by Calculated Risk on 1/05/2016 03:33:00 PM

Tuesday, January 05, 2016

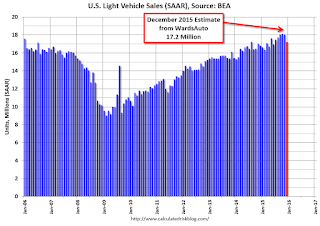

U.S. Light Vehicle Sales at 17.2 million annual rate in December

Based on an estimate from WardsAuto, light vehicle sales were at a 17.2 million SAAR in December.

That is up about 2% from December 2014, and down about 5% from the 18.06 million annual sales rate last month.

This is probably a record year for light vehicle sales (more on that when the official data is released).

It looks like the best years were:

1) 2015 with 17.39 million sold

2) 2000 with 17.35 million

3) 2001 with 17.12 million

4) 2005 with 16.95 million

5) 1999 with 16.89 million

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 17.2 million SAAR from WardsAuto).

This was below the consensus forecast of 18.1 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was a below expectations, however 2015 was the best year ever for light vehicle sales.

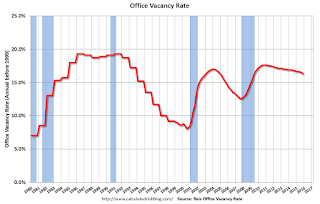

Reis: Office Vacancy Rate declined in Q4 to 16.3%

by Calculated Risk on 1/05/2016 11:48:00 AM

Reis released their Q4 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.3% in Q4, from 16.5% in Q3. This is down from 16.7% in Q4 2014, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

The ongoing decline in the national vacancy rate finally gained momentum this quarter, falling by 20 basis points to 16.3%. This marks the first time since the market began to recover in early 2011 that the quarterly vacancy rate fell by more than 10 basis points. The vacancy rate has now declined in five of the last six quarters and is at its lowest level since the second quarter of 2009. The quiet acceleration in the office market recovery is now beginning to make more noise. Both net absorption and new construction are increasing, but absorption is beginning to pull ahead of construction by a wider margin. By many measures, including absorption, construction, and vacancy compression, 2015 was the best year in the office market in recent history. The acceleration in improvement will persist in 2016 as the labor market remains near full employment, the economy expands, and office jobs are created.

...

Occupied stock increased by 15.322 million square feet during the fourth quarter. This was an increase versus last quarter and was the highest level for quarterly net absorption since the third quarter of 2007. The calendar-year total for 2015 of 42.436 million square feet was the highest annual total since 2007. In short, 2015 was the best year for demand in the office market since before the recession. Moreover, the improvement is accelerating - roughly 11 million more square feet were absorbed in 2015 versus 2014. That is the largest increase between calendar years since 2005. This should accelerate in 2016 as the continued gains in the labor market translate into greater demand for office space.

New construction of 9.597 million SF is a bit of a decline from last quarter. However, the trend over time is still upward. Construction has exceeded 9 million square feet in each of the last three quarters. That has not happened since the third quarter of 2009 when construction was slowing due to the recession. Slowly, but surely, investors and developers are feeling more confident about their prospects, spurred on by the recovery in fundamentals. Over time, speculative projects are making a return to the market, evidence of this turnabout in sentiment. Confidence will continue to grow over time, resulting in a greater number of office space being constructed going forward.

...

4Q2015 asking rent growth: +0.8% / 12-month change: +3.1%

4Q2015 effective rent growth: +0.8% / 12-month change: +3.2%

Asking and effective rents both grew by 0.8% during the fourth quarter, marking the twenty-first consecutive quarter of asking and effective rent growth. These growth rates were slightly ahead of the growth rates from last quarter. On a year-over-year basis, both asking and effective rent growth slowed versus third quarter figures. However, this is more due to the weak rent growth that was observed during the third quarter of 2014 than any slowdown in rent. In eight of the last nine quarters, both asking and effective rent growth have been at least 0.7%. Annual growth rates in excess of 3% is still strong for a market with a vacancy rate greater than 16%. Nonetheless, these growth rates should accelerate as the market continues to tighten in the coming years.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.3% in Q4.

Office vacancy data courtesy of Reis.

CoreLogic: House Prices up 6.3% Year-over-year in November

by Calculated Risk on 1/05/2016 09:43:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up 6.3 Percent Year Over Year in November 2015

Home prices nationwide, including distressed sales, increased by 6.3 percent in November 2015 compared with November 2014 and increased by 0.5 percent in November 2015 compared with October 2015, according to the CoreLogic HPI.

