by Calculated Risk on 10/10/2015 08:15:00 AM

Saturday, October 10, 2015

Schedule for Week of October 11, 2015

The key economic reports this week is September retail sales on Tuesday.

For manufacturing, September Industrial Production will be released on Friday, and the October NY and Philly Fed manufacturing surveys will be released this week.

For prices, CPI will be released on Thursday.

The Bond Market and Banks will be closed in observance of the Columbus Day Holiday. The stock market will be open.

9:00 AM ET: NFIB Small Business Optimism Index for September.

2:00 PM: The Monthly Treasury Budget Statement for September (end of fiscal 2015).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

8:30 AM ET: Retail sales for September will be released.

8:30 AM ET: Retail sales for September will be released.This graph shows retail sales since 1992 through August 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 0.2% from July to August (seasonally adjusted), and sales were up 2.2% from August 2014.

The consensus is for retail sales to increase 0.1% in September, and to decrease 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for no change in inventories.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 263 thousand the previous week.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.2% decrease in CPI, and a 0.1% increase in core CPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for October. The consensus is for a reading of -7.0, up from -14.7.

10:00 AM: the Philly Fed manufacturing survey for October. The consensus is for a reading of -1.0, up from -6.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for September.This graph shows industrial production since 1967.

The consensus is for a 0.3% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.4%.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 5.753 million from 5.323 million in June

The number of job openings (yellow) were up 22% year-over-year, and Quits were up 6% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 89.5, up from 87.2 in September.

Friday, October 09, 2015

Sacramento Housing in September: Sales up 13%, Inventory down 19% YoY

by Calculated Risk on 10/09/2015 07:10:00 PM

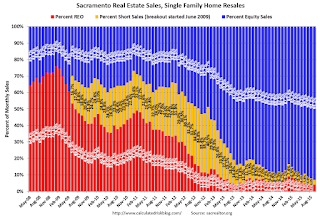

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In September, total sales were up 13.1% from September 2014, and conventional equity sales were up 18.5% compared to the same month last year.

In September, 6.9% of all resales were distressed sales. This was down from 7.8% last month, and down from 11.1% in September 2014. This is the lowest percentage of distressed sales since they started breaking out distressed sales).

The percentage of REOs was at 4.1% in September, and the percentage of short sales was 2.7.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales. Distressed sales are so small, the font doesn't fit.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 18.5% year-over-year (YoY) in September. This was the fifth consecutive monthly YoY decrease in inventory in Sacramento (a big recent change).

Cash buyers accounted for 15.6% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying.

Nomura on September CPI

by Calculated Risk on 10/09/2015 06:11:00 PM

Yesterday I posted some comments by Merrill Lynch economists on September CPI. Here is the take of economists at Nomura:

"Given the recent tightening in labor markets, higher wages in the health care sector and continued declines in the vacancy rate of rental houses, we think that the slowdown in core service inflation in August was temporary and still expect a gradual pick up in core inflation in the medium term. We expect a 0.17% m-o-m (1.8% y-o-y) gain in core CPI in September. We expect the continued decline in energy prices in September to weigh on the overall price index. As such, we expect headline prices to decline by 0.20% m-o-m (-0.1% y-o-y)."CPI for September will be released next Thursday.

"Is 2015 Peak Renter?" @TheStalwart @adsteel

by Calculated Risk on 10/09/2015 04:35:00 PM

Joe Weisenthal and Alix Steel have invited me to be on Bloomberg's 'What'd You Miss?' today. We are going to discuss demographics and the impact on renting.

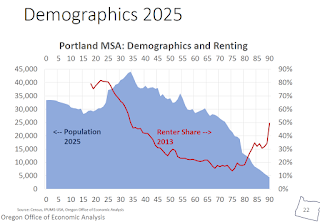

The title of this post is from a report by Oregon Office of Economic Analysis economist Josh Lehner on the Portland housing market. Josh was kind enough to allow me to use a couple of his graphs for my appearance on Bloomberg.

