by Calculated Risk on 12/14/2015 02:41:00 PM

Monday, December 14, 2015

Hotel Occupancy: Heading for a Record Year

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 5 December

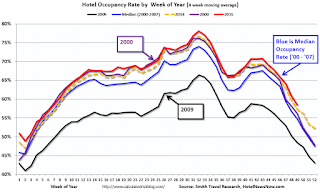

The U.S. hotel industry recorded positive results in two of the three key performance measurements during the week of 29 November through 5 December 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are currently in the weakest part of the year; December and January.

In year-over-year measurements, the industry’s occupancy decreased 0.4% to 57.0%. However, average daily rate for the week was up 1.8% to US$116.51, and revenue per available room increased 1.5% to US$66.37.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.For 2015, the 4-week average of the occupancy rate is above 2000 (best year for hotels), and 2015 will be the best year ever for hotels.

Occupancy Rate Year-to-date:

1) 2015 66.9%

2) 2000 66.1%

3) 2014 64.8%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Merrill Lynch: "Home Sweet Home"

by Calculated Risk on 12/14/2015 11:59:00 AM

A few excerpts from a piece by Michelle Meyer at Merrill Lynch: Home sweet home

We expect continued improvement in homebuilding and sales in 2016 and 2017, but still far from a V-shaped trajectory. Here are our baseline forecasts:

• Housing starts to average 1.275 million in 2016 and 1.4 million in 2017 on the way to a return to the historical average of 1.5 million by the end of 2017.

[CR NOTE: For reference, housing starts will probably be just over 1.1 million in 2015].

• Existing home sales to increase 5% in 2016 and 3% in 2017. We look for more robust growth in new home sales with a gain of 10% and about 14% over the next two years, respectively.

[CR Note: New Home sales will probably be just over 500 thousand in 2015]

• Home price appreciation should slow with prices up only 1.8% in 2016. The forecast for 2017 becomes more controversial as our baseline forecast is for a decline of 1.5%, as our model looks for home prices to converge to income.

[CR Note: A decline in nominal prices seems unlikely in 2017. However a decline in real prices (nominal price increases less than inflation) is possible].

When considering the forecasts for the next two years, we have to ask two critical questions: what is a “normal” rate of activity, and, after years of below-normal activity, could the sector overshoot?

In our view, a reasonable estimate of “normal” is the pre-crisis average of about 1.5 million. The math is simple: household formation of 1.2 million + demolitions of 300K + some number of second home purchases. There is a risk that household formation is on a slightly slower pace given persistently high rates of doubling up among young adults.

Starting in the early 2000s, and accelerating post crisis, there is a rising share of “grown-up” children who live with their parents. While this is partly due to the Great Recession and slow recovery, there could also be some secular changes related to delayed marriage. This could imply a somewhat lower equilibrium pace of housing starts.

That said, in the medium term, the risk is that we overshoot this new-normal level given pent-up household formation. Although we are skeptical about the quality of the data, the recent statistics from the Housing Vacancy Survey show a surge in household formation, implying formation of about 1.5 million this year. While the data will probably be revised lower, there is an improving trend. Provided the overall economy continues to heal as we are expecting, with 2.5% growth in 2016 and an unemployment rate of 4.5% by year-end, we will see further growth in households.

Indeed, there is a risk that housing demand continues to overshoot supply, as we believe it has this year. Homebuilders have been complaining that a shortage of labor has been a major impediment to production. According to the NAHB, 52% of homebuilders report labor shortages, back to 2000 levels and up notably from 21% just three years ago. The challenge is that many skilled workers left the construction industry after the housing bubble burst and have not come back This could continue to extend delivery times and slow production.

Duy: "Makes You Wonder What The Fed Is Thinking"

by Calculated Risk on 12/14/2015 09:21:00 AM

A few excerpts from an article by Tim Duy: Makes You Wonder What The Fed Is Thinking

The Fed is poised to raise the target range on the federal funds rate this week. More on that decision tomorrow. My interest tonight is a pair of Wall Street Journal articles that together call into question the wisdom of the Fed's expected decision. The first is on inflation, or lack thereof, by Josh Zumbrun:

Central bank officials predict inflation will approach their target in 2016. The trouble is they have made the same prediction for the past four years. If the Fed is again fooled, it may find it raised rates too soon, risking recession.A key reason for the Federal Reserve to raise interest rates is to be ahead of the curve on inflation. But given their poor inflation forecasting record, not to mention that of other central banks ... why are they so sure that they must act now to head off inflationary pressures? One would expect waning confidence in their inflation forecasts to pull the center more toward the views of Chicago Federal Reserve President Charles Evans and Board Governors Lael Brainard and Daniel Tarullo and thus defer tighter policy until next year.

