by Calculated Risk on 1/20/2016 11:47:00 AM

Wednesday, January 20, 2016

Key Measures Show Inflation close to 2% in December

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.8% annualized rate) in December. The 16% trimmed-mean Consumer Price Index also rose 0.1% (0.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for December here. Motor fuel was down 38% annualized in December.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.1% (-1.3% annualized rate) in December. The CPI less food and energy rose 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy also rose 2.1%. Core PCE is for November and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 0.8% annualized, and core CPI was at 1.5% annualized.

On a year-over-year basis, two of these measures suggest inflation remains below the Fed's target of 2%, and two measures, core CPI and median CPI, are above 2%.

Using these measures, inflation has been mostly moving up, and three of the measures are close to the Fed's target (Core PCE is still way below).

Comments on December Housing Starts

by Calculated Risk on 1/20/2016 10:11:00 AM

Earlier: Housing Starts declined to 1.149 Million Annual Rate in December

Total starts were up 10.8% in 2015 compared to 2014. My guess was for an increase of 8% to 12%.

Here is a table showing 1 unit and 5+ unit housing starts since the peak year in 2005. This also shows the year-over-year change for both categories. Single family starts were up 10.4% in 2015 compared to 2014. Starts for 5+ units were up 12.5% compared to 2014.

Note that the year-over-year change for 5+ units is smaller in 2015, and will probably be even smaller in 2016. Last year, after the June data was released, I pointed out that that might be the peak for the cycle (524 thousand SAAR in June 2015). I expect multi-family starts to move more sideways going forward.

| Starts and YOY % Change | ||||

|---|---|---|---|---|

| Year | 1 unit | % Change | 5+ units | % Change |

| 2005 | 1,715.8 | 6.5% | 311.4 | 2.8% |

| 2006 | 1,465.4 | -14.6% | 292.8 | -6.0% |

| 2007 | 1,046.0 | -28.6% | 277.3 | -5.3% |

| 2008 | 622.0 | -40.5% | 266.0 | -4.1% |

| 2009 | 445.1 | -28.4% | 97.3 | -63.4% |

| 2010 | 471.2 | 5.9% | 104.3 | 7.2% |

| 2011 | 430.6 | -8.6% | 167.3 | 60.4% |

| 2012 | 535.3 | 24.3% | 233.9 | 39.8% |

| 2013 | 617.6 | 15.4% | 293.7 | 25.6% |

| 2014 | 647.9 | 4.9% | 341.7 | 16.3% |

| 2015 | 715.3 | 10.4% | 384.4 | 12.5% |

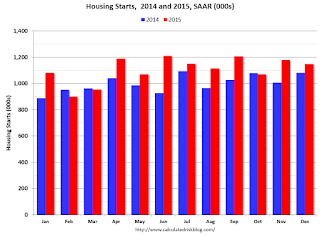

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).Starts were up year-over-year in 9 of 12 months in 2015. The year started slow - weather impacted starts in February and March - but overall growth was about as expected.

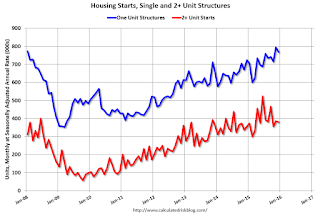

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply year-over-year.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked in June (at 524 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, but I expect less growth from multi-family going forward.

Housing Starts declined to 1.149 Million Annual Rate in December

by Calculated Risk on 1/20/2016 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in December were at a seasonally adjusted annual rate of 1,149,000. This is 2.5 percent below the revised November estimate of 1,179,000, but is 6.4 percent above the December 2014 rate of 1,080,000.

Single-family housing starts in December were at a rate of 768,000; this is 3.3 percent below the revised November figure of 794,000. The December rate for units in buildings with five units or more was 365,000.

An estimated 1,111,200 housing units were started in 2015. This is 10.8 percent above the 2014 figure of 1,003,300.

Building Permits:

Privately-owned housing units authorized by building permits in December were at a seasonally adjusted annual rate of 1,232,000. This is 3.9 percent below the revised November rate of 1,282,000, but is 14.4 percent above the December 2014 estimate of 1,077,000.

Single-family authorizations in December were at a rate of 740,000; this is 1.8 percent above the revised November figure of 727,000. Authorizations of units in buildings with five units or more were at a rate of 455,000 in December.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in December. Multi-family starts are up 6% year-over-year.

Single-family starts (blue) decreased in December and are up 7% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in December were below expectations, however starts for October and November were revised up. And starts were up 10.8% in 2015 compared to 2014. I'll have more later ...

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 17% YoY

by Calculated Risk on 1/20/2016 07:01:00 AM

From the MBA: Refinance Mortgage Applications Increase as Rates Fall in Latest MBA Weekly Survey

Mortgage applications increased 9.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 15, 2016.

...

The Refinance Index increased 19 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 17 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since October 2015, 4.06 percent, from 4.12 percent, with points increasing to 0.41 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity will probably stay low in 2016.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 17% higher than a year ago.