Here are the three graphs I'm planning on discussing:

The first graph is from my post yesterday: Demographic Impacts: Renting vs. Owning, Labor Force Participation, GDP

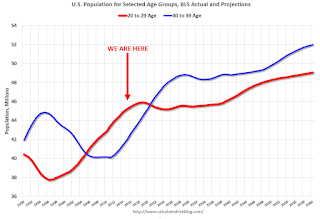

This graph shows the long term trend for two key age groups: 20 to 29, and 30 to 39.

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

Note: I used a similar graph five years ago to argue there would be a surge in rentals from both demographics, and also from people losing their homes to foreclosure.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

Renting peaks when people are in their 20s, and then steadily falls off (behavior may change a little going forward).

The second graph from Lehner shows population projections for 2025.

This doesn't mean 2015 is "peak renter". But this does suggest growth will slow for multi-family, but not a sharp decline.

The recent Reis survey on apartment vacancies and rents also suggests some slowdown, but overall the rental market is still very tight.

Hotel Occupancy: 2015 on pace for Best Year Ever

by Calculated Risk on 10/09/2015 01:05:00 PM

From HotelNewsNow.com: STR: US results for week ending 3 October

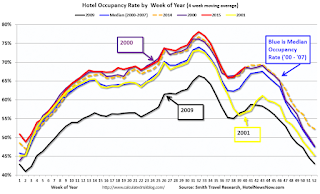

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 27 September through 3 October 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are now in the Fall business travel season.

In year-over-year measurements, the industry’s occupancy increased 3.4% to 68.8%. Average daily rate for the week was up 8.0% to US$124.96. Revenue per available room increased 11.6% to finish the week at US$86.01.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.Special Note: I added 2001 (yellow) to show the impact of 9/11/2001 on hotel occupancy. Occupancy was already down in 2001 due to the recession, and really collapsed following 9/11.

For 2015, the 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and 2015 will probably be the best year ever for hotels.

Occupancy Year-to-date:

1) 2015 67.5%

2) 2000 66.9%

3) 2014 66.3%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Q3 Review: Ten Economic Questions for 2015

by Calculated Risk on 10/09/2015 09:15:00 AM

At the end of each year, I post Ten Economic Questions for the coming year. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2015 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q3 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2015: How much will housing inventory increase in 2015?

Right now my guess is active inventory will increase further in 2015 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2015). I expect active inventory to move closer to 6 months supply this summer.According to the August NAR report on existing home sales, inventory was down 1.7% year-over-year in August, and the months-of-supply was at 5.2 months. I still expect inventory to increase in 2015, but it could be close.

9) Question #9 for 2015: What will happen with house prices in 2015?

In 2015, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. Low inventories, and a better economy (with more consumer confidence) suggests further price increases in 2015. I expect we will see prices up mid single digits (percentage) in 2015 as measured by these house price indexes.If is still early - house price data is released with a lag - but the Case Shiller data for July showed prices up 4.7% year-over-year. The year-over-year change seems to be moving mostly sideways recently in the mid single digits.

8) Question #8 for 2015: How much will Residential Investment increase?

My guess is growth of around 8% to 12% for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts might shift a little more towards single family in 2015.Through August, even with a weak start to the year, starts were up 11.3% year-over-year compared to the same period in 2014. New home sales were up 24% year-over-year through August - better than expected, but the comparisons will be more difficult going forward. So far this is a better than expected.

7) Question #7 for 2015: What about oil prices in 2015?

It is impossible to predict an international supply disruption - if a significant disruption happens, then prices will obviously move higher. Continued weakness in Europe and China does seem likely - and I expect the frackers to slow down with exploration and drilling, but to continue to produce at most existing wells at current prices (WTI at $55 per barrel). This suggests in the short run (2015) that prices will stay well below $100 per barrel (perhaps in the $50 to $75 range) - and that is a positive for the US economy.WTI futures are close to $50 per barrel.

6) Question #6 for 2015: Will real wages increase in 2015?

