by Calculated Risk on 11/02/2015 02:08:00 PM

Monday, November 02, 2015

Fed Survey: Banks reports stronger demand for CRE loans

From the Federal Reserve: The October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices

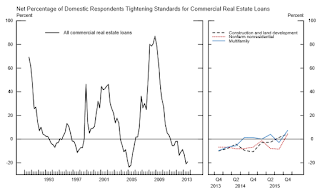

Regarding loans to businesses, the October survey results indicated that, on balance, banks reported little change in their standards on commercial and industrial (C&I) loans in the third quarter of 2015. In addition, banks reported having eased some loan terms, such as spreads and loan maturities, on net. However, banks also indicated that they increased premiums charged on riskier loans for larger firms on net. With respect to commercial real estate (CRE) lending, on balance, survey respondents reported that standards on loans secured by nonfarm nonresidential properties, loans secured by multifamily residential properties, and construction and land development loans remained about unchanged. On the demand side, banks reported that demand for C&I loans was about unchanged, on balance, and moderate net fractions of survey respondents experienced stronger demand for all three categories of CRE loans during the third quarter.

Regarding loans to households, banks reported having eased lending standards on loans eligible for purchase by the government-sponsored enterprises and on qualified mortgage (QM) loans over the past three months on net. On balance, modest fractions of banks indicated having eased standards for credit card loans as well as for auto loans. On the demand side, modest net fractions of banks reported weaker demand across most categories of home-purchase loans. In contrast, respondents experienced stronger demand for credit card loans on net.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Mostly standards were unchanged for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.This suggests that we will see further increases in commercial real estate development.

Construction Spending increased 0.6% in September, Up 14.1% YoY

by Calculated Risk on 11/02/2015 11:31:00 AM

The Census Bureau reported that overall construction spending increased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2015 was estimated at a seasonally adjusted annual rate of $1,094.2 billion, 0.6 percent above the revised August estimate of $1,087.5 billion. The September figure is 14.1 percent above the September 2014 estimate of $959.2 billion.Both private spending and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $794.2 billion, 0.6 percent above the revised August estimate of $789.7 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas has been declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In September, the estimated seasonally adjusted annual rate of public construction spending was $300.0 billion, 0.7 percent above the revised August estimate of $297.8 billion.

emphasis added

As an example, construction spending for private lodging is up 33% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 11% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 42% below the bubble peak.

Non-residential spending is only 4% below the peak in January 2008 (nominal dollars).

Public construction spending is now 8% below the peak in March 2009 and about 14% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 17%. Non-residential spending is up 15% year-over-year. Public spending is up 9% year-over-year.

Looking forward, all categories of construction spending should increase this year and in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This was at the consensus forecast of a 0.4% increase, also spending for July and August were revised up slightly. Another solid construction report.

ISM Manufacturing index decreased to 50.1 in October

by Calculated Risk on 11/02/2015 10:04:00 AM

The ISM manufacturing index barely suggested expansion in October. The PMI was at 50.1% in October, down from 50.2% in September. The employment index was at 47.6%, down from 50.5% in September, and the new orders index was at 52.9%, up from 50.1%.

From the Institute for Supply Management: October 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October for the 34th consecutive month, and the overall economy grew for the 77th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The October PMI® registered 50.1 percent, a decrease of 0.1 percentage point from the September reading of 50.2 percent. The New Orders Index registered 52.9 percent, an increase of 2.8 percentage points from the reading of 50.1 percent in September. The Production Index registered 52.9 percent, 1.1 percentage points above the September reading of 51.8 percent. The Employment Index registered 47.6 percent, 2.9 percentage points below the September reading of 50.5 percent. Backlog of Orders registered 42.5 percent, an increase of 1 percentage point from the September reading of 41.5 percent. The Prices Index registered 39 percent, an increase of 1 percentage point from the September reading of 38 percent, indicating lower raw materials prices for the 12th consecutive month. The New Export Orders Index registered 47.5 percent, up 1 percentage point from September, and the Imports Index registered 47 percent, down 3.5 percentage points from the September reading of 50.5 percent. Comments from the panel reflect concern over the high price of the dollar and the continuing low price of oil, mixed with cautious optimism about steady to increasing demand in several industries."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was at expectations of 50.0%, and indicates slower manufacturing expansion in October.

