by Calculated Risk on 11/04/2015 10:05:00 AM

Wednesday, November 04, 2015

ISM Non-Manufacturing Index increased to 59.1% in October

The October ISM Non-manufacturing index was at 59.1%, up from 56.9% in September. The employment index increased in October to 59.2%, up from 58.3% in September. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 69th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59.1 percent in October, 2.2 percentage points higher than the September reading of 56.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 63 percent, which is 2.8 percentage points higher than the September reading of 60.2 percent, reflecting growth for the 75th consecutive month at a faster rate. The New Orders Index registered 62 percent, 5.3 percentage points higher than the reading of 56.7 percent in September. The Employment Index increased 0.9 percentage point to 59.2 percent from the September reading of 58.3 percent and indicates growth for the 20th consecutive month. The Prices Index increased 0.7 percentage point from the September reading of 48.4 percent to 49.1 percent, indicating prices decreased in October for the second consecutive month. According to the NMI®, 14 non-manufacturing industries reported growth in October. After the slight cooling off in September, the non-manufacturing sector reflected growth across most of the indexes. Respondents remain mostly positive about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was well above the consensus forecast of 56.7% and suggests faster expansion in October than in September. A strong report.

Trade Deficit decreased in September to $40.8 Billion

by Calculated Risk on 11/04/2015 08:46:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was was $40.8 billion in September, down $7.2 billion from $48.0 billion in August, revised. September exports were $187.9 billion, $3.0 billion more than August exports. September imports were $228.7 billion, $4.2 billion less than August imports.The trade deficit was close to the consensus forecast of $41.1 billion.

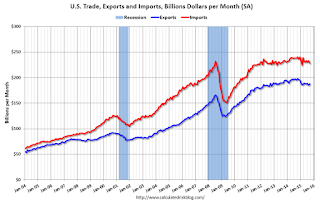

The first graph shows the monthly U.S. exports and imports in dollars through September 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in September.

Exports are 13% above the pre-recession peak and down 4% compared to September 2014; imports are 1% below the pre-recession peak, and down 4% compared to September 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings earlier this year were due to West Coast port slowdown).Oil imports averaged $42.72 in September, down from $49.33 in August, and down from $92.52 in September 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China increased to $36.3 billion in September, from $35.6 billion in August 2014. The deficit with China is a substantial portion of the overall deficit.

ADP: Private Employment increased 182,000 in October

by Calculated Risk on 11/04/2015 08:20:00 AM

Private sector employment increased by 182,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 185,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 24,000 jobs in October, representing the best month in this sector since January of this year. The construction industry added 35,000 jobs in October, roughly matching September’s gain. Meanwhile, manufacturing remained in negative territory losing 2,000 jobs in October after shrinking by 17,000 in September.

Service-providing employment rose by 158,000 jobs in October, down from a downwardly revised 182,000 in September. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth as measured by the ADP Research Institute is not slowing meaningfully in contrast with the recent slowdown in the government’s data. The economy is creating close to 200,000 jobs per month. Job gains are broad based with energy and manufacturing alone subtracting from the top line. Small businesses, in particular, are contributing to the labor market’s solid performance.”

The BLS report for October will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in October.

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey, Purchase Applications up 20% YoY

by Calculated Risk on 11/04/2015 07:01:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 30, 2015

...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 20 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.01 percent from 3.98 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 20% higher than a year ago.

Tuesday, November 03, 2015

Wednesday: Trade Deficit, ADP Employment, ISM Non-Mfg Index

by Calculated Risk on 11/03/2015 08:22:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 185,000 payroll jobs added in October, down from 200,000 in September.

• At 8:30 AM, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.1 billion in September from $48.3 billion in August.

• At 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 56.7 from 56.9 in September.

Some interesting data released last week from Freddie Mac: Insight & Outlook The following text and graphs are from Fannie Mae:

Click on graph for larger image.