As the labor market tightens, we should start seeing some wage pressure as companies have to compete more for employees. Whether real wages start to pickup in 2015 - or not until 2016 or later - is a key question. I expect to see some increase in both real and nominal wage increases this year. I doubt we will see a significant pickup, but maybe another 0.5 percentage points for both, year-over-year.Through September, nominal hourly wages were up 2.2 year-over-year . I still expect a little more pick up over the next three months.

Note: I was more pessimistic than most on wages, and that was about right.

5) Question #5 for 2015: Will the Fed raise rates in 2015? If so, when?

The FOMC will not want to immediately reverse course, so the might wait a little longer than expected. Right now my guess is the first rate hike will happen at either the June, July or September meetings.June and September didn't happen. It could even be late this year, or even next year.

4) Question #4 for 2015: Will too much inflation be a concern in 2015?

Due to the slack in the labor market (elevated unemployment rate, part time workers for economic reasons), and even with some real wage growth in 2015, I expect these measures of inflation will stay mostly at or below the Fed's target in 2015. If the unemployment rate continues to decline - and wage growth picks up - maybe inflation will be an issue in 2016.Inflation was still low through August.

So currently I think core inflation (year-over-year) will increase in 2015, but too much inflation will not be a serious concern this year.

3) Question #3 for 2015: What will the unemployment rate be in December 2015?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to close to 5% by December 2015. My guess is based on the participation rate staying relatively steady in 2015 - before declining again over the next decade. If the participation rate increases a little, then I'd expect unemployment in the low-to-mid 5% range.The participation rate has mostly moved sideways this year, and the unemployment rate was 5.1% in September. This is on track for close to 5% in December.

2) Question #2 for 2015: How many payroll jobs will be added in 2015?

Energy related construction hiring will decline in 2015, but I expect other areas of construction to be solid.Through September 2015, the economy has added 1,779,000 jobs, or 198,000 per month. I still expect employment gains to average 200,000 to 225,000 per month in 2015 (lower than 2014, but still solid).

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - and more companies will have difficulty finding qualified candidates. Even with the overall boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2015 than in 2014.

So my forecast is for gains of about 200,000 to 225,000 payroll jobs per month in 2015. Lower than 2014, but another solid year for employment gains given current demographics.

1) Question #1 for 2015: How much will the economy grow in 2015?

Lower gasoline prices suggest an increase in personal consumption expenditures (PCE) excluding gasoline. And it seems likely PCE growth will be above 3% in 2015. Add in some more business investment, the ongoing housing recovery, some further increase in state and local government spending, and 2015 should be the best year of the recovery with GDP growth at or above 3%.Once again the first quarter was disappointing due to the weather, cutbacks in the oil sector, the West Coast port slowdown and the strong dollar, but there was some bounce back in Q2. It looks like GDP will be in the 2s again this year. Based on the August Personal Income and Outlays report, PCE growth will probably be at or above 3% this year.

Overall, so far, 2015 is unfolding about as expected.

Thursday, October 08, 2015

Merrill on September CPI

by Calculated Risk on 10/08/2015 11:14:00 PM

With the Fed focused on inflation, here is an excerpt from Merrill Lynch research piece today on September CPI to be released next week:

We expect headline CPI to decline for the second straight month, growing -0.3% in September after a -0.1% reading for August. Weak energy prices should more than offset a slight increase in food prices this past month. Such a reading will once again push the annual headline CPI inflation rate slightly negative, at -0.2% yoy for September. Stripping out food and energy should result in a 0.1% increase in core CPI in September, matching the pace of the prior two months. As a result, the annual core inflation rate should hold steady at 1.8%. Inflation looks likely to move largely sideways for the rest of this year.

Demographic Impacts: Renting vs. Owning, Labor Force Participation, GDP

by Calculated Risk on 10/08/2015 04:44:00 PM

Here is a review of three key demographic points:

1) Demographics have been favorable for apartments, and will become more favorable for homeownership.

