2014 (preliminary estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised down from the advance estimate of 3.5%..

9:00 AM: FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

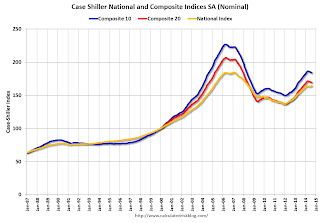

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the August 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.5% year-over-year increase in the National Index for September, down from 5.1% in August (consensus 4.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 4.7% year-over-year in September, and for prices to increase 0.1% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for the index to increase to 95.7 from 94.5.

11:00 AM: NY Fed Q3 2014 Household Debt and Credit Report. The New York Fed will also release an accompanying blog, which will analyze household deleveraging.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 288 thousand from 291 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 63.2, down from 66.2 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 90.0, up from the preliminary reading of 89.4, and up from the October reading of 86.9.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an increase in sales to 470 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 467 thousand in September.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 0.6% increase in the index.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.

Unofficial Problem Bank list declines to 411 Institutions

by Calculated Risk on 11/22/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 21, 2014.

Changes and comments from surferdude808:

The OCC provided an update on its latest enforcement action activity that resulted in several removals from the Unofficial Problem Bank List. For the week, there were four removals that push the list count to 411 institutions with assets of $126.6 billion. A year ago, there were 654 institutions with assets of $222.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 411.

The OCC terminated actions against Queensborough National Bank & Trust Company, Louisville, GA ($808 million); First Bank Richmond, National Association, Richmond, IN ($495 million); and First National Bank, Groesbeck, TX ($55 million). Texas Savings Bank, Snyder, TX ($74 million) found their way off the list by being acquired in an unassisted transaction.

Next week, we anticipate the FDIC will provide an update on its enforcement action activity, industry results for the third quarter, and updated aggregate figures for their official problem bank list.

Friday, November 21, 2014

Vehicle Sales Forecast: "Could Reach 17 Million" SAAR in November

by Calculated Risk on 11/21/2014 05:13:00 PM

The automakers will report November vehicle sales on Tuesday, December 2nd. Sales in October were at 16.35 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in November might be at or above 17 million SAAR.

Note: There were 25 selling days in November this year compared to 26 last year.

Here is an early forecast (I'll post more next week).

From WardsAuto: Forecast: SAAR Could Reach 17 Million for Second Time in Four Months

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17 million-unit seasonally adjusted annual rate for just the second time since 2006, after crossing that threshold most recently in August, when deliveries equated to a 17.4 million SAAR. The WardsAuto report is calling for 1.29 million light vehicles to be delivered over 25 selling days. The resulting daily sales rate of 51,461 units represents an 8.1% improvement over same-month year-ago (over 26 days) and a 9.1% month-to-month gain on October (27 days), slightly ahead of an average 6% October-November gain over the past three years. The 17 million-unit SAAR would be significantly higher than the 16.3 million recorded year-to-date through October, and would help bring 2014 sales in line with WardsAuto’s full year forecast of 16.4 million units.It appears there will be a strong finish to 2014 for both auto sales and the economy!

DOT: Vehicle Miles Driven increased 2.3% year-over-year in September

by Calculated Risk on 11/21/2014 01:33:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 2.3% (5.6 billion vehicle miles) for September 2014 as compared with September 2013.The following graph shows the rolling 12 month total vehicle miles driven.

Travel for the month is estimated to be 246.6 billion vehicle miles

Cumulative Travel for 2014 changed by 0.7% (16.7 billion vehicle miles).

The rolling 12 month total is slowly moving up, after moving sideways for a few years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 82 months - almost 7 years - and still counting. Currently miles driven (rolling 12 months) are about 1.8% below the previous peak.

The second graph shows the year-over-year change from the same month in the previous year.

In September 2014, gasoline averaged of $3.48 per gallon according to the EIA. That was down from September 2013 when prices averaged $3.60 per gallon.

In September 2014, gasoline averaged of $3.48 per gallon according to the EIA. That was down from September 2013 when prices averaged $3.60 per gallon. Prices will really be down year-over-year in October and November too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 7 years is probably also due to the lingering effects of the great recession (lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven - but it does seem like miles driven is now increasing.

Kansas City Fed: Regional Manufacturing "Activity Expanded Further" in November

by Calculated Risk on 11/21/2014 11:47:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slightly faster pace in November, and producers’ expectations for future activity increased further.The last regional Fed manufacturing surveys for November will be released next week (the Dallas and Richmond Fed surveys). So far the regional surveys have indicated solid growth in November - suggesting another strong reading for the ISM manufacturing survey - and significant optimism about the future.

“Regional factory growth improved somewhat in November, although many contacts reported that the cost to retain or hire quality employees is rising, said Wilkerson. The majority of firms expected activity to improve considerably in the next six months.”

The month-over-month composite index was 7 in November, up from 4 in October and 6 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes.... The employment index decreased from 16 to 10 ...

The future composite index moved higher from 17 to 22, and the future production, shipments, and order backlog indexes also rose. The future employment index jumped from 16 to 31, its highest level in almost nine years. In contrast, the future new orders index eased from 26 to 24, and the future capital expenditures index also edged lower.

emphasis added

BLS: Thirty-four States had Unemployment Rate Decreases in October

by Calculated Risk on 11/21/2014 10:14:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in October. Thirty-four states and the District of Columbia had unemployment rate decreases from September, 5 states had increases, and 11 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Georgia had the highest unemployment rate among the states in October, 7.7 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Georgia, at 7.7%, had the highest unemployment rate for the third consecutive month.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Eight states and D.C. are still at or above 7% (dark blue).

