by Calculated Risk on 11/18/2015 07:14:00 PM

Wednesday, November 18, 2015

Sacramento Housing in October: Sales up 11%, Inventory down 22% YoY

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 276 thousand the previous week.

• At 10:00 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 0.0, up from -4.5.

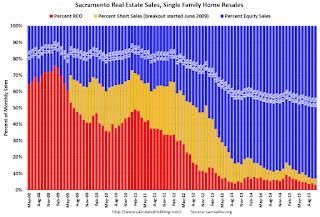

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October, total sales were up 10.5% from October 2014, and conventional equity sales were up 16.9% compared to the same month last year.

In October, 7.0% of all resales were distressed sales. This was up from 6.9% last month, and down from 12.1% in October 2014.

The percentage of REOs was at 3.3% in October, and the percentage of short sales was 3.7%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales. Distressed sales are so small, the font doesn't fit.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 21.5% year-over-year (YoY) in October. This was the sixth consecutive monthly YoY decrease in inventory in Sacramento (a big recent change).

Cash buyers accounted for 15.3% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying.

Lawler: Early Look at Existing Home Sales in October

by Calculated Risk on 11/18/2015 04:20:00 PM

From housing economist Tom Lawler:

Based on publicly-released realtor/MLS reports from across the country which combined total over 200,000 residential sales, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.33 million in October, down 4.0% from September’s preliminary pace and up 3.3% from last October’s seasonally adjusted pace.

On a not seasonally adjusted basis the YOY % change in home sales last month was down sharply from September in the vast majority of markets, and there were quite a few markets where sales were down from a year ago A few markets – including Houston, Oklahoma City, and Denver – saw double-digit YOY % declines in home sales last month. To be sure, there was one fewer business day this October compared to last October, which ceteris paribus would result is a mildly lower YOY % change in unadjusted sales. However, the overall sales decline was considerable greater than can be attributed to any “business-day count” effect.

In some markets slower home closings may have been adversely impacted by bad weather, as there were very heavy rains and flooding in a few parts of the country early last month (e.g. South Carolina, where home sales were down 5.5% YOY). Weather cannot explain, however, the broad-based slowdown in sales. It may also be possible that the new “TLIA-RESPA Integrated Disclosure” (TRID) rules may have delayed closings slightly in some cases.

On the inventory front, realtor/MLS data suggest that the inventory of existing home sales as estimated by the National Association of Realtors declined by a bit more this October than last October, and I project that the NAR’s inventory number for October will be 2,160,000, down 2.3% from September’s preliminary level and down 3.6% from last October. A very notable exception to the YOY decline in inventories is Houston, where home listing at the end of October were up 18.9% from a year ago.

Finally, realtor/MLS data suggest that the median existing SF home sale price last month was up about 5.7% from last October.

FOMC Minutes: "Most participants anticipated conditions could be met by next meeting"

by Calculated Risk on 11/18/2015 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, October 27-28, 2015. Excerpts:

During their discussion of economic conditions and monetary policy, participants focused on a number of issues associated with the timing and pace of policy normalization. Some participants thought that the conditions for beginning the policy normalization process had already been met. Most participants anticipated that, based on their assessment of the current economic situation and their outlook for economic activity, the labor market, and inflation, these conditions could well be met by the time of the next meeting. Nonetheless, they emphasized that the actual decision would depend on the implications for the medium-term economic outlook of the data received over the upcoming intermeeting period. Some others, however, judged it unlikely that the information available by the December meeting would warrant raising the target range for the federal funds rate at that meeting.

A number of participants pointed to various reasons why the Committee should avoid a delay in policy firming. One concern was that such a delay, if the reasons were not well understood by market participants, could increase uncertainty in financial markets and unduly magnify the perceived importance of the beginning of the policy normalization process. Another concern mentioned was the increasing risk of a buildup of financial imbalances after a prolonged period of very low interest rates. It was also noted that a decision to defer policy firming could be interpreted as signaling lack of confidence in the strength of the U.S. economy or erode the Committee's credibility. Some participants emphasized that progress toward the Committee's objectives should be assessed in light of the cumulative gains made to date without placing excessive weight on month-to-month changes in incoming data.