Black Knight September Mortgage Monitor

by Calculated Risk on 11/02/2015 09:38:00 AM

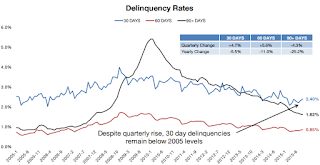

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for September today. According to BKFS, 4.87% of mortgages were delinquent in September, up from 4.79% in August. BKFS reported that 1.46% of mortgages were in the foreclosure process, down from 1.89% in September 2014.

This gives a total of 6.33% delinquent or in foreclosure. It breaks down as:

• 2,457,000 properties that are 30 or more days delinquent, but not in foreclosure.

• 737,000 loans in foreclosure process.

For a total of 3,194,000 loans delinquent or in foreclosure in September. This is down from 3,800,000 in September 2014.

Press Release: Black Knight’s September Mortgage Monitor: Recent Surge in Purchase Originations Driven Primarily by High-Credit Borrowers

oday, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of September 2015. ...

“Purchase mortgage originations are up significantly in 2015,” said Graboske. “Q2 2015 purchase originations were up 15 percent from the same quarter in 2014. In June, we saw the highest level of purchase lending since June 2007 and early Q3 figures show purchase originations are up 11 percent from the same period last year. What’s striking about this rise, though, is that it’s being driven almost entirely by high-credit borrowers. Year-over-year comparisons of purchase originations from sub-700 credit score borrowers show that purchase volumes from lower-credit borrowers are actually flat to slightly down from last year’s levels. Only 20 percent of purchase loans originated in the past three months have gone to borrowers with credit scores below 700. That’s the lowest level we’ve seen in well over 10 years. The weighted average credit score for purchase mortgages has also hit an all-time high of about 755."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the delinquency rates for the 30, 60 and 90 day buckets.

From Black Knight:

30-day and 60-day delinquencies saw quarterly increases due to market seasonality in Q3, rising 4.7 and 5.6 percent respectivelyThere is much more in the mortgage monitor.

Despite the Q3 rise in 30-day delinquencies, they remain below 2005’s pre-crisis levels; 60-day delinquencies remain slightly above 2005 levels

Positive movement continues in 90-day inventory, despite the seasonal inflow of new delinquencies, on both a quarterly and yearly basis

90-day delinquencies are down 25 percent over the past year

Sunday, November 01, 2015

Monday: ISM Mfg Index, Construction Spending

by Calculated Risk on 11/01/2015 08:49:00 PM

From the WSJ: Retailers Work Harder to Lure Holiday Employees

Retailers are facing a shrinking pool of workers as they staff up for the holidays, prompting some to offer more hours or higher pay to make sure they have enough cashiers or salespeople for the Christmas crush.Seasonal hiring in October usually gives a good indication for the holiday season. Something to watch in the employment report on Friday.

Weekend:

• Schedule for Week of November 1, 2015

Monday:

• At 10:00 AM ET, the ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September. The employment index was at 50.5%, and the new orders index was at 50.1%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for a 0.4% increase in construction spending.

• At 2:00 PM, the October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 6 and DOW futures are dwon 36 (fair value).

Oil prices were up over the last week with WTI futures at $46.21 per barrel and Brent at $49.36 per barrel. A year ago, WTI was at $81, and Brent was at $85 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.19 per gallon (down about $0.80 per gallon from a year ago).

Hotel Occupancy: 2015 on pace for Best Year Ever

by Calculated Risk on 11/01/2015 09:02:00 AM

From HotelNewsNow.com: STR: US results for week ending 24 October

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 18-24 October 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are now in the Fall business travel season.

In year-over-year measurements, the industry’s occupancy increased 1.7% to 70.6%. Average daily rate for the week was up 4.6% to US$124.76. Revenue per available room increased 6.4% to finish the week at US$88.08.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.I added 2001 (yellow) to show the impact of 9/11/2001 on hotel occupancy. Occupancy was already down in 2001 due to the recession, and really collapsed following 9/11.

For 2015, the 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and 2015 will probably be the best year ever for hotels. This is why lodging investment is up 39% year-over-year!

Occupancy Year-to-date:

1) 2015 67.7%

2) 2000 67.1%

3) 2014 66.6%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, October 31, 2015

Schedule for Week of November 1st

by Calculated Risk on 10/31/2015 01:01:00 PM

The key report this week is the October employment report on Friday.

Other key indicators include October vehicle sales, the October ISM manufacturing and non-manufacturing indexes, and the September trade deficit.