“Heading into 2016, home price growth remains in its sweet spot as prices have increased between 5 and 6 percent on a year-over-year basis for 16 consecutive months,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Regionally we are beginning to see fissures, with slowdowns in some Texas and California markets, but the northwest and southeast remain on solid footing.”

“Many factors, including strong demand and tight supply in many markets, are contributing to the long-sustained boom in prices and home equity which is a very good thing for those owning homes,” said Anand Nallathambi, president and CEO of CoreLogic. “On the flip side, prices have outstripped incomes for several years in a number of regions so, as we enter 2016, affordability is becoming more of a constraint on sales in some markets.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.5% in October (NSA), and is up 6.3% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The YoY increase had been moving sideways over most of the last year, but has picked up a recently.

The YoY increase had been moving sideways over most of the last year, but has picked up a recently.The year-over-year comparison has been positive for forty five consecutive months.

Monday, January 04, 2016

Tuesday: Auto Sales

by Calculated Risk on 1/04/2016 08:44:00 PM

Tuesday:

• All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 18.1 million SAAR in December from 18.2 million in November (Seasonally Adjusted Annual Rate).

A few excerpts from Tim Duy's article at Fed Watch: A Look Ahead Into 2016

What do I expect to see in 2016? Briefly, here are my baseline expectations for the year:There is much more in the article (and I generally agree with Dr. Duy).

1.) No recession. I think that fears of recession in 2016 are overblown. Softness in the manufacturing sector is the primary motivation for such fears, but this ignores the declining economic importance of manufacturing in the US economy. Manufacturing now accounts for just 8.6% of jobs. I think people are falling into a trap of overemphasizing the importance of manufacturing as a cyclical indicator. A broader perspective indicates little reason to be worried of recession in 2016

...

5.) Inflation will accelerate. I think 2016 will be the year that economic resources become sufficiently scarce to push inflation back to the Fed's target. I know this may seem like a wildly optimistic call given the persistence of low inflation during this cycle

...

9.) The Federal Reserve will continue to hike rates, slowly. I expect that economic conditions will be sufficient for the Federal Reserve to justify 100bp of rate hikes in 2016. Although the Fed will not want to appear mechanical in its normalization process, they will likely find themselves hiking every other meeting beginning in January. They will be slow to begin the process of "normalizing" the balance sheet, although I expect that they will be fully engaged in that conversation by the middle of the year. That conversation will take on more urgency if they have difficulty controlling short rates with their new tools.

Fed: Q3 Household Debt Service Ratio Very Low

by Calculated Risk on 1/04/2016 03:32:00 PM

The Fed's Household Debt Service ratio through Q3 2015 was released Dec 28th: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio was unchanged in Q3, and has been moving sideways and is near a record low. Note: The financial obligation ratio (FOR) declined in Q3 and is also near a record low (not shown)

The DSR for mortgages (blue) are near the low for the last 35 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last three years.

This data suggests aggregate household cash flow has improved.

Construction Spending decreased 0.4% in November, Up 10.5% YoY

by Calculated Risk on 1/04/2016 11:54:00 AM

The Census Bureau reported that overall construction spending decreased in November compared to October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2015 was estimated at a seasonally adjusted annual rate of $1,122.5 billion, 0.4 percent below the revised October estimate of $1,127.0 billion. The November figure is 10.5 percent above the November 2014 estimate of $1,016.1 billion.Both private spending and public spending decreased:

During the first 11 months of this year, construction spending amounted to $1,011.9 billion, 10.7 percent (±1.2%) above the $913.9 billion for the same period in 2014.

Spending on private construction was at a seasonally adjusted annual rate of $828.2 billion, 0.2 percent below the revised October estimate of $829.7 billion. ...Note: There were substantial upward revisions to private residential construction spending for the last few years.

n November, the estimated seasonally adjusted annual rate of public construction spending was $294.3 billion, 1.0 percent below the revised October estimate of $297.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 37% below the bubble peak.

Non-residential spending is only 3% below the peak in January 2008 (nominal dollars).

Public construction spending is now 10% below the peak in March 2009 and about 11% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 11%. Non-residential spending is up 14% year-over-year. Public spending is up 6% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This well below the consensus forecast of a 0.7% increase, however spending for prior months was revised up sharply.

ISM Manufacturing index decreased to 48.2 in December

by Calculated Risk on 1/04/2016 10:00:00 AM

The ISM manufacturing index indicated contraction in December. The PMI was at 48.2% in December, down from 48.6% in November. The employment index was at 48.3%, down from 51.3% in November, and the new orders index was at 49.2%, up from 48.9%.

