by Calculated Risk on 1/02/2016 08:11:00 AM

Saturday, January 02, 2016

Schedule for Week of January 3, 2016

The key report this week is the December employment report on Friday.

Other key indicators include December vehicle sales, the December ISM manufacturing and non-manufacturing indexes, and the November trade deficit.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.2, up from 48.6 in November.

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.2, up from 48.6 in November.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated contraction at 48.6% in November. The employment index was at 51.3%, and the new orders index was at 48.9%.

10:00 AM: Construction Spending for November. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 18.1 million SAAR in December from 18.2 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 18.1 million SAAR in December from 18.2 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 190,000 payroll jobs added in December, down from 217,000 in November.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.4 billion in November from $43.9 billion in October.

10:00 AM: the ISM non-Manufacturing Index for December. The consensus is for index to increase to 56.5 from 55.9 in November.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is a 0.2% decrease in orders.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of December 15-16, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, down from 287 thousand the previous week.

8:30 AM: Employment Report for December. The consensus is for an increase of 200,000 non-farm payroll jobs added in December, down from the 211,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to be unchanged at 5.0%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.64 million jobs.

A key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a no change in inventories.

3:00 PM: Consumer Credit for November from the Federal Reserve. The consensus is for an increase of $19 billion in credit.

Friday, January 01, 2016

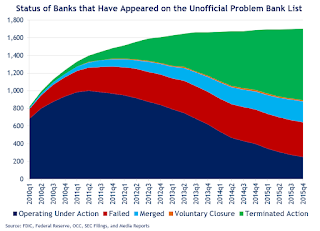

December 2015: Unofficial Problem Bank list declines to 250 Institutions, Q4 2015 Transition Matrix

by Calculated Risk on 1/01/2016 11:20:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for December 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2015. During the month, the list fell from 264 institutions to 250 after eight removals and three additions. Assets dropped by $2.0 billion to an aggregate $74.97 billion. A year ago, the list held 401 institutions with assets of $125.1 billion.

This month, actions have been terminated against Fieldpoint Private Bank & Trust, Greenwich, CT ($786 million); Broadway Federal Bank, f.s.b., Los Angeles, CA ($404 million); Lifestore Bank, West Jefferson, NC ($256 million); American National Bank of Minnesota, Baxter, MN ($251 million); Fidelity Bank of Florida, National Association, Merritt Island, FL ($229 million); Mid-Southern Savings Bank, FSB, Salem, IN ($188 million); State Bank of Herscher, Herscher, IL ($146 million); and Cornerstone Bank, Wilson, NC ($107 million).

The additions this month were The First State Bank, Barboursville, WV ($241 million); Calumet County Bank, Brillion, WI ($91 million); and State Bank of Nauvoo, Nauvoo, IL ($32 million).

With it being the end of the fourth quarter, we bring an updated transition matrix to identify how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,701 institutions have appeared on a weekly or monthly list at some point. There have been 1,451 institutions that have transitioned through the list. Departure methods include 809 action terminations, 395 failures, 233 mergers, and 14 voluntary liquidations. The fourth quarter of 2015 started with 276 institutions on the list, so the 24 action terminations during the quarter reduced the list by 8.7 percent. Of the 389 institutions on the first published list, 28 or 7.2 percent still remain more than six years later. The 395 failures represent 23.2 percent of the 1,701 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 161 | (61,047,816) | |

| Unassisted Merger | 39 | (9,713,878) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (2,684,126) | ||

| Still on List at 12/31/2015 | 28 | 7,480,046 | |

| Additions after 8/7/2009 | 222 | 67,491,915 | |

| End (12/31//2015) | 250 | 74,971,961 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 648 | 265,149,840 | |

| Unassisted Merger | 194 | 78,301,665 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 238 | 119,574,853 | |

| Total | 1,090 | 465,350,500 | |

| 1Institution not on 8/7/2009 or 12/31/2015 list but appeared on a weekly list. | |||

Thursday, December 31, 2015

Hotel Occupancy: 2015 is Best Year on Record

by Calculated Risk on 12/31/2015 05:31:00 PM

Here is an update on hotel occupancy from HotelNewsNow.com: STR: US results for week ending 26 December

The U.S. hotel industry reported negative results in the three key performance measurements during the week of 20-26 December 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are currently in the weakest part of the year; December and January.

In year-over-year measurements, the industry’s occupancy decreased 4.0% to 42.8%. Average daily rate for the week was down 1.7% to US$108.34. Revenue per available room fell 5.6% to US$46.37.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.2015 is the best year on record for hotels.

