by Calculated Risk on 12/21/2015 10:59:00 AM

Monday, December 21, 2015

An update on oil prices

From the NY Times: Oil Prices Slump to 11-Year Lows in Asia and Europe

Oil prices hit 11-year lows in Asia and Europe on Monday, as a glut of crude on world markets and the recent global climate accord continue to depress fossil-fuel prices.

Brent crude oil, the international benchmark, was trading at $36.50 per barrel in late European trading.

...

In a recent report, the International Energy Agency said it expected global inventories to keep growing at least until late 2016, although at a much slower pace than this year. “As inventories continue to swell into 2016, there will still be a lot of oil weighing on the market,” the agency said.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $34.46 per barrel today, and Brent is at $36.62

Prices really collapsed a year ago - and then rebounded a little - and have collapsed again. There are many factors pushing down oil prices - more global supply (even as shale producers cut back), global economic weakness (slowing demand), and warm weather in the US (less heating demand) to mention a few.

Chicago Fed: "Index shows Economic Growth Slowed in November"

by Calculated Risk on 12/21/2015 08:42:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows Economic Growth Slowed in November

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to –0.30 in November from –0.17 in October. Two of the four broad categories of indicators that make up the index decreased from October, and three of the four categories made negative contributions to the index in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.20 in November from –0.18 in October. November’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat below the historical trend in November (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, December 20, 2015

Sunday Night Futures

by Calculated Risk on 12/20/2015 07:19:00 PM

From Reuters: U.S. gas prices fall to lowest in more than six years: survey

U.S. gasoline prices dropped by 4 cents to $2.06 a gallon on average in the past two weeks to the lowest in more than six years, according to a Lundberg survey released on Sunday.According to Gasbuddy.com, average national regular gasoline prices today are now under $2.00 per gallon. And prices should fall further over the next few weeks (based on the recent decline in oil prices).

The price, for regular grade as of Friday, was the lowest since $2.05 in April 2009 ...

Weekend:

• Schedule for Week of December 20th

• Lawler: "Yes, Houston will have a problem next year"

• Existing Home Sales: Expect a Miss

• Goldman Sachs on Fed Funds rate: "Fairly easy path to a second hike in March"

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 2 and DOW futures are up 20 (fair value).

Oil prices were down over the last week with WTI futures at $34.66 per barrel and Brent at $36.88 per barrel. A year ago, WTI was at $57, and Brent was at $59 - so prices are down almost 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at close to $1.99 per gallon (down about $0.40 per gallon from a year ago). Gasoline prices are now at the lowest level since the financial crisis.

Lawler: "Yes, Houston will have a problem next year"

by Calculated Risk on 12/20/2015 01:17:00 PM

Some thoughts on the Houston housing market from housing economist Tom Lawler:

Earlier this week I sent out a message with a link to the Houston Association of Realtors report showing that MLS-based home sales in the Houston metro market showed a double digit YOY decline for the second straight month in November, and that total property listings were up by over 20% from a year earlier.

Here are some other “macro” numbers (in table or graph form) for the Houston metro area.

Non-farm payroll employment, YOY growth, November 2014 – November 2015, Not Seasonally Adjusted (released this morning for Texas/Houston)

| Year-over-year Employment Growth | |||

|---|---|---|---|

| US | Houston | Rest of Texas | |

| Total | 1.9% | 0.8% | 1.8% |

| Mining and Logging | -13.5% | -4.9% | -12.4% |

| Construction | 4.2% | 1.9% | 1.4% |

| Manufacturing | 0.3% | -6.0% | -3.2% |

| Education and Health | 2.9% | 4.2% | 4.1% |

| Leisure and Hospitality | 3.0% | 6.7% | 3.8% |

| Other Private Services | 2.1% | -0.3% | 2.4% |

| Government | 0.4% | 2.7% | 1.1% |

| Total Less L&H | 1.7% | 0.2% | 1.5% |

| Total Less L&H and Govt | 2.0% | -0.3% | 1.7% |

Houston was one of the fastest growing large MSAs in terms of both population growth and employment growth from 2011 to 2014. Over the 12-month period ending in November, however, employment growth was quite anemic in Houston, and excluding the Leisure & Hospitality Sector (which has lower than average hourly wages and lower than average hours worked per week) employment was virtually unchanged from a year ago.