Black Knight: Mortgage Delinquencies decreased in October, Lowest in Seven Years

by Calculated Risk on 11/21/2014 07:31:00 AM

According to Black Knight's First Look report for October, the percent of loans delinquent decreased in October compared to September, and declined by 12% year-over-year. Mortgage delinquencies are at the lowest level since November 2007.

Also the percent of loans in the foreclosure process declined further in October and were down 33% over the last year. Foreclosure inventory was at the lowest level since February 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.44% in October, down from 5.67% in September. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 1.69% in October from 1.76% in September.

The number of delinquent properties, but not in foreclosure, is down 393,000 properties year-over-year, and the number of properties in the foreclosure process is down 418,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for October in early December.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2014 | Sept 2014 | Oct 2013 | Oct 2012 | |

| Delinquent | 5.44% | 5.67% | 6.28% | 7.40% |

| In Foreclosure | 1.69% | 1.76% | 2.54% | 3.87% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,658,000 | 1,760,000 | 1,869,000 | 1,957,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,101,000 | 1,118,000 | 1,283,000 | 1,543,000 |

| Number of properties in foreclosure pre-sale inventory: | 858,000 | 893,000 | 1,276,000 | 1,800,000 |

| Total Properties | 3,617,000 | 3,771,000 | 4,427,000 | 5,300,000 |

Thursday, November 20, 2014

Friday: State Employment, October Mortgage Delinquencies

by Calculated Risk on 11/20/2014 08:43:00 PM

A few excerpts from a research piece on wages by economist Nathan Harris at Merrill Lynch:

After the deep freeze last winter, the labor market has steadily recovered over the last 10 months. Payrolls have averaged about 240,000 and the unemployment rate has dropped mainly for “good reasons”—because of solid jobs rather than falling participation. While it is very hard to pin down the inflation neutral (NAIRU) unemployment rate in real time, we seem to be in the neighborhood of NAIRU. At 5.8%, the official U-3 measure has dipped below its 30-year average of 6.1% and is approaching estimates of NAIRU from the FOMC (5.2 to 5.5%) and the Congressional Budget Office (5.5%). We like to focus on the broader U-6 measure. If the rate of decline over the last year continues, it will hit its historical average by next year and its pre-crisis average by early 2016.Friday:

What is missing from this labor lullaby is some sign of normal wage growth. There have been a number of head fakes—jumps in erratic second-tier indicators and pockets of pressure that never expanded. However, the two best gauges of pressure, total average hourly earnings (AHE) and the employment cost index (ECI) have shown few signs of life.

The good news is that while AHE are still stuck at 2%, there are now early hints of a pick-up in the ECI. After a very weak 1Q reading the index was solid in both 2Q and 3Q. Moreover, the pick-up is broad-based, including both wages and benefits and increases for most occupational groups and industries. Finally, just maybe, labor compensation is starting to pick up.

Before we get too excited about improved income or inflation, keep in mind that the recovery in both wage and price inflation is likely to be very slow.

...

At this stage, it is not clear whether the long-awaited rise in labor costs has arrived or will start sometime next year. Two things are clear. First, the rise is likely to be very slow. Second, the Fed’s initial response will be to breathe a sigh of relief and they will only view it as a threat to the inflation target if it gets above its historic norm of 3.5%.

• Early, the Black Knight Financial Services’ “First Look” at October 2014 Mortgage Data.

• At 10:00 AM ET, the Regional and State Employment and Unemployment (Monthly) report for October 2014.

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

Quarterly Housing Starts by Intent

by Calculated Risk on 11/20/2014 05:55:00 PM

In addition to housing starts for October, the Census Bureau also released the Q3 "Started and Completed by Purpose of Construction" report yesterday.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released yesterday showed there were 125,000 single family starts, built for sale, in Q3 2014, and that was above the 111,000 new homes sold for the same quarter, so inventory increased in Q3 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling (although they started more in Q3 than they sold), and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 4% compared to Q3 2013.

Single family starts built for sale were up about 4% compared to Q3 2013. Owner built starts were up 20% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly and is at the highest level since the mid-80s.

A Few Comments on October Existing Home Sales

by Calculated Risk on 11/20/2014 01:43:00 PM

• Once again housing economist Tom Lawler's forecast of 5.31 million SAAR was closer than the consensus (5.15 million) to the NAR reported sales (5.26 million).

• The most important number in the NAR report each month is inventory. This morning the NAR reported that inventory was up 5.2% year-over-year in October. It is important to note that the NAR inventory data is "noisy" and difficult to forecast based on other data. However this increase in inventory has slowed price increases.

The headline NAR inventory number is not seasonally adjusted, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko has sent me the seasonally adjusted inventory. NOTE: The NAR does provide a seasonally adjusted months-of-supply, although that is in the supplemental data.

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 11.7% from the bottom. On a seasonally adjusted basis, inventory was up 0.1% in October compared to September.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, many "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

And another key point: The NAR reported total sales were up 2.5% from October 2013, however normal equity sales were even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed homes – foreclosures and short sales – increased slightly in September to 10 percent from 8 percent in August, but are down from 14 percent a year ago. Seven percent of September sales were foreclosures and 3 percent were short sales.Last year in October the NAR reported that 14% of sales were distressed sales.

A rough estimate: Sales in October 2013 were reported at 5.13 million SAAR with 14% distressed. That gives 718 thousand distressed (annual rate), and 4.41 million equity / non-distressed. In October 2014, sales were 5.26 million SAAR, with 10% distressed. That gives 526 thousand distressed - a decline of about 27% from October 2013 - and 4.73 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 7%..

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in October (red column) were at the highest level for October since 2006.

This was another solid report.

Earlier:

• Existing Home Sales in October: 5.26 million SAAR, Inventory up 5.2% Year-over-year