by Calculated Risk on 12/30/2015 10:02:00 AM

Wednesday, December 30, 2015

NAR: Pending Home Sales Index decreased 0.9% in November, up 2.7% year-over-year

From the NAR: Pending Home Sales Decline Modestly in November

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 0.9 percent to 106.9 in November from an upwardly revised 107.9 in October but is still 2.7 percent above November 2014 (104.1). Although the index has increased year-over-year for 15 consecutive months, last month's annual gain was the smallest since October 2014 (2.6 percent).This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

...

The PHSI in the Northeast decreased 3.0 percent to 91.8 in November, but is still 4.3 percent above a year ago. In the Midwest the index rose 1.0 percent to 104.9 in November, and is now 4.1 percent above November 2014.

Pending home sales in the South increased 1.3 percent to an index of 119.9 in November and are 0.5 percent higher than last November. The index in the West declined 5.5 percent in November to 100.4, but remains 4.5 percent above a year ago.

emphasis added

Tuesday, December 29, 2015

From CNBC: "Luxury home prices finally getting too high?"

by Calculated Risk on 12/29/2015 08:54:00 PM

Wednesday:

• At 10:00 AM ET, Pending Home Sales Index for November. The consensus is for a 0.5% increase in the index.

Note: Long time reader and mortgage broker "Soylent Green Is People" sent me a note yesterday: "the unthinkable is occurring: seems like Irvine home prices have hit an air pocket, falling in some cases."

Irvine is expensive, but not a "luxury home" market. But this has me thinking that we might be seeing a slowdown in prices increases (or flat prices) in some areas.

From Denise Garcia at CNBC: Luxury home prices finally getting too high?

The tables have turned in the real estate industry as luxury listing prices fell for the first time since 2012, according to a Redfin report. The brokerage firm suggests that the drop in prices stems from wealthy buyers and foreign investors refusing to buy at the top of the market.These are listing prices, not sale prices - and it has seemed like many homes were listed at absurd asking prices. I doubt we will see a significant price decline in these areas, but prices might flatten out.

Prices for luxury homes fell by 2.2 percent in the third quarter, compared to a year ago, according to the report.

Question #9 for 2016: What will happen with house prices in 2016?

by Calculated Risk on 12/29/2015 02:01:00 PM

Over the weekend, I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% or so in 2015 (after increasing 7% in 2012, 11% in 2013, and 5% in 2014 according to Case-Shiller). What will happen with house prices in 2016?

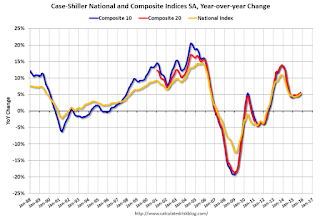

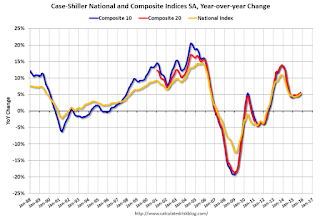

The following graph shows the year-over-year change in the seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 5.1% compared to October 2014, the Composite 20 SA was up 5.6% and the National index SA was up 5.2% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I mostly use Case-Shiller, I also follow several other price indexes. The following table shows the year-over-year change for several house prices indexes.

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Oct-15 | 5.6% |

| Case-Shiller National | Oct-15 | 5.2% |

| CoreLogic | Oct-15 | 6.8% |

| Zillow | Oct-15 | 4.3% |

| Black Knight | Sept-15 | 5.1% |

| FNC | Oct-14 | 5.9% |

| FHFA Purchase Only | Oct-15 | 6.1% |

There were some special factors in 2012 and 2013 that led to sharp price increases. This included limited inventory, fewer foreclosures, continued investor buying in certain areas, and a change in psychology as buyers and sellers started believing house prices had bottomed. In some areas, like Phoenix, there appeared to be a strong bounce off the bottom, but that bounce mostly ended in 2014.

Currently investor buying has slowed, as have distressed sales - however inventory is still low in many areas. In 2016, inventories will probably remain low, but I expect inventories to increase on a year-over-year basis.

Low inventories, and a decent economy suggests further price increases in 2016. However I expect we will see prices up less in 2016, than in 2015, as measured by these house price indexes - mostly because I expect more inventory.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Real Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/29/2015 11:01:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.2% year-over-year in October

The year-over-year increase in prices is mostly moving sideways now around 5%. In October 2013, the National index was up 10.9% year-over-year (YoY). In October 2015, the index was up 5.2% YoY.