Unemployment rate (Not Seasonally Adjusted)

| Unemployment rate (Not Seasonally Adjusted) | ||

|---|---|---|

| November-15 | November-14 | |

| US | 4.81% | 5.53% |

| Houston | 4.89% | 4.33% |

| Rest of Texas | 4.53% | 4.46% |

Despite a sharp slowdown in employment growth, the CPS-based unemployment rate for Houston actually declined somewhat in the first half of this year, which seemed “odd.” Since then, however, the unemployment rate has risen sharply, and Houston’s unemployment rate is now higher than the national average for the first time since 2006.

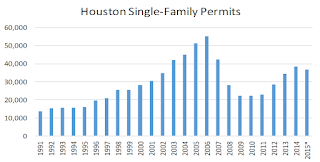

Single-Family Building Permits

*2015, SAAR through October

Reflecting the relatively strong population and employment growth, Housing SF building permits recovered by a substantially greater amount than the nation as a whole in the current recovery, and in 2013 and 2014 builders often described the market as “red-hot.” Permits in Houston have slowed a bit this year compared to last year, but have not slowed as much as one might have hoped given the sharp deceleration in employment growth, as well as dim prospects for employment growth next year.

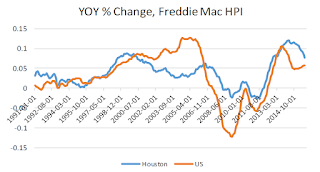

Home Prices

Reflecting strong demand relative to the rest of the nation, Houston home price growth has considerably outpaced the national average over the past few years.

CR Note: This graph shows the Year-over-year (YoY) change in the Freddie Mac House Price Index (HPI) for both Houston and the U.S..

Oil Prices

Oil prices continued to fall in December.

Outlook

Houston’s economy has not yet fully adjusted to the decline in oil prices, and especially the slide in the past few months. There is a pretty good chance that Houston will see negative employment growth next year, along with a rise in its unemployment rate to above 6%. This environment, combined with the lack of any meaningful reduction in housing production to date, suggests that (1) housing production in the Houston MSA should decline significantly next year; and (2) overall home prices should fall as well.

Existing Home Sales: Expect a Miss

by Calculated Risk on 12/20/2015 08:11:00 AM

The NAR will report November Existing Home Sales on Tuesday, December 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.32 million. Housing economist Tom Lawler estimates the NAR will report sales of 4.97 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.36 million SAAR in October.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 5 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last five years, the consensus average miss was 145 thousand, and Lawler's average miss was 68 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, December 19, 2015

Schedule for Week of December 20th

by Calculated Risk on 12/19/2015 08:21:00 AM

The key reports this week are the third estimate of Q3 GDP, November New Home sales, November Existing Home Sales, and November personal income and outlays.

Merry Christmas and Happy Holidays to All!

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

8:30 AM ET: Gross Domestic Product, 3rd quarter 2015 (Third estimate). The consensus is that real GDP increased 2.0% annualized in Q3, revised down from the second estimate of 2.1%.

9:00 AM: FHFA House Price Index for October 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.36 million in October.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.36 million in October. Economist Tom Lawler estimates the NAR will report sales of 4.97 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

8:30 AM ET: Personal Income and Outlays for November. The consensus is for a 0.2% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: New Home Sales for November from the Census Bureau.

10:00 AM: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the August sales rate.

The consensus is for a increase in sales to 503 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 495 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 91.9, up from the preliminary reading 91.8.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 171 thousand the previous week.

The NYSE and the NASDAQ will close at 1:00 PM ET.

All US markets will be closed in observance of the Christmas Holiday.

Friday, December 18, 2015

Goldman Sachs on Fed Funds rate: "Fairly easy path to a second hike in March"

by Calculated Risk on 12/18/2015 07:26:00 PM

A few excerpts from a research piece by Goldman Sachs economists David Mericle and Daan Struyven A Road Map to Hikes in March and Beyond

The FOMC raised its target range for the federal funds rate to 0.25-0.50% this week, shifting attention to the pace of subsequent hikes. While the median dot indicates a further 100bp increase in the funds rate in 2016, implying a second hike in March, the market is skeptical. ...Most analysts expect no change at the January FOMC meeting, but another rate hike in March seems likely.

