by Calculated Risk on 1/18/2016 03:35:00 PM

Monday, January 18, 2016

Lawler: Early Read on Existing Home Sales in December and Post-Mortem on November

From housing economist Tim Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.36 million in December, up 12.6% from November’s preliminary pace and up 5.7% from last Decembers seasonally adjusted pace. The bounce back in sales from November’s “shockingly” low pace – which occurred in many but by no means all markets across the country – strongly suggests that the new “TRID” disclosure rules and/or documents artificially depressed the pace of home sales in November – though by the same token they may have artificially inflated slightly the pace of sales in December.

As noted above, the bounce-back in sales last month was not only uneven across the country, but uneven even across different markets in the same state. Here are a few examples (the YOY increase in sales are based on preliminary reports).

| YOY % Change, Home Sales | ||

|---|---|---|

| Nov-15 | Dec-15 | |

| North Texas | 8.7% | 20.1% |

| Houston | -10.5% | -9.3% |

| Triangle Region | -1.0% | 13.1% |

| Charlotte | -3.3% | -2.6% |

| Toledo | -7.0% | 16.0% |

| Columbus | 4.0% | 6.0% |

| Tucson | 3.5% | 15.9% |

| Phoenix | 6.5% | 3.8% |

On the inventory front, I forecast that the inventory of existing home sales at the end of December as estimated by the National Association of Realtors will be 1.81 million, down 11.3% from November’s preliminary level and down 2.7% from last December. Finally I expect that the NAR’s estimate of the median existing SF home sales price for December will be up 6.7% from last December.

CR Note: Existing home sales for December will be released on Friday, and the consensus is for sales of 5.19 million SAAR.

And from Lawler: Post-Mortem on November Existing Home Sales ...

In its report on November home sales released on December 22nd, the National Association of Realtors estimated that US existing home sales ran at a seasonally adjusted annual rate of 4.76 million, down 10.5% from October’s downwardly-revised (to 5.32 million from 5.36 million) pace and down 3.8% from last November’s seasonally adjusted pace. The NAR estimated that unadjusted sales in November were unchanged from a year earlier. The NAR’s estimate was massively lower than the “consensus” forecast (5.32 million SAAR), but was also below my projection (4.97 million SAAR) from December 15th based on publicly-available realtor/MLS reports released through that date. My projection for unadjusted November sales based on regional tracking through December 15th was for a YOY gain of 2.4% (so obviously I underestimated the YOY increase in the November seasonal factor).

There have been numerous local realtor/MLS reports for November released since mid-December, and based on these reports (which comprise over 230,000 sales), I would estimate that “national” existing home sales in November on an unadjusted basis were up by just 1.3% from last November’s surprisingly slow pace, and just a bit higher than the NAR’s estimate. Any way you slice it, then, the pace of existing home sales in November was, on a seasonally adjusted basis, massively slower than in the Spring and Summer.

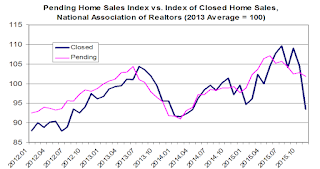

There is a pretty broad consensus that implementation of new mortgage disclosure rules and closing documents, which went into effect in early October, delayed some home closings in November and as such were behind some of the steep drop-off in sales, though it is difficult to quantify this impact (though any impact appears to have varied considerably across various markets). One reason for this consensus is that there was no plunge in various measures of pending home sales – though the NAR’s Pending Home Sales Index has been trending downward since May.

It is worth noting, of course, that the NAR’s Pending Home Sales Index has not been a great predictor of monthly home sales of late. These are several reasons for the “imperfect” linkage: first, of course, monthly data don’t give any indication of the intra-monthly pattern of signed contracts; second, contract “fallout” rates can vary; third, the NAR’s “sample size” for pending home sales is only half as large as that for closed sales; and finally, “data quality” issues are more significant in the pending home sales statistics than in the closed home sales statistics1.

Nevertheless, if in fact the new disclosure/closing rules and documents were behind much of the plunge in November home sales, then one would expect to see a sharp snap back in sales in December.