Here is the YoY change since January 2014 for the National Index:

| Month | YoY Change |

|---|---|

| Jan-14 | 10.5% |

| Feb-14 | 10.1% |

| Mar-14 | 8.9% |

| Apr-14 | 7.9% |

| May-14 | 7.0% |

| Jun-14 | 6.3% |

| Jul-14 | 5.6% |

| Aug-14 | 5.1% |

| Sep-14 | 4.8% |

| Oct-14 | 4.6% |

| Nov-14 | 4.6% |

| Dec-14 | 4.6% |

| Jan-15 | 4.3% |

| Feb-15 | 4.2% |

| Mar-15 | 4.3% |

| Apr-15 | 4.3% |

| May-15 | 4.4% |

| Jun-15 | 4.4% |

| Jul-15 | 4.5% |

| Aug-15 | 4.6% |

| Sep-15 | 4.9% |

| Oct-15 | 5.2% |

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 5.1% below the bubble peak. However, in real terms, the National index is still about 19.1% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through September) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through September) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to August 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to October 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to January 2004.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.3% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to June 2003 levels, the Composite 20 index is back to January 2003 levels, and the CoreLogic index is back to October 2003.

In real terms, and as a price-to-rent ratio, prices are back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Case-Shiller: National House Price Index increased 5.2% year-over-year in October

by Calculated Risk on 12/29/2015 09:21:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("September" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Continued Increases in Home Prices for October According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a slightly higher year-over-year gain with a 5.2% annual increase in October 2015 versus a 4.9% increase in September 2015. The 10-City Composite increased 5.1% in the year to October compared to 4.9% previously. The 20-City Composite’s year-over-year gain was 5.5% versus 5.4% reported in September.

...

Before seasonal adjustment, the National Index posted a gain of 0.1% month-over-month in October. The 10-City Composite was unchanged and the 20-City Composite reported gains of 0.1% month-over-month in October. After seasonal adjustment, the National Index posted a gain of 0.9%, while the 10-City and 20-City Composites both increased 0.8% month-over-month. Ten of 20 cities reported increases in October before seasonal adjustment; after seasonal adjustment, all 20 cities increased for the month.

emphasis added

Click on graph for larger image.

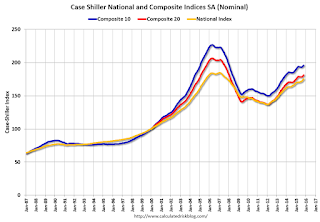

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 13.7% from the peak, and up 0.8% in October (SA).

The Composite 20 index is off 12.3% from the peak, and up 0.8% (SA) in October.

The National index is off 5.1% from the peak, and up 0.9% (SA) in October. The National index is up 28.2% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to October 2014.

The Composite 20 SA is up 5.6% year-over-year..

The National index SA is up 5.2% year-over-year.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in October seasonally adjusted. (Prices increased in 10 of the 20 cities NSA) Prices in Las Vegas are off 39.0% from the peak.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 55% above January 2000 (55% nominal gain in almost 16 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 15% above the change in overall prices due to inflation.

Five cities - Charlotte, Boston, Dallas, Denver and Portland - are above the bubble highs (other Case-Shiller Comp 20 city are close - San Francisco and Seattle). Detroit prices are barely above the January 2000 level.

I'll have more on house prices later.

Monday, December 28, 2015

Tuesday: Case-Shiller House Prices

by Calculated Risk on 12/28/2015 07:02:00 PM

From Jann Swanson at Mortgage News Daily: TRID Causing Noticeable Delays -Ellie Mae

The new RESPA-TILA Know Before You Owe regulations, commonly called TRIID, was cited as a probable reason for a three day increase in the average time it took to close a mortgage loan in November compared to October. Ellie Mae said the average application-to-closing time of 49 days was the longest time to close a loan since February 2013. Conventional and FHA loans each took 49 days while VA loans took an average of 50.Tuesday:

...

"We are beginning to see the anticipated impacts of the Know Before You Owe changes that went into effect in October," said Jonathan Corr, president and CEO of Ellie Mae. "The time to close loans has crept up to 49 days, a 3-day increase over October, while the closing rate on purchased loans increased to 72 percent. Additionally, we've seen the percentage of refinances increase to 46 percent of all closed loans, most likely driven by a recent dip in rates over the last three months since the 2015 high point in August."

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October prices. The consensus is for a 5.4% year-over-year increase in the Comp 20 index for October. The Zillow forecast is for the National Index to increase 4.9% year-over-year in October.

Freddie Mac Mortgage Serious Delinquency rate declined in November, Fannie Mae Rate Unchanged

by Calculated Risk on 12/28/2015 03:05:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in November to 1.36%, down from 1.38% in October. Freddie's rate is down from 1.91% in November 2014, and the rate in November was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Fannie Mae reported today that the Single-Family Serious Delinquency rate was unchanged in November at 1.58%. The serious delinquency rate is down from 1.91% in November 2014.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Freddie Mac serious delinquency rate has fallen 0.55 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

The Fannie Mae serious delinquency rate has only fallen 0.33 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Question #10 for 2016: How much will housing inventory increase in 2016?

by Calculated Risk on 12/28/2015 12:31:00 PM

Yesterday I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

10) Housing Inventory: Housing inventory bottomed in early 2013. However, after slight increases in 2013 and 2014, inventory was down slightly year-over-year in 2015 (through November). Will inventory increase or decrease in 2016?

