by Calculated Risk on 10/15/2015 03:19:00 PM

Thursday, October 15, 2015

Earlier: Philly and NY Fed Manufacturing Surveys showed contraction in October

From the Philly Fed: October Manufacturing Survey

Manufacturing conditions in the region continued to weaken in October, according to firms responding to this month’s Manufacturing Business Outlook Survey. The indicator for general activity remained negative, while the new orders and shipments indexes turned negative this month. Labor market indicators also weakened.This was below the consensus forecast of a reading of -1.0 for October.

...

he diffusion index for current activity remained negative for the second consecutive month, although it edged slightly higher from -6.0 in September to -4.5...

The survey’s indicators for labor market conditions suggest slightly weaker employment. The percentage of firms reporting declines in employment (15 percent) was slightly greater than the percentage reporting increases (13 percent). The employment index declined nearly 12 points, from 10.2 to -1.7.

emphasis added

From the NY Fed: October 2015 Empire State Manufacturing Survey

Business activity declined for a third consecutive month for New York manufacturers, according to the October 2015 survey. The general business conditions index edged up three points to -11.4, marking three straight months of readings below -10, the first such occurrence since 2009.

The index for number of employees fell for a fourth consecutive month, slipping two points to -8.5 in a sign that employment levels were lower. The average workweek index remained negative at -7.6, pointing to shorter workweeks.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys increased in September, but was still negative. This suggests another weak reading for the ISM survey.

Key Measures Show Inflation slightly higher in September

by Calculated Risk on 10/15/2015 12:06:00 PM

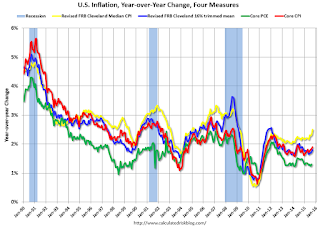

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.4% annualized rate) in September. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for September here. Motor fuel was down sharply again in September.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.2% (-1.8% annualized rate) in September. The CPI less food and energy rose 0.2% (2.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for August and increased 1.2% year-over-year.

On a monthly basis, median CPI was at 3.4% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI was at 2.6% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low, but mostly moving up a little.

Cost of Living Adjustment Unchanged in 2016, Contribution Base also Unchanged

by Calculated Risk on 10/15/2015 09:10:00 AM

With the release of the CPI report this morning, we now know the Cost of Living Adjustment (COLA), and the contribution base for 2016.

Currently CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). Here is a discussion from Social Security on the current calculation (no increase) and a list of previous Cost-of-Living Adjustments. Note: this is not the headline CPI-U.

The contribution and benefit base will be unchanged at $118,500 in 2016.

The National Average Wage Index increased to $46,481.52 in 2014, up 3.55% from $44,888.16 in 2013 (used to calculate contribution base). However, by law, since COLA was unchanged, the contribution base will be unchanged in 2016.

CPI decreased 0.2% in September, Weekly Initial Unemployment Claims decreased to 255,000

by Calculated Risk on 10/15/2015 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.2 percent in September on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index was essentially unchanged before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.2% decrease for CPI, and above the forecast of a 0.1% increase in core CPI.

The energy index fell 4.7 percent in September, with all major component indexes declining. The gasoline index continued to fall sharply and was again the main cause of the seasonally adjusted all items decrease. The indexes for fuel oil, electricity, and natural gas declined as well.

In contrast to the energy declines, the indexes for food and for all items less food and energy both accelerated in September. The food index rose 0.4 percent, its largest increase since May 2014. The index for all items less food and energy rose 0.2 percent in September.

emphasis added

The DOL reported:

In the week ending October 10, the advance figure for seasonally adjusted initial claims was 255,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 263,000 to 262,000. The 4-week moving average was 265,000, a decrease of 2,250 from the previous week's revised average. This is the lowest level for this average since December 15, 1973 when it was 256,750. The previous week's average was revised down by 250 from 267,500 to 267,250.The previous week was revised down to 262,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 265,000. This is the lowest level in over 40 years.

