by Calculated Risk on 10/26/2015 04:37:00 PM

Monday, October 26, 2015

Vehicle Sales Forecast for October: Over 17 Million Annual Rate Again

The automakers will report October vehicle sales on Tuesday, November 3rd. Sales in September were at 18.1 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in October will be over 17 million SAAR again. Sales in September were boosted by the timing of Labor Day.

Note: There were 28 selling days in October, up from 27 in October 2014. Here are two forecasts:

From WardsAuto: Forecast: SAAR Expected to Remain Above 17 Million in October

WardsAuto forecast calls for October U.S. light-vehicle sales to reach a 17.5 million-unit seasonally adjusted annual rate, making it the sixth consecutive month above 17 million.From J.D. Power: October New-Vehicle Retail Sales Strongest in 15 years

The 17.5 million-unit SAAR would be higher than the 17.2 million recorded year-to-date through September and an 11-year peak for the month.

New-vehicle retail and total sales in October 2015 are expected to be the strongest for the month since 2001, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive. ...Another solid month for auto sales, although I expect Volkswagen sales to be down year-over-year.

“September was a strong month—bolstered by the Labor Day weekend—so the expectation is that we would see some weakness is subsequent months, but that hasn’t been the case,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. “Through the first 18 days in October, retail sales are up 7 percent compared with the same period a year ago.” [17.4 million SAAR]

emphasis added

Comments on September New Home Sales

by Calculated Risk on 10/26/2015 01:18:00 PM

The new home sales report for September was well below expectations and sales for July and August were revised down. Sales were up only 2.0% year-over-year in September (SA). Overall this was a disappointing report.

Earlier: New Home Sales decreased to 468,000 Annual Rate in September.

Even though the September report was disappointing, sales are still up solidly year-to-date. The Census Bureau reported that new home sales this year, through September, were 392,000, not seasonally adjusted (NSA). That is up 17.6% from 333,000 sales during the same period of 2014 (NSA). That is a strong year-over-year gain for the first nine months of 2015!

In other words, no worries.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain was weak in September, and I expect the year-over-year increases to be lower over the remaining months compared to earlier this year - but the overall year-over-year gain should be solid in 2015.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decreased to 468,000 Annual Rate in September

by Calculated Risk on 10/26/2015 10:14:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 468 thousand.

The previous three months were revised down by a total of 39 thousand (SAAR).

"Sales of new single-family houses in September 2015 were at a seasonally adjusted annual rate of 468,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised August rate of 529,000, but is 2.0 percent above the September 2014 estimate of 459,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in September to 5.8 months.

The months of supply increased in September to 5.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of September was 225,000. This represents a supply of 5.8 months at the current sales rate."

On inventory, according to the Census Bureau:

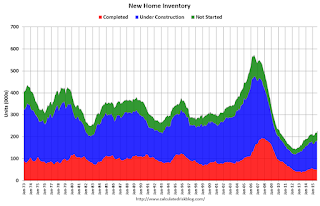

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2015 (red column), 36 thousand new homes were sold (NSA). Last year 37 thousand homes were sold in September.

The all time high for August was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was well below expectations of 549,000 sales SAAR in August, and prior months were revised down - a disappointing report. I'll have more later today.

Black Knight: House Price Index up 0.3% in August, Up 5.5% year-over-year

by Calculated Risk on 10/26/2015 09:08:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.3 Percent for the Month; Up 5.5 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services, Inc. released its latest Home Price Index (HPI) report, based on August 2015 residential real estate transactions in the United States. The Black Knight HPI combines the company's extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI increased 0.3% percent in August, and is off 5.3% from the peak in June 2006 (not adjusted for inflation).

For a more in-depth review of this month's home price trends, including detailed views of results from the 20 largest states and 40 largest metros, please download the full Black Knight HPI Report.

The year-over-year increase in the index has been about the same for the last year.

