by Calculated Risk on 10/01/2015 03:15:00 PM

Thursday, October 01, 2015

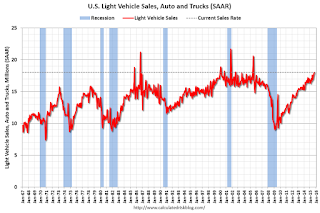

U.S. Light Vehicle Sales increased to 18 million annual rate in September

Based on a WardsAuto estimate, light vehicle sales were at a 18.03 million SAAR in September. That is up almost 10% from September 2014, and up 1.7% from the 17.7 million annual sales rate last month.

Labor day was included in September this year, and that probably pushed sales over 18 million.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 18.03 million SAAR from WardsAuto).

This was above to the consensus forecast of 17.5 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was another very strong month for auto sales and it appears 2015 will be the best year for light vehicle sales since 2001.

Reis: Office Vacancy Rate declined in Q3 to 16.5%

by Calculated Risk on 10/01/2015 01:17:00 PM

Reis released their Q3 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.5% in Q3, from 16.6% in Q2. This is down from 16.8% in Q3 2014, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

During the third quarter, net absorption exceeded construction which caused vacancy to decline by 10 basis points to 16.5%. This marks the fourth time in the last five quarters that vacancy declined and kept the rate at its lowest level since the second quarter of 2009. Slowly and quietly, the recovery in the office market is gathering pace. 2015 is shaping up to be the best year for demand for office space since 2007, before the recession. Year‐to‐date figures for most metrics are already well ahead of last year. Because the improvement in the office market has been so gradual, it has largely gone unnoticed by many in the industry. However, improvement is becoming stronger and more consistent which portends better times ahead for the office market over the next five years.

...

Occupied stock increased by 9.865 million square feet during the third quarter. This was an increase versus last quarter and indicating of the gradual strengthening of demand for office space. Moreover, year‐to‐date figures show even more dramatic improvement. Through the third quarter net absorption for 2015 totaled 25.304 million SF. This exceeds the year‐to date figure from 2014 by 5.380 million SF, or roughly 26%. ...

New construction of 7.674 million SF is a bit of a decline from last quarter. While many lenders still require preleasing in order to provide construction and development financing, speculative new construction is slowly returning to the market. Admittedly, speculative projects remain at very low levels, well below cycles past, but their existence provides another sign of the ongoing recovery.

...

Asking and effective rents grew by 0.6% and 0.7%, respectively, during the third quarter, marking the twentieth consecutive quarter of asking and effective rent growth. These growth rates are more or less in line with the growth rates from last quarter. However, even though quarterly rent growth did not accelerate, year‐over‐year rental growth rates for both asking and effective rents did accelerate. Effective rent growth of 3.5% is quite strong for a market with such an elevated vacancy rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.5% in Q2.

Office vacancy data courtesy of Reis.

Construction Spending increased 0.7% in August, Up 13.7% YoY

by Calculated Risk on 10/01/2015 11:07:00 AM

The Census Bureau reported that overall construction spending increased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2015 was estimated at a seasonally adjusted annual rate of $1,086.2 billion, 0.7 percent above the revised July estimate of $1,079.1 billion. The August figure is 13.7 percent above the August 2014 estimate of $955.0 billion.Both private spending and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $788.0 billion, 0.7 percent above the revised July estimate of $782.3 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas has been declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In August, the estimated seasonally adjusted annual rate of public construction spending was $298.2 billion, 0.5 percent above the revised July estimate of $296.8 billion.

emphasis added

As an example, construction spending for private lodging is up 43% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 9% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 44% below the bubble peak.

Non-residential spending is only 3% below the peak in January 2008 (nominal dollars).

Public construction spending is now 9% below the peak in March 2009 and about 12% above the post-recession low.

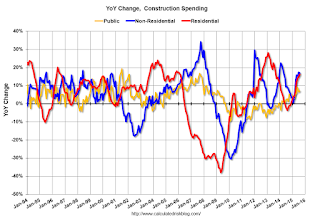

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 16%. Non-residential spending is up 17% year-over-year. Public spending is up 7% year-over-year.

Looking forward, all categories of construction spending should increase this year and in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This was at the consensus forecast of a 0.7% increase, however spending for June and July were revised down. Overall, another solid construction report.

ISM Manufacturing index decreased to 50.2 in September

by Calculated Risk on 10/01/2015 10:04:00 AM

The ISM manufacturing index barely suggested expansion in September. The PMI was at 50.2% in September, down from 51.1% in August. The employment index was at 50.5%, down from 51.2% in August, and the new orders index was at 50.1%, down from 51.6%.

From the Institute for Supply Management: September 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in September for the 33rd consecutive month, and the overall economy grew for the 76th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The September PMI® registered 50.2 percent, a decrease of 0.9 percentage point from the August reading of 51.1 percent. The New Orders Index registered 50.1 percent, a decrease of 1.6 percentage points from the reading of 51.7 percent in August. The Production Index registered 51.8 percent, 1.8 percentage points below the August reading of 53.6 percent. The Employment Index registered 50.5 percent, 0.7 percentage point below the August reading of 51.2 percent. Backlog of Orders registered 41.5 percent, a decrease of 5 percentage points from the August reading of 46.5 percent. The Prices Index registered 38 percent, a decrease of 1 percentage point from the August reading of 39 percent, indicating lower raw materials prices for the 11th consecutive month. The New Export Orders Index registered 46.5 percent, the same reading as in August. Comments from the panel are mixed with some concern about the global economy and customer confidence."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.5%, and indicates slower manufacturing expansion in September.