Several participants indicated that, despite lessening concerns about the implications of recent global economic and financial developments for domestic economic activity and inflation, appreciable downside risks to the outlook remained. They were concerned about a potential loss of momentum in the economy and the associated possibility that inflation might fail to increase as expected. Such concerns might suggest that the initiation of the normalization process may not yet be warranted. They also noted uncertainty about whether economic growth was robust enough to withstand potential adverse shocks, given the limited ability of monetary policy to offset such shocks when the federal funds rate is near its effective lower bound, and concern that the beginning of policy normalization might be associated with an unwarranted tightening of financial conditions. They believed that in these circumstances, risk-management considerations called for a cautious approach. They judged it appropriate to wait for additional information providing evidence of further improvement in the labor market and increasing their confidence that inflation was on a path to return to 2 percent over the medium term before raising the target range for the federal funds rate. In addition, a couple of participants cited concerns that a premature tightening might damage the credibility of the Committee's inflation objective if inflation stayed below 2 percent for a prolonged period.

Several participants indicated that, in the current low interest rate environment, it would be prudent for the Committee to consider options for providing additional monetary policy accommodation if the outlook for economic activity were to weaken to a degree that seemed likely to undermine continued progress in labor market conditions and impede the movement of inflation back to the Committee's 2 percent objective over the medium term. It was also noted that the Committee would need to reformulate its communications regarding the near-term outlook for monetary policy if the economic outlook weakened significantly.

During their discussion of the likely path for the federal funds rate after the time of the first increase in the target range, participants generally agreed that it would probably be appropriate to remove policy accommodation gradually. Participants also indicated that the expected path of policy, rather than the timing of the initial increase, would be the more important influence on financial conditions and thus on the outlook for the economy and inflation, and they noted the importance of underscoring this view at the time of liftoff. It was noted that beginning the normalization process relatively soon would make it more likely that the policy trajectory after liftoff could be shallow. It was also emphasized that, while participants' most recent economic projections suggested that a gradual increase in the target range for the federal funds rate will likely be appropriate to support progress toward the Committee's dual objectives, monetary policy adjustments ultimately would be dependent on economic and financial developments. These adjustments thus could be either more or less gradual than the Committee currently anticipates, responding to the Committee's assessment of the implications of incoming information for the medium-run outlook.

...

In its postmeeting statement, rather than framing its near-term policy path in terms of how long to maintain the current target range, the Committee decided to indicate that, in determining whether it would be appropriate to raise the target range at its next meeting, it would assess both realized and expected progress toward its objectives of maximum employment and 2 percent inflation. Members emphasized that this change was intended to convey the sense that, while no decision had been made, it may well become appropriate to initiate the normalization process at the next meeting, provided that unanticipated shocks do not adversely affect the economic outlook and that incoming data support the expectation that labor market conditions will continue to improve and that inflation will return to the Committee's 2 percent objective over the medium term. Members saw the updated language as leaving policy options open for the next meeting. However, a couple of members expressed concern that this wording change could be misinterpreted as signaling too strongly the expectation that the target range for the federal funds rate would be increased at the Committee's next meeting.

emphasis added

AIA: "Architecture Billings Index on Solid Footing" in October

by Calculated Risk on 11/18/2015 09:38:00 AM

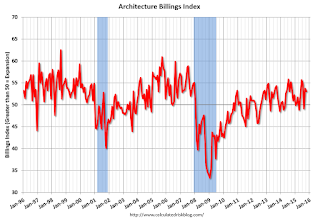

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index on Solid Footing

There has been increasing levels of demand for design services for nearly all construction project types for the majority of the year as revealed in the Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 53.1, down slightly from the mark of 53.7 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.5, down from a reading of 61.0 the previous month.

“Allowing for the possibility of occasional and minor backsliding, we expect healthy business conditions for the design and construction industry to persist moving into next year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “One area of note is that the multi-family project sector has come around the last two months after trending down for the better part of the year.”

...

• Regional averages: South (56.2), West (54.4), Midwest (52.6), Northeast (49.2)

• Sector index breakdown: commercial / industrial (55.1), mixed practice (54.9), multi-family residential (52.5), institutional (51.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.1 in October, down from 53.7 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of the year - suggesting a slowdown or less growth for apartments - but has now turned positive.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

Housing Starts decreased to 1.060 Million Annual Rate in October

by Calculated Risk on 11/18/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,060,000. This is 11.0 percent below the revised September estimate of 1,191,000 and is 1.8 percent below the October 2014 rate of 1,079,000.

Single-family housing starts in October were at a rate of 722,000; this is 2.4 percent below the revised September figure of 740,000. The October rate for units in buildings with five units or more was 327,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,150,000. This is 4.1 percent above the revised September rate of 1,105,000 and is 2.7 percent above the October 2014 estimate of 1,120,000.

Single-family authorizations in October were at a rate of 711,000; this is 2.4 percent above the revised September figure of 694,000. Authorizations of units in buildings with five units or more were at a rate of 405,000 in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in October. Multi-family starts are down year-over-year.