Average Weekly Occupancy Rate by Year:

1) 2015 65.9%

2) 2000 64.8%

3) 2014 64.8%

And the worst:

2009 55.0%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Goldman Forecast: "Questions for 2016"

by Calculated Risk on 12/31/2015 02:51:00 PM

Here are a few excerpts from a piece by Goldman Sachs economists Jan Hatzius and Zach Pandl: "8 Questions for 2016"

On GDP Growth:

We forecast that growth will improve only slightly from its current pace, averaging 2.25% next year.On Housing:

[W]e see a strong case for a continued recovery in housing starts from about 1.2 million currently to 1.4-1.5 million over the next few years—even without a major easing in lending standards or a rebound in the headship rate of young adults ... we expect that 2016 will mark the end of the post-crisis housing market in several respects. We forecast that the rebound in house prices will slow, that single-family construction will account for a rising share of new housing starts, and that the homeownership rate will finally stabilize.On Fed hikes:

[A] standard policy rule coupled with the Fed's economic projections (or our own) calls for a roughly 125bp increase in the funds rate by end-2016. While the FOMC's preference for a "gradual" path of hikes suggests that four is most likely, the economic case for the full 100bp implied by the Summary of Economic Projections (SEP) is strong.

Question #7 for 2016: What about oil prices in 2016?

by Calculated Risk on 12/31/2015 12:05:00 PM

Over the weekend, I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

7) Oil Prices: The decline in oil prices was a huge story at the end of 2014, and prices have declined sharply again at the end of 2015. Will oil prices stabilize here (WTI is at $38 per barrel)? Or will prices decline further? Or will prices increase in 2016?

First, Josh Zumbrun at the WSJ has a review of 2015 forecasts compared to what actually happened: What Economic Forecasters Got Right, and Wrong, in 2015

Crude OilForecasters did a poor job on oil prices (including me). Oil prices are difficult to predict with all the supply and demand factors.

Average forecast for December 2015: $63/barrel

Actual as of December 29: about $38/barrel

None of the forecasters in the survey saw the price of oil being below $40 this month. Throughout the year, economists have continued to forecast that oil prices would regain some of their lost ground and have been continually disappointed.

The reason prices have fallen sharply is supply and demand. It is important to remember that the short term supply and demand curves for oil are very steep.

In the long run, supply and demand will adjust to price changes. But if someone asks why prices have fallen so sharply recently, the answer is "supply and demand" and that the short term supply and demand curves are steep for oil.

As I noted last year, the keys on the short term demand side have been the ongoing weakness in Europe and the slowdown in China. There has been an increase in demand in the US, but that has been more than offset by global weakness. Will Europe recovery in 2016? Will China's growth increase? Right now it looks like more of the same, so I expect the demand side to stay weak again in 2016.

The supply side is even more difficult. There are volatile regions that have increased supply, such as from Libya and Iraq. And there will be more supply from Iran in 2016. Will be there be a 2016 supply disruption in Libya, Iraq, Iran, Nigeria, or some other oil exporting country? That is a key geopolitical question.

And what about tight oil production in 2016? At the current price, it would seem fracking would be uneconomical for new wells (existing wells will continue to produce). We've seen some decline in US oil production, but the decline in supply has been fairly small. As an example, production in North Dakota peaked at 38.1 million barrels in December 2015, and is only down to 34.6 million barrels in September.

It is impossible to predict an international supply disruption, however if a significant disruption happens, then prices will move higher. Continued weakness in Europe and China seems likely, however sluggish demand will be somewhat offset by less tight oil production. It seems like the key oil producers (Saudi, etc) will continue production at current levels. This suggests in the short run (2016) that prices will stay low, but probably move up a little in 2016. I'll guess WTI will be up from the current price by December 2016 (but still under $50 per barrel).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Chicago PMI declines to 42.9

by Calculated Risk on 12/31/2015 09:50:00 AM

Chicago PMI: Dec Chicago Business Barometer Down 5.8 points to 42.9

The Chicago Business Barometer contracted at the fastest pace since July 2009, falling 5.8 points to 42.9 in December from 48.7 in NovemberThis was well below the consensus forecast of 50.0.

...

There was also ongoing weakness in New Orders, which contracted at a faster pace, to the lowest level since May 2009. The fall in Production was more moderate but still put it back into contraction for the sixth time this year. The Employment component, which had recovered in recent months, dropped back below the 50 neutral mark in December, leaving it at the lowest since July.

The only positive this month came from a special question with 55.1% of the panel expecting demand to be stronger in 2016 compared with 14.3% who thought it would be lower. 30.6% of respondents thought demand would be unchanged.

...

Chief Economist of MNI Indicators Philip Uglow said, “The steepness of the decline in the Barometer in recent months ends a particularly volatile year, which has seen orders and output move in and out of contraction. It lends weight to the Fed’s gradual approach to tightening, with the flexibility to change direction if needed.”

emphasis added

Weekly Initial Unemployment Claims increase to 287,000

by Calculated Risk on 12/31/2015 08:36:00 AM

The DOL reported:

In the week ending December 26, the advance figure for seasonally adjusted initial claims was 287,000, an increase of 20,000 from the previous week's unrevised level of 267,000. The 4-week moving average was 277,000, an increase of 4,500 from the previous week's unrevised average of 272,500.The previous week was unrevised at 267,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 277,000.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Average weekly unemployment claims in 2015 were the lowest in over 40 years (when the workforce was much smaller).

