by Calculated Risk on 10/21/2015 07:03:00 AM

Wednesday, October 21, 2015

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Applications up 9% YoY

This index has had some wild swings recently due to the TILA-RESPA regulatory change that led to a surge in activity as borrowers filed applications before the change, and then a sharp decline in the survey released last week.

From the MBA: Government Applications Drive Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 16, 2015. This week’s results include an adjustment to account for the Columbus Day holiday.

...

The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 16 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 9 percent higher than the same week one year ago.

“On an adjusted basis, application volume increased last week, led by a sharp rebound in government volume. We expect that application volume will remain volatile over the next few weeks as the industry continues to implement TILA-RESPA integrated disclosures,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.95 percent, the lowest level since May 2015, from 3.99 percent, with points decreasing to 0.43 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 9% higher than a year ago.

The wild swings should resolve fairly quickly.

Tuesday, October 20, 2015

Retail: October Seasonal Hiring vs. Holiday Retail Sales

by Calculated Risk on 10/20/2015 05:09:00 PM

Every year I track seasonal retail hiring for hints about holiday retail sales. At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales.

First, here is the NRF forecast for this year: National Retail Federation Forecasts Holiday Sales to Increase 3.7%

[T]he National Retail Federation ... expects sales in November and December (excluding autos, gas and restaurant sales) to increase a solid 3.7 percent to $630.5 billion — significantly higher than the 10-year average of 2.5 percent. Holiday sales in 2015 are expected to represent approximately 19 percent of the retail industry’s annual sales of $3.2 trillion. Additionally, NRF is forecasting online sales to increase between 6 and 8 percent to as much as $105 billion.Note: NRF defines retail sales as including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

ccording to NRF, retailers are expected to hire between 700,000 and 750,000 seasonal workers this holiday season, in line with last year’s 714,000 new holiday positions.

Here is a graph of retail hiring for previous years based on the BLS employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired about 755 thousand seasonal workers last year (using BLS data, Not Seasonally Adjusted), and 186 thousand seasonal workers last October.

Note that in the early '90s, retailers started hiring seasonal workers earlier - and the trend towards hiring earlier has continued.

The following scatter graph is for the years 2005 through 2014 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.84 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.84 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.When the October employment report is released on November 6th, I'll be looking at seasonal retail hiring for hints on what the retailers expect for the holiday season.

Comments on September Housing Starts

by Calculated Risk on 10/20/2015 01:32:00 PM

Total housing starts in September were above expectations, mostly due to an increase in the volatile multi-family sector.

However permits were down in September for multi-family (and down slightly year-over-year).

Earlier: Housing Starts increased to 1.206 Million Annual Rate in September

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Single family starts are running 11.0% ahead of 2014 through September, and single family starts were up 12.0% year-over-year in September.

Starts for 5+ units are up 14.8% for the first nine months compared to last year.

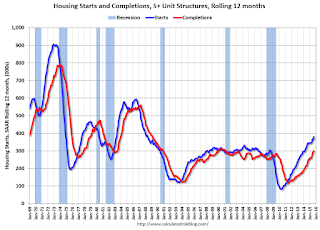

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply and are up 25% year-over-year.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked in June (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, but I expect less growth from multi-family going forward.

BLS: Thirty-seven States had Unemployment Rate Decreases in September

by Calculated Risk on 10/20/2015 10:43:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in September. Thirty-seven states and the District of Columbia had unemployment rate decreases from August, six states had increases, and seven states had no change, the U.S. Bureau of Labor Statistics reported today.

...

North Dakota had the lowest jobless rate in September, 2.8 percent, followed by Nebraska, 2.9 percent. West Virginia had the highest rate, 7.3 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. West Virginia, at 7.3%, had the highest state unemployment rate.

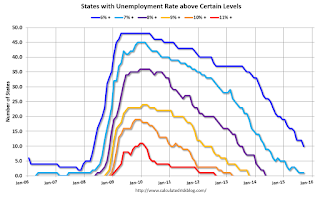

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (purple); Only one state (West Virginia) was at or above 7% (light blue), and ten states are at or above 6% (dark blue).

