by Calculated Risk on 1/12/2016 08:34:00 PM

Tuesday, January 12, 2016

Phoenix Real Estate in December: Sales up 4%, Inventory down 8%

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• At 2:00 PM, The Monthly Treasury Budget Statement for December.

On Phoenix:

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

For the thirteen consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from the prior year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in December were up 4.3% year-over-year.

2) Cash Sales (frequently investors) were down to 23.9% of total sales.

3) Active inventory is now down 8.0% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

With falling inventory, prices increased a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 4.6% through October according the Case-Shiller (about double the pace for 2014).

| December Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Dec-08 | 5,524 | --- | 1,665 | 30.1% | 53,7921 | --- |

| Dec-09 | 7,661 | 38.7% | 3,008 | 39.3% | 39,709 | -26.2%1 |

| Dec-10 | 8,401 | 9.7% | 3,939 | 46.9% | 42,463 | 6.9% |

| Dec-11 | 7,843 | -6.6% | 3,635 | 46.3% | 24,712 | -41.8% |

| Dec-12 | 7,071 | -9.8% | 3,211 | 45.4% | 21,095 | -14.6% |

| Dec-13 | 5,930 | -16.1% | 2,053 | 34.6% | 25,511 | 20.9% |

| Dec-14 | 6,475 | 9.2% | 1,893 | 29.2% | 25,052 | -1.8% |

| Dec-15 | 6,756 | 4.3% | 1,617 | 23.9% | 23,053 | -8.0% |

| 1 December 2008 probably includes pending listings | ||||||

An update on oil prices

by Calculated Risk on 1/12/2016 02:54:00 PM

From the WSJ: U.S. Oil Prices Sink Below $30 a Barrel, First Time Since ’03

Oil tumbled below $30 a barrel on Tuesday, underscoring the global economy’s difficulty with absorbing a relentless flood of crude supplies.

...

The benchmark U.S. oil contract has dropped from $40 a barrel to $30 in just one month, and the pace of the selloff has rattled stock, bond and currency markets from Moscow to Riyadh to New York. Oil is down more than 70% since last trading in the triple digits, back in June 2014.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $30.20 per barrel today, and Brent is at $30.60

Prices really collapsed at the end of 2014 - and then rebounded a little - and have collapsed again. There are many factors pushing down oil prices - more global supply (even as some shale producers cut back), global economic weakness (slowing demand), strong dollar, and warm weather in the US (less heating demand) to mention a few.

U.S. Heavy Truck Sales

by Calculated Risk on 1/12/2016 12:55:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2015 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate basis (SAAR). Since then sales increased more than 2 1/2 times, and hit 492 thousand SAAR in November 2015 - even with weakness in the oil sector.

Heavy truck sales declined in December to 440 thousand SAAR.

The level in November 2015 was the highest level since December 2006 (9 years ago). Sales have been above 400 thousand SAAR for 18 consecutive months, are now above the average (and median) of the last 20 years.

Click on graph for larger image.

BLS: Jobs Openings increased in November

by Calculated Risk on 1/12/2016 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

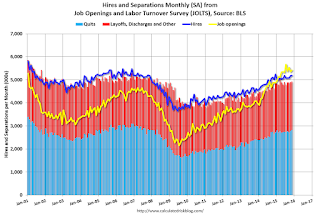

The number of job openings was little changed at 5.4 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.2 million and 4.9 million, respectively. Within separations, the quits rate was 2.0 percent, and the layoffs and discharges rate was 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in November, little changed from October. The number of quits has held between 2.7 million and 2.8 million for the past 15 months. The quits rate in November was 2.0 percent.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in November to 5.431 million from 5.349 million in October.

The number of job openings (yellow) are up 11% year-over-year compared to November 2014.

Quits are up 6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a solid report. Job openings are close to the record high set in July, and Quits are up 6% year-over-year.

NFIB: Small Business Optimism Index increased slightly in December

by Calculated Risk on 1/12/2016 09:23:00 AM

From the National Federation of Independent Business (NFIB): NFIB Survey Remains Flat, With Small Business Owners Divided on Sales Outlook, Business Conditions

The overall Index gained a modest 0.4 points in December. It now stands at 95.2, which is well below the 42-year average of 98. ...

Reported job creation faded a bit in December, with the average employment gain per firm falling to -0.07 workers from .01 in November, basically flat for the last few months. Fifty-five percent reported hiring or trying to hire (unchanged), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. ... Twenty-eight percent of all owners reported job openings they could not fill in the current period, up 1 point and at the highest level for this expansion. This is a solid reading historically and indicates no significant change in the unemployment rate. A seasonally adjusted net 15 percent plan to create new jobs, up 4 points, a nice gain, possibly driven by the surge in expected real sales gains.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.2 in December.

Hiring plans are solid.

