by Calculated Risk on 11/14/2015 08:11:00 AM

Saturday, November 14, 2015

Schedule for Week of November 15th

The key economic reports this week is October housing starts on Wednesday.

For prices, CPI will be released on Tuesday.

For manufacturing, October Industrial Production will be released on Tuesday, and the November New York, Philly, and Kansas City Fed manufacturing surveys will be released this week.

A key focus will be on the FOMC minutes on Wednesday.

8:30 AM: NY Fed Empire State Manufacturing Survey for November. The consensus is for a reading of -5.0, up from -11.4.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.5%.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 64, unchanged from October. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: The Mortgage Bankers Association (MBA) Q3 2015 National Delinquency Survey (NDS).

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. Total housing starts increased to 1.206 million (SAAR) in September. Single family starts increased to 740 thousand SAAR in September.

The consensus for 1.162 million, down from September.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of October 27-28, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 276 thousand the previous week.

10:00 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 0.0, up from -4.5.

10:00 AM ET: Regional and State Employment and Unemployment for October.

11:00 AM: the Kansas City Fed manufacturing survey for November.

Friday, November 13, 2015

Goldman: Decline in Oil Prices boosted GDP by 0.2% in 2015

by Calculated Risk on 11/13/2015 08:35:00 PM

A few excerpts from a Goldman Sachs research piece by economist Daan Struyven: Shale, States and the Shrinking Oil Stimulus

Crude oil prices are down more than 50% from their level in mid-2014. As oil prices declined, many observers—ourselves included—expected substantial positive effects from cheaper oil on US growth. But 18 months later, the size of the stimulus—and how much might be left in the tank—remains a source of debate.

The energy profile of the US has changed substantially over the past decade. The US is now more self-reliant because of the fracking revolution, and energy investment plays an increasingly important role in the economy.

We revisit the impact of cheaper oil on GDP growth and payrolls using a disaggregated view in this week’s Analyst. Specifically, we exploit the fact that oil-producing states lose from price declines while oil-consuming states gain. The differential effects across states can therefore help uncover the economy-wide impact of oil shocks.

Our state-level analysis suggests that a 50% decline in oil prices is associated with an eventual rise in aggregate output of 0.4% and 400,000 to 500,000 extra jobs. These estimates are broadly consistent with our most recent research, but below the impact implied by many earlier studies. Taking together our new state-level estimates as well as our earlier work and a few back-of-the-envelope calculations, our best estimate would be that cheaper oil has boosted GDP growth in 2015 by 0.2 pp. Looking ahead, we think that about 0.1 pp of oil growth stimulus is left in the tank, which should lift growth over the next 18 months.

Hotels: RevPAR up 35% over the last 6 years

by Calculated Risk on 11/13/2015 02:12:00 PM

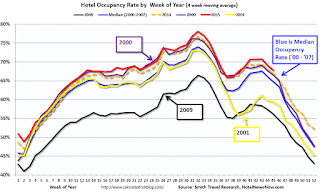

RevPAR (revenue per available room) was $80.23 last week. For the same week in 2009, RevPAR was $59.28. An increase of 35% in six years.

Here is weekly update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 7 November

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 1-7 November 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are now in the Fall business travel season.

In year-over-year measurements, the industry’s occupancy increased 0.2% to 66.4%. Average daily rate for the week was up 3.1% to US$120.73. Revenue per available room increased 3.3% to finish the week at US$80.23.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.I added 2001 (yellow) to show the impact of 9/11/2001 on hotel occupancy. Occupancy was already down in 2001 compared to 2000 due to the recession, and then really collapsed following 9/11.

For 2015, the 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and 2015 will probably be the best year ever for hotels.

Occupancy Rate Year-to-date:

1) 2015 67.6%

2) 2000 66.9%

3) 2014 66.4%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Flashback to 2006: "Housing prices have got a long way to fall"

by Calculated Risk on 11/13/2015 12:21:00 PM

Sometimes I look back through some older posts. Back in 2005 and 2006, the primary subject of my posts were the housing bubble, and the potential impact of the then coming housing bust on the US economy.

There were a number of people warning about the housing bust. Here is an interview I came across this morning. In this September 2006 post, I linked to a Bloomberg video of Paul Krugman discussing housing:

"I think we are looking at a housing cycle that we've never seen.On a national basis, according to Case-Shiller, house prices declined 25% following that interview to the post-bubble lows. In Las Vegas, house prices fell 60%.

...

If history is any guide, housing prices have got a long way to fall and the housing industry is going to go through a long drought."