Housing Starts increased to 1.206 Million Annual Rate in September

by Calculated Risk on 10/20/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,206,000. This is 6.5 percent above the revised August estimate of 1,132,000 and is 17.5 percent above the September 2014 rate of 1,026,000.

Single-family housing starts in September were at a rate of 740,000; this is 0.3 percent above the revised August figure of 738,000. The September rate for units in buildings with five units or more was 454,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,103,000. This is 5.0 percent below the revised August rate of 1,161,000, but is 4.7 percent above the September 2014 estimate of 1,053,000.

Single-family authorizations in September were at a rate of 697,000; this is 0.3 percent below the revised August figure of 699,000. Authorizations of units in buildings with five units or more were at a rate of 369,000 in September.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in September. Multi-family starts were up sharply year-over-year.

Single-family starts (blue) increased in September and are up about 12% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),Total housing starts in September were above expectations, and starts were mostly unchanged for July and August. I'll have more later ...

Monday, October 19, 2015

Tuesday: Housing Starts

by Calculated Risk on 10/19/2015 06:48:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Quietly Holding Near Lows

Most lenders continue to quote conventional 30yr fixed rates in the 3.75% to 3.875% range. Any changes from yesterday would be seen in the form of microscopic adjustments to the upfront cost/credit (as opposed to the "note rate" itself). Apart from October 2nd, today's rates sheets are right in line with the recent run of 5-month lows.Tuesday:

emphasis added

• At 8:30 AM ET, Housing Starts for September. Total housing starts decreased to 1.126 million (SAAR) in August. Single family starts decreased to 739 thousand SAAR in August. The consensus for 1.147 million, up from August.

• At 10:00 AM, Regional and State Employment and Unemployment for September.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in September

by Calculated Risk on 10/19/2015 02:34:00 PM

Economist Tom Lawler sent me a preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in September.

On distressed: Total "distressed" share is down in most of these markets. Distressed sales are up in the Baltimore due to an increase in foreclosures.

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep- 2015 | Sep- 2014 | Sep- 2015 | Sep- 2014 | Sep- 2015 | Sep- 2014 | Sep- 2015 | Sep- 2014 | |

| Las Vegas | 6.8% | 10.4% | 7.1% | 8.8% | 13.9% | 19.2% | 26.8% | 34.3% |

| Reno** | 3.0% | 7.0% | 3.0% | 7.0% | 6.0% | 14.0% | ||

| Phoenix | 2.4% | 3.8% | 3.5% | 5.8% | 5.9% | 9.6% | 22.5% | 25.7% |

| Sacramento | 2.9% | 5.3% | 4.1% | 5.3% | 6.9% | 10.7% | 17.6% | 19.4% |

| Minneapolis | 1.8% | 3.4% | 6.5% | 9.6% | 8.3% | 13.0% | ||

| Mid-Atlantic | 3.9% | 5.5% | 11.1% | 9.7% | 14.9% | 15.2% | 17.5% | 19.1% |

| Baltimore MSA**** | 4.3% | 5.6% | 18.6% | 15.4% | 22.9% | 21.0% | ||

| Orlando | 3.5% | 7.1% | 20.1% | 24.8% | 23.6% | 31.8% | 35.6% | 41.7% |

| Chicago (city) | 17.5% | 18.8% | ||||||

| Hampton Roads | 15.6% | 19.6% | ||||||

| Spokane | 7.8% | 12.6% | ||||||

| Northeast Florida | 23.8% | 29.7% | ||||||

| Chicago (city) | 17.5% | 18.8% | ||||||

| Colorado***** | 1.8% | 3.7% | ||||||

| Toledo | 26.5% | 31.4% | ||||||

| Tucson | 25.9% | 26.7% | ||||||

| Georgia*** | 22.3% | 27.4% | ||||||

| Omaha | 18.1% | 19.9% | ||||||

| Pensacola | 31.4% | 29.2% | ||||||

| Tucson | 25.9% | 26.7% | ||||||

| Richmond MSA | 10.5% | 11.7% | 15.2% | 18.4% | ||||

| Memphis* | 13.1% | 13.2% | ||||||

| Springfield IL** | 10.1% | 9.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS ****Baltimore is included in the Mid-Atlantic region, but is shown separately here *****As tabulated by the Colorado Association of Realtors | ||||||||

