by Calculated Risk on 12/01/2015 10:08:00 AM

Tuesday, December 01, 2015

ISM Manufacturing index decreased to 48.6 in November

The ISM manufacturing index indicated contraction in November. The PMI was at 48.6% in November, down from 50.1% in October. The employment index was at 51.3%, up from 47.6% in October, and the new orders index was at 48.9%, down from 52.9%.

From the Institute for Supply Management: November 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November for the first time in 36 months, since November 2012, while the overall economy grew for the 78th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The November PMI® registered 48.6 percent, a decrease of 1.5 percentage points from the October reading of 50.1 percent. The New Orders Index registered 48.9 percent, a decrease of 4 percentage points from the reading of 52.9 percent in October. The Production Index registered 49.2 percent, 3.7 percentage points below the October reading of 52.9 percent. The Employment Index registered 51.3 percent, 3.7 percentage points above the October reading of 47.6 percent. The Prices Index registered 35.5 percent, a decrease of 3.5 percentage points from the October reading of 39 percent, indicating lower raw materials prices for the 13th consecutive month. The New Export Orders Index registered 47.5 percent, unchanged from October, and the Imports Index registered 49 percent, up 2 percentage points from the October reading of 47 percent. Ten out of 18 manufacturing industries reported contraction in November, with lower new orders, production and raw materials inventories accounting for the overall softness in November."

emphasis added

Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.5%, and indicates manufacturing contracted in November.

Monday, November 30, 2015

Tuesday: ISM Manufacturing, Construction Spending, Auto Sales

by Calculated Risk on 11/30/2015 09:04:00 PM

From the LA Times: After subprime collapse, nonbank lenders again dominate riskier mortgages

So-called nonbank lenders are again dominating a riskier corner of the housing market — this time, loans insured by the Federal Housing Administration, aimed at first-time and bad-credit buyers. Such lenders now control 64% of the market for FHA and similar Veterans Affairs loans, compared with 18% in 2010.This is probably not a serious problem, but additional oversight makes sense.

A Times analysis of federal loan data shows that FHA mortgages from nonbank lenders are seeing more delinquencies than similar loans from banks.

...

"The idea that a lot of the folks who benefited during subprime are now back in action calls out for closer scrutiny," said Kevin Stein, associate director of the California Reinvestment Coalition, a fair-lending advocacy group in San Francisco.

The surge in nonbank lending also has prompted alarm at Ginnie Mae, a government corporation that monitors FHA and VA lenders. Ginnie Mae's president, Ted Tozer, has requested $5 million in additional federal funding to hire 33 additional regulators.

"These firms have grown so fast," he said.

Tuesday:

• At 10:00 AM ET, ISM Manufacturing Index for November. The consensus is for the ISM to be at 50.5, up from 50.1 in October. The employment index was at 47.6% in October, and the new orders index was at 52.9%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

• All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 18.0 million SAAR in November from 18.1 million in October (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined slightly in October

by Calculated Risk on 11/30/2015 04:06:00 PM

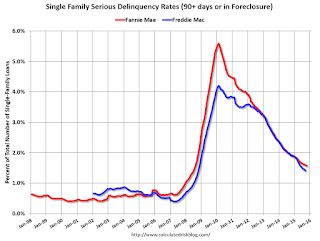

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined slightly in October to 1.58% from 1.59% in September. The serious delinquency rate is down from 1.92% in October 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Freddie Mac has not reported for October yet.