1This was especially apparent in the NAR’s Pending Home Sales Index in the West, which I noted in 2014 looked “just plain wrong.” Early last year the NAR made massive revisions in it Pending Home Sales Index for the West that now look more reasonable.

Update: Predicting the Next Recession

by Calculated Risk on 1/18/2016 10:49:00 AM

CR 2016 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and last summer) because of all the recession calls. Now, once again, the recession callers are out in force - this time arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - will lead to a global recession and drag the US into recession. I don't think so.

I've added a few updates in italics by year (some updates are from 2015). Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR 2016 Update: Now it has been three years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR 2016 Update: 2013 was a little better than I expected, but still sluggish. 2014 and 2015 saw some pickup in growth.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2016 Update: The current recession calls are mostly based on exogenous events: the problems in China and in commodity based economies (especially oil based). There will be some spillover to the US such as fewer exports (and an impact on oil producing regions in the US), but unless there is a related financial crisis, I think the spillover will be insufficient to cause a recession in the US.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2016 Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state, local and Federal levels. It is possible the Fed could tighten too quickly. ]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR 2016 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. This still seems correct today, so no recession this year.]

Sunday, January 17, 2016

Hamilton: "World oil supply and demand"

by Calculated Risk on 1/17/2016 08:40:00 PM

Oil prices are still declining with Brent falling below $28 today.

Here a few excerpts from an article by Professor James Hamilton: World oil supply and demand

According to the Energy Information Administration’s Monthly Energy Review database, world field production of crude oil in September was up 1.5 million barrels a day over the previous year. More than all of that came from a 440,000 b/d increase in the U.S., 550,000 b/d from Saudi Arabia, and 900,000 b/d from Iraq. If it had not been for the increased oil production from these three countries, world oil production would actually have been down almost 400,000 b/d over the last year.

...

Since I last updated these calculations in September, the dollar has appreciated 3% against our major trading partners, and the price of copper has fallen 16%. Based on a weekly historical regression of oil prices on these variables along with the 10-year Treasury yield, we would have predicted a 10% drop in the price of WTI from $46/barrel in $41.50 today on the basis of changes in the exchange rate, copper price, and interest rates since September, explaining about a third of the drop in oil prices since September from international factors that are not unique to oil markets.

Bob Barbera discussed the role of slowing world GDP growth as one of those factors. His graph below shows that the observed slowdown in world GDP since 2010 ... could easily account for much of the drop in commodity prices through 2014. Barbera speculates on the basis of the numbers for Chinese rail shipments and electricity production that the true Chinese GDP growth for 2015 may have been significantly below the country’s official target of 7%. ...

...

If Iranian production is about to surge, Iraqi production remains high, and the Chinese economy is stumbling, that can only mean that even bigger drops in U.S. oil production are inevitable.

Bank Failures by Year

by Calculated Risk on 1/17/2016 11:34:00 AM

In 2015, eight FDIC insured banks failed. This was the lowest level since 2007.

Most of the great recession / housing bust / financial crisis related failures are behind us.

However there might be an increase in energy related bank failures over the next couple of years.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year, so the 8 failures in 2015 was close to normal.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. A large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s, the recent financial crisis was much worse (large banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Saturday, January 16, 2016

Schedule for Week of January 17, 2016

by Calculated Risk on 1/16/2016 08:11:00 AM

The key economic reports this week are December housing starts on Wednesday, and December Existing Home Sales on Friday.

For prices, CPI will be released on Wednesday.

All US markets will be closed in observance of the Martin Luther King Jr. Day

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 62, up from 61 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for no changed in CPI, and a 0.2% increase in core CPI.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts increased to 1.173 million (SAAR) in November. Single family starts increased to 768 thousand SAAR in November.

The consensus for 1.198 million, up from November.

During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 284 thousand the previous week.

10:00 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of -4.0, up from -5.9.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, up from 4.76 million in November.

10:00 AM: Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, up from 4.76 million in November.