From the Institute for Supply Management: December 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in December for the second consecutive month, while the overall economy grew for the 79th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The December PMI® registered 48.2 percent, a decrease of 0.4 percentage point from the November reading of 48.6 percent. The New Orders Index registered 49.2 percent, an increase of 0.3 percentage point from the reading of 48.9 percent in November. The Production Index registered 49.8 percent, 0.6 percentage point higher than the November reading of 49.2 percent. The Employment Index registered 48.1 percent, 3.2 percentage points below the November reading of 51.3 percent. The Prices Index registered 33.5 percent, a decrease of 2 percentage points from the November reading of 35.5 percent, indicating lower raw materials prices for the 14th consecutive month. The New Export Orders Index registered 51 percent, up 3.5 percentage points from the November reading of 47.5 percent and the Imports Index registered 45.5 percent, down 3.5 percentage points from the November reading of 49 percent. As was the case in November, 10 out of 18 manufacturing industries reported contraction in December. Contraction in new orders, production, employment and raw materials inventories accounted for the overall softness in December."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 49.2%, and indicates manufacturing contracted in December.

Black Knight: House Price Index up 0.2% in October, Up 5.5% year-over-year

by Calculated Risk on 1/04/2016 08:25:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Up 0.2 Percent for the Month; Up 5.5 Percent Year-Over-Year

» U.S. home prices were up 0.2 percent for the month, and have gained 5.5 percent from one year agoThe Black Knight HPI increased 0.2% percent in October, and is off 5.3% from the peak in June 2006 (not adjusted for inflation).

» At $254K, the national level HPI is now just 5.3 percent off its June 2006 peak of $268K, and up 26.9 percent from the market’s bottom in January 2012

» New York led gains among the states for the fourth consecutive month, seeing 1.1 percent month-over-month appreciation, followed by Nevada and Utah, both of which rose 0.8 percent from September » Connecticut once again saw the most negative movement among the states in October, with home prices there falling by 0.6 percent month-over-month

» New York, NY and Reno, NV led the nation’s metro areas, with home prices there rising 1.2 percent from September

» All five California metro areas ranked among the nation’s 40 largest saw home prices decline in October, as did the state as a whole

» Home prices in New York, Tennessee and Texas all hit new peaks again in October

» Of the nation’s 40 largest metros, 7 hit new peaks in October – Austin, TX; Dallas, TX; Denver, CO; Houston, TX; Nashville, TN; Portland OR and San Antonio, TX

The year-over-year increase in the index has been about the same for the last year.

Note: Case-Shiller for October was released last week.

Sunday, January 03, 2016

Sunday Night Futures

by Calculated Risk on 1/03/2016 09:53:00 PM

Weekend:

• Schedule for Week of January 3, 2016

• Question #6 for 2016: Will real wages increase in 2016?

• December 2015: Unofficial Problem Bank list declines to 250 Institutions, Q4 2015 Transition Matrix

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for December. The consensus is for the ISM to be at 49.2, up from 48.6 in November. The ISM manufacturing index indicated contraction at 48.6% in November. The employment index was at 51.3%, and the new orders index was at 48.9%.

• Also at 10:00 AM, Construction Spending for November. The consensus is for a 0.7% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 7 and DOW futures are down 55 (fair value).

Oil prices were mixed over the last week with WTI futures at $37.50 per barrel and Brent at $37.87 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so prices are down over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at close to $1.99 per gallon (down about $0.20 per gallon from a year ago).

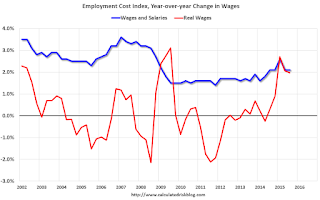

Question #6 for 2016: Will real wages increase in 2016?

by Calculated Risk on 1/03/2016 12:41:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

6) Real Wage Growth: Last year I was one of the most pessimistic forecasters on wage growth. That was unfortunately correct (on nominal wages). Hopefully 2016 will be better for wages! How much will wages increase in 2016?

Note: Last year I was correct on nominal wages, but real wages increased (because of falling oil prices).

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up significantly last year. Sustained 2% real wage growth would be great, but most of the recent increase in real wages was due to falling oil prices - and that is not sustainable.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

The second graph shows the year-over-year change using the quarterly wage data from the Employment Cost Index (data starts in 2001). Once again this shows nominal wages have increasing a little over 2% in 2015, and real wages increased (due to lower oil prices).

For this post the key point is that nominal wages have been only increasing about 2% per year with some pickup in 2015. As the labor market continues to tighten, we should start see more wage pressure as companies have to compete more for employees. I expect to see some further increase in nominal wage increases in 2016 (perhaps over 3% later in the year). The year-over-year change in real wages will depend on inflation, and I expect headline CPI to pickup some this year as the impact on headline inflation of declining oil prices fades.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?