Tuesday, January 19, 2016

Wednesday: CPI, Housing Starts

by Calculated Risk on 1/19/2016 08:04:00 PM

An update on the rain in California ... from the LA Times: What happened to El Niño? Be patient, L.A., it'll come, expert says

[M]uch of the rain Northern California has received in recent months is not significantly related to El Niño. Most of that precipitation — including this week's storms hitting San Francisco — is coming from the typical winter weather pattern in California: cold storms from the northern Pacific Ocean, coming northwest of the state.Wednesday:

...

Experts say it's possible that the classic El Niño-influenced pattern could emerge by late January or early February. That would put it more in line with how the most punishing series of storms arrived in February 1998 and March of 1983.

"As we look back, the big show is usually in February, March — even into April and May," [NASA Jet Propulsion Laboratory climatologist] Patzert said. "So, in many ways, this is on schedule."

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for December from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

• Also at 8:30 AM, Housing Starts for December. The consensus is for 1.198 million SAAR, up from 1.173 million in November.

• During the day: The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

Mortgage News Daily: "Lenders quoting 30yr fixed rates of 3.875% on top tier scenarios"

by Calculated Risk on 1/19/2016 05:37:00 PM

Mortgage rates are nears the lows of the last two months ...

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Away From Long Term Lows

Mortgage rates moved higher today, but remained near the lowest levels in more than 2 months. Friday's drop was uncharacteristically sharp and put rates in a position to break 7 month lows had today gone the other direction. Most lenders are quoting conventional 30yr fixed rates of 3.875% on top tier scenarios. 4.0% is the next most prevalent quote with only a select few of the most aggressive lenders down at 3.75%. All of these assume top tier scenarios.Here is a table from Mortgage News Daily:

emphasis added

ATA Trucking Index increased 1% in December

by Calculated Risk on 1/19/2016 02:31:00 PM

From the ATA: ATA Truck Tonnage Index Increased 1% in December

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 1% in December, following a decrease of 0.9% during November. In December, the index equaled 135.6 (2000=100), up from 134.3 in November, and 0.1% below the all-time high of 135.8 reached in January 2015.

Compared with December 2014, the SA index increased 1.1%, which was better than November’s 0.2% year-over-year gain. For all of 2015, compared with 2014, tonnage was up 2.6%.

...

“Tonnage ended 2015 on a strong note, but it was not strong for the year as a whole,” said ATA Chief Economist Bob Costello. “With year-over-year gains averaging just 1.2% over the last four months, there was a clear deceleration in truck tonnage.

“At the expense of sounding like a broken record, I remain concerned about the high level of inventories throughout the supply chain. The total business inventory-to-sales record is at the highest level in over a decade, excluding the Great Recession period. This will have a negative impact on truck freight volumes over the next few months at least. And, this inventory cycle is overriding any strength from consumer spending and housing at the moment” he said.

Trucking serves as a barometer of the U.S. economy, representing 68.8% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled just under 10 billion tons of freight in 2014. Motor carriers collected $700.4 billion, or 80.3% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.1% year-over-year.

Existing Home Sales: Take the Over

by Calculated Risk on 1/19/2016 11:52:00 AM

A short note: The NAR will report December Existing Home Sales on Friday, January 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.19 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.36 million on a seasonally adjusted annual rate (SAAR) basis, up from 4.76 million SAAR in November.

Based on Lawler's estimate, I'd take the "over" on Friday.

Note: Lawler is not always right on, but he is usually pretty close. See this post for a review of Lawler's track record.

NAHB: Builder Confidence unchanged at 60 in January

by Calculated Risk on 1/19/2016 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in January, unchanged from December (revised). Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Holds Firm in January

Builder confidence in the market for newly-built single-family homes held steady at 60 in January from a downwardly revised December reading of 60 on the National Association of Home Builders/Wells Fargo Housing Market Index.

“After eight months hovering in the low 60s, builder sentiment is reflecting that many markets continue to show a gradual improvement, which should bode well for future home sales in the year ahead,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“January’s HMI reading is right in line with our forecast of modest growth for housing,” said NAHB Chief Economist David Crowe. “The economic outlook remains promising, as consumers regain confidence and home values increase, which will help the housing market move forward.”

...

The HMI component gauging current sales condition rose two points 67 in January. The index measuring sales expectations in the next six months fell three points to 63, and the component charting buyer traffic dropped two points to 44.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. The Northeast, Midwest and West each posted a one-point decline to 49, 57 and 75, respectively, while the South fell two points to 61.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 62, but still a strong reading.

Monday, January 18, 2016

Monday Night Futures

by Calculated Risk on 1/18/2016 09:03:00 PM

Note: China's GDP was reported at 6.9% year-over-year, at expectations.

Weekend:

• Schedule for Week of January 17, 2016

• Lawler: Early Read on Existing Home Sales in December and Post-Mortem on November

• Update: Predicting the Next Recession

Monday:

• At 10:00 AM ET, the January NAHB homebuilder survey. The consensus is for a reading of 62, up from 61 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 12 and DOW futures are up 120 (fair value).

Oil prices were down sharply over the last week with WTI futures at $29.20 per barrel (lowest since 2003) and Brent at $28.83 per barrel (lowest since 2003). A year ago, WTI was at $47, and Brent was at $48 - so prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.89 per gallon (down about $0.20 per gallon from a year ago). Gasoline prices should decline over the next few weeks based on the sharp decline in oil prices.