The Fannie Mae serious delinquency rate has only fallen 0.34 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Restaurant Performance Index indicates faster expansion in October

by Calculated Risk on 11/30/2015 12:31:00 PM

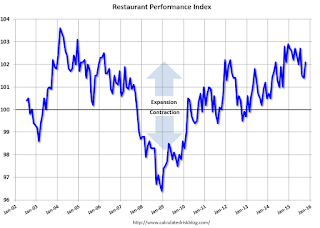

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Rose in October

Driven by stronger same-store sales and a more optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a moderate gain in October. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.1 in October, up 0.7 percent from a level of 101.4 in September. In addition, October represented the 32nd consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

“The October gain in the RPI was buoyed by broad-based improvements in the current situation indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are somewhat more optimistic about both sales growth and the economy in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.1 in October, down from 101.4 in September. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This index is indicated decent expansion in October, and it appears restaurants are benefiting from lower gasoline prices and the improved labor market.

NAR: Pending Home Sales Index increased 0.2% in October, up 3.9% year-over-year

by Calculated Risk on 11/30/2015 10:02:00 AM

From the NAR: Pending Home Sales Nudge Forward in October

The Pending Home Sales Index, a forward-looking indicator based on contract signings, inched 0.2 percent to 107.7 in October from an upwardly revised 107.5 in September and is now 3.9 percent above October 2014 (103.7). The index has increased year-over-year for 14 consecutive months.This is below expectations of a 1% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

...

The PHSI in the Northeast rose 4.5 percent to 93.6 in October, and is now 6.8 percent above a year ago. In the Midwest the index declined 1.0 percent to 103.9 in October, but remains 3.3 percent above October 2014.

Pending home sales in the South decreased 1.7 percent to an index of 118.1 in October and are now 0.3 percent below last October. The index in the West climbed 1.7 percent in October to 106.2, and is 10.4 percent above a year ago.

emphasis added

Chicago PMI declines to 48.7

by Calculated Risk on 11/30/2015 09:53:00 AM

Chicago PMI: Nov Chicago Business Barometer Down 7.5 Points To 48.7

The Chicago Business Barometer decreased 7.5 points to 48.7 in November from 56.2 in October, as a sharp fall in New Orders put it back into contraction for the sixth time this year.This was well below the consensus forecast of 54.0.

The significant decline in the Barometer is indicative of the see-saw pattern of demand seen in 2015, with output and orders shifting in and out of contraction. The November fall also suggests that activity over the final quarter of the year may well decelerate barring a bounceback in December.

New Orders fell 15.3 points to 44.1 in November from 59.4 in October, leaving it at the lowest level since March. Production also fell sharply, although managed to hold just above the neutral 50 level that separates expansion from contraction.

...

Chief Economist of MNI Indicators Philip Uglow said, “That the Barometer was unable to hold on to the gain seen in October is a reflection of the erratic pattern of demand seen throughout 2015. The slowdown in the global economy, the strong dollar and decline in oil prices have all impacted businesses this year to varying degrees.”

emphasis added

Sunday, November 29, 2015

Monday: Chicago PMI, Pending Home Sales

by Calculated Risk on 11/29/2015 07:18:00 PM

From the WSJ: Divergent Paths for U.S., European Central Banks

This break in rate policy, particularly between the Fed and the European Central Bank, could strengthen the dollar even further against the euro, crimping U.S. exporters while giving a leg up to European ones.US policymakers responded to the financial crisis quicker, and with better policy (although the US made a premature pivot to austerity on fiscal policy, fiscal policy in Europe was much worse).

The divergent paths highlight how much more vigorous the U.S. recovery has been, particularly on the hiring front, a trend economists expect to see continue when the U.S. job numbers for November come out Friday.

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for November. The consensus is for a reading of 54.0, down from 56.2 in October.

• At 10:00 AM, Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

• At 10:30 AM, Dallas Fed Manufacturing Survey for November.

Weekend:

• Schedule for Week of November 29, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures and DOW futures are down slightly (fair value).

Oil prices were up slightly over the last week with WTI futures at $41.71 per barrel and Brent at $44.86 per barrel. A year ago, WTI was at $66, and Brent was at $71 - so prices are down about 35% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.04 per gallon (down about $0.75 per gallon from a year ago).