The report has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 37.4% from the peak in Las Vegas, off 31.1% in Orlando, and 27.4% off from the peak in Riverside-San Bernardino, CA (Inland Empire).

Note: Case-Shiller for August will be released tomorrow.

Sunday, October 25, 2015

Monday: New Home Sales

by Calculated Risk on 10/25/2015 07:50:00 PM

Most economist think there is a better than 50% chance of a Fed rate hike in December. Analysts and traders don't think so. From Min Zeng at the WSJ: Betting Against a Fed Rate Rise

[Global] developments, together with mixed U.S. economic data in recent months, increase the likelihood the Fed will keep interest rates near zero for the rest of 2015, according to analysts and traders ...Weekend:

The odds Friday were measured at 37% for an increase at the Dec. 15-16 policy meeting, compared with 44% last month.

• Schedule for Week of October 25, 2015

Monday:

• At 10:00 AM ET, New Home Sales for September from the Census Bureau. The consensus is for a decrease in sales to 549 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 552 thousand in August.

• At 10:30 AM, Dallas Fed Manufacturing Survey for October.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 2 and DOW futures are dwon 25 (fair value).

Oil prices were down over the last week with WTI futures at $44.61 per barrel and Brent at $47.99 per barrel. A year ago, WTI was at $81, and Brent was at $86 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.20 per gallon (down about $0.85 per gallon from a year ago).

Goldman: FOMC Preview

by Calculated Risk on 10/25/2015 10:50:00 AM

A few excerpts from a research piece by Goldman Sachs economist David Mericle

We do not expect significant changes in the October FOMC statement. The statement is likely to acknowledge slower payroll gains while still describing growth as “moderate.” We would view such an outcome as indicating that, despite the weaker-than-expected recent data, the leadership’s baseline for liftoff remains December.The FOMC is meeting on Tuesday and Wednesday of this week, and the FOMC statement will be released at 2 PM ET on Wednesday.

The October meeting is unlikely to resolve questions about recent dovish comments from Governors Brainard and Tarullo. Although their comments have been widely interpreted as implying that a hike this year is unlikely, we instead see their remarks as reflecting reasonable and predictable disagreement, and we continue to expect liftoff in December, though only with 60% confidence.

Saturday, October 24, 2015

Schedule for Week of October 25th

by Calculated Risk on 10/24/2015 08:11:00 AM

The key reports this week are September New Home sales on Monday, the advance estimate of Q3 GDP on Thursday, and August Case-Shiller house prices on Tuesday.

The FOMC meets on Tuesday and Wednesday, but no change in policy is expected.

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for a decrease in sales to 549 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 552 thousand in August.

10:30 AM: Dallas Fed Manufacturing Survey for October.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.0% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the July 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.1% year-over-year increase in the Comp 20 index for August. The Zillow forecast is for the National Index to increase 4.7% year-over-year in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

10:00 AM: the Q3 Housing Vacancies and Homeownership from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Announcement. No change in policy is expected at this meeting.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2015 (Advance estimate). The consensus is that real GDP increased 1.7% annualized in Q3.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 1.0% increase in the index.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

8:30 AM ET: Employment Cost Index for Q3. The consensus is for a 0.6% increase in Q3.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 49.2, up from 48.7 in September.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 92.5, up from the preliminary reading of 92.1.

Friday, October 23, 2015

Merrill on Q3 GDP and Headwinds

by Calculated Risk on 10/23/2015 08:00:00 PM

The advance estimate for Q3 GDP will be released Thursday October 29th. Here is Merrill Lynch's forecast:

The economy has faced some strong headwinds this year, including a sharp rise in the dollar, weaker-than-expected global growth and sharp cuts in oil sector investment. Further, the economy is in the middle of an inventory correction. Weaker data, particularly for inventories, has contributed to lower GDP tracking, and we are now incorporating that weakness into our official forecast, cutting 3Q real GDP growth by 0.8pp to 1.2%. This lowers 2014 annual GDP growth to 2.4% from 2.5%. Looking past trade and inventories, domestic demand is expected to remain strong, rising by 3.5% in 3Q 2015, and by 3.0% in 2015 as a whole.And on headwinds for the U.S. economy:

First, while the economy faces new global headwinds, the fundamental backdrop for the domestic economy has improved significantly. Post-crisis deleveraging has largely run its course. The housing and banking sectors are back on their feet. And Washington is no longer a major source of austerity and confidence shocks: Federal and state and local fiscal policy has shifted from a 1% or higher GDP headwind to a small tailwind and Americans have learned to largely ignore the budget battles in Washington. In our view, the new global headwinds—a strong dollar, weak growth in emerging markets and weak commodity prices—have less impact on US growth than the fading domestic headwinds –deleveraging, crippled banking and housing sectors and fiscal shocks.The future is bright!

Second, it is important to get the timing of the various shocks right. In our view, most of the hit to growth from global developments has already happened. The strong dollar is an ongoing drag on growth, but model simulations suggest a hump-shape pattern, with small effects last year, a peak drag on growth this summer and diminishing drag in the quarters ahead. On a similar vein, the biggest hit from the collapse in oil prices is behind us, with the collapse in mining investment in the first half of the year. Going forward, we expect a small net effect from low prices as a slow decline in mining related activity is offset or more than offset by consumers spending more of their savings from lower gas prices. The same applies to the inventory adjustment: almost all of the correction came in 3Q. The only shock that builds, rather than diminishes, going forward is the trade and confidence shocks from weakness in China and the rest of emerging markets. Our hope and expectation is that these effects will be small.

Off topic: Hurricane Patricia

by Calculated Risk on 10/23/2015 04:51:00 PM

Hurricane Patricia is about to make landfall in Mexico as a category 5 storm. According to the National Hurricane Center:

There has been little change in the satellite appearance of Patricia since the earlier Hurricane Hunter aircraft left the hurricane. Based on this, the initial intensity remains 175 kt. Some fluctuations in strength are possible before landfall, but it is expected that Patricia will make landfall as a Category 5 hurricane in southwestern Mexico in less than 12 hours. After landfall, a combination of the mountainous terrain of Mexico and increasing shear should cause the cyclone to rapidly weaken, with the system likely to dissipate completely after 36 hours.Below is a satellite image of Patricia. The storm east of Hawaii is Olaf (that is expected to dissipate). For a larger image, click here.

...

The global models continue to depict the development of a cyclone near the Texas coast over the weekend. This system should be non-tropical in nature. However, this cyclone is expected to draw significant amounts of moisture from Patricia's remnants, and could result in locally heavy rainfall over portions of the northwestern Gulf of Mexico coastal area within the next few days.

A Few Random Comments on September Existing Home Sales

by Calculated Risk on 10/23/2015 02:43:00 PM

Once again, housing economist Tom Lawler's projection of the NAR reported sales rate was much closer than the consensus. For September, the NAR reported sales of 5.55 million on a seasonally adjusted annual rate (SAAR) basis, the consensus was 5.35 million, and Lawler's projection was 5.56 million (almost exact). Thanks to Tom for sharing his research with all of us!

Yesterday: Existing Home Sales in September: 5.55 million SAAR

Even though sales were up in September, I expect that the seasonally adjusted pace for existing home sales will slow in coming months due to limited inventory and higher prices.

However, if sales do slow, it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc - but overall the economic impact is small compared to a new home sale. So some slowing for existing home sales (if it happens) will not be a big deal for the economy.

Also, I've been expecting some increase in inventory this year, but it hasn't happened yet. Inventory is still very low (down 3.1% year-over-year in September). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Also, the NAR reported distressed sales declined a little further year-over-year:

Distressed sales — foreclosures and short sales — remained at 7 percent in September for the third consecutive month; they were 10 percent a year ago. Six percent of September sales were foreclosures and 1 percent (lowest since NAR began tracking in October 2008) were short sales.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in September (red column) were the highest for September since 2006 (NSA).