by Calculated Risk on 10/18/2015 09:46:00 AM

Sunday, October 18, 2015

Goldman Sachs Expects "Fed Liftoff" in December

A few excerpts from a research piece by Goldman Sachs chief economist Jan Hatzius: Q&A on Fed Liftoff

We still expect a rate hike at the December FOMC meeting. The leadership has signaled that such a move is likely if the economy and markets evolve broadly as expected, and our forecast is similar to theirs. However, we are only about 60% confident. Most of the uncertainty relates to the possibility that the economic and market environment—or in a broad sense, “the data”—will be worse than the FOMC’s (and our) expectations.

...

The low market-implied probability of a December hike of only 30%-40% probably reflects a mixture of concerns about the data (which we find reasonable) and a belief among some market participants that the FOMC will find an “excuse” to stay on hold even if the economy does fine (which we find unreasonable). ...

Our own view is that it might make sense to start normalizing in December if we were perfectly confident in our baseline forecast for the economy. But uncertainty around that forecast still argues for waiting longer. The main reason is risk management.

Saturday, October 17, 2015

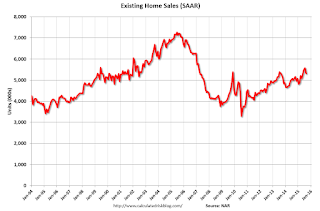

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 10/17/2015 04:01:00 PM

The NAR will report September Existing Home Sales on Thursday, October 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.35 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.31 million SAAR in August.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 5 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last five years, the consensus average miss was 146 thousand with a standard deviation of 150 thousand. Lawler's average miss was 69 thousand with a standard deviation of 50 thousand.

NOTE: Last month was Lawler's largest miss by 0.23 million SAAR (read his explanation here). For comparison, the consensus' largest miss was 0.83 million. Ouch.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | --- |

| 1NAR initially reported before revisions. | |||

Schedule for Week of October 18th

by Calculated Risk on 10/17/2015 08:11:00 AM

The key economic reports this week are September housing starts on Tuesday, and September Existing Home Sales on Thursday.

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 62, unchanged from September. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. Total housing starts decreased to 1.126 million (SAAR) in August. Single family starts decreased to 739 thousand SAAR in August.

The consensus for 1.147 million, up from August.

10:00 AM ET: Regional and State Employment and Unemployment for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 255 thousand the previous week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data.

9:00 AM: FHFA House Price Index for August 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.35 million SAAR, up from 5.31 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.35 million SAAR, up from 5.31 million in August. Economist Tom Lawler estimates the NAR will report sales of 5.56 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

11:00 AM: the Kansas City Fed manufacturing survey for September.

During the day: Q3 NMHC Apartment Tightness Index.

No economic released scheduled.

Friday, October 16, 2015

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/16/2015 04:42:00 PM

From housing economist Tom Lawler:

Based on publicly-released realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.56 million in September, up about 4.7% from August’s preliminary pace and up 9.0% from last September’s seasonally-adjusted pace. I expect the NAR’s estimate of the inventory of existing homes for sale at the end of September to be down about 1.7% from August’s preliminary estimate, and down about 1.3% from last September. Finally, I expect the NAR’s median existing home sales price estimate for September to be up about 5.5% from last September.

Post-Mortem on August’s Existing Home Sales Report: NAR’s Estimate of the YOY % Change in Unadjusted Sales Seems Reasonable

On September 21st the NAR estimated that US existing home sales ran at a seasonally adjusted annual rate of 5.31 million in August – far below both the “consensus” forecast and my projection based on realtor/MLS reports available as of September 15th. As I acknowledged following the NAR EHS report for August, part of my “miss” reflected a “misread” of the likely seasonal factor used to adjust the “raw” sales data. However, my projection was also off because the “sample” of local realtor/MLS reports I had available as of September 15th proved to be a poor representation of the larger sample of local realtor/MLS reports for August that include reports subsequently released. Based on this larger sample, the NAR’s estimate of the YOY % change in existing home sales in August seems broadly consistent with local realtor/MLS reports.

If, in fact, my September projection for existing home sales is correct, then one might ask: why have there been such large month swings in seasonally-adjusted home sales over the past several months? My gut is that some of these swings have been less related to volatile markets, and more related to difficulties in accurately estimating the true “seasonal” component of existing home sales. Statistical estimates of this seasonal pattern of home sales have changed considerably over the past 10-15 years, and it is quite possible that some of the observed change in the “seasonal” pattern may actually be related to other forces (witness, e.g., the huge increase in the amplitude of “seasonal” swings in home prices since the housing collapse, which most analyst attribute to the combination of the surge in distressed sales and the seasonal pattern of the distressed-sales share of total home sales).

CR Note: The NAR is scheduled to release September Existing Home Sales on Thursday, Oct 22nd. The consensus forecast is for 5.36 million (this will move up after this is posted). Take the over!

Treasury: "There is Only One Solution to the Debt Limit"

by Calculated Risk on 10/16/2015 03:30:00 PM

From the U.S. Treasury: There is Only One Solution to the Debt Limit

Some commentators have suggested that the President could invoke the Fourteenth Amendment of the Constitution as a justification for issuing debt in excess of the debt limit. Others have suggested that Treasury could mint and issue a large-denomination platinum coin to obtain cash without exceeding the debt limit. But as we’ve said before, the Fourteenth Amendment does not give the President the power to ignore the debt ceiling. And neither the Treasury nor the Federal Reserve believes that the law can or should be used to produce platinum coins for the purpose of avoiding an increase in the debt limit.It is the responsibility of Congress - and Congress alone - to pay the bills. Default is not an option. They have less than 3 weeks to act ...