Tracking housing inventory is very helpful in understanding the housing market. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2015.

According to the NAR, inventory decreased to 2.04 million in November from 2.08 million in November 2014, and up from 1.99 million in November 2012. A small increase over the last three years.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays.

Inventory decreased 1.9% year-over-year in November from November 2014 (blue line). Note that the blue line (year-over-year change) turned slightly positive in 2013, but has been slightly negative for the 2nd half of 2015.

The NAR numbers are the usual measure of inventory. However Zillow also has some inventory data (by state, city, zip code and more here). We have to be careful using the Zillow data because the coverage is probably increasing, but looking at the state level data, it appears inventory is down about 7% year-over-year. This ranges from a sharp year-over-year decrease in some states (like Utah) to a sharp increase in other areas (like North Dakota). Some cities, like Houston, are seeing a sharp increase in inventory due to lower oil prices. Real estate is local!

There are several reasons for the low inventory. Because of low inventory, potential sellers are concerned they will not be able to find a home to buy - so they do not list their home. Another reason for low inventory is that some homeowners are still "underwater" on their mortgages and can't sell. However negative equity is becoming less of a problem. Also some potential sellers haven't built up enough equity to sell and have a down payment for a new purchase.

Over time, as the market moves back to normal, it seems homeowners will sell for the usual reasons (changing jobs, kids, etc).

Right now my guess is active inventory will increase in 2016 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2016). I don't expect a double digit surge in inventory, but maybe a mid-single digit increase year-over-year. If correct, this will keep house price increases down in 2015 (probably lower than the 5% or so gains in 2014 and 2015).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Dallas Fed: "Texas Manufacturing Activity Rises Again, but Outlook Worsens" in December

by Calculated Risk on 12/28/2015 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Rises Again, but Outlook Worsens

Texas factory activity increased for a third month in a row in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 5.2 to 13.4, indicating stronger growth in output.Output increased, but the general business activity index declined sharply. This was the last of the regional Fed surveys for December. Four out of five of the regional surveys indicated contraction in December, especially in oil producing areas.

...

Perceptions of broader business conditions weakened markedly in December. The general business activity index has been negative throughout 2015 and plunged to -20.1 this month. After pushing just above zero last month, the company outlook index fell 10 points in December to -9.7, its lowest level since August.

Labor market indicators reflected a notable rise in December. The employment index inched up further to 12.8; 26 percent of firms noted net hiring, while 14 percent noted net layoffs. The hours worked index suggested longer workweeks and rose to 15.2, its highest level since May 2010.

emphasis added

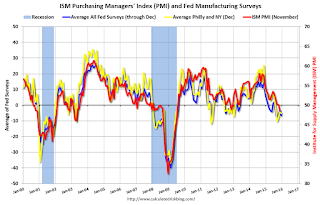

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

It seems likely the ISM index will be weak in December, and will probably show contraction again; a reading below 50. (although these regional surveys overemphasize oil producing areas).

Sunday, December 27, 2015

Sunday Night Futures

by Calculated Risk on 12/27/2015 08:26:00 PM

From the OC Register: On a roll: O.C. housing market wraps up a 'fantastic' 2015 (ht Ilya)

As the year draws to a close, the latest median home price hit $623,000 – just 3.4 percent below the $645,000 record high of June 2007. From January through November, the county’s median averaged about $604,000, up 4 percent from last year, according to data from real estate data firm Corelogic.I don't think renters would think 2015 was a "fantastic year". Also it has been almost 10 years since prices were close to this high, so inflation adjusted, prices aren't close to the previous highs.

...

In the view of John Burns, a real estate consultant based in Irvine, it was for the most part a “fantastic year... Prices, rents and sales volumes rose at a steady, sustainable pace, and construction levels hit their highest levels in at least 12 years.”

Weekend:

• Schedule for Week of December 27th

• Ten Economic Questions for 2016

Monday:

• At 10:30 AM ET, the Dallas Fed Manufacturing Survey for December. This is the last of the regional manufacturing surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 5 and DOW futures are down 55 (fair value).

Oil prices were up over the last week with WTI futures at $37.92 per barrel and Brent at $37.73 per barrel. A year ago, WTI was at $54, and Brent was at $58 - so prices are down over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at close to $2.00 per gallon (down about $0.30 per gallon from a year ago).