by Calculated Risk on 12/18/2015 10:13:00 AM

Friday, December 18, 2015

BLS: Unemployment Rate decreased in 27 States in November

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in November. Twenty-seven states had unemployment rate decreases from October, 11 states had increases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

North Dakota had the lowest jobless rate in November, 2.7 percent, followed by Nebraska, 2.9 percent. New Mexico had the highest rate, 6.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. New Mexico, at 6.8%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only nine states are at or above 6% (dark blue).

Thursday, December 17, 2015

FNC: Residential Property Values increased 5.9% year-over-year in October

by Calculated Risk on 12/17/2015 08:37:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their October 2015 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.1% from September to October (Composite 100 index, not seasonally adjusted).

The 10 city MSA decreased 0.1% (NSA), the 20-MSA RPI increased 0.1%, and the 30-MSA RPI increased 0.1% in October. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

From FNC: FNC Index: Home prices slipped 0.1% after a nine-month run

The latest FNC Residential Price Index™ (RPI) indicates that U.S. home prices pulled back in October, ending a nine-month run of increases buoyed by low mortgages rates and rising credits. Nationwide, home prices fell 0.1% between September and October, led by declines in some of the country’s largest housing markets. October’s year-over-year growth remains unchanged from the prior month at a solid 5.9%.The year-over-year (YoY) change was the same in October as in September.

“In a relatively stable market like today’s, it is normal that home prices retreat to flat or negative growth territory as home sales subside entering the fall and winter months,” said Yanling Mayer, FNC’s housing economist and Director of Research.

“On the upside, low interest rates and the leverage provided by loans under affordable housing programs help maintain affordability and partly offset the impact on affordability from months of rapidly rising prices. With a much anticipated policy rate increase to affirm the strength of the U.S. economy, we will likely be looking at a milder seasonal slowdown and possibly a sooner return of market rebound in 2016,” continued Mayer.

The index is still down 14.6% from the peak in 2006 (not inflation adjusted).

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change based on the FNC index (four composites) through October 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range. For example, Case-Shiller was up 4.9% in September, CoreLogic was up 6.8% in October.

Note: The October Case-Shiller index will be released on Tuesday, December 29th.

LA area Port Traffic increased YoY in November

by Calculated Risk on 12/17/2015 02:10:00 PM

First, from the Port of Long Beach: Port Sees Fifth Straight Month of Cargo Gains

Strong cargo volume continued at the Port of Long Beach in November with 6.6 percent growth in container trade over the same month last year. It was the fifth straight month of increases and enough cargo to rack up the second-busiest November in the Port’s 104-year history.Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled in late February. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April.

...

Upcoming post-holiday sales planned by retailers across the country drove the Port’s strong cargo numbers.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.5% compared to the rolling 12 months ending in October. Outbound traffic was down 0.4% compared to 12 months ending in October.

The recent downturn in exports might be due to the strong dollar and weakness in China.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). Imports were up 6% year-over-year in November; exports were down 5% year-over-year.

Comments on November Housing Starts

by Calculated Risk on 12/17/2015 11:26:00 AM

Total housing starts in November were above expectations, however some of the strength might be related to the relatively warm weather in some parts of the country.

As an example, starts in the Northeast were up 21.5% year-over-year. But most of the strength was in the South (up 35.5% year-over-year), so the positive report was not all weather.

Yesterday: Housing Starts increased to 1.173 Million Annual Rate in November

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Single family starts are running 10.5% ahead of 2014 through November, and single family starts were up 14.6% year-over-year in November.

Starts for 5+ units are up 13.1% through November compared to last year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply year-over-year.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked in June (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, but I expect less growth from multi-family going forward.

Weekly Initial Unemployment Claims decrease to 271,000

by Calculated Risk on 12/17/2015 08:35:00 AM

The DOL reported:

In the week ending December 12, the advance figure for seasonally adjusted initial claims was 271,000, a decrease of 11,000 from the previous week's unrevised level of 282,000. The 4-week moving average was 270,500, a decrease of 250 from the previous week's unrevised average of 270,750.The previous week was unrevised at 282,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 270,500.

This was close to the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, December 16, 2015

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 12/16/2015 10:42:00 PM

From Tim Duy at Fed Watch: As Expected

Today, the FOMC voted to raise the target range on the federal funds rate by 25bp. The accompanying statement and the Summary of Economic Projections offered no surprises. That very lack of surprise should be counted as a "win" for the Fed's communication strategy. A little bit of extra direction since September went a long way.Thursday:

...

No dissents; none of the possible dissenters thought their objections were sufficient to deny Federal Reserve Chair Janet Yellen a unanimous decision on this first hike.

The median forecasts for growth, employment, and inflation were virtually unchanged. Note that the central tendency range for longer run unemployment shifted down; participants continue to shave down their estimates of the natural rate of unemployment. The median rate projection for 2017 and 2018 edged down. This understates somewhat the decline in the range of the central tendency.

As I am running short of time today, I will leave any analysis of the press conference for a later time. Gradual, data dependent, not mechanical (not equally spaced or sized hikes), etc.