Monday, January 11, 2016

Tuesday: Job Openings

by Calculated Risk on 1/11/2016 07:53:00 PM

Tuesday:

• At 5:30 AM ET, Panel Discussion with Vice Chairman Stanley Fischer, Monetary Policy, Financial Stability, and the Zero Lower Bound, At the Banque de France and Bank for International Settlements Farewell Symposium for Christian Noyer, Paris, France

• At 9:00 AM, NFIB Small Business Optimism Index for November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS. Job openings decreased in October to 5.383 million from 5.534 million in September. The number of job openings were up 11% year-over-year, and Quits were up slightly year-over-year.

Some interesting information from Jody Kahn and Devyn Bachman at John Burns Real Estate Consulting 23,263 New Home Sales Last Year at Top 50 Masterplans, a 14% Increase over 2014

In 2015, the top 50 masterplans listed in the table below sold nearly 23,300 homes, representing:I expect sales in Houston to slow in 2016 (see: Lawler: "Yes, Houston will have a problem next year" , and Houston has been a major contributor to New Home sales - this is a reason I'm less optimistic than most housing analysts on new home sales this year.

• A 14% increase over 2014

• Roughly 4.7% of all new home sales nationally

• The highest sales volume in the 6 years we have been compiling our list

...

Texas continues to lead the country. The state boasts 17 of the top 50 best-selling master-planned communities, including 9 in Houston, the most of any metro area, 6 in Dallas, and one each in Austin and San Antonio. California contributed 11 top sellers, Florida had 7 communities, Las Vegas contributed 4, and Denver had 3. After getting shut out in 2014, 3 Phoenix communities joined the list ...

emphasis added

Question #1 for 2016: How much will the economy grow in 2016?

by Calculated Risk on 1/11/2016 02:19:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'm adding some thoughts, and a few predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

1) Economic growth: Heading into 2016, most analysts are once again pretty sanguine. Even with weak growth in the first quarter, 2015 was a decent year (GDP growth will be around 2.5% in 2015). Right now analysts are expecting growth of 2.6% in 2016, although a few analysts are projecting a recession. How much will the economy grow in 2016?

First, there are several analysts predicting a recession in 2016, see: The Endless Parade of Recession Calls. No one has a perfect crystal ball, but I'm not even on recession watch right now. In 2007, when I correctly predicted a recession, I was watching the impact of the housing bust on the economy - and that recession call seemed obvious (although it was out of the consensus). A recession in 2016 seems very unlikely.

Second, here is a table of the annual change in real GDP since 2007. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%. It is possible with some boost related to lower oil prices (something that is hard to see in the data, but is certainly happening in some sectors), and some boost from government spending in 2016 - and maybe some help from the weather in Q1 - perhaps we will finally see growth at 3% this year.

| Annual Real GDP Growth | ||

|---|---|---|

| Year | GDP | |

| 2005 | 3.3% | |

| 2006 | 2.7% | |

| 2007 | 1.8% | |

| 2008 | -0.3% | |

| 2009 | -2.8% | |

| 2010 | 2.5% | |

| 2011 | 1.6% | |

| 2012 | 2.2% | |

| 2013 | 1.5% | |

| 2014 | 2.4% | |

| 20151 | 2.5% | |

| 1 2015 estimate. | ||

The good news is that all of the positives that led to the pickup in activity since 2013 are still present - the housing recovery is ongoing, state and local government austerity is over (and now Federal austerity is over), household balance sheets are in much better shape and household deleveraging is over, and commercial real estate (CRE) investment (ex-energy) and public construction will both probably make further positive contributions in 2016.

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016.

The most likely growth rate is in the mid-2% range again, however a 3 handle is possible if PCE picks up a little more (ex-gasoline).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Question #2 for 2016: How many payroll jobs will be added in 2016?

by Calculated Risk on 1/11/2016 11:29:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'm adding some thoughts, and a few predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

2) Employment:2) Employment: Through November, the economy has added 2,308,000 jobs this year, or 210,000 per month. As expected, this was down from the 260 thousand per month in 2014. Will job creation in 2016 be as strong as in 2015? Or will job creation be even stronger, like in 2014? Or will job creation slow further in 2016?

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total and private employment gains, 2015 was the second best year since the '90s (only trailing the previous year, 2014).

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,408 | 3,213 | 195 |

| 1998 | 3,047 | 2,734 | 313 |

| 1999 | 3,177 | 2,716 | 461 |

| 2000 | 1,945 | 1,681 | 264 |

| 2001 | -1,735 | -2,286 | 551 |

| 2002 | -507 | -740 | 233 |

| 2003 | 105 | 147 | -42 |

| 2004 | 2,032 | 1,885 | 147 |

| 2005 | 2,506 | 2,320 | 186 |

| 2006 | 2,087 | 1,878 | 209 |

| 2007 | 1,139 | 851 | 288 |

| 2008 | -3,577 | -3,757 | 180 |

| 2009 | -5,088 | -5,014 | -74 |

| 2010 | 1,066 | 1,282 | -216 |

| 2011 | 2,080 | 2,396 | -316 |

| 2012 | 2,257 | 2,315 | -58 |

| 2013 | 2,388 | 2,452 | -64 |

| 2014 | 3,116 | 3,042 | 74 |

| 2015 | 2,650 | 2,551 | 99 |

The good news is the economy still has solid momentum heading into the new year. The further decline in oil prices will give a boost to many sectors, construction activity (non-energy related) should continue to increase, and the pace of public hiring will probably increase further in 2016.