Ornithology: What is a "deficit hawk"?

by Calculated Risk on 10/19/2015 01:27:00 PM

Nick Timiraos wrote yesterday in the WSJ: Debt, Growth Concerns Rain on Deficit Parade

The U.S. budget deficit is lower than before the 2008 financial crisis. But the good news is tempered by concerns on two fronts, one about the nation’s debt load and the other about the economy.I'd like to see the definition of a "deficit hawk"!

Deficit hawks are concerned that the improvement will lead both parties to overlook the red ink set to rise later this decade from a surge in spending on health care and retirement benefits for the baby-boom generation.

They worry that while the deficit is at the lowest level since 2007, the U.S. has added nearly $8 trillion in debt, an increase of 140%. That has nearly doubled the nation’s debt-to-GDP ratio, which stands near 73%—based on federal debt held by the public—and isn’t projected to fall in the coming years.

I'd think a true deficit hawk would be truly concerned about, uh, the deficit. So they'd support both tax increases1 and spending cuts to reduce the deficit. They'd oppose policies that increase the deficit (like the Bush tax cuts, and the war in Iraq). They'd also be concerned about policies that led to the financial crisis and a deep recession - since the deficit increases during a recession.

Maybe I'm talking my own position since I opposed the Bush tax cuts (that created a structural deficit). I opposed the Iraq war. I frequently talked to regulators about lax lending in real estate (and posted some of those discussion on this blog in 2005) that led directly to the financial crisis and large deficits. And I support both intelligent tax increases and spending cuts.

Unfortunately, my experience is that most people who claims to be "deficit hawks", are really pushing a different agenda. I wish Timiraos would provide a few examples of deficit hawks!

Also the "red ink set to rise later this decade" is expected in increase the deficit from 2.5% of GDP to about 3.1% in 2020.

1 Note: Some people like to focus on "growth" to reduce the deficit, and they tend to focus on tax cuts to boost growth. However, all data and research shows that at the current marginal rates, tax cuts do not pay for themselves and lead to much larger deficits.

NAHB: Builder Confidence at 64 in October, Highest in 10 Years

by Calculated Risk on 10/19/2015 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 64 in October, up from 61 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Three Points in October

Builder confidence in the market for newly constructed single-family homes rose three points in October to a level of 64 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This month’s reading is a return to HMI levels seen at the end of the housing boom in late 2005.

...

“With October’s three-point uptick, builder confidence has been holding steady or increasing for five straight months. This upward momentum shows that our industry is strengthening at a gradual but consistent pace,” said NAHB Chief Economist David Crowe. “With firm job creation, economic growth and the release of pent-up demand, we expect housing to keep moving forward as we start to close out 2015.”

...

Two of the three HMI components posted gains in October. The index measuring sales expectations in the next six months rose seven points to 75, and the component gauging current sales conditions increased three points to 70. Meanwhile, the index charting buyer traffic held steady at 47.

Looking at the three-month moving averages for regional HMI scores, all four regions posted gains. The West registered a five-point uptick to 69 while the Northeast, Midwest and South each rose one point to 47, 60 and 65, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 62.

Sunday, October 18, 2015

Sunday Night Futures

by Calculated Risk on 10/18/2015 09:17:00 PM

Weekend:

• Schedule for Week of October 18, 2015

Monday:

• At 10:00 AM, the October NAHB homebuilder survey. The consensus is for a reading of 62, unchanged from September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $47.31 per barrel and Brent at $50.50 per barrel. A year ago, WTI was at $82, and Brent was at $85 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon (down about $0.75 per gallon from a year ago).