As the Chair of the Council of the Inspectors General on Financial Oversight (CIGFO) explained in 2012, Treasury found no option that could reasonably protect the full faith and credit of the United States and the American people from very serious harm. Additionally, CIGFO noted that Treasury viewed the option of delaying payments as the least harmful among these options. But this option would still be default. Fortunately, because Congress ultimately took action, no final decision was needed.

With some in Congress again suggesting that we prioritize principal and interest while missing payments on other obligations, it’s worth considering again why this is such an unacceptable outcome. It is simply default by another name.

...

Principal and interest on the debt are only part of our obligations. Prioritizing principal and interest would mean paying some of our creditors – many of whom are foreign institutions – while defaulting on across-the-board payments everywhere else. That would include payments to members of the military, veterans, and senior citizens. It would include payments on infrastructure projects. In this scenario that America defaults on its obligations, there would be no way to prevent significant disruptions and hardship for millions of Americans. Default would undermine confidence in the creditworthiness of the United States.

...

For 226 years, we have been a country that pays all our bills. We can’t break that trust with our creditors and investors and put the full faith and credit of the United States in question. And we can’t break that trust with our citizens.

emphasis added

Earlier: Preliminary October Consumer Sentiment increases to 92.1

by Calculated Risk on 10/16/2015 12:09:00 PM

The preliminary University of Michigan consumer sentiment index for October was at 92.1, up from 87.2 in September.

"The rebound in confidence signifies that consumers have concluded that the fears expressed on Wall Street did not extend to Main Street. Importantly, the renewed confidence did not simply represent a relief rally, but instead reflected renewed optimism. Personal financial expectations rose to their highest level since 2007, as did consumers' views toward purchases of durable goods. While consumers anticipate a continued economic expansion, many expected strong headwinds from falling commodity prices, weakened economies in China and elsewhere as well as continued stresses on European countries. Perhaps the most important finding is that low inflation and continued job growth have enabled consumers to adapt to a slower and more variable rate of economic growth by varying the pace of their spending without losing confidence that the expansion will continue. Overall, the data still indicate that consumption will expand at 2.9% during 2016."This was above the consensus forecast of 89.5.

Click on graph for larger image.

BLS: Jobs Openings decreased to 5.4 million in August

by Calculated Risk on 10/16/2015 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings decreased to 5.4 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. The number of hires and separations was little changed at 5.1 million and 4.8 million, respectively. Within separations, the quits rate was 1.9 percent for the fifth month in a row, and the layoffs and discharges rate was unchanged at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in August, little changed from July. The number of quits has held between 2.7 million and 2.8 million for the past 12 months after increasing steadily since the end of the recession.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for August, the most recent employment report was for September.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in August to 5.370 million from 5.668 million in July.

The number of job openings (yellow) are up 9% year-over-year compared to August 2014.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a decent report. Even though Job Openings decreased, this was from the record high in July - and Openings are still up 9% year-over-year.

Fed: Industrial Production decreased 0.2% in September

by Calculated Risk on 10/16/2015 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.2 percent in September after edging down 0.1 percent in August. The decline in August is smaller than previously reported. In September, manufacturing output moved down 0.1 percent for a second consecutive monthly decrease; the index for mining fell 2.0 percent, while the index for utilities rose 1.3 percent. For the third quarter as a whole, total industrial production rose at an annual rate of 1.8 percent, and manufacturing output increased 2.5 percent. A strong gain for motor vehicles and parts contributed substantially to the quarterly increases. At 107.1 percent of its 2012 average, total industrial production in September was 0.4 percent above its year-earlier level. Capacity utilization for the industrial sector fell 0.3 percentage point in September to 77.5 percent, a rate that is 2.6 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is 2.6% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.2% in September to 107.1. This is 22.8% above the recession low, and 1.8% above the pre-recession peak.

This was above expectations of a 0.3% decrease and August was revised up. A decent report given the weakness in oil and the strong dollar.

Thursday, October 15, 2015

Friday: Industrial Production, Jobs Openings, Consumer Sentiment

by Calculated Risk on 10/15/2015 09:01:00 PM

Commercial real estate prices are increasing significantly, from CoStar: CCRSI: Commercial Property Price Growth Continued To Heat Up In August

While construction is rising in many markets, aggregate demand across the major property types continues to outstrip supply, resulting in tighter vacancy rates and rent growth, which in turn, continues to drive strong investor interest in commercial real estate. In August 2015, the two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 1.3% and 1%, respectively, and 12.6% and 11.4%, respectively, in the 12 months ended August 2015.These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Friday:

• At 9:15 AM ET, the Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.3% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.4%.

• At 10:00 AM, Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings increased in July to 5.753 million from 5.323 million in June. The number of job openings were up 22% year-over-year, and Quits were up 6% year-over-year.

• Also at 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 89.5, up from 87.2 in September.

LA area Port Traffic declined in September

by Calculated Risk on 10/15/2015 06:00:00 PM

Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled in late February. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.6% compared to the rolling 12 months ending in August. Outbound traffic was down 0.6% compared to 12 months ending in August.

The recent downturn in exports might be due to the strong dollar and weakness in China.

For imports, August was the all time inbound record, so some of September probably arrived in August (might be related to timing of Labor Day).

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 6% year-over-year in September; exports were down 7% year-over-year.

For the July through September period, imports were up 3.5% year-over-year.

This data suggests a slightly smaller trade deficit with Asia in September than in August.