And on the "long drought" ... housing starts fell over 70% ... and are still 30% below the level of September 2006.

Sometimes economists and analysts get it right.

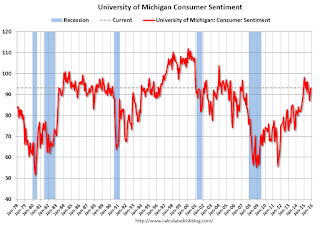

Preliminary November Consumer Sentiment increases to 93.1

by Calculated Risk on 11/13/2015 10:02:00 AM

The preliminary University of Michigan consumer sentiment index for November was at 93.1, up from 90.0 in October.

"Confidence rose in early November mainly due to a stronger outlook for the domestic economy. Overall, the most recent confidence reading was equal to the average during the first ten months of 2015, and higher than any year since 2004. Two trends dominated the early November data: consumers anticipated somewhat larger income increases during the year ahead as well as expected a somewhat lower inflation rate. This meant that consumers held the most favorable inflation-adjusted income expectations since 2007. Moreover, the somewhat larger gains were anticipated by lower income households. Buying plans for large discretionary purchases improved, especially for vehicles. Overall, the data indicate an expected rate of growth in personal consumption expenditures of 2.9% in 2016. "This was above the consensus forecast of 92.0.

Click on graph for larger image.

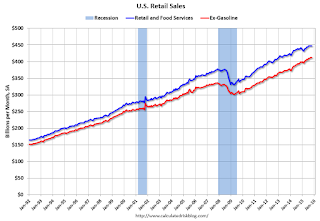

Retail Sales increased 0.1% in October

by Calculated Risk on 11/13/2015 08:40:00 AM

On a monthly basis, retail sales were up 0.1% from September to October (seasonally adjusted), and sales were up 1.7% from October 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $447.3 billion, an increase of 0.1 percent from the previous month, and 1.7 percent above October 2014. ... The August 2015 to September 2015 percent change was revised from +0.1 percent to virtually unchanged.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 4.1% on a YoY basis (1.7% for all retail sales including gasoline).

Retail and Food service sales ex-gasoline increased by 4.1% on a YoY basis (1.7% for all retail sales including gasoline).The increase in October was below expectations of a 0.3% increase,and sales in August and September were revised down. This was a weak report, however sales ex-gasoline are still up a decent 4.1% YoY.

Thursday, November 12, 2015

Friday: Retail Sales, PPI, Consumer Sentiment

by Calculated Risk on 11/12/2015 08:24:00 PM

Friday:

• At 8:30 AM ET, the Producer Price Index for October from the BLS. The consensus is for a 0.2% increase in prices, and a 0.1% increase in core PPI.

• Also at 8:30 AM, Retail sales for October will be released. On a monthly basis, retail sales were up 0.1% from August to September (seasonally adjusted), and sales were up 2.4% from September 2014. The consensus is for retail sales to increase 0.3% in October, and to increase 0.4% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for no change in inventories.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 92.0, up from 90.0 in October.

From Reuters: Oil slumps 4 percent, nears new six-year low as glut persists

Oil prices tumbled almost 4 percent on Thursday, accelerating a slump that threatens to test new six-and-a-half year lows, with traders unnerved by a persistent rise in U.S. stockpiles and a downbeat forecast for next year.

...

The latest decline was triggered by data showing that U.S. stockpiles were still rising rapidly toward the record highs reached in April, despite slowing U.S. shale production.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices Friday added). According to Bloomberg, WTI was at $41.66 per barrel today, and Brent at $44.06.

This is about still above the lows back in August ($38.22 for WTI, and $41.59 for Brent), and down almost 50% year-over-year.

Fed's Fischer: "The Transmission of Exchange Rate Changes to Output and Inflation"

by Calculated Risk on 11/12/2015 06:29:00 PM

From Fed Vice Chair Stanley Fischer The Transmission of Exchange Rate Changes to Output and Inflation. An excerpt on the strong dollar and inflation:

One way in which the stronger dollar depresses inflation is by putting downward pressure on import prices. ...Fischer thinks the impact of the strong dollar on inflation will be transient, and PCE inflation will rise next year.