Weekly Initial Unemployment Claims increased to 277,000

by Calculated Risk on 10/01/2015 08:35:00 AM

The DOL reported:

In the week ending September 26, the advance figure for seasonally adjusted initial claims was 277,000, an increase of 10,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 270,750, a decrease of 1,000 from the previous week's unrevised average of 271,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 270,750.

This was above the consensus forecast of 272,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, September 30, 2015

Thursday: Vehicle Sales, ISM Mfg, Construction Spending, Unemployment Claims

by Calculated Risk on 9/30/2015 10:10:00 PM

From the WSJ: Congress Passes Bill to Fund Government Through Dec. 11

Congress now confronts a new Dec. 11 deadline to try to strike a long-term budget deal at a time when House Republicans are losing their most experienced leader and remain split about how to negotiate with Mr. Obama and Democrats.Thursday:

Moreover, the stopgap measure will end around the time when Congress also has to consider raising the debt ceiling, and one week before a key Federal Reserve meeting, at which many economists expect the central bank to raise interest rates for the first time in nearly a decade. Lawmakers also will contend with a long-term highway bill and expiring tax breaks at year’s end.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 272 thousand initial claims, up from 267 thousand the previous week.

• At 10:00 AM, the ISM Manufacturing Index for September. The consensus is for the ISM to be at 50.5, down from 51.1 in August. The ISM manufacturing index indicated expansion at 51.1% in August. The employment index was at 51.2%, and the new orders index was at 51.6%.

• Also at 10:00 AM, Construction Spending for August. The consensus is for a 0.7% increase in construction spending.

• All day: Light vehicle sales for September. The consensus is for light vehicle sales to decrease to 17.5 million SAAR in September from 17.7 million in August (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined slightly in August, Lowest since August 2008

by Calculated Risk on 9/30/2015 05:27:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined slightly in August to 1.62% from 1.63% in July. The serious delinquency rate is down from 1.99% in August 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has only fallen 0.37 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Restaurant Performance Index declines, Indicates slower expansion in August

by Calculated Risk on 9/30/2015 12:51:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Declined in August

As a result of softer same-store sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) declined in August. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.5 in August, down 1.2 percent from July and the lowest level in 11 months. Despite the decline, August represented the 30th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

“The RPI's August decline was the result of broad-based declines in the current situation indicators,” said Hudson Riehle, Senior Vice President, Research and Knowledge Group, National Restaurant Association. “Same-store sales and customer traffic softened from July’s strong levels, while the labor and capital spending indicators also dipped.

“Despite the declines, each of the current situation indicators were in expansion territory above 100, which indicates the restaurant industry remains on a positive growth trajectory,” Riehle added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.5 in August, up from 102.7 in July. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with the decline in the index, this is a solid reading.

Even with this decline, the index is indicating expansion, and it appears restaurants are benefiting from lower gasoline prices.

Chicago PMI declined sharply in September

by Calculated Risk on 9/30/2015 09:58:00 AM

Chicago PMI: Sep Chicago Business Barometer Down 5.7 Points to 48.7

The Chicago Business Barometer declined 5.7 points to 48.7 in September as Production growth collapsed and New Orders fell sharply.This was well below the consensus forecast of 53.6.

The drop in the Barometer to below 50 was its fifth time in contraction this year and comes amid downgrades to global economic growth and intense volatility in financial markets which have slowed activity in some industries. The latest decline followed two months of moderate expansion, and while growth in Q3 accelerated a little from Q2, the speed of the September descent is a source of concern.

...

Chief Economist of MNI Indicators Philip Uglow said, “While activity between Q2 and Q3 actually picked up, the scale of the downturn in September following the recent global financial fallout is concerning. Disinflationary pressures intensified and output was down very sharply. We await the October data to better judge whether this was a knee jerk reaction and there is a bounceback, or whether it represents a more fundamental slowdown.“

emphasis added

ADP: Private Employment increased 200,000 in September

by Calculated Risk on 9/30/2015 08:19:00 AM

Private sector employment increased by 200,000 jobs from August to September according to the September ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 190,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 12,000 jobs in September, off from 15,000 the previous month. The construction industry added 35,000 jobs in September, almost double the 18,000 gained in August. Meanwhile, manufacturing dropped into negative territory losing 15,000 jobs in September, the worst showing since December 2010.

Service-providing employment rose by 188,000 jobs in September, up from 172,000 in August. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “The U.S. job machine continues to produce jobs at a strong and consistent pace. Despite job losses in the energy and manufacturing industries, the economy is creating close to 200,000 jobs per month. At this pace full employment is fast approaching.”

The BLS report for September will be released Friday, and the consensus is for 203,000 non-farm payroll jobs added in September.