Hotels: Finishing Year Strong

by Calculated Risk on 11/29/2015 10:56:00 AM

Looking back at historical data, the only time hotel occupancy was this strong in November was in 2005 - and the high occupancy rate in the Fall of 2005 was the result of people displaced from their homes due to the damage from Hurricane Katrina.

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 21 November

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 15-21 November 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are now in the Fall business travel season.

In year-over-year measurements, the industry’s occupancy increased 3.7% to 63.1%. Average daily rate for the week was up 3.8% to US$116.26. Revenue per available room increased 7.6% to finish the week at US$73.33.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.I added 2001 (yellow) to show the impact of 9/11/2001 on hotel occupancy. Occupancy was already down in 2001 compared to 2000 due to the recession, and then really collapsed following 9/11.

For 2015, the 4-week average of the occupancy rate is above 2000 (best year for hotels), and 2015 will be the best year ever for hotels.

Occupancy Rate Year-to-date:

1) 2015 67.4%

2) 2000 66.5%

3) 2014 66.2%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, November 28, 2015

Schedule for Week of November 29th

by Calculated Risk on 11/28/2015 09:09:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include November vehicle sales, the November ISM manufacturing and non-manufacturing indexes, and the October trade deficit.

Federal Reserve Chair Janet Yellen will speak on the Economic Outlook.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 54.0, down from 56.2 in October.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for November.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 50.5, up from 50.1 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for the ISM to be at 50.5, up from 50.1 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 50.1% in October. The employment index was at 47.6%, and the new orders index was at 52.9%.

10:00 AM: Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 18.0 million SAAR in November from 18.1 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 18.0 million SAAR in November from 18.1 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the October sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 183,000 payroll jobs added in November, up from 182,000 in October.

12:25 PM: Speech by Fed Chair Janet Yellen, Economic Outlook, At the Economic Club of Washington, Washington, D.C.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 260 thousand the previous week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is a 1.4% increase in orders.

10:00 AM: the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 58.2 from 59.1 in October.

10:00 AM: Testimony by Fed Chair Janet Yellen, Economic Outlook, Before the Joint Economic Committee, U.S. Senate, Washington, D.C.

1:10 PM: Speech by Fed Vice Chairman Stanley Fischer, Financial Stability and Shadow Banks, At the Federal Reserve Bank of Cleveland Financial Stability Conference, Washington, D.C.

8:30 AM: Employment Report for November. The consensus is for an increase of 190,000 non-farm payroll jobs added in November, down from the 271,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to be unchanged at 5.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.81 million jobs.

A key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $40.6 billion in October from $40.8 billion in September.

Friday, November 27, 2015

November 2015: Unofficial Problem Bank list declines to 255 Institutions

by Calculated Risk on 11/27/2015 08:35:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2015. During the month, the list fell from 264 institutions to 255 after nine removals. Assets dropped by $2.2 billion to an aggregate $77.0 billion. The asset total was updated to reflect third quarter figures, which resulted in a small decline of $224 million. A year ago, the list held 408 institutions with assets of $124.7 billion. This past week, the FDIC released third quarter industry results and an update on the Official Problem Bank List. FDIC said the official list held 203 problem banks, a decline of 25 during the quarter. During the past three months, the unofficial list holds 27 fewer banks.

Actions have been terminated against CertusBank, National Association, Easley, SC ($877 million); First National Bank in Howell, Howell, MI ($355 million); United American Bank, San Mateo, CA ($303 million); Quontic Bank, Astoria, NY ($165 million); First Alliance Bank, Cordova, TN ($120 million); and Summit National Bank, Hulett, WY ($64 million).

Several banks merged to find their way off the problem bank list including Columbus Junction State Bank, Columbus Junction, IA ($47 million); Farmers State Bank, Lumpkin, GA ($45 million); and The State Bank of Blue Mound, Blue Mound, IL ($31 million).

One other change this month was a name change of The Farmers Bank to Persons Banking Company, Forsyth, GA ($328 million).