Now combine the inflation forecast uncertainty with the growing consensus among economists that the Fed faces the zero bound again in less than five years. This one's from Jon Hilsenrath:

Among 65 economists surveyed by The Wall Street Journal this month, not all of whom responded, more than half said it was somewhat or very likely the Fed’s benchmark federal-funds rate would be back near zero within the next five years. Ten said the Fed might even push rates into negative territory, as the European Central Bank and others in Europe have done—meaning financial institutions have to pay to park their money with the central banks...Not a surprising conclusion given that Fed officials expect the terminal fed funds rate in the 3.3-3.8 percent range (central tendency) while the 2001-03 easing was 5.5 percentage points and the 1990-92 easing was 5.0 percentage points. You see of course how the math works.

...

Bottom Line: Given that the Fed likely only gets one chance to lift-off from the zero bound on a sustained basis, it is reasonable to think they would wait until they were absolutely sure inflation was coming. Even more so given the poor performance of their inflation forecasts. But the Fed thinks there is now more danger in waiting than moving. And so into the darkness we go.

Sunday, December 13, 2015

Sunday Night Futures

by Calculated Risk on 12/13/2015 07:47:00 PM

From Jon Hilsenrath at the WSJ: Fed Officials Worry Interest Rates Will Go Up, Only to Come Back Down

Federal Reserve officials are likely to raise their benchmark short-term interest rate from near zero Wednesday, expecting to slowly ratchet it higher to above 3% in three years.Weekend:

But that’s if all goes as planned. Their big worry is they’ll end up right back at zero.

• Schedule for Week of December 13th

• FOMC Preview and Review of Projections

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are unchanged and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $35.62 per barrel and Brent at $37.93 per barrel. A year ago, WTI was at $58, and Brent was at $61 - so prices are down almost 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.01 per gallon (down about $0.55 per gallon from a year ago). Prices should fall under $2.00 per gallon soon.

FOMC Preview and Review of Projections

by Calculated Risk on 12/13/2015 12:08:00 PM

Almost all analysts are expecting the FOMC to raise the Fed Funds rate this week. Most analysts think the federal funds rate will be increased from a target range of "0 to 1/4 percent" to a range of "1/4 to 1/2 percent".

The current effective rate is 0.14 percent, close to the middle of the current range.

For review, here are the key paragraph in the October FOMC statement:

"In determining whether it will be appropriate to raise the target range at its next meeting, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. "Since that statement, the economy added 298 thousand jobs in October and 211 thousand jobs in November. The unemployment rate declined further from 5.1% in September to 5.0% in November. This is the "some further improvement" in the labor market that the FOMC mentioned in the October statement.

emphasis added

Also, based on recent comments, it seems several key members of the FOMC are reasonably confident inflation will move back towards the 2% target. Of course headline inflation will take another dip due to the recent decline in oil prices.

Here are the September FOMC projections. Since the release of those projections, Q2 GDP was revised up from 3.7% annualized to +3.9% annualized. And Q2 GDP was reported at 2.1%. It appears GDP will be up around 2.2% for this year - in the September forecast range.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 2.0 to 2.3 | 2.2 to 2.6 | 2.0 to 2.4 | |

| Jun 2015 | 1.8 to 2.0 | 2.4 to 2.7 | 2.1 to 2.5 | |

The unemployment rate was at 5.0% in October and November, so the unemployment rate projection for Q4 2015 will probably be changed to 5.0% (at the lower end of Sept projection).

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Sept 2015 | 5.0 to 5.1 | 4.7 to 4.9 | 4.7 to 4.9 | |

| Jun 2015 | 5.2 to 5.3 | 4.9 to 5.1 | 4.9 to 5.1 | |

As of October, PCE inflation was up only 0.2% from October 2014. Since oil prices have declined further since September, headline PCE inflation could move down some more in November and December. Overall PCE inflation projections will probably be revised down for 2015, and will be well below the FOMC's 2% target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 0.3 to 0.5 | 1.5 to 1.8 | 1.8 to 2.0 | |

| Jun 2015 | 0.6 to 0.8 | 1.6 to 1.9 | 1.9 to 2.0 | |

PCE core inflation was up only 1.3% in October year-over-year. It appears PCE inflation will be in the September forecast range, and will be mostly unrevised.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Sept 2015 | 1.3 to 1.4 | 1.5 to 1.8 | 1.8 to 2.0 | |

| Jun 2015 | 1.3 to 1.4 | 1.6 to 1.9 | 1.9 to 2.0 | |

Overall, it appears the labor market has improved, and the economy is growing about as expected - although inflation is still low.

Saturday, December 12, 2015

Goldman: FOMC Preview

by Calculated Risk on 12/12/2015 05:41:00 PM

A few excepts from a research piece by Goldman Sachs economists Zach Pandl and Jan Hatzius: December FOMC Preview

Next week we expect the FOMC to raise its target range for the federal funds rate to 0.25-0.50%, bringing an end to the seven-year period of near-zero interest rates. With this action essentially priced in, focus will be on the committee’s policy guidance for 2016 and beyond.