The recent trend of lender de-concentration in the mortgage industry continues. For example, in 2014 large lenders – those who originated at least $10 billion – represented about 30 percent of all conventional originations versus 41 percent in 2013. Virtually all of the de-concentration has come from the very largest lenders. According to data from Inside Mortgage Finance, the top 5 originators accounted for about 34 percent of all originations in 2014, down from 62 percent in 2009. The gain in share has been spread across a broad range of smaller lenders; the share of originations from lenders ranked 21 or higher increased from about 14 percent in 2009 to over 42 percent in 2014 (Exhibit 3).

The market share of non-depository, independent mortgage companies increased sharply in 2014. With the collapse of the housing and secondary mortgage market during the Great Recession, many independent mortgage companies went out of business, especially those focused on subprime lending, and the market share of this group dropped sharply. Since then, the industry has more than recovered its former market share with independent mortgage companies accounting for about 47 percent of home-purchase loans and 42 percent of refinance loans in 2014 (Exhibit 4). These shares are higher than at any point in the past 20 yearsCR Comment: This is a significant shift in lending, especially for purchase lending. If these smaller, independent lenders are not fully represented in the MBA purchase index, then the index would understate the growth in the housing market (something I wondered about a few years ago). At that time, MBA's chief economist Mike Fratantoni told me:

Despite some reports attributing this rise to nonconventional lending and a willingness to originate riskier loans, the HMDA data indicate this rise has been broad-based across different types of loans and demographic groups. However, the increase in lending by independent mortgage companies has been concentrated in states in the West and Southwest, where they focus mostly on originating home purchase loans.

Nonbanks have less stable sources of financing and less financial oversight than banks. Some experts have expressed concern that these lenders are more likely to fail in an economic downturn and thus expose the GSEs and Ginnie Mae to losses.

[I]n the last couple of years ... independent mortgage bankers have accounted for a fast growing share of the purchase market ... We have actively recruited independents and smaller banks to get better coverage of the purchase market. ... It is likely that many of the lenders not in the survey have a higher purchase share and lower refi share.The index is very useful, but it has probably been difficult to keep up with this shift in lending.

U.S. Light Vehicle Sales at 18.1 million annual rate in October

by Calculated Risk on 11/03/2015 03:14:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 18.13 million SAAR in October. That is up almost 10% from October 2014, and up slightly from the 18.1 million annual sales rate last month.

This was the second consecutive month over 18 million.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 18.13 million SAAR from WardsAuto).

This was above the consensus forecast of 17.7 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was another very strong month for auto sales and it appears 2015 will be the best year for light vehicle sales since 2001.

Freddie: REO inventory declined in Q3, Down 31% Year-over-year

by Calculated Risk on 11/03/2015 11:44:00 AM

Note: Fannie Mae is scheduled to report on Thursday.

From Freddie Mac:

Freddie Mac today reported a net loss of $475 million for the third quarter of 2015, compared to net income of $4.2 billion for the second quarter of 2015. The company also reported a comprehensive loss of $501 million for the third quarter of 2015, compared to comprehensive income of $3.9 billion for the second quarter of 2015.And on Real Estate Owned (REO):

“For the first time in four years, Freddie Mac had a net loss in the most recent quarter. This $0.5 billion loss was caused mainly by the accounting associated with our use of derivatives, whereby the derivatives are marked-tomarket but many of the assets and liabilities being hedged are not. The resulting difference between GAAP reporting and the actual underlying economics, which has created significant GAAP income volatility in our quarterly financial statements, reduced the after tax earnings in the quarter by an estimated $1.5 billion as interest rates declined significantly” said Donald H. Layton, chief executive officer. “In the prior quarter, we had the opposite result with a $1.5 billion positive contribution to earnings as rates rose significantly.”

Our single-family REO inventory (measured in number of properties) declined 31% from December 31, 2014 to September 30, 2015, primarily due to our loss mitigation efforts and a larger proportion of properties being sold to third parties at foreclosure auction.Notice that most of the REO is from loans originated in 2005 through 2008, and they are heavily Alt-A loans.