There will be several Federal Reserve speakers this week.

10:00 AM: ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September.

10:00 AM: ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 50.2% in September. The employment index was at 50.5%, and the new orders index was at 50.1%.

10:00 AM: Construction Spending for September. The consensus is for a 0.4% increase in construction spending.

2:00 PM ET: the October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

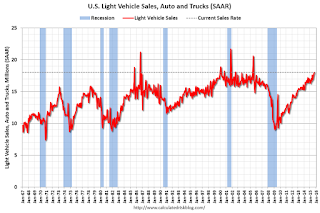

All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is a 0.9% decrease in orders.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in October, down from 200,000 in September.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.1 billion in September from $48.3 billion in August.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 56.7 from 56.9 in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 262 thousand initial claims, up from 260 thousand the previous week.

8:30 AM: Employment Report for October. The consensus is for an increase of 190,000 non-farm payroll jobs added in October, up from the 142,000 non-farm payroll jobs added in September.

The consensus is for the unemployment rate to decrease to 5.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 2.75 million jobs.

A key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for September from the Federal Reserve. The consensus is consumer credit increased by $18.0 billion in September.

October 2015: Unofficial Problem Bank list declines to 264 Institutions

by Calculated Risk on 10/31/2015 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for October 2015. During the month, the list fell from 276 institutions to 264 after 12 removals. Assets dropped by $2.8 billion to an aggregate $79.2 billion. A year ago, the list held 422 institutions with assets of $133.5 billion.

Actions have been terminated against Severn Savings Bank, FSB, Annapolis, MD ($779 million Ticker: SVBI); Artisans' Bank, Wilmington, DE ($472 million); Valley Bank & Trust, Brighton, CO ($295 million); The Citizens Bank of Logan, Logan, OH ($191 million); United International Bank, Flushing, NY ($184 million); First National Bank, Goodland, KS ($181 million); Goldwater Bank, N.A., Scottsdale, AZ ($103 million); Tri-Valley Bank, San Ramon, CA ($103 million Ticker: TRVB); PNA Bank, Chicago, IL ($96 million); and Park State Bank & Trust, Woodland Park, CO ($91 million).

Two banks failed during the month -- The Bank of Georgia, Peachtree City, GA ($294 million) and Hometown National Bank, Longview, WA ($5 million). Astonishingly, there was a bank failure in Georgia as we thought there were not any banks left to fail in the state. Since the on-set of the Great Recession, 90 banks headquartered in Georgia have failed. Nearly 26 percent of the 352 banks headquartered in Georgia at year-end 2007 have failed. These failures have cost the FDIC insurance fund about $11.7 billion, with the average cost approximating an exorbitant 34 percent of failed bank assets. It does not take rocket science to understand this is what happens when unfettered construction & development lending collides with a housing downturn.

Friday, October 30, 2015

Q3 2015 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/30/2015 05:33:00 PM

The BEA released the underlying details for the Q3 advance GDP report today.

Yesterday, the BEA reported that investment in non-residential structures decreased slightly in Q3.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $88.6 billion annual rate in Q2 to a $75.0 billion annual rate in Q3. "Mining exploration, shafts, and wells" investment is down 49% year-over-year.

Excluding petroleum, non-residential investment in structures increased solidly in Q3.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q3, and is up 24% year-over-year -increasing from a very low level - and is still near the lows for previous recessions (as percent of GDP). .

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is up slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q3, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 39% year-over-year.

Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 7 quarters and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $211 billion (SAAR) (about 1.2% of GDP).

Investment in home improvement was at a $178 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just under 1.0% of GDP).

These graphs show investment is generally increasing, but is still very low.

Restaurant Performance Index indicates slower expansion in September

by Calculated Risk on 10/30/2015 03:41:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index: Operators’ Sales Outlook at Two-Year Low

Although same-store sales and customer traffic remained positive in September, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a modest decline. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.4 in September, down slightly from a level of 101.5 in August. Despite the decline, September represented the 31st consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

“The RPI's current situation indicators continued to illustrate growth in September, as both same-store sales and customer traffic remained positive,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “However, restaurant operators are more cautious about business conditions in the months ahead, as the proportion expecting a sales increase fell to a two-year low.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.4 in September, down from 101.5 in August. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with this decline, the index is indicating expansion, and it appears restaurants are benefiting from lower gasoline prices.