by Calculated Risk on 11/17/2015 10:05:00 AM

Tuesday, November 17, 2015

NAHB: Builder Confidence declines to 62 in November

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 62 in November, down from 65 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Drops in November but Still Solid

Builder confidence in the market for newly constructed single-family homes slipped three points to 62 in November from an upwardly revised October reading on the NAHB/Wells Fargo Housing Market Index (HMI).

...

“The November report is pullback from an unusually high October, and is more in line with the consistent, modest growth that we have seen throughout the year,” said NAHB Chief Economist David Crowe. “A firming economy, continued job creation and affordable mortgage rates should keep housing on an upward trajectory as we approach 2016.”

...

Two of the three HMI components posted losses in November. The index measuring sales expectations in the next six months fell five points to 70, and the component gauging current sales conditions decreased three points to 67. Meanwhile, the index charting buyer traffic rose one point to 48.

Looking at the three-month moving averages for regional HMI scores, the West increased four points to 73 while the Northeast rose three points to 50. Meanwhile the Midwest and South held steady at 60 and 65, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 64, but still a strong reading.

Fed: Industrial Production decreased 0.2% in October

by Calculated Risk on 11/17/2015 09:26:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.2 percent in October after decreasing the same amount in September. In October, the index for manufacturing moved up 0.4 percent, while the index for mining fell 1.5 percent and the index for utilities dropped 2.5 percent. For the third quarter as a whole, total industrial production is now estimated to have increased at an annual rate of 2.6 percent; a gain of 1.8 percent had been reported previously. At 107.2 percent of its 2012 average, total industrial production in October was 0.3 percent above its year-earlier level. Capacity utilization for the industrial sector declined 0.2 percentage point in October to 77.5 percent, a rate that is 2.6 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is 2.6% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.2% in October to 107.2. This is 22.9% above the recession low, and 2.0% above the pre-recession peak.

This was below expectations of a 0.1% increase, however August and September were revised up.

CPI increased 0.2% in October

by Calculated Risk on 11/17/2015 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.2 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.2% increase for CPI, and also at the forecast of a 0.2% increase in core CPI.

The indexes for food, energy, and all items less food and energy all increased modestly in October. The food index, which increased 0.4 percent in September, rose 0.1 percent in October, with four of the six major grocery store food group indexes rising. The energy index, which declined in August and September, advanced 0.3 percent in October; major energy component indexes were mixed.

The index for all items less food and energy rose 0.2 percent in October, the same increase as in September. ... The index for all items less food and energy has risen 1.9 percent over the past 12 months; this is the same figure as the 12 months ending September.

emphasis added

Monday, November 16, 2015

Tuesday: CPI, Industrial Production, MBA Q3 National Delinquency Survey

by Calculated Risk on 11/16/2015 08:56:00 PM

Tuesday:

• At 8:30 AM ET, the Consumer Price Index for October from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.5%.

• At 10:00 AM, the November NAHB homebuilder survey. The consensus is for a reading of 64, unchanged from October. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, The Mortgage Bankers Association (MBA) Q3 2015 National Delinquency Survey (NDS).

Fed Economic Letter: "What’s Different about the Latest Housing Boom?"

by Calculated Risk on 11/16/2015 02:54:00 PM

From Reuven Glick, Kevin J. Lansing, and Daniel Molitor at the San Francisco Fed: What’s Different about the Latest Housing Boom?

After peaking in March 2006, the median U.S. house price fell about 30%, finally hitting bottom in November 2011. Since then, the median house price has rebounded strongly and is nearly back to its pre-recession peak. In some parts of the country, house prices have reached all-time highs. This Economic Letter assesses recent housing market indicators to gauge whether “this time is different.”

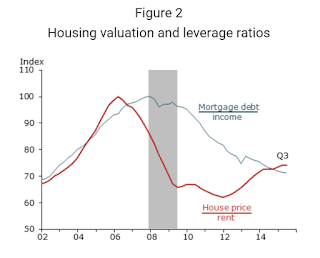

We find that the increase in U.S. house prices since 2011 differs in significant ways from the mid-2000s housing boom. The prior episode can be described as a credit-fueled bubble in which housing valuation—as measured by the house price-to-rent ratio—and household leverage—as measured by the mortgage debt-to-income ratio—rose together in a self-reinforcing feedback loop. In contrast, the more recent episode exhibits a less-pronounced increase in housing valuation together with an outright decline in household leverage—a pattern that is not suggestive of a credit-fueled bubble.

...

Figure 2 plots the house price-to-rent ratio and the mortgage debt-to-income ratio, each normalized to 100 at its pre-recession peak. The price-to-rent ratio (red line) reached an all-time high in early 2006, marking the apex of the housing bubble. Currently, the price-to-rent ratio is about 25% below the bubble peak. As house prices have recovered since 2011, so too has rent growth, providing some fundamental justification for the upward price movement.

Click on graph for larger image.