Wednesday, December 30, 2015

Vehicle Sales Forecast: Record Production in 2016

by Calculated Risk on 12/30/2015 08:10:00 PM

Thursday:

• At 8:30 AM ET, initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

• At 9:45 AM, Chicago Purchasing Managers Index for December. The consensus is for a reading of 50.0, up from 48.7 in November.

The automakers will report December vehicle sales on Tuesday, January 5th. Sales in November were at 18.1 million on a seasonally adjusted annual rate basis (SAAR), and it possible sales in December will be over 18 million SAAR again.

From WardsAuto: North America Production Will Hit 18 Million Next Year

Forecast 2016 production totals 18.2 million vehicles, including 17.7 million light vehicles and 490,000 medium- and heavy-duty trucks. The LV total is 1.2% above the estimated 17.44 million in 2015, while the big-truck volume is 4.9% under 2015’s estimated total of 515,000.2015 was a record year for light vehicle production in the US, and it looks like 2016 will be even better.

Total estimated vehicle output in 2015 of 17.96 million units is 1.1% above 2014’s 17.42 million and will topple the previous high of 17.66 million in 2000. LV volume this year will be a new record – beating 2000’s 17.16 million – while big-truck output will be a 9-year high.

Zillow Forecast: Expect November Year-over-year Change for Case-Shiller Index slightly higher than in October

by Calculated Risk on 12/30/2015 04:31:00 PM

The Case-Shiller house price indexes for October were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: November Case-Shiller Forecast Shows Continued Growth

Similar to last month’s Zillow’s Home Value Index data, October S&P Case-Shiller data shows home prices continuing to climb. The 10- and 20-City Indices as well as the National Case-Shiller Index grew by nearly 1 percent between September and October. Similarly all three of the indices showed annual growth rates north of 5 percent. This marks the first time in over a year the national index has grown at 5 percent annually.This suggests the year-over-year change for the November Case-Shiller National index will be slightly higher than in the October report.

When November Case-Shiller data is released a month from now, we expect the data will show continuing growth month-over-month, though not at quite the same sizzling pace. We predict that the 10- and 20- City Indices will end November 0.5 percent above their October values (seasonally adjusted). We expect the national index to grow slightly faster than the other two, at a rate of 0.7 percent month-over-month.

Inline with continued monthly growth we also expect all rates still above 5 percent when November data is released. The table below shows the current changes in Case-Shiller data along with our forecasts for next month’s data.

Question #8 for 2016: How much will Residential Investment increase?

by Calculated Risk on 12/30/2015 12:38:00 PM

Over the weekend, I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

8) Residential Investment: Residential investment (RI) was up solidly in 2015. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2016? How about housing starts and new home sales in 2016?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2015.

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish. Residential investment finally turned positive during 2011 and made a solid positive contribution to GDP every year since then.

But even with the recent increases, RI as a percent of GDP is still very low - close to the lows of previous recessions - and it seems likely that residential investment as a percent of GDP will increase further in 2016.

Housing starts are on pace to increase over 10% in 2015. And even after the significant increase over the last four years, the approximately 1.1 million housing starts in 2015 will still be the 11th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the seven lowest years were 2008 through 2014). The other lower years were the bottoms of previous recessions.

New home sales in 2015 were up close to 14% compared to 2014 at close to 500 thousand.

Here is a table showing housing starts and new home sales over the last decade. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That means starts will come close to increasing 40% over the next few years from the 2015 level.

| Housing Starts and New Home Sales (000s) | ||||

|---|---|---|---|---|

| Housing Starts | Change | New Home Sales | Change | |

| 2005 | 2068 | --- | 1,283 | --- |

| 2006 | 1801 | -12.9% | 1,051 | -18.1% |

| 2007 | 1355 | -24.8% | 776 | -26.2% |

| 2008 | 906 | -33.2% | 485 | -37.5% |

| 2009 | 554 | -38.8% | 375 | -22.7% |

| 2010 | 587 | 5.9% | 323 | -13.9% |

| 2011 | 609 | 3.7% | 306 | -5.3% |

| 2012 | 781 | 28.2% | 368 | 20.3% |

| 2013 | 925 | 18.5% | 429 | 16.6% |

| 2014 | 1003 | 8.5% | 437 | 1.9% |

| 20151 | 1110 | 10.6% | 498 | 14.0% |

| 12015 estimated | ||||

Most analysts are looking for starts to increase to around 1.25 million in 2016, and for new home sales around 560 thousand. This would be an increase of around 12% for both starts and new home sales.

I think there will be further growth in 2016, but I'm a little more pessimistic than some analysts. Some key areas - like Houston - will be hit hard by the decline oil prices. And I think growth will slow for multi-family starts. Also, to achieve double digit growth for new home sales in 2016, the builders would have to offer more lower priced homes (the builders have focused on higher priced homes in recent years). There has been a shift to offering more affordable new homes, but it takes time.

My guess is growth of around 4% to 8% in 2016 for new home sales, and about the same percentage growth for housing starts. Also I think the mix between multi-family and single family starts will shift a little more towards single family in 2016.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?