This was below the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, October 14, 2015

Thursday: CPI, Unemployment Claims, NY and Philly Fed Mfg Surveys

by Calculated Risk on 10/14/2015 06:21:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 263 thousand the previous week.

• Also at 8:30 AM, the Consumer Price Index for September from the BLS. The consensus is for a 0.2% decrease in CPI, and a 0.1% increase in core CPI.

• Also at 8:30 AM,NY Fed Empire State Manufacturing Survey for October. The consensus is for a reading of -7.0, up from -14.7.

• At 10:00 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of -1.0, up from -6.0.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drop After Weak Economic Data

Mortgage rates dropped quickly today, getting them much of the way back to lows seen at the beginning of the month. For context, there has only been one day in the past 5 months with better rates (Friday October 2nd, immediately following the weak jobs data). That means the average lender is quoting conventional 30yr fixed rates between 3.75 and 3.875% on top tier scenarios. A few of the more aggressive lenders are already back down to 3.625%Here is a table from Mortgage News Daily:

Fed's Beige Book: "Modest Expansion in Economic Activity"

by Calculated Risk on 10/14/2015 02:03:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of New York and based on information collected on or before October 5, 2015."

Reports from the twelve Federal Reserve Districts point to continued modest expansion in economic activity during the reporting period from mid-August through early October. The pace of growth was characterized as modest in the New York, Philadelphia, Cleveland, Atlanta, Chicago, and St. Louis Districts, while the Minneapolis, Dallas, and San Francisco Districts described growth as moderate. Boston and Richmond reported that activity increased. Kansas City, on the other hand, noted a slight decline in economic activity. Compared with the previous report, the pace of growth is said to have slowed in the Richmond and Chicago Districts. A number of Districts cite the strong dollar as restraining manufacturing activity as well as tourism spending. Business contacts across the nation were generally optimistic about the near-term outlook.And on real estate:

Residential real estate activity has generally improved since the last report, with almost all Districts reporting rising prices and sales volume. One exception was the Chicago District, where prices and sales volume were generally steady. A number of Districts noted that the market for lower or moderately priced homes has outperformed the high end of the market. The inventory of available homes was reported to be low in the Boston, New York, Richmond, and St. Louis Districts; and San Francisco reported a shortage of available land in some areas. On the other hand, Philadelphia reported adequate inventories, and Dallas noted a fair amount of supply in the pipeline. Boston, New York, and Chicago indicated rising residential rents, while Minneapolis reported sharp declines in rents in energy-producing areas of North Dakota. Residential construction has been mixed but generally stronger in the latest reporting period, with multi-family outpacing single-family construction. Strong multi-family construction was highlighted in the New York, Cleveland, Richmond, and San Francisco Districts, while Atlanta reported strong residential construction generally. However, Minneapolis and Kansas City reported declines in new home construction. Philadelphia mentioned a lack of new construction, while Dallas reported that new construction has been restrained by labor shortages; Chicago indicated little change.Positive in real estate.

Commercial real estate markets have shown signs of strengthening in all twelve Districts. Most Districts noted improvement across all major segments, though New York and St. Louis noted some increased slack in the market for retail space. Commercial construction was also stronger in most Districts. Boston and St. Louis noted brisk construction in the health sector, including senior care facilities, and Cleveland also indicated strong demand for senior living structures. New York, on the other hand, noted some pullback in new commercial construction, though activity remained fairly brisk.

emphasis added

Altanta Fed GDPNow tracking 0.9% for Q3

by Calculated Risk on 10/14/2015 12:08:00 PM

From the Atlanta Fed: Latest forecast — October 14, 2015

The GDPNow model nowcast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2015 is 0.9 percent on October 14, down from 1.0 percent on October 9. The model's nowcast for real consumer spending growth in the third quarter fell from 3.6 percent to 3.2 percent after this morning's retail sales report from the U.S. Census Bureau. This was partly offset by an 0.1 percentage point increase in the nowcast for the contribution of inventory investment to third-quarter real GDP growth following this morning's update on retail inventories from the Census Bureau.Note that consumer spending is expected to be solid (probably in the mid 3s).