Click on graph for larger image.The mortgage debt-to-income ratio (blue line) reached an all-time high in late 2007, coinciding with the peak of the business cycle. An important lesson from history is that bubbles can be extraordinarily costly when accompanied by significant increases in borrowing. On this point, Irving Fisher (1933, p. 341) famously remarked, “over-investment and over-speculation are often important; but they would have far less serious results were they not conducted with borrowed money.”

As house prices rose during the mid-2000s, the lending industry marketed a range of exotic mortgage products to attract borrowers. These included loans requiring no down payment or documentation of income, monthly payments for interest only or less, and adjustable-rate mortgages with low introductory “teaser” rates that reset higher over time. While these were sold as a way to keep monthly payments affordable for new homebuyers, the exotic lending products paradoxically harmed affordability by fueling the price run-up. Empirical studies show that house prices rose faster in places where subprime and exotic mortgages were more prevalent. Furthermore, past house price appreciation in a given area significantly improved loan approval rates in that area (see Gelain, Lansing, and Natvik 2015 for a summary of the evidence).

The official report of the U.S. Financial Crisis Inquiry Commission (2011) states: “Despite the expressed view of many on Wall Street and in Washington that the crisis could not have been foreseen or avoided, there were warning signs. The tragedy was that they were ignored or discounted” (p. xvii). The report lists such red flags as “an explosion in risky subprime lending and securitization, an unsustainable rise in housing prices, widespread reports of egregious and predatory lending practices, [and] dramatic increases in household mortgage debt.”

Figure 2 shows that the house price-to-rent ratio and the mortgage debt-to-income ratio rose together in the mid-2000s, creating a self-reinforcing feedback loop. Since 2011, however, the two ratios have moved in opposite directions; the recent increase in housing valuation has not been associated with an increase in household leverage. Rather, leverage has continued to decline, reflecting a return of prudent lending practices, more vigilant regulatory oversight, and efforts by consumers to repair their balance sheets. The “red flags” are not evident in the current housing recovery. These observations help allay concerns about another credit-fueled bubble.

...

Conclusion

The bursting of an enormous credit-fueled housing bubble during the mid-2000s resulted in a severe recession, the effects of which are still evident more than six years after the episode officially ended. Since bottoming out in 2011, the median U.S. house price has rebounded strongly. However, the latest boom exhibits a less-pronounced increase in the house price-to-rent ratio and an outright decline in the ratio of household mortgage debt to personal disposable income—a pattern that is very different from the prior episode. Nevertheless, given that housing booms and busts can have significant and long-lasting effects on employment and other parts of the economy, policymakers and regulators must remain vigilant to prevent a replay of the mid-2000s experience.

Phoenix Real Estate in October: Sales up 2%, Inventory down 11%

by Calculated Risk on 11/16/2015 01:16:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

For the eleventh consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in October were up 2.0% year-over-year.

2) Cash Sales (frequently investors) were down to 24.9% of total sales.

3) Active inventory is now down 11.0% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

Now, with falling inventory, prices are increasing a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 3.5% through August (about double the pace for 2014).

| October Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Oct-08 | 5,384 | --- | 1,348 | 25.0% | 55,7031 | --- |

| Oct-09 | 8,121 | 50.8% | 2,688 | 33.1% | 39,312 | -29.4% |

| Oct-10 | 6,591 | -18.8% | 2,800 | 42.5% | 45,252 | 15.1% |

| Oct-11 | 7,561 | 14.7% | 3,336 | 44.1% | 27,266 | -39.7% |

| Oct-12 | 7,020 | -7.2% | 3,081 | 43.9% | 22,702 | -16.7% |

| Oct-13 | 6,038 | -14.0% | 1,910 | 31.6% | 26,267 | 15.7% |

| Oct-14 | 6,186 | 2.5% | 1,712 | 27.7% | 27,760 | 5.7% |

| Oct-15 | 6,308 | 2.0% | 1,570 | 24.9% | 24,702 | -11.0% |

| 1 October 2008 probably includes pending listings | ||||||

HUD: FHA'S 2015 Annual Report Shows Capital Reserves Now Exceed 2%, First Time Since 2008

by Calculated Risk on 11/16/2015 10:05:00 AM

From HUD: FHA'S 2015 ANNUAL REPORT SHOWS CAPITAL RESERVES NOW EXCEED 2%

The U.S. Department of Housing and Urban Development (HUD) today released its annual report to Congress on the financial condition of the Federal Housing Administration’s Mutual Mortgage Insurance (MMI) Fund. The independent actuarial analysis shows the MMI Fund’s capital ratio stands at 2.07 percent—the first time since 2008 that FHA’s reserve ratio exceeded the congressionally required 2 percent threshold. The economic value of the MMI Fund gained $19 billion in Fiscal Year 2015, driven by strong actions to reduce risk, cut losses and improve recoveries.From the report:

This is the third consecutive year of economic growth for the MMI Fund, allowing FHA to expand credit access to qualified borrowers even as the broader housing market continues to recover. FHA’s annual report also notes a significant increase in loan volume during FY 2015, due largely to a reduction in annual mortgage insurance premium prices announced in January. Read a comprehensive summary of the report released today.

“FHA is on solid financial footing and positioned to continue playing its vital role in assisting future generations of homeowners,” said HUD Secretary Julián Castro. “We’ve taken a number of steps to strengthen the Fund and increase credit access to responsible borrowers. Today’s report demonstrates that we struck the right balance in responsibly growing the Fund, reducing premiums, and doing what FHA was born to do – allowing hardworking Americans to become homeowners and spurring growth in the housing market as well as the broader economy.”

Click on graph for larger image.

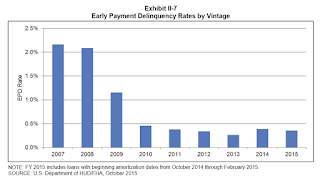

Click on graph for larger image.The quality of new business is reflected by early payment delinquencies (EPD) rates. The EPD rate is the rate at which loans experience 90-day delinquencies within the first six months of origination, another metric that suggests the sustainability of the recovery in the Forward portfolio. EPD rates provide the first indication of potential credit performance of newly insured loans and are a leading indicator of the long-term claim risk of a particular book of business.

The EPD performance of FHA’s portfolio in FY 2015 continued trends seen in recent years, as newer books of business vastly outperform those insured in prior years. EPD rates for the FY 2010 through February 2015 vintages are less than 20 percent of the EPD rates for the FY 2007 and 2008 vintages (Exhibit II-7).

The number of seriously delinquent FHA loans (loans that are 90 or more days past due) continued to decline in FY 2015. Exhibit II-8 shows the serious delinquency rate has fallen by 35 percent over the last four years, a nearly $35 billion improvement in the size of the seriously delinquent portfolio over that time.

NY Fed: Manufacturing Activity Declined in November

by Calculated Risk on 11/16/2015 08:41:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity declined for a fourth consecutive month for New York manufacturers, according to the November 2015 survey. The general business conditions index was little changed at -10.7.This is the first regional survey for November, and manufacturing contracted further in the NY region. This was well below the consensus forecast of a reading of -5.0.

...

Labor market conditions continued to weaken. The index for number of employees was little changed at -7.3, a sign that employment levels fell for a third consecutive month, and the average workweek index moved down seven points to -14.6, its lowest level since mid-2011.

...

Indexes for the six-month outlook were little changed from last month, and suggested that optimism about future business conditions remained muted.

emphasis added

Sunday, November 15, 2015

Sunday Night Futures

by Calculated Risk on 11/15/2015 06:22:00 PM

From the LA Times: El Niño 'is here, and it is huge,' as officials race to prep for winter

El Niño continues to gain strength in the Pacific Ocean, climate experts said, with unusually wet conditions expected to hit California between January and March -- and perhaps into May.It will probably be a crazy winter. Goldman Sachs thinks El Niño will provide a small economic boost: El Niño: A Potential Small Boost to Growth This Winter

The El Niño climatological event that began this spring is currently on track to be one of the five strongest episodes since 1950. ... we assess the implications for the US economy.Monday:

Weather conditions have varied widely during previous major El Niño events, and considerable uncertainty remains about this winter’s conditions. On average, the US has had about 1 standard deviation more precipitation and fewer heating degree days (warmer weather) during El Niño winters, with the South generally wetter and the North generally warmer.

If weather this winter is in line with conditions during the average major El Niño, we would expect warmer temperatures to boost growth by about 0.2pp during Q1. On the inflation side, while food prices have been somewhat higher and energy prices somewhat lower during El Niño winters, we would not expect a significant impact on core inflation.

• At 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for November. The consensus is for a reading of -5.0, up from -11.4.

Weekend:

• Schedule for Week of November 15, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 16 and DOW futures are down 119 (fair value).

Oil prices were down over the last week with WTI futures at $40.74 per barrel and Brent at $44.47 per barrel. A year ago, WTI was at $75, and Brent was at $77 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.15 per gallon (down about $0.75 per gallon from a year ago).

LA area Port Traffic declined in October

by Calculated Risk on 11/15/2015 09:33:00 AM

First, from the WSJ: Quiet U.S. Ports Spark Slowdown Fears

For the first time in at least a decade, imports fell in both September and October at each of the three busiest U.S. seaports, according to data from trade researcher Zepol Corp. analyzed by The Wall Street Journal. ...Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled in late February. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April.

...

The declines came during a stretch from late summer to early fall known in the transportation world as peak shipping season, when cargo volumes typically surge through U.S. ports. It is a crucial few months for the U.S. economy as well: High import volumes can signal a confident view on the economy among retailers and manufacturers, while fears of a slowdown grow when ports are quiet.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was down 0.2% compared to the rolling 12 months ending in October. Outbound traffic was down 0.5% compared to 12 months ending in October.

The recent downturn in exports might be due to the strong dollar and weakness in China.

For imports, August was the all time inbound record, so some of September and October traffic probably arrived in August.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were down 2% year-over-year in October; exports were down 6% year-over-year.

For the July through October peak period, imports were up 2.1% year-over-year - not the weakness described in the WSJ article (although the WSJ article included New York harbor).