Also the drag on manufacturing due to the strong dollar will probably lessen in 2016.

There are also some negatives. The decline in oil prices will lead to further layoffs in the energy sector and have a ripple effect in some communities (like Houston). And the lower unemployment rate will mean some companies will have difficulty finding qualified candidates.

Note: Too many people compare to the '80s and '90s, without thinking about changing demographics. The prime working age population (25 to 54 years old) was growing 2.2% per year in the '80s, and 1.3% per year in the '90s. The prime working age population has actually declined slightly this decade. Note: The prime working age population is now growing slowly again, and growth will pick up the '20s.

In 2015, public employment added to total employment for the second consecutive year, but still at a fairly low level. Public hiring will probably pick up to 150,000+ in 2016.

The second table shows the change in construction and manufacturing payrolls starting in 2006.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1,047 | -1,375 |

| 2010 | -187 | 120 |

| 2011 | 145 | 204 |

| 2012 | 112 | 162 |

| 2013 | 213 | 125 |

| 2014 | 338 | 215 |

| 2015 | 263 | 30 |

Energy related construction hiring will decline in 2015, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2016. Lower than in 2015, but another solid year for employment gains given current demographics.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Black Knight November Mortgage Monitor: First Time Foreclosure Starts Lowest on Record

by Calculated Risk on 1/11/2016 09:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for November today. According to BKFS, 4.92% of mortgages were delinquent in November, up from 4.77% in October. BKFS reported that 1.38% of mortgages were in the foreclosure process.

This gives a total of 6.30% delinquent or in foreclosure.

Press Release: Black Knight’s November Mortgage Monitor: Refinanceable Population Shrinks While Tappable Equity Rises; HELOC Originations Continue to Climb

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of November 2015. This month, Black Knight revisited the population of refinanceable borrowers and found that approximately 5.2 million borrowers could likely both qualify for and benefit from refinancing at today’s interest rates. However, as Black Knight Data & Analytics Senior Vice President Ben Graboske explained, this population is diminishing, and as mortgage interest rates rise, it will only continue to shrink further.

“Looking at current interest rates on existing 30-year mortgages and applying a set of broad-based underwriting criteria, we found that there are still approximately 5.2 million borrowers that make good candidates for traditional refinancing,” said Graboske. “Of course, that’s down from over 7 million as recently as April 2015, when interest rates were below 3.7 percent. If rates go up 50 basis points from where they are now, 2.1 million borrowers will fall out of the running; a 100-basis-point increase would eliminate another million, leaving only 2 million potential refinance candidates, the lowest population of refinance candidates in recent history. That said, of those that could likely qualify for and benefit from refinancing today, some 2.4 million are looking at potentially saving $200 or more on their monthly mortgage payments post-refinancing. Again, this is a very rate-sensitive population: after a 50-basis-point rise in rates, a million borrowers would lose out on those savings.

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the first time foreclosure starts since 2005.

From Black Knight:

Looking more closely at November’s foreclosure starts, we see that the month’s 31,000 first time foreclosure starts were the lowest in over 10 yearsThere is much more in the mortgage monitor.

In fact, the lowest number of foreclosure starts seen in 2005 (when Black Knight began tracking this data) was 37,700 in January – so not only are we back to pre-crisis levels, but November was 18 percent below the lowest level of first time foreclosure starts in all of 2005

Likewise, repeat foreclosures were at their lowest level since April of 2008

Sunday, January 10, 2016

Sunday Night Futures: Brent Oil Price Lowest Since 2004

by Calculated Risk on 1/10/2016 08:02:00 PM

Brent oil prices are now the lowest since June 2004 according to the EIA. WTI prices are the lowest since December 2008 (WTI fell to $30.28 per barrel on December 23, 2008).

From the USA Today: Gas prices could drop toward $1 a gallon

As oil prices fall, and refinery capacity stays strong, the price of gas could reach $1 a gallon in some areas, a level last reached in 1999. As a matter of fact, the entire states of Alabama, Arkansas, Missouri, Oklahoma and South Caroline have gas prices that average at or below $1.75.Weekend:

• Schedule for Week of January 11, 2016

• Question #3 for 2016: What will the unemployment rate be in December 2016?

Monday:

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 15 and DOW futures are down 125 (fair value).

Oil prices were down sharply over the last week with WTI futures at $32.45 per barrel (lowest since December 2008) and Brent at $32.92 per barrel (lowest since June 2004). A year ago, WTI was at $48, and Brent was also at $48 - so prices are down over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.97 per gallon (down about $0.20 per gallon from a year ago). Gasoline prices should decline over the next few weeks based on the sharp decline in oil prices.