...

Our REO acquisition activity is disproportionately high for certain types of mortgage loans, including mortgage loans with certain higher-risk characteristics. For example, while the percentage of interest-only and Alt-A mortgage loans in our single-family credit guarantee portfolio, based on UPB, was approximately 1% and 3%, respectively, at September 30, 2015, the percentage of our REO acquisitions during the nine months ended September 30, 2015 that had been financed by either of these mortgage loan types represented approximately 20% of our total REO acquisitions, based on mortgage loan amount prior to acquisition. In addition, mortgage loans from our 2005-2008 Legacy single-family book comprised approximately 69% of our REO acquisition activity during the nine months ended September 30, 2015.

As of September 30, 2015, approximately 52% of our REO properties were unable to be marketed because the properties were occupied, under repair, or are located in states with a redemption period and 13% of the properties were being evaluated for listing and determination of our sales strategy. As of September 30, 2015, approximately 22% of our REO properties were listed and available for sale and 13% of our inventory was pending the settlement of sales. Though it varied significantly in different states, the average holding period of our single-family REO properties, excluding any redemption period, was 251 days and 221 days for our REO dispositions during the nine months ended September 30, 2015 and the nine months ended September 30, 2014, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Freddie Real Estate Owned (REO).

REO inventory decreased in Q3 for Freddie, and and inventory is down 31% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007.

Short term delinquencies are at normal levels, but there are still a fairly large number of legacy properties in the foreclosure process with long time lines in judicial foreclosure states.

CoreLogic: House Prices up 6.4% Year-over-year in September

by Calculated Risk on 11/03/2015 10:03:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up 6.4 Percent Year Over Year

According to the CoreLogic HPI, home prices nationwide, including distressed sales, increased by 6.4 percent in September 2015 compared with September 2014 and increased by 0.6 percent in September 2015 compared with August 2015.

“After nearly 10 years of very high home price volatility, home price increases have been remarkably stable for the last 15 months, ranging between a 4.8 percent and 6.5 percent year-over-year increase,” said Sam Khater, deputy chief economist for CoreLogic. “Home price volatility is now back to the long-term trend prior to the boom and bust which is a good barometer of the market’s stability and health.”

“The continued growth in home prices is welcome news for many homeowners but more markets are becoming overvalued. In the near term, this trend is likely to continue and pose evaluated risks to the housing economy,” said Anand Nallathambi, president and CEO of CoreLogic. "More has to be done to expand inventories if we are going to address the emerging affordability crisis, especially in hot markets like California and Colorado.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.6% in September (NSA), and is up 6.4% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.

The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.The year-over-year comparison has been positive for forty three consecutive months.

Monday, November 02, 2015

Tuesday: Auto Sales

by Calculated Risk on 11/02/2015 08:02:00 PM

An excerpt from a research piece by Goldman Sachs economist Alec Phillips on the impact of the budget deal:

• The budget deal that the President signed into law today allows for greater federal spending in 2016. Along with a slightly positive trend at the state and local level, it should result in a modestly expansionary fiscal stance (+0.3% of GDP), for the first time in five years.Tuesday:

• The agreement looks likely to raise the federal contribution to quarterly GDP growth primarily in 1H 2016. Since Congress has already funded the government through mid-December at the lower 2015 level, we do not expect the deal to affect the current quarter.

• The budget deal removes most of the remaining fiscal policy uncertainty through the 2016 election. Congress still needs to pass spending bills by December, but the risk of a government shutdown at that point appears low.

• All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is a 0.9% decrease in orders.

Fannie Mae: Mortgage Serious Delinquency rate declined in September, Lowest since August 2008

by Calculated Risk on 11/02/2015 04:46:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in September to 1.59% from 1.62% in August. The serious delinquency rate is down from 1.96% in September 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Freddie Mac reported last week.

The Fannie Mae serious delinquency rate has only fallen 0.37 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.