Bottom Line: Almost as exactly as should have been expected.

• At 8:30 AM ET, initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 282 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 1.2, down from 1.9.

FOMC Projections and Press Conference

by Calculated Risk on 12/16/2015 02:15:00 PM

Statement here. Fed Funds Rate target range increased to 1/4 to 1/2 percent.

As far as the "Appropriate timing of policy firming", participant generally think there will be three to four rate hikes in 2016.

The FOMC projections for inflation are still on the low side through 2018.

Yellen press conference here.

On the projections, mostly projection for Q4 2015 were just narrowed.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | 2018 |

| Dec 2015 | 2.1 | 2.3 to 2.5 | 2.0 to 2.3 | 1.8 to 2.2 |

| Sept 2015 | 2.0 to 2.3 | 2.2 to 2.6 | 2.0 to 2.4 | 1.8 to 2.2 |

The unemployment rate was at 5.0% in November, so the unemployment rate projection for Q4 2015 was set to 5.0%.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | 2018 |

| Dec 2015 | 5.0 | 4.6 to 4.8 | 4.6 to 4.8 | 4.6 to 5.0 |

| Sept 2015 | 5.0 to 5.1 | 4.7 to 4.9 | 4.7 to 4.9 | 4.7 to 5.0 |

As of October, PCE inflation was up only 0.2% from October 2014.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | 2018 |

| Dec 2015 | 0.4 | 1.2 to 1.7 | 1.8 to 2.0 | 1.9 to 2.0 |

| Sept 2015 | 0.3 to 0.5 | 1.5 to 1.8 | 1.8 to 2.0 | 2.0 |

PCE core inflation was up only 1.3% in October year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | 2018 |

| Dec 2015 | 1.3 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 |

| Sept 2015 | 1.3 to 1.4 | 1.5 to 1.8 | 1.8 to 2.0 | 1.9 to 2.0 |

FOMC Statement: Fed Funds Rate target range increased to 1/4 to 1/2 percent

by Calculated Risk on 12/16/2015 02:00:00 PM

Information received since the Federal Open Market Committee met in October suggests that economic activity has been expanding at a moderate pace. Household spending and business fixed investment have been increasing at solid rates in recent months, and the housing sector has improved further; however, net exports have been soft. A range of recent labor market indicators, including ongoing job gains and declining unemployment, shows further improvement and confirms that underutilization of labor resources has diminished appreciably since early this year. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation remain low; some survey-based measures of longer-term inflation expectations have edged down.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen. Overall, taking into account domestic and international developments, the Committee sees the risks to the outlook for both economic activity and the labor market as balanced. Inflation is expected to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further. The Committee continues to monitor inflation developments closely.

The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective. Given the economic outlook, and recognizing the time it takes for policy actions to affect future economic outcomes, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent. The stance of monetary policy remains accommodative after this increase, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

emphasis added

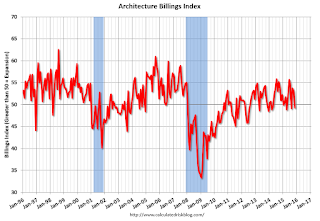

AIA: "Architecture Billings Index Hits another Bump " in November

by Calculated Risk on 12/16/2015 11:31:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Hits another Bump

As has been the case a few times already this year, the Architecture Billings Index (ABI) dipped in November. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the November ABI score was 49.3, down from the mark of 53.1 in the previous month. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.6, up just a nudge from a reading of 58.5 the previous month.

“Since architecture firms continue to report that they are bringing in new projects, this volatility in billings doesn’t seem to reflect any underlying weakness in the construction sector,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Rather, it could reflect the uncertainty of moving ahead with projects given the continued tightness in construction financing and the growing labor shortage problem gripping the entire design and construction industries.”

...

• Regional averages: South (55.4), West (54.5), Midwest (47.8), Northeast (46.2)

• Sector index breakdown: multi-family residential (53.8), institutional (52.0), commercial / industrial (51.0), mixed practice (47.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.3 in November, down from 53.1 in October. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of the year - suggesting a slowdown or less growth for apartments - but has been positive for the last two months.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 8 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

Fed: Industrial Production decreased 0.6% in November

by Calculated Risk on 12/16/2015 09:25:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.6 percent in November after decreasing 0.4 percent in October. In November, manufacturing production was unchanged from October. The index for utilities dropped 4.3 percent, as unusually warm weather held down the demand for heating. The index for mining fell 1.1 percent in November, with much of this decrease attributable to sizable declines for coal mining and for oil and gas well drilling and servicing. At 106.5 percent of its 2012 average, total industrial production in November was 1.2 percent below its year-earlier level. Capacity utilization for the industrial sector declined 0.5 percentage point in November to 77.0 percent, a rate that is 3.1 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.1 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.0% is 3.1% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.6% in November to 106.5. This is 22.1% above the recession low, and 1.3% above the pre-recession peak.

This was below expectations of a 0.2% decrease, partially due to the warm weather.

The weather is boosting some sectors - like housing starts - and hurting other sectors like heating utilities.