2) Demographics are the key reason the Labor Participation Rate has declined.

3) Demographics are a key reason real GDP growth is closer to 2% than 4%.

• Renting vs. Owning

It was over five years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

Demographics are still favorable, but my sense is the move "from owning to renting" has slowed. And more supply has been coming online.

On demographics, a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts are 20 to 24 years old, and 25 to 29 years old (the largest cohorts are no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last five years - and I expect new apartment construction to stay relatively strong for a few more years.

And looking forward on demographics ...

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

• Labor Force Participation

A significant decline in the participation rate was expected based on demographics (there is an ongoing debate about how much is due to demographics, and how much of the decline is cyclical - however, as I've pointed out many time, a careful analysis suggests most of the decline is due to demographics).

But what about the decline in the prime working age labor force participation rate?

Each month I post the following graph of the participation rate and employment-population rate for prime working age (25 to 54 years old) workers. The following graph is through the September report.

The 25 to 54 participation rate decreased in September to 80.6%, and the 25 to 54 employment population ratio was unchanged at 77.2%.

A couple of key points:

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old). For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

First, here is a graph of the participation rate by 5 year age groups for the years 2000, 2005, 2010, and 2015.

1) the participation rate for the "prime working age" (25 to 54) is fairly flat (the six highest participation rates).

2) However, the lowest participation rate is for the 50 to 54 age group.

3) And notice that the participation rate for EACH prime age group was declining BEFORE the recession. (Dark blue is January 2000, and light blue is January 2005).

Everyone is aware that there large cohorts moving into retirement - and a large cohort in the 20 to 24 age group - but there has also been in a shift in the prime working age groups.

Since the lowest prime participation is for the 50 to 54 age group (the second lowest is for the 25 to 29 age group), lets focus on those two groups. The 50 to 54 age group is the red line (now the largest percentage of the prime working age) and the 25 to 29 age group is the blue line (now the second largest percentage). Just these shifts in prime demographics would lead to a somewhat lower prime working age participation rate. Overall, the impact of this shift is small compared to long term trends.

Lets focus on just one age group and just for men to look at the long term trend.

This fourth graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and new research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about the decline in the prime participation rate, we need to take these long term trends into account.

The bottom line is that the participation rate was declining for prime working age workers before the recession, there the key is understand and adjusting for the long term trend..

Here is a look at the participation rate of women in the prime working age groups over time.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and the prime working age participation rate is probably close to expected without the recession.

• GDP: 2% is the New 4%

And a third key point: We should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis.

One simple way to look at the change in GDP is as the change in the labor force, times the change in productivity. If the labor force is growing quickly, GDP will be higher with the same gains in productivity. And the opposite is true.

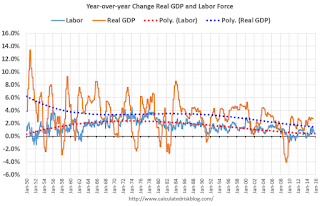

So here is a graph of the year-over-year change in the labor force since 1950 (data from the BLS).

The data is noisy - because of changes in population controls and the business cycle - but the pattern is clear as indicated by the dashed red trend line. The labor force has been growing slowly recently but the rate of increase has been declining for some time.

We could also look at just the prime working age population - I've pointed out before the that prime working age population has just started growing again after declining for a few years (see See: Prime Working-Age Population Growing Again)

Now here is a look at real GDP for the same period.

GDP was high in the early 50s - and early-to-mid 60s because of government spending (Korean and Vietnam wars). As in example, in 1951, national defense added added 6.5 percentage points to GDP. Of course we don't want another war ...

Now lets put the two graphs together.

The good news is that will change going forward (prime working age population will grow faster next decade). But right now, due to demographics, 2% real GDP growth is the new 4%.