We see a fairly easy path to a second hike in March. We expect growth to remain above trend and employment gains to remain well above the "breakeven" rate. Most importantly, inflation is likely to rise by March as sharp declines in energy and health care prices drop out of the year-on-year calculation, supporting the Fed's expectation that inflation will pick up as transitory pressures fade.

... We find that ... the odds of a March hike are about 80% and the odds of four hikes by year-end are about 66%.

Note that the effective funds rate was 0.37% yesterday (in the new range).

Mortgage Equity Withdrawal Slightly Positive in Q3, First Time since Q1 2008

by Calculated Risk on 12/18/2015 03:10:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released last week) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2015, the Net Equity Extraction was a positive $4 billion, or a positive 0.1% of Disposable Personal Income (DPI) - only slightly positive. MEW for Q2 was revised up slightly, so this is the 2nd consecutive quarter with slightly positive MEW - the first positive MEW since Q1 2008.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is still heavily impacted by debt cancellation and foreclosures.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $48 billion in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

With residential investment increasing, and a slower rate of debt cancellation, MEW has now turned slightly positive.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

What I like to see: Agencies Issue Statement on CRE Loans

by Calculated Risk on 12/18/2015 12:25:00 PM

During the housing bubble, the regulatory agencies were lax in providing guidance related to weak lending standards and high credit concentrations. Now the agencies are being more proactive.

This doesn't suggest a problem in CRE lending, rather the agencies are trying to get ahead of future problems.

From the FDIC: Agencies Issue Statement on Prudent Risk Management for Commercial Real Estate Lending

The Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency (the agencies) are jointly issuing this statement to remind financial institutions of existing regulatory guidance on prudent risk management practices for commercial real estate (CRE) lending activity through economic cycles.The seeds for the next round of bank failures are always planted during an expansion. This statement - and strict enforcement - are important to limit future failures.

Recent Supervisory Findings

The agencies have observed that many CRE asset and lending markets are experiencing substantial growth, and that increased competitive pressures are contributing significantly to historically low capitalization rates and rising property values. At the same time, other indicators of CRE market conditions (such as vacancy and absorption rates) and portfolio asset quality indicators (such as non-performing loan and charge-off rates) do not currently indicate weaknesses in the quality of CRE portfolios. Influenced in part by the continuing strong demand for such credit and the reassuring trends in asset-quality metrics, many institutions’ CRE concentration levels have been rising.

The agencies’ examination and industry outreach activities have revealed an easing of CRE underwriting standards, including less-restrictive loan covenants, extended maturities, longer interest-only payment periods, and limited guarantor requirements. The agencies also have observed certain risk management practices at some institutions that cause concern, including a greater number of underwriting policy exceptions and insufficient monitoring of market conditions to assess the risks associated with these concentrations.

Historical evidence demonstrates that financial institutions with weak risk management and high CRE credit concentrations are exposed to a greater risk of loss and failure.

emphasis added

Kansas City Fed: Regional Manufacturing Activity "declined moderately" in December

by Calculated Risk on 12/18/2015 11:02:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined Moderately

The Federal Reserve Bank of Kansas City released the December Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined moderately, although expectations for future activity remained solid.The Kansas City region has been hit hard by lower oil prices and the strong dollar. Contraction in December was probably due to the recent decline in oil prices.

“After two months of mostly steady activity, regional factories pulled back again in December,” said Wilkerson. “The weakest activity was in energy-concentrated states.”

...

Tenth District manufacturing activity declined moderately in December, reversing gains from the last several months, while producers’ expectations for future activity remained solid. Most price indexes continued to ease further.

The month-over-month composite index was -9 in December, down from 1 in November and -1 in October

...

The employment index dropped from -8 to -14, and the capital expenditures index posted its lowest level since August 2010. ...

Future factory indexes were mixed, but remained at generally solid levels. The future composite index was basically unchanged at 7, while the future production, shipments, and new orders for exports indexes increased modestly.

emphasis added