If the FOMC raises rates next week the post-meeting statement will require a thorough rewrite. We expect three main changes. First, we expect the committee to upgrade its description of the labor market in light of firmer payroll growth. Second, we expect the statement to remove some of its relatively cautious language on inflation, while continuing to emphasize that inflation will remain a key determinant of the policy outlook. Third, we look for the statement to show a clear baseline for additional rate hikes—it will not signal “one and done”.

Although Fed officials regularly describe the likely pace of rate hikes as “gradual” we do not expect this term to appear in the statement itself. Recent comments suggest some hesitation about adopting “gradual” as official guidance, despite the frequent mentions. That being said, from the press conference guidance and the Summary of Economic Projections (SEP), the gradual message should be all but explicit.

Schedule for Week of December 13th

by Calculated Risk on 12/12/2015 08:31:00 AM

The focus this week will be on the FOMC announcement and press conference on Wednesday.

The key economic report this week is November housing starts on Wednesday.

For manufacturing, November Industrial Production will be released on Wednesday, and the December NY, Philly and Kansas City Fed manufacturing surveys will be released this week.

For prices, CPI will be released on Tuesday.

No economic releases scheduled.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for no changed in CPI, and a 0.2% increase in core CPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for December. The consensus is for a reading of -7.0, up from -10.7.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 63, up from 62 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. Total housing starts decreased to 1.060 million (SAAR) in October. Single family starts decreased to 722 thousand SAAR in October.

The consensus for 1.140 million, up from October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.4%.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to raise the Fed Funds rate at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 282 thousand the previous week.

10:00 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 1.2, down from 1.9.

10:00 AM ET: Regional and State Employment and Unemployment for November.

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 11, 2015

Mortgage News Daily: Mortgage Rates Move Lower

by Calculated Risk on 12/11/2015 08:11:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lower as Markets Grow Anxious Ahead of Fed

Mortgage rates recovered yesterday's losses in many cases, and moved even lower in many other cases. The mortgage sector was one of the tamer performances of the day when it comes to financial markets. Even if we focus solely on the mortgage-backed-securities (MBS) that most directly affect mortgage rates, we see a lot more movement in the marketplace than we see on lender rate sheets.Here is a table from Mortgage News Daily:

This dichotomy between market movement and rate sheets is fairly common when volatility increases or on the approach to a significant economic event. That's especially true of Friday afternoons. With a big increase in volatility on this Friday before next week's big Fed announcement, today meets all the conditions.

Still, rates did drop--just not as much as we might like. The most prevalently-quoted conventional 30yr fixed rate moved back down to 3.875% for some of the more aggressive lenders, though most remain at 4.0%. Among the lenders quoting the same rates as yesterday, upfront costs would be slightly lower (or lender credit slightly higher).

emphasis added

Nomura on FOMC: "Life after lift-off"

by Calculated Risk on 12/11/2015 04:20:00 PM

Another short preview, this one from economists at Nomura:

We believe that the FOMC will raise short-term interest rates at its December meeting as comments from Fed officials in recent months have suggested that the bar for liftoff is low. With liftoff quite likely, the attention is on what happens after liftoff. We think that the FOMC will want to send the signal that we should not expect liftoff to be followed by a series of subsequent rate hikes in rapid succession. We think the Committee will continue to stress that the subsequent rate adjustment will be “gradual” and “data dependent.” In addition to the FOMC statement, we will also receive the Committee’s summary of economic projections and Chair Yellen will hold a press conference. We will play close attention to the FOMC’s projections for the economic and inflation outlook and how it ties this into its expectation of the path of policy.CR: I'll post an additional preview of the FOMC meeting this weekend.

Merrill on FOMC: "The not-so-dovish hike"

by Calculated Risk on 12/11/2015 12:16:00 PM

A few excerpts from a research piece by Merrill Lynch economist Michael Hanson: The not-so-dovish hike

With the market pricing in a better than 90% chance the Fed will hike at its December meeting, liftoff expectations are very different than in September. However, it is déjà vu all over again for talk of a “dovish hike” thereafter. We do not expect the Fed will be find the right mix of language, projections, dots and press conference remarks that ratifies current market expectations of a little more than two hikes next year — particularly when the Fed views four as “gradual.” The overall message from the December meeting is likely to be dovish, but probably less than the market hopes. ...From CR: It seems that the Fed will raise rates next week. For 2016, several key analysts are forecasting 4 rate hikes (every other meeting), however the market is only pricing in about 2 rate hikes in 2016.

The challenge for Yellen will be to find the right balance between “gradual” and “data dependent.” ... the Fed does not want to suggest that it will pre-commit to any particular policy path. Several Fed officials have noted that “gradual” is a forecast, not a promise. As long as the data behave largely in line with the FOMC’s projections, a gradual pace of rate hikes is likely. But Yellen’s ability to explain this nuance to a market that would like a clear sign that the Fed is going to go even more slowly in 2016 may well be tested.