FOMC Minutes: Waiting on Inflation

by Calculated Risk on 10/08/2015 02:05:00 PM

From the Fed: Minutes of the Federal Open Market Committee, September 16-17, 2015 . Excerpts:

In assessing whether economic conditions had improved sufficiently to initiate a firming in the stance of policy, many members said that the improvement in labor market conditions met or would soon meet one of the Committee's criteria for beginning policy normalization. But some indicated that their confidence that inflation would gradually return to the Committee's 2 percent objective over the medium term had not increased, in large part because recent global economic and financial developments had imparted some restraint to the economic outlook and placed further downward pressure on inflation in the near term. Most members agreed that their confidence that inflation would move to the Committee's inflation objective would increase if, as expected, economic activity continued to expand at a moderate rate and labor market conditions improved further. Many expected those conditions to be met later this year, although several members were concerned about downside risks to the outlook for real activity and inflation.

Other factors important to the Committee's assessment of the inflation outlook were the expectation that the influences of lower energy and commodity prices on headline inflation would abate, as had occurred in previous episodes, and that inflation expectations would remain stable. With energy and commodity prices expected to stabilize, members' projections of inflation incorporated a step-up in headline inflation next year. However, several members saw a risk that the additional downward pressure on inflation from lower oil prices and a higher foreign exchange value of the dollar could persist and, as a result, delay or diminish the expected upturn in inflation. And, while survey measures of longer-run inflation expectations remained stable, a couple of members expressed unease with the decline in market-based measures of inflation compensation over the intermeeting period.

After assessing the outlook for economic activity, the labor market, and inflation and weighing the uncertainties associated with the outlook, all but one member concluded that, although the U.S. economy had strengthened and labor underutilization had diminished, economic conditions did not warrant an increase in the target range for the federal funds rate at this meeting. They agreed that developments over the intermeeting period had not materially altered the Committee's economic outlook. Nevertheless, in part because of the risks to the outlook for economic activity and inflation, the Committee decided that it was prudent to wait for additional information confirming that the economic outlook had not deteriorated and bolstering members' confidence that inflation would gradually move up toward 2 percent over the medium term. One member, however, preferred to raise the target range for the federal funds rate at this meeting, indicating that the current low level of real interest rates was not appropriate in the context of current economic conditions.

emphasis added

Las Vegas Real Estate in September: Sales Increased 10% YoY, Inventory Down YoY

by Calculated Risk on 10/08/2015 10:52:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR Report on Local Housing Market Suggests Predictable Can Be Positive

Local home prices remained remarkably stable in September, according to a report released Thursday by the Greater Las Vegas Association of REALTORS® (GLVAR). GLVAR President Keith Lynam ... said the 2015 trend toward increasingly stable home prices and gradually increasing home sales is a healthy one for homeowners.There are several key trends that we've been following:

...

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in September was 3,285, up from 2,982 one year ago. Compared to September 2014, 14.3 percent more homes, but 6.3 percent fewer condos and townhomes, sold this September. So far in 2015, Lynam said local home sales remain ahead of last year’s sales pace.

For more than two years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In September, 6.8 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10.4 percent one year ago. Another 7.1 percent of September sales were bank-owned, down from 8.8 percent one year ago.

...

By the end of September, GLVAR reported 8,134 single-family homes listed without any sort of offer. That’s down 0.8 percent from one year ago. For condos and townhomes, the 2,311 properties listed without offers in September represented a 4.3 percent decrease from one year ago.

emphasis added

1) Overall sales were up 10.2% year-over-year.

2) Conventional (equity, not distressed) sales were up 17% year-over-year. In Sept 2014, 80.8% of all sales were conventional equity. In Sept 2015, 86.1% were standard equity sales.

3) The percent of cash sales has declined year-over-year from 34.3% in Sept 2014 to 26.8% in Sept 2015. (investor buying appears to be declining).

4) Non-contingent inventory is down 0.8% year-over-year. This was the first YoY decline in inventory since 2013. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build might be over.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

| Jun-15 | 4.3% |

| Jul-15 | 5.1% |

| Aug-15 | 3.5% |

| Sep-15 | -0.8% |