Sometimes GDPNow has been very close - other times they've missed (In June, GDPNow was forecasting Q2 at 1.1% and the first BEA report was 2.3% - since revised up to 3.9%).

Retail Sales increased 0.1% in September

by Calculated Risk on 10/14/2015 08:41:00 AM

On a monthly basis, retail sales were up 0.1% from August to September (seasonally adjusted), and sales were up 2.4% from September 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $447.7 billion, an increase of 0.1 percent from the previous month, and 2.4 percent above September 2014. ... The July 2015 to August 2015 percent change was revised from +0.2 percent to virtually unchanged.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.8% on a YoY basis (2.4% for all retail sales including gasoline).

Retail and Food service sales ex-gasoline increased by 4.8% on a YoY basis (2.4% for all retail sales including gasoline).The increase in September was at the consensus expectations of a 0.1% increase, however sales in August were revised down - gasoline sales were revised down - and retail sales for July were revised up.

MBA: Mortgage Applications Down Sharply due to TILA-RESPA regulatory change

by Calculated Risk on 10/14/2015 07:01:00 AM

Last week I noted that the surge was related to applications being filed before the TILA-RESPA regulatory change, and that I expected applications to decline significant in the survey this week since demand was pulled forward. So the decline is not a surprise - just a reverse of the previous week.

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 27.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 9, 2015.

...

The Refinance Index decreased 23 percent from the previous week. The seasonally adjusted Purchase Index decreased 34 percent from one week earlier. The unadjusted Purchase Index decreased 34 percent compared with the previous week and was 1 percent lower than the same week one year ago.

“Application volume plummeted last week in the wake of the implementation of the new TILA-RESPA integrated disclosures, which caused lenders to significantly revamp their business processes, and as a result dramatically slowed the pace of activity. The prior week’s results evidently pulled forward much of the volume that would have more naturally taken place into this week. Purchase volume for the week was below last year’s pace, the first year over year decrease since February 2015, while refinance volume dropped sharply even with little change in mortgage rates,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 3.99 percent, with points increasing to 0.53 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

This week was just the reverse of last week.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 1% lower than a year ago.

The surge last week was related to applications being filed before the TILA-RESPA regulatory change, and the decline this week was the inverse. The wild swings should resolve fairly quickly.

Tuesday, October 13, 2015

NBER Paper: "Strategic default rarely occurs"

by Calculated Risk on 10/13/2015 06:58:00 PM

Ht to Nick Timiraos for link to the paper.

An NBER paper from Kristopher Gerardi, Kyle F. Herkenhoff, Lee E. Ohanian, and Paul S. Willen Can’t Pay or Won’t Pay? Unemployment, Negative Equity, and Strategic Default

On the flip side we find that less than 1 percent of “can pay” households, which we define to be households that are employed and have at least 6 months worth of mortgage payments in stock, bonds, or liquid assets (net of unsecured debt) are in default. Conditioning on negative equity does not have much effect as only 5 percent of “can pay” borrowers with negative equity are in default. Thus, the vast majority of borrowers in positions of negative equity continue paying their mortgages, which suggests that strategic default rarely occurs.Not a surprise. The researchers also found the opposite - that most people with few assets, negative equity and unemployed - still finds ways to make their mortgage payments.

Suppose we define “can’t pay” to be households without a job and with less than one month of mortgage payments in stock, bonds, or liquid assets (net of unsecured debt). The data show that approximately 19 percent of these “can’t pay households” are in default as compared to only 4 percent in the population as a whole. What is surprising though is the flip side of that 19 percent: 81 percent of “can’t pay” households are current on their loans. In other words, despite no income and no savings, most households in this group continue to pay their mortgages. Furthermore, we show that these striking patterns remain even when conditioning on negative equity.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Producer Price Index for September from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, Retail sales for September will be released. The consensus is for retail sales to increase 0.1% in September, and to decrease 0.1% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for no change in inventories.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.