An important difference between the transmission of dollar appreciation to inflation compared with output is that the effects on inflation are probably more transient. In particular, given that most of the effect on inflation occurs through changes in import prices--and import prices respond quickly to the exchange rate--the peak effect on inflation probably occurs within a few quarters. From the standpoint of the outlook, this transience means that some of the forces holding down inflation in 2015--particularly those due to a stronger dollar and lower energy prices--will begin to fade next year. Consequently, overall PCE inflation is likely on this account alone to rebound next year to around 1-1/2 percent. And as long as inflation expectations remain well anchored, both core and overall inflation are likely to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of declines in energy and import prices dissipate.

emphasis added

Rosenberg on Labor Force Participation Rate

by Calculated Risk on 11/12/2015 02:27:00 PM

David Rosenberg, chief economist at Gluskin Sheff wrote about the Labor Force Participation Rate (LFPR) in his daily "Breakfast with Dave" newsletter: THEY AIN’T COMING BACK.

The title says it all. Here is the introduction and his conclusion (a long piece):

There has been a surprisingly large amount of commentary writing off the improvement in the U.S. unemployment rate — which dipped below the Congressional Budget Office’s estimate of the non-accelerating inflation rate of unemployment (NAIRU) for the first time since February 2008 in October — given that we have not seen an attendant uptick in the labour force participation rate.This is similar to my post earlier this year: Why the Prime Labor Force Participation Rate has Declined. Rosenberg focused on the Boomers retiring, however I've argued there are other factors too (People staying in school longer and a slow, but steady decline in prime men participation). But our conclusions are the same: the participation rate has mostly declined due to structural factors, not cyclical. And the participation rate will continue to decline for the next decade or more.

...

So, once again, any mention of the participation rate — or alternatively, mentions of a participation rate-adjusted unemployment rate or anything else of along those lines — as an indicator of labour market slack or as an argument for why the unemployment rate is obsolete and should be ignored, especially in the context of the policy discussion.

emphasis added

Fed's Dudley and Evans

by Calculated Risk on 11/12/2015 12:29:00 PM

First, from the WSJ Economists Overwhelmingly Expect Fed to Raise Interest Rates in December

About 92% of the business and academic economists polled by The Wall Street Journal in recent days said they expected the Fed to raise its benchmark federal-funds rate at its Dec. 15-16 policy meeting. Some 5% said the Fed would stay on hold until March and 3% predicted the Fed would keep rates at near-zero even longer.From NY Fed President William Dudley sees the risks in liftoff as "balanced": The U.S. Economic Outlook and Monetary Policy

I see the risks right now of moving too quickly versus moving too slowly as nearly balanced. The weight that one puts on each undoubtedly influences one’s views on when the time will be right to begin to normalize monetary policy and the appropriate short-term rate trajectory thereafter.Chicago Fed President Charles Evans argues for a later liftoff: A Cautious Approach to Monetary Policy Normalization

There is no doubt that labor markets have improved significantly over the past seven years. Job growth has been quite solid for some time now. That includes last month’s number, which was quite good. And today, at 5 percent, the unemployment rate is one half its peak in 2009. This is just a tenth of a percentage point above the median long-run projection. However, a number of other labor market indicators lead me to believe that there still remains some additional resource slack beyond what is indicated by the unemployment rate alone: Notably, 1) a large number of people who are employed part time would prefer a full-time job; 2) the labor force participation rate is quite low, even after accounting for demographic and other long-running trends; and 3) wage growth has been quite subdued. In sum, I don’t think we’re quite there yet, but we have made good progress toward meeting our employment mandate.

...

However, I am far less confident about reaching our inflation goal within a reasonable time frame. Inflation has been too low for too long. Core PCE inflation — which strips out the volatile energy and food components and is a good indicator of underlying inflation trends — has averaged just 1.4 percent over the past seven years. Core PCE inflation over the past 12 months was just 1.3 percent. And inflation according to the total PCE Price Index — which does include food and energy prices — was just 0.2 percent over the past year.

Most FOMC participants expect inflation to rise steadily from these low levels, coming in just a shade under the Committee’s 2 percent target by the end of 2017. My own forecast is less sanguine. I expect core PCE inflation to undershoot 2 percent by a greater margin over the next two years than do my colleagues. I expect core PCE inflation to be just below 2 percent at the end of 2018.

...

How does this asymmetric assessment of risks to achieving the dual mandate goals influence my view of the most appropriate path for monetary policy over the next three years? It leads me to conclude that 1) a later liftoff and 2) a more gradual normalization of our monetary policy setting will best position the economy for the potential challenges ahead.

More specifically, before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment. I believe that it could be well into next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation. After liftoff, I think it would be appropriate to raise the target interest rate very gradually. This would give us sufficient time to assess how the economy is adjusting to higher rates and the progress we are making toward our policy goals.

Overall, my view of appropriate policy is somewhat more accommodative than those held by the majority of my colleagues.