Friday, January 15, 2016

FNC: Residential Property Values increased 6.0% year-over-year in November

by Calculated Risk on 1/15/2016 06:29:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their November 2015 index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values were unchanged from October to November (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 0.5% (NSA), the 20-MSA RPI increased 0.2%, and the 30-MSA RPI increased 0.1% in November. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The index is still down 14.5% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through November 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change in the mid single digit range.

Note: The November Case-Shiller index will be released on Tuesday, January 26th.

CoStar: Commercial Real Estate prices "Continued Climb" in November, up 12% year-over-year

by Calculated Risk on 1/15/2016 02:23:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Prices Continued Upward Climb in November

STRONG FUNDAMENTALS AND CAPITAL FLOWS SUPPORTED BROAD CRE PRICE GROWTH IN NOVEMBER. U.S. commercial real estate continued to post broad price gains in November 2015, with market fundamentals reflecting healthy levels of absorption and continued rental gains, even as construction levels slowly increased. The two broadest measures of aggregate pricing for commercial properties within the CCRSI — the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index — each increased by 0.9% in November 2015, contributing to annual gains of 12.2% and 11.7%, respectively, for the 12 months ended November 2015.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index increased 0.9% in November and is up 12.2% year-over-year.

The equal-weighted index increased 0.9% in November and up 11.7% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Preliminary January Consumer Sentiment increases to 93.3

by Calculated Risk on 1/15/2016 10:07:00 AM

The preliminary University of Michigan consumer sentiment index for January was at 93.3, up from 92.6 in December:

"Consumer confidence inched upward for the fourth consecutive month due to more positive expectations for future economic growth. Personal financial prospects have remained largely unchanged during the past year at the most favorable levels since 2007 largely due to trends in inflation rather than wages. Indeed, expected wage gains fell to their lowest level in a year in early January, but were more than offset by declines in the expected inflation rate. The result was that inflation-adjusted income expectations rose to their highest level in nine years. Consumer optimism is now dependent on the continuation of an extraordinarily low inflation rate. Rather than welcoming a rising inflation rate as a signal of a strengthening economy, consumers are now more likely to reduce the pace of their spending and thus act to erase the Fed's rationale for higher interest rates. Given the favorable overall state of the Sentiment Index, the data continue to indicate that real personal consumption expenditures can be expected to advance by 2.8% in 2016."This was slightly above the consensus forecast of 93.0.

emphasis added

Click on graph for larger image.

Fed: Industrial Production decreased 0.4% in December

by Calculated Risk on 1/15/2016 09:24:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.4 percent in December, primarily as a result of cutbacks for utilities and mining. The decrease for total industrial production in November was larger than previously reported, but upward revisions to earlier months left the level of the index in November only slightly below its initial estimate. For the fourth quarter as a whole, industrial production fell at an annual rate of 3.4 percent. Manufacturing output edged down in December. The index for utilities dropped 2.0 percent, as continued warmer-than-usual temperatures reduced demand for heating. Mining production decreased 0.8 percent in December for its fourth consecutive monthly decline. At 106.0 percent of its 2012 average, total industrial production in December was 1.8 percent below its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in December to 76.5 percent, a rate that is 3.6 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.5% is 3.6% below the average from 1972 to 2014 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.4% in December to 106.5. This is 21.5% above the recession low, and 0.8% above the pre-recession peak.

This was below expectations of a 0.2% decrease, mostly due to "cutbacks in utilities and mining" (warm weather and lower gasoline prices).

Retail Sales decreased 0.1% in December

by Calculated Risk on 1/15/2016 08:39:00 AM

On a monthly basis, retail sales were down 0.1% from November to December (seasonally adjusted), and sales were up 2.2% from December 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $448.1 billion, a decrease of 0.1 percent from the previous month, and 2.2 percent above December 2014. Total sales for the 12 months of 2015 were up 2.1 percent from 2014.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was unchanged.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.9% on a YoY basis (22.2% for all retail sales including gasoline).

Retail and Food service sales ex-gasoline increased by 3.9% on a YoY basis (22.2% for all retail sales including gasoline).The increase in December was below expectations of unchanged, however retailed sales for November were revised up from a 0.2% increase to a 0.4% increase. The headline number was weak, however sales ex-gasoline are up a solid 3.9% YoY.