Most of the weakness in October was in the volatile multi-family sector.

Single-family starts (blue) decreased in October and are up year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),Total housing starts in October were below expectations, and starts for August and September were revised down slightly. I'll have more later ...

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey, Purchase Applications up 19% YoY

by Calculated Risk on 11/18/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

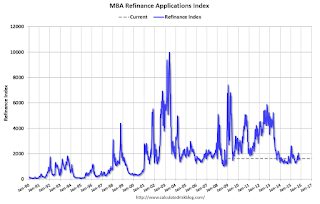

Mortgage applications increased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 13, 2015. This week’s results included an adjustment for the Veterans Day holiday.

...

The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 19 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.18 percent, its highest level since July 2015, from 4.12 percent, with points remaining unchanged at 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 19% higher than a year ago.

Tuesday, November 17, 2015

Wednesday: Housing Starts, FOMC Minutes

by Calculated Risk on 11/17/2015 08:40:00 PM

Congress might shut down the government in December, from the WSJ: House Speaker Ryan Warns of Budget, Guantanamo Bay Confrontations With White House

Spending legislation needed to avoid a government shutdown in December must include Republican policy measures in order to pass Congress, House Speaker Paul Ryan (R., Wis.) said Tuesday.Shutting down the government is a bad idea.

Mr. Ryan didn’t rule out the possibility of a lapse in government funding when its current funding expires on Dec. 11, saying Republicans will force President Barack Obama to accept some conservative provisions, known as “riders” in the sweeping spending bill.

“There will have to be some riders in this for us to pass it through Congress,” Mr. Ryan said ...

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for October. Total housing starts increased to 1.206 million (SAAR) in September. Single family starts increased to 740 thousand SAAR in September. The consensus for 1.162 million, down from September.

• During the day, the AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

• At 2:00 PM, the Fed will release the FOMC Minutes for the Meeting of October 27-28, 2015

El Niño Update: Possibly "most powerful on record"

by Calculated Risk on 11/17/2015 04:31:00 PM

From the LA Times: El Niño could be the most powerful on record, scientists say

On the impact:

For the United States, El Niño can shift the winter track of storms that normally keeps the jungles of southern Mexico and Central America wet and moves them over California and the southern United States. The northern United States, like the Midwest and Northeast, typically see milder winters during El Niño.The South will probably be wetter than normal, and the north warmer. Typically growth picks up a little during an El Niño due to the milder winters in the midwest and northeast.

And on the data:

A key location of the Pacific Ocean is now hotter than recorded in at least 25 years, surpassing the temperatures during the record 1997 El Niño.

Some scientists say their measurements show that this year’s El Niño could be among the most powerful on record -- and even toppling the 1997 event from its pedestal.

“This thing is still growing and it’s definitely warmer than it was in 1997,” said Bill Patzert, climatologist with NASA’s Jet Propulsion Laboratory in La Cañada Flintridge. As far as the temperature readings go, "it’s now bypassed the previous champ of the modern satellite era -- the 1997 El Niño has just been toppled by 2015.”

Key Measures Show Inflation somewhat higher in October

by Calculated Risk on 11/17/2015 12:09:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in October. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for October here. Motor fuel was up a little in October following sharp declines in previous months.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in October. The CPI less food and energy rose 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy also rose 1.9%. Core PCE is for September and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized, trimmed-mean CPI was at 2.5% annualized, and core CPI was at 2.5% annualized.

On a year-over-year basis, three of these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low, but appears to be moving up.

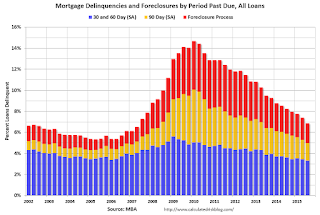

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q3

by Calculated Risk on 11/17/2015 10:28:00 AM

From the MBA: Mortgage Foreclosures and Delinquencies Continue to Drop

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.99 percent of all loans outstanding at the end of the third quarter of 2015. This was the lowest level since the first quarter of 2007. The delinquency rate decreased 31 basis points from the previous quarter, and 86 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.88 percent, down 21 basis points from the second quarter and 51 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the third quarter of 2007.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.38 percent, a decrease of two basis points from the previous quarter, and down six basis points from one year ago. The foreclosure starts rate is at the lowest level since the second quarter of 2005.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 3.57 percent, a decrease of 38 basis points from last quarter, and a decrease of 108 basis points from last year. This was the lowest serious delinquency rate since the third quarter of 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 85% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 80% of the way back to normal.

So